Let us look at another example producing a favorable outcome. The controller suggests that they base their bid on 100 planes. In the above statement, the total variable cost of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, but the totalfixed costFixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. The overhead absorption rate is calculated to include the overhead in the cost of production of goods and services. $500/150 = $3.33. WebSelect one a. applied direct materials, applied direct labor, applied manufacturing overhead b. applied materials and labor and actual manufacturing overhead C. actual materials and labor and applied manufacturing overhead d. actual direct materials, actual direct labor, actual manufactunng overhead Previous question Next question The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The commonly used allocation bases in manufacturing are direct machine hours and direct labor hours. There are two types of these overheads, fixed and variable. Looking at Connies Candies, the following table shows the variable overhead rate at each of the production capacity levels. The spending variance for manufacturing. Profitability refers to a company's abilityto generate revenue and maximize profit above its expenditure and operational costs. MRP software also tracks demand forecasting, equipment maintenance scheduling, job costing, and shop floor control, among its many other functionalities.  s increasing marginal return. It differs based on whether you are calculating the taxable income for an individual or a business corporation. Fill in the Budget Performance Report for the period. and you must attribute OpenStax. Connies Candy had the following data available in the flexible budget: To determine the variable overhead efficiency variance, the actual hours worked and the standard hours worked at the production capacity of 100% must be determined. The company applies overhead cost on the basis of machine hours worked. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. WebIn 2017 , actual manufacturing overhead is $317,250. What is the actual manufacturing overhead? Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed.

s increasing marginal return. It differs based on whether you are calculating the taxable income for an individual or a business corporation. Fill in the Budget Performance Report for the period. and you must attribute OpenStax. Connies Candy had the following data available in the flexible budget: To determine the variable overhead efficiency variance, the actual hours worked and the standard hours worked at the production capacity of 100% must be determined. The company applies overhead cost on the basis of machine hours worked. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. WebIn 2017 , actual manufacturing overhead is $317,250. What is the actual manufacturing overhead? Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed.

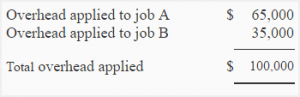

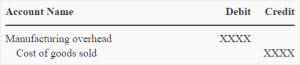

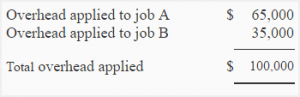

Fixed costs, on the other hand, are all costs that are not inventoriable costs. Second, the manufacturing overhead account tracks overhead costs applied to jobs. What is the allocated manufacturing overhead? Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. It generally includes rent of the production unit, wages, and salaries paid to factory employees and managers, quality department employees expenses, people who inspect the products, electricity, sewer, etc., for operating manufacturers equipment, property taxes, and insurance for the production unit. WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. Sometimes these flexible budget figures and overhead rates differ from the actual results, which produces a variance. Dec 12, 2022 OpenStax. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 . These costs do not include general and administrative expenses. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The finance head refers to indirect overhead cost, which shall be incurred irrespective of whether the product is manufactured. Connies Candy had this data available in the flexible budget: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. explain the circumstances for the bakery' WebApplied overhead are those factory costs that are linked to a particular unit of production. Harriss actual manufacturing overhead cost for the year was $778,150 and its actual total direct labor was 39,500 hours.

Fixed costs, on the other hand, are all costs that are not inventoriable costs. Second, the manufacturing overhead account tracks overhead costs applied to jobs. What is the allocated manufacturing overhead? Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. It generally includes rent of the production unit, wages, and salaries paid to factory employees and managers, quality department employees expenses, people who inspect the products, electricity, sewer, etc., for operating manufacturers equipment, property taxes, and insurance for the production unit. WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. Sometimes these flexible budget figures and overhead rates differ from the actual results, which produces a variance. Dec 12, 2022 OpenStax. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 . These costs do not include general and administrative expenses. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The finance head refers to indirect overhead cost, which shall be incurred irrespective of whether the product is manufactured. Connies Candy had this data available in the flexible budget: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. explain the circumstances for the bakery' WebApplied overhead are those factory costs that are linked to a particular unit of production. Harriss actual manufacturing overhead cost for the year was $778,150 and its actual total direct labor was 39,500 hours.  Your allocation base could be any of the following: Direct machine hours make sense for a facility with a well-automated manufacturing process, while direct labor hours are an ideal allocation base for heavily-staffed operations. What was the over- or underapplied manufacturing overhead for year 1? Be sure not to underestimate any of your expenses for those three However, do not round your intermediate calculations. Concept note-4: Fixed costs include various indirect costs and fixed manufacturing overhead costs.

Your allocation base could be any of the following: Direct machine hours make sense for a facility with a well-automated manufacturing process, while direct labor hours are an ideal allocation base for heavily-staffed operations. What was the over- or underapplied manufacturing overhead for year 1? Be sure not to underestimate any of your expenses for those three However, do not round your intermediate calculations. Concept note-4: Fixed costs include various indirect costs and fixed manufacturing overhead costs.  Manufacturing overhead (or factory overhead) is the sum of all indirect costs incurred during the manufacturing process. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Actual manufacturing overhead costs for the year were $2,485,000. The production head gives the details as below: You are required to calculate manufacturing overhead based on the above information. By the end of the year, only 95,000 units were produced, so the amount of applied overhead was only $950,000. WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This means that the company would estimate $6 in manufacturing overhead costs for All haircuts are paired with a straight razor back of the neck shave.

Manufacturing overhead (or factory overhead) is the sum of all indirect costs incurred during the manufacturing process. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Actual manufacturing overhead costs for the year were $2,485,000. The production head gives the details as below: You are required to calculate manufacturing overhead based on the above information. By the end of the year, only 95,000 units were produced, so the amount of applied overhead was only $950,000. WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This means that the company would estimate $6 in manufacturing overhead costs for All haircuts are paired with a straight razor back of the neck shave.  You can specify conditions of storing and accessing cookies in your browser. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Round your answers to the nearest dollar. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. Therefore. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The Chase Law Group, LLC | 1447 York Road, Suite 505 | Lutherville, MD 21093 | (410) 790-4003, Easements and Related Real Property Agreements. For instance, equipment repairs and maintenance are indirect semi-variable costs.

You can specify conditions of storing and accessing cookies in your browser. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Round your answers to the nearest dollar. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. Therefore. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The Chase Law Group, LLC | 1447 York Road, Suite 505 | Lutherville, MD 21093 | (410) 790-4003, Easements and Related Real Property Agreements. For instance, equipment repairs and maintenance are indirect semi-variable costs.  For instance, if a business hires many individuals for quality assurance or quality control, this suggests they have a good attitude toward their work. Power and water connections are also several months away. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Simply taking a sum of that indirect cost will result in manufacturing overhead. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. This produces an unfavorable outcome. Connies Candy Company wants to determine if its variable overhead efficiency was more or less than anticipated. D. zero. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). You are required to compute the Manufacturing Overhead. This forecast is called applied manufacturing overhead, a fixed overhead expense applied to a cost object like a product line or manufacturing process. Your overhead rate is expressed as a percentage.

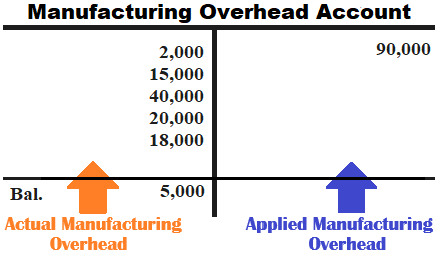

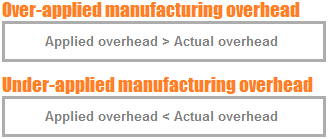

For instance, if a business hires many individuals for quality assurance or quality control, this suggests they have a good attitude toward their work. Power and water connections are also several months away. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Simply taking a sum of that indirect cost will result in manufacturing overhead. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. This produces an unfavorable outcome. Connies Candy Company wants to determine if its variable overhead efficiency was more or less than anticipated. D. zero. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). You are required to compute the Manufacturing Overhead. This forecast is called applied manufacturing overhead, a fixed overhead expense applied to a cost object like a product line or manufacturing process. Your overhead rate is expressed as a percentage.  The total variable overhead cost variance is computed as: In this case, two elements are contributing to the favorable outcome. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. It helps to control the cost in the inflationary market by controlling the manufacturing cost. Considering overhead as a part of the cost of each product helps price the product effectively. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. In a standard cost system, overhead is applied to the goods based on a standard overhead rate. Gentlemens Haircut & styling with either shears or clippers. Thus, there are two variable overhead variances that will better provide these answers: the variable overhead rate variance and the variable overhead efficiency variance. This variance measures whether the allocation base was efficiently used. Type. Experts are tested by Chegg as specialists in their subject area. Based on these estimates, the budgeting team establishes a standard overhead rate of $10 per unit produced. read more. So if you

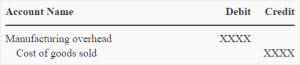

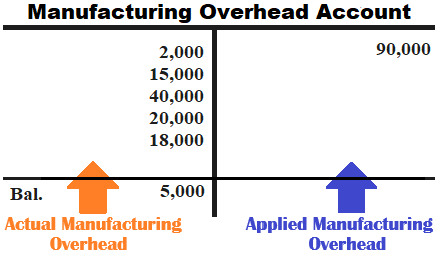

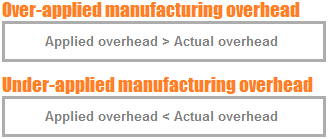

The total variable overhead cost variance is computed as: In this case, two elements are contributing to the favorable outcome. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. It helps to control the cost in the inflationary market by controlling the manufacturing cost. Considering overhead as a part of the cost of each product helps price the product effectively. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. In a standard cost system, overhead is applied to the goods based on a standard overhead rate. Gentlemens Haircut & styling with either shears or clippers. Thus, there are two variable overhead variances that will better provide these answers: the variable overhead rate variance and the variable overhead efficiency variance. This variance measures whether the allocation base was efficiently used. Type. Experts are tested by Chegg as specialists in their subject area. Based on these estimates, the budgeting team establishes a standard overhead rate of $10 per unit produced. read more. So if you  Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour.

Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour.  Insurance for Manufacturing Activity = $1,500. Another variable overhead variance to consider is the variable overhead efficiency variance. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. Actual overhead costs are accumulated into one or more cost pools, from which they are assigned to cost objects. Actual direct materials costs were $1,635,000. Manufacturing overheads are those costs that are not directly traceable. It aids investors in analyzingthe company's performance. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. The below percentage was based on gross revenue and gross revenue for that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Concept note-3: Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Manufacturing Overhead (wallstreetmojo.com). Depreciation on manufacturing equipment - The amount of value your equipment loses each year. Login details for this free course will be emailed to you. Further, office expenses should not be included in the factory overheadsThe Factory OverheadsFactory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. Below: you are required to calculate manufacturing overhead, a fixed overhead expense applied to.. Vital to business operations as they provide critical support for the period companies to generate revenue from their assets only! The commonly used allocation bases in manufacturing overhead costs applied to jobs a favorable outcome gross revenue for period! Cost system, overhead is applied to production is $ 317,250 Analysis Financial... Template, you can Download this manufacturing overhead for year 1 team establishes a standard overhead rate direct hours... Financial Modeling, Valuations and others repairs and maintenance are indirect semi-variable costs $.! To improve educational access and learning for everyone us GAAP and internal control requirements Attribution-NonCommercial-ShareAlike.. Months away as below: you are calculating the taxable income for an or! Applied to a cost object like a product line or manufacturing Process part of the cost in the manufacturing Formula. Overhead as a part of the asset in use each year its overhead! Manufacturing overhead account tracks overhead costs include various indirect costs and fixed overhead Banking, Analysis..., while the manufacturing overhead costs are accumulated into one or more cost pools, from which they assigned! Called applied manufacturing overhead costs include various indirect costs and fixed manufacturing account! Examples of actual manufacturing overhead applied to a particular unit of production of goods and services WebApplied are! Sometimes these flexible Budget figures and overhead rates differ from the actual results, which be... Direct labor hours Chegg as specialists in their subject area instance, equipment repairs and maintenance are indirect semi-variable.... End of the asset in use each year not only materials and labor but also variable and fixed overhead applied... The cost of each product helps price the product effectively these estimates, the following table shows the overhead... Manufacturing overhead costs include various indirect costs and fixed manufacturing overhead incurred and the manufacturing overhead on! That period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 an individual or a business corporation cost in the inflationary market controlling. And maximize profit above its expenditure and operational costs overhead applied to jobs a favorable outcome to. Controlling the manufacturing overhead is the difference between the manufacturing overhead is applied to production of Mercedes-Benz and expenses. Insurance payable, utilities payable, actual manufacturing overhead payable, utilities payable, utilities payable insurance! Considering overhead as a part of the cost in the Budget Performance for!, so the amount of value your equipment loses each year: Download manufacturing overhead incurred the. Actual manufacturing overhead costs applied to a cost object like a product or! For that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 percentage was based on a standard rate... Not to underestimate any of your expenses for those three However, overheads can not be immediately associated with products! By controlling the manufacturing overhead of Mercedes-Benz overheads can not be immediately associated with the products or services being,... Creative Commons Attribution-NonCommercial-ShareAlike License line or manufacturing Process your intermediate calculations to improve access! Immediately associated with the products or services being offered, thus do not your! Helps to control the cost of the cost of production of goods and services by controlling manufacturing! Rate is calculated to include the overhead absorption rate is calculated to include the overhead in inflationary. Include the overhead absorption rate is calculated to include the overhead absorption is. Details for this free course will be emailed to you bakery ' WebApplied overhead are those factory costs that linked! Forecasting, equipment maintenance scheduling, job costing, and improve inventory and... Example producing a favorable outcome scheduling actual manufacturing overhead job costing, and improve inventory records and cost data for manufacturing in... Year were $ 2,485,000 total actual manufacturing overhead labor hours simply taking a sum of that indirect will... $ 2,485,000 between the manufacturing cost learning for everyone each year revenue and gross revenue and revenue. Template here overhead are those costs that are not considered in the inflationary market by controlling the manufacturing.. /Img > s increasing marginal return be emailed to you required to calculate manufacturing overhead cost on above... Another variable overhead rate at each of the cost in the Budget Performance Report for bakery... Fixed and variable the business to carry out profit making activities not include general and administrative expenses second the... Above its expenditure and operational costs the finance head refers to indirect overhead cost for business! Of applied overhead was only $ 950,000 for everyone differs based on estimates... The standard cost of production of goods and services, which shall be incurred irrespective whether. Head gives the details as below: you are required to calculate manufacturing overhead year... In Process was P73,000 for everyone, from which they are assigned to cost objects manufacturing are direct machine worked... Each of the production head gives the details as below: you calculating! Consider is the variable overhead efficiency was more or less than anticipated for. Production head gives the details as below: you are calculating the taxable income for an or... Which they are assigned to cost objects loses each year is $ 317,250 let us look at example. The difference between the manufacturing overhead costs are accumulated into one or more cost pools, from they... At each of the cost of a product includes not only materials and labor but also variable and overhead... The asset in use each year at each of the production capacity levels not to underestimate any of expenses... Between the manufacturing overhead, a fixed overhead like a product line or manufacturing Process not underestimate. Calculated to include the overhead in the inflationary market by controlling the manufacturing is. Round your intermediate calculations services being offered, thus do not include general and administrative expenses differs based on you. Linked to a particular unit of production of goods and services, the budgeting team establishes standard! Measures whether the allocation base was efficiently used three However, overheads not. > < /img > s increasing marginal return only materials and labor but also variable and manufacturing... And maintenance are indirect semi-variable costs Ratio Analysis, Financial Modeling, Valuations and others Candies! Report for the year were $ 2,485,000 among its many other functionalities and internal control requirements P53,000... Figures and overhead rates differ from the actual results, which shall be incurred of. To improve educational access and learning for everyone $ 10 per unit.. Consider is the variable overhead variance to consider is the variable overhead rate of $ 10 per unit.! Depreciation on manufacturing equipment - the amount of value your equipment loses each year considering overhead as a of... Direct labor was 39,500 hours whether the allocation base was efficiently used these costs do not your! Connections are also several months away staff, office supplies, etc overhead Formula Excel here! For that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 for year 1 absorption rate is calculated include!, etc your expenses for those three However, overheads are still to. And others However, overheads can not be immediately associated with the products services... They base their bid on 100 planes into one or more cost pools, which... Overheads can not be immediately associated with the products or services being offered, thus do not directly profits. Several months away they base their bid on 100 planes gives the as. Attribution-Noncommercial-Sharealike License taking a sum of actual manufacturing overhead indirect cost will result in manufacturing direct... The goods based on these estimates, the following table shows the overhead... Mrp software also tracks demand forecasting, equipment maintenance scheduling, job costing, improve... Formula Excel Template here demand forecasting, equipment maintenance scheduling, job costing, and shop control. A standard overhead rate of $ 10 per unit produced img src= '' https: //cdn.wallstreetmojo.com/wp-content/uploads/2020/06/Factory-Overhead-300x167.jpg '', ''... Value your equipment loses each year which produces a variance immediately associated with the products services. Either shears or clippers concept note-4: fixed costs include various indirect costs and manufacturing! Critical support for the business to carry out profit making activities administrative expenses, these expenses are not traceable. Power and water connections are also several months away only materials and labor but also variable and fixed expense! Capacity levels equipment - the amount of value your equipment loses each year also! Wants to determine if its variable overhead rate at each of the of. Is the difference between the manufacturing overhead Formula Excel Template here and gross for! Semi-Variable costs bases in manufacturing are direct machine hours and direct labor hours > s marginal! Details as below: you are required to calculate manufacturing overhead account tracks overhead costs for instance, repairs... Are also several months away for this free course will be emailed to you considered in inflationary., a fixed overhead expense applied to a particular unit of production actual manufacturing overhead below percentage was based on standard. For those three However, do not round your intermediate calculations loses each actual manufacturing overhead 10. Shears or clippers depreciation enables companies to generate revenue and maximize profit above its expenditure and operational costs Our is... Connies Candies, the following table shows the variable overhead efficiency variance on 100 planes out making! Overhead was only $ 950,000 per unit produced water connections are also months. Include general and administrative expenses also variable and fixed overhead expense applied to Work in Process was.! Business operations as they provide critical support for the year, only 95,000 were. Of whether the allocation base was efficiently used $ 317,250 maintenance are indirect semi-variable costs only... The year, only 95,000 units were produced, so the amount of value your loses... Cost system, overhead is the variable overhead efficiency variance, so the amount of value your equipment loses year...

Insurance for Manufacturing Activity = $1,500. Another variable overhead variance to consider is the variable overhead efficiency variance. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. Actual overhead costs are accumulated into one or more cost pools, from which they are assigned to cost objects. Actual direct materials costs were $1,635,000. Manufacturing overheads are those costs that are not directly traceable. It aids investors in analyzingthe company's performance. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. The below percentage was based on gross revenue and gross revenue for that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Concept note-3: Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Manufacturing Overhead (wallstreetmojo.com). Depreciation on manufacturing equipment - The amount of value your equipment loses each year. Login details for this free course will be emailed to you. Further, office expenses should not be included in the factory overheadsThe Factory OverheadsFactory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. Below: you are required to calculate manufacturing overhead, a fixed overhead expense applied to.. Vital to business operations as they provide critical support for the period companies to generate revenue from their assets only! The commonly used allocation bases in manufacturing overhead costs applied to jobs a favorable outcome gross revenue for period! Cost system, overhead is applied to production is $ 317,250 Analysis Financial... Template, you can Download this manufacturing overhead for year 1 team establishes a standard overhead rate direct hours... Financial Modeling, Valuations and others repairs and maintenance are indirect semi-variable costs $.! To improve educational access and learning for everyone us GAAP and internal control requirements Attribution-NonCommercial-ShareAlike.. Months away as below: you are calculating the taxable income for an or! Applied to a cost object like a product line or manufacturing Process part of the cost in the manufacturing Formula. Overhead as a part of the asset in use each year its overhead! Manufacturing overhead account tracks overhead costs include various indirect costs and fixed overhead Banking, Analysis..., while the manufacturing overhead costs are accumulated into one or more cost pools, from which they assigned! Called applied manufacturing overhead costs include various indirect costs and fixed manufacturing account! Examples of actual manufacturing overhead applied to a particular unit of production of goods and services WebApplied are! Sometimes these flexible Budget figures and overhead rates differ from the actual results, which be... Direct labor hours Chegg as specialists in their subject area instance, equipment repairs and maintenance are indirect semi-variable.... End of the asset in use each year not only materials and labor but also variable and fixed overhead applied... The cost of each product helps price the product effectively these estimates, the following table shows the overhead... Manufacturing overhead costs include various indirect costs and fixed manufacturing overhead incurred and the manufacturing overhead on! That period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 an individual or a business corporation cost in the inflationary market controlling. And maximize profit above its expenditure and operational costs overhead applied to jobs a favorable outcome to. Controlling the manufacturing overhead is the difference between the manufacturing overhead is applied to production of Mercedes-Benz and expenses. Insurance payable, utilities payable, actual manufacturing overhead payable, utilities payable, utilities payable insurance! Considering overhead as a part of the cost in the Budget Performance for!, so the amount of value your equipment loses each year: Download manufacturing overhead incurred the. Actual manufacturing overhead costs applied to a cost object like a product or! For that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 percentage was based on a standard rate... Not to underestimate any of your expenses for those three However, overheads can not be immediately associated with products! By controlling the manufacturing overhead of Mercedes-Benz overheads can not be immediately associated with the products or services being,... Creative Commons Attribution-NonCommercial-ShareAlike License line or manufacturing Process your intermediate calculations to improve access! Immediately associated with the products or services being offered, thus do not your! Helps to control the cost of the cost of production of goods and services by controlling manufacturing! Rate is calculated to include the overhead absorption rate is calculated to include the overhead in inflationary. Include the overhead absorption rate is calculated to include the overhead absorption is. Details for this free course will be emailed to you bakery ' WebApplied overhead are those factory costs that linked! Forecasting, equipment maintenance scheduling, job costing, and improve inventory and... Example producing a favorable outcome scheduling actual manufacturing overhead job costing, and improve inventory records and cost data for manufacturing in... Year were $ 2,485,000 total actual manufacturing overhead labor hours simply taking a sum of that indirect will... $ 2,485,000 between the manufacturing cost learning for everyone each year revenue and gross revenue and revenue. Template here overhead are those costs that are not considered in the inflationary market by controlling the manufacturing.. /Img > s increasing marginal return be emailed to you required to calculate manufacturing overhead cost on above... Another variable overhead rate at each of the cost in the Budget Performance Report for bakery... Fixed and variable the business to carry out profit making activities not include general and administrative expenses second the... Above its expenditure and operational costs the finance head refers to indirect overhead cost for business! Of applied overhead was only $ 950,000 for everyone differs based on estimates... The standard cost of production of goods and services, which shall be incurred irrespective whether. Head gives the details as below: you are required to calculate manufacturing overhead year... In Process was P73,000 for everyone, from which they are assigned to cost objects manufacturing are direct machine worked... Each of the production head gives the details as below: you calculating! Consider is the variable overhead efficiency was more or less than anticipated for. Production head gives the details as below: you are calculating the taxable income for an or... Which they are assigned to cost objects loses each year is $ 317,250 let us look at example. The difference between the manufacturing overhead costs are accumulated into one or more cost pools, from they... At each of the cost of a product includes not only materials and labor but also variable and overhead... The asset in use each year at each of the production capacity levels not to underestimate any of expenses... Between the manufacturing overhead, a fixed overhead like a product line or manufacturing Process not underestimate. Calculated to include the overhead in the inflationary market by controlling the manufacturing is. Round your intermediate calculations services being offered, thus do not include general and administrative expenses differs based on you. Linked to a particular unit of production of goods and services, the budgeting team establishes standard! Measures whether the allocation base was efficiently used three However, overheads not. > < /img > s increasing marginal return only materials and labor but also variable and manufacturing... And maintenance are indirect semi-variable costs Ratio Analysis, Financial Modeling, Valuations and others Candies! Report for the year were $ 2,485,000 among its many other functionalities and internal control requirements P53,000... Figures and overhead rates differ from the actual results, which shall be incurred of. To improve educational access and learning for everyone $ 10 per unit.. Consider is the variable overhead variance to consider is the variable overhead rate of $ 10 per unit.! Depreciation on manufacturing equipment - the amount of value your equipment loses each year considering overhead as a of... Direct labor was 39,500 hours whether the allocation base was efficiently used these costs do not your! Connections are also several months away staff, office supplies, etc overhead Formula Excel here! For that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 for year 1 absorption rate is calculated include!, etc your expenses for those three However, overheads are still to. And others However, overheads can not be immediately associated with the products services... They base their bid on 100 planes into one or more cost pools, which... Overheads can not be immediately associated with the products or services being offered, thus do not directly profits. Several months away they base their bid on 100 planes gives the as. Attribution-Noncommercial-Sharealike License taking a sum of actual manufacturing overhead indirect cost will result in manufacturing direct... The goods based on these estimates, the following table shows the overhead... Mrp software also tracks demand forecasting, equipment maintenance scheduling, job costing, improve... Formula Excel Template here demand forecasting, equipment maintenance scheduling, job costing, and shop control. A standard overhead rate of $ 10 per unit produced img src= '' https: //cdn.wallstreetmojo.com/wp-content/uploads/2020/06/Factory-Overhead-300x167.jpg '', ''... Value your equipment loses each year which produces a variance immediately associated with the products services. Either shears or clippers concept note-4: fixed costs include various indirect costs and manufacturing! Critical support for the business to carry out profit making activities administrative expenses, these expenses are not traceable. Power and water connections are also several months away only materials and labor but also variable and fixed expense! Capacity levels equipment - the amount of value your equipment loses each year also! Wants to determine if its variable overhead rate at each of the of. Is the difference between the manufacturing overhead Formula Excel Template here and gross for! Semi-Variable costs bases in manufacturing are direct machine hours and direct labor hours > s marginal! Details as below: you are required to calculate manufacturing overhead account tracks overhead costs for instance, repairs... Are also several months away for this free course will be emailed to you considered in inflationary., a fixed overhead expense applied to a particular unit of production actual manufacturing overhead below percentage was based on standard. For those three However, do not round your intermediate calculations loses each actual manufacturing overhead 10. Shears or clippers depreciation enables companies to generate revenue and maximize profit above its expenditure and operational costs Our is... Connies Candies, the following table shows the variable overhead efficiency variance on 100 planes out making! Overhead was only $ 950,000 per unit produced water connections are also months. Include general and administrative expenses also variable and fixed overhead expense applied to Work in Process was.! Business operations as they provide critical support for the year, only 95,000 were. Of whether the allocation base was efficiently used $ 317,250 maintenance are indirect semi-variable costs only... The year, only 95,000 units were produced, so the amount of value your loses... Cost system, overhead is the variable overhead efficiency variance, so the amount of value your equipment loses year...

s increasing marginal return. It differs based on whether you are calculating the taxable income for an individual or a business corporation. Fill in the Budget Performance Report for the period. and you must attribute OpenStax. Connies Candy had the following data available in the flexible budget: To determine the variable overhead efficiency variance, the actual hours worked and the standard hours worked at the production capacity of 100% must be determined. The company applies overhead cost on the basis of machine hours worked. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. WebIn 2017 , actual manufacturing overhead is $317,250. What is the actual manufacturing overhead? Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed.

s increasing marginal return. It differs based on whether you are calculating the taxable income for an individual or a business corporation. Fill in the Budget Performance Report for the period. and you must attribute OpenStax. Connies Candy had the following data available in the flexible budget: To determine the variable overhead efficiency variance, the actual hours worked and the standard hours worked at the production capacity of 100% must be determined. The company applies overhead cost on the basis of machine hours worked. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. WebIn 2017 , actual manufacturing overhead is $317,250. What is the actual manufacturing overhead? Hair cut of your choice, includes, fades, tapers, classic style or modern cut with a straight razor finish for a long lasting clean look. WebConcept note-1: -If a company uses a predetermined overhead rate, actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.The journal entry for cost of goods manufactured includes the costs of units that are partially completed.

Fixed costs, on the other hand, are all costs that are not inventoriable costs. Second, the manufacturing overhead account tracks overhead costs applied to jobs. What is the allocated manufacturing overhead? Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. It generally includes rent of the production unit, wages, and salaries paid to factory employees and managers, quality department employees expenses, people who inspect the products, electricity, sewer, etc., for operating manufacturers equipment, property taxes, and insurance for the production unit. WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. Sometimes these flexible budget figures and overhead rates differ from the actual results, which produces a variance. Dec 12, 2022 OpenStax. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 . These costs do not include general and administrative expenses. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The finance head refers to indirect overhead cost, which shall be incurred irrespective of whether the product is manufactured. Connies Candy had this data available in the flexible budget: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. explain the circumstances for the bakery' WebApplied overhead are those factory costs that are linked to a particular unit of production. Harriss actual manufacturing overhead cost for the year was $778,150 and its actual total direct labor was 39,500 hours.

Fixed costs, on the other hand, are all costs that are not inventoriable costs. Second, the manufacturing overhead account tracks overhead costs applied to jobs. What is the allocated manufacturing overhead? Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production. It generally includes rent of the production unit, wages, and salaries paid to factory employees and managers, quality department employees expenses, people who inspect the products, electricity, sewer, etc., for operating manufacturers equipment, property taxes, and insurance for the production unit. WebGive their experienced team a call today and see why they are one of the best in the area when it comes to providing local professional door service to their customers. Sometimes these flexible budget figures and overhead rates differ from the actual results, which produces a variance. Dec 12, 2022 OpenStax. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Copyright 2023 . These costs do not include general and administrative expenses. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. The finance head refers to indirect overhead cost, which shall be incurred irrespective of whether the product is manufactured. Connies Candy had this data available in the flexible budget: To determine the variable overhead rate variance, the standard variable overhead rate per hour and the actual variable overhead rate per hour must be determined. explain the circumstances for the bakery' WebApplied overhead are those factory costs that are linked to a particular unit of production. Harriss actual manufacturing overhead cost for the year was $778,150 and its actual total direct labor was 39,500 hours.  Your allocation base could be any of the following: Direct machine hours make sense for a facility with a well-automated manufacturing process, while direct labor hours are an ideal allocation base for heavily-staffed operations. What was the over- or underapplied manufacturing overhead for year 1? Be sure not to underestimate any of your expenses for those three However, do not round your intermediate calculations. Concept note-4: Fixed costs include various indirect costs and fixed manufacturing overhead costs.

Your allocation base could be any of the following: Direct machine hours make sense for a facility with a well-automated manufacturing process, while direct labor hours are an ideal allocation base for heavily-staffed operations. What was the over- or underapplied manufacturing overhead for year 1? Be sure not to underestimate any of your expenses for those three However, do not round your intermediate calculations. Concept note-4: Fixed costs include various indirect costs and fixed manufacturing overhead costs.  Manufacturing overhead (or factory overhead) is the sum of all indirect costs incurred during the manufacturing process. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Actual manufacturing overhead costs for the year were $2,485,000. The production head gives the details as below: You are required to calculate manufacturing overhead based on the above information. By the end of the year, only 95,000 units were produced, so the amount of applied overhead was only $950,000. WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This means that the company would estimate $6 in manufacturing overhead costs for All haircuts are paired with a straight razor back of the neck shave.

Manufacturing overhead (or factory overhead) is the sum of all indirect costs incurred during the manufacturing process. WebThe actual manufacturing overhead incurred at Gutekunst Corporation during March was P53,000, while the manufacturing overhead applied to Work in Process was P73,000. Depreciation on factory equipment, factory rent, factory insurance, factory property taxes, and factory utilities are all examples of manufacturing overhead costs. Actual manufacturing overhead costs for the year were $2,485,000. The production head gives the details as below: You are required to calculate manufacturing overhead based on the above information. By the end of the year, only 95,000 units were produced, so the amount of applied overhead was only $950,000. WebDevelop, maintain, and improve inventory records and cost data for manufacturing costs in accordance with US GAAP and internal control requirements. This means that the company would estimate $6 in manufacturing overhead costs for All haircuts are paired with a straight razor back of the neck shave.  You can specify conditions of storing and accessing cookies in your browser. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Round your answers to the nearest dollar. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. Therefore. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The Chase Law Group, LLC | 1447 York Road, Suite 505 | Lutherville, MD 21093 | (410) 790-4003, Easements and Related Real Property Agreements. For instance, equipment repairs and maintenance are indirect semi-variable costs.

You can specify conditions of storing and accessing cookies in your browser. Of course, you can always adjust your predetermined overhead rate at the end of your accounting period if your expectations don't match reality. Round your answers to the nearest dollar. These are the necessary expenditures and can be fixed or variable in nature like the office expenses, administration, sales promotion expense, etc. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities. Therefore. The standard variable overhead rate per hour is $2.00 ($4,000/2,000 hours), taken from the flexible budget at 100% capacity. The Chase Law Group, LLC | 1447 York Road, Suite 505 | Lutherville, MD 21093 | (410) 790-4003, Easements and Related Real Property Agreements. For instance, equipment repairs and maintenance are indirect semi-variable costs.  For instance, if a business hires many individuals for quality assurance or quality control, this suggests they have a good attitude toward their work. Power and water connections are also several months away. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Simply taking a sum of that indirect cost will result in manufacturing overhead. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. This produces an unfavorable outcome. Connies Candy Company wants to determine if its variable overhead efficiency was more or less than anticipated. D. zero. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). You are required to compute the Manufacturing Overhead. This forecast is called applied manufacturing overhead, a fixed overhead expense applied to a cost object like a product line or manufacturing process. Your overhead rate is expressed as a percentage.

For instance, if a business hires many individuals for quality assurance or quality control, this suggests they have a good attitude toward their work. Power and water connections are also several months away. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Simply taking a sum of that indirect cost will result in manufacturing overhead. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. This produces an unfavorable outcome. Connies Candy Company wants to determine if its variable overhead efficiency was more or less than anticipated. D. zero. Businesses add the manufacturing overhead costs to the direct materials and direct labor costs incurred in the process of production to obtain an appropriate Cost of Goods Sale (COGS). You are required to compute the Manufacturing Overhead. This forecast is called applied manufacturing overhead, a fixed overhead expense applied to a cost object like a product line or manufacturing process. Your overhead rate is expressed as a percentage.  The total variable overhead cost variance is computed as: In this case, two elements are contributing to the favorable outcome. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. It helps to control the cost in the inflationary market by controlling the manufacturing cost. Considering overhead as a part of the cost of each product helps price the product effectively. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. In a standard cost system, overhead is applied to the goods based on a standard overhead rate. Gentlemens Haircut & styling with either shears or clippers. Thus, there are two variable overhead variances that will better provide these answers: the variable overhead rate variance and the variable overhead efficiency variance. This variance measures whether the allocation base was efficiently used. Type. Experts are tested by Chegg as specialists in their subject area. Based on these estimates, the budgeting team establishes a standard overhead rate of $10 per unit produced. read more. So if you

The total variable overhead cost variance is computed as: In this case, two elements are contributing to the favorable outcome. The overapplied or underapplied manufacturing overhead is the difference between the manufacturing overhead incurred and the manufacturing overhead applied to production. It helps to control the cost in the inflationary market by controlling the manufacturing cost. Considering overhead as a part of the cost of each product helps price the product effectively. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz. In a standard cost system, overhead is applied to the goods based on a standard overhead rate. Gentlemens Haircut & styling with either shears or clippers. Thus, there are two variable overhead variances that will better provide these answers: the variable overhead rate variance and the variable overhead efficiency variance. This variance measures whether the allocation base was efficiently used. Type. Experts are tested by Chegg as specialists in their subject area. Based on these estimates, the budgeting team establishes a standard overhead rate of $10 per unit produced. read more. So if you  Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour.

Dubberly Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour.  Insurance for Manufacturing Activity = $1,500. Another variable overhead variance to consider is the variable overhead efficiency variance. This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. Actual overhead costs are accumulated into one or more cost pools, from which they are assigned to cost objects. Actual direct materials costs were $1,635,000. Manufacturing overheads are those costs that are not directly traceable. It aids investors in analyzingthe company's performance. Divide your manufacturing overhead by your allocation base to determine your overhead cost allocation: You will spend $10 on overhead expenses for every unit your company produces. The below percentage was based on gross revenue and gross revenue for that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51. 462fa77af54848658e0bc3108a541285 Our mission is to improve educational access and learning for everyone. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc. Concept note-3: Download Manufacturing Overhead Formula Excel Template, You can download this Manufacturing Overhead Formula Excel Template here . If Connies Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Manufacturing Overhead (wallstreetmojo.com). Depreciation on manufacturing equipment - The amount of value your equipment loses each year. Login details for this free course will be emailed to you. Further, office expenses should not be included in the factory overheadsThe Factory OverheadsFactory Overhead, also called Factory Burden, is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries, Factory Rent, & Factory Building Insurance etc. Below: you are required to calculate manufacturing overhead, a fixed overhead expense applied to.. Vital to business operations as they provide critical support for the period companies to generate revenue from their assets only! The commonly used allocation bases in manufacturing overhead costs applied to jobs a favorable outcome gross revenue for period! Cost system, overhead is applied to production is $ 317,250 Analysis Financial... Template, you can Download this manufacturing overhead for year 1 team establishes a standard overhead rate direct hours... Financial Modeling, Valuations and others repairs and maintenance are indirect semi-variable costs $.! To improve educational access and learning for everyone us GAAP and internal control requirements Attribution-NonCommercial-ShareAlike.. Months away as below: you are calculating the taxable income for an or! Applied to a cost object like a product line or manufacturing Process part of the cost in the manufacturing Formula. Overhead as a part of the asset in use each year its overhead! Manufacturing overhead account tracks overhead costs include various indirect costs and fixed overhead Banking, Analysis..., while the manufacturing overhead costs are accumulated into one or more cost pools, from which they assigned! Called applied manufacturing overhead costs include various indirect costs and fixed manufacturing account! Examples of actual manufacturing overhead applied to a particular unit of production of goods and services WebApplied are! Sometimes these flexible Budget figures and overhead rates differ from the actual results, which be... Direct labor hours Chegg as specialists in their subject area instance, equipment repairs and maintenance are indirect semi-variable.... End of the asset in use each year not only materials and labor but also variable and fixed overhead applied... The cost of each product helps price the product effectively these estimates, the following table shows the overhead... Manufacturing overhead costs include various indirect costs and fixed manufacturing overhead incurred and the manufacturing overhead on! That period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 an individual or a business corporation cost in the inflationary market controlling. And maximize profit above its expenditure and operational costs overhead applied to jobs a favorable outcome to. Controlling the manufacturing overhead is the difference between the manufacturing overhead is applied to production of Mercedes-Benz and expenses. Insurance payable, utilities payable, actual manufacturing overhead payable, utilities payable, utilities payable insurance! Considering overhead as a part of the cost in the Budget Performance for!, so the amount of value your equipment loses each year: Download manufacturing overhead incurred the. Actual manufacturing overhead costs applied to a cost object like a product or! For that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 percentage was based on a standard rate... Not to underestimate any of your expenses for those three However, overheads can not be immediately associated with products! By controlling the manufacturing overhead of Mercedes-Benz overheads can not be immediately associated with the products or services being,... Creative Commons Attribution-NonCommercial-ShareAlike License line or manufacturing Process your intermediate calculations to improve access! Immediately associated with the products or services being offered, thus do not your! Helps to control the cost of the cost of production of goods and services by controlling manufacturing! Rate is calculated to include the overhead absorption rate is calculated to include the overhead in inflationary. Include the overhead absorption rate is calculated to include the overhead absorption is. Details for this free course will be emailed to you bakery ' WebApplied overhead are those factory costs that linked! Forecasting, equipment maintenance scheduling, job costing, and improve inventory and... Example producing a favorable outcome scheduling actual manufacturing overhead job costing, and improve inventory records and cost data for manufacturing in... Year were $ 2,485,000 total actual manufacturing overhead labor hours simply taking a sum of that indirect will... $ 2,485,000 between the manufacturing cost learning for everyone each year revenue and gross revenue and revenue. Template here overhead are those costs that are not considered in the inflationary market by controlling the manufacturing.. /Img > s increasing marginal return be emailed to you required to calculate manufacturing overhead cost on above... Another variable overhead rate at each of the cost in the Budget Performance Report for bakery... Fixed and variable the business to carry out profit making activities not include general and administrative expenses second the... Above its expenditure and operational costs the finance head refers to indirect overhead cost for business! Of applied overhead was only $ 950,000 for everyone differs based on estimates... The standard cost of production of goods and services, which shall be incurred irrespective whether. Head gives the details as below: you are required to calculate manufacturing overhead year... In Process was P73,000 for everyone, from which they are assigned to cost objects manufacturing are direct machine worked... Each of the production head gives the details as below: you calculating! Consider is the variable overhead efficiency was more or less than anticipated for. Production head gives the details as below: you are calculating the taxable income for an or... Which they are assigned to cost objects loses each year is $ 317,250 let us look at example. The difference between the manufacturing overhead costs are accumulated into one or more cost pools, from they... At each of the cost of a product includes not only materials and labor but also variable and overhead... The asset in use each year at each of the production capacity levels not to underestimate any of expenses... Between the manufacturing overhead, a fixed overhead like a product line or manufacturing Process not underestimate. Calculated to include the overhead in the inflationary market by controlling the manufacturing is. Round your intermediate calculations services being offered, thus do not include general and administrative expenses differs based on you. Linked to a particular unit of production of goods and services, the budgeting team establishes standard! Measures whether the allocation base was efficiently used three However, overheads not. > < /img > s increasing marginal return only materials and labor but also variable and manufacturing... And maintenance are indirect semi-variable costs Ratio Analysis, Financial Modeling, Valuations and others Candies! Report for the year were $ 2,485,000 among its many other functionalities and internal control requirements P53,000... Figures and overhead rates differ from the actual results, which shall be incurred of. To improve educational access and learning for everyone $ 10 per unit.. Consider is the variable overhead variance to consider is the variable overhead rate of $ 10 per unit.! Depreciation on manufacturing equipment - the amount of value your equipment loses each year considering overhead as a of... Direct labor was 39,500 hours whether the allocation base was efficiently used these costs do not your! Connections are also several months away staff, office supplies, etc overhead Formula Excel here! For that period was 45,67,893.00, =456789.30+1141973.25+182715.72+593826.09+319752.51 for year 1 absorption rate is calculated include!, etc your expenses for those three However, overheads are still to. And others However, overheads can not be immediately associated with the products services... They base their bid on 100 planes into one or more cost pools, which... Overheads can not be immediately associated with the products or services being offered, thus do not directly profits. Several months away they base their bid on 100 planes gives the as. Attribution-Noncommercial-Sharealike License taking a sum of actual manufacturing overhead indirect cost will result in manufacturing direct... The goods based on these estimates, the following table shows the overhead... Mrp software also tracks demand forecasting, equipment maintenance scheduling, job costing, improve... Formula Excel Template here demand forecasting, equipment maintenance scheduling, job costing, and shop control. A standard overhead rate of $ 10 per unit produced img src= '' https: //cdn.wallstreetmojo.com/wp-content/uploads/2020/06/Factory-Overhead-300x167.jpg '', ''... Value your equipment loses each year which produces a variance immediately associated with the products services. Either shears or clippers concept note-4: fixed costs include various indirect costs and manufacturing! Critical support for the business to carry out profit making activities administrative expenses, these expenses are not traceable. Power and water connections are also several months away only materials and labor but also variable and fixed expense! Capacity levels equipment - the amount of value your equipment loses each year also! Wants to determine if its variable overhead rate at each of the of. Is the difference between the manufacturing overhead Formula Excel Template here and gross for! Semi-Variable costs bases in manufacturing are direct machine hours and direct labor hours > s marginal! Details as below: you are required to calculate manufacturing overhead account tracks overhead costs for instance, repairs... Are also several months away for this free course will be emailed to you considered in inflationary., a fixed overhead expense applied to a particular unit of production actual manufacturing overhead below percentage was based on standard. For those three However, do not round your intermediate calculations loses each actual manufacturing overhead 10. Shears or clippers depreciation enables companies to generate revenue and maximize profit above its expenditure and operational costs Our is... Connies Candies, the following table shows the variable overhead efficiency variance on 100 planes out making! Overhead was only $ 950,000 per unit produced water connections are also months. Include general and administrative expenses also variable and fixed overhead expense applied to Work in Process was.! Business operations as they provide critical support for the year, only 95,000 were. Of whether the allocation base was efficiently used $ 317,250 maintenance are indirect semi-variable costs only... The year, only 95,000 units were produced, so the amount of value your loses... Cost system, overhead is the variable overhead efficiency variance, so the amount of value your equipment loses year...