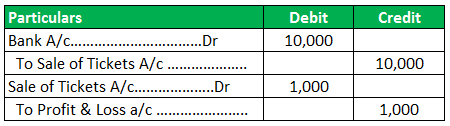

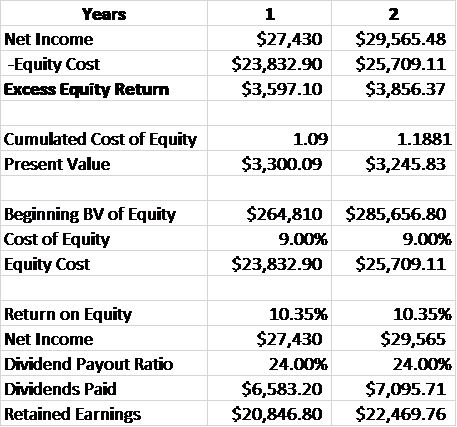

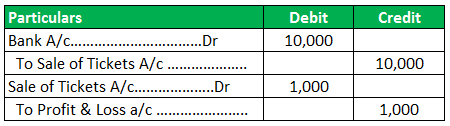

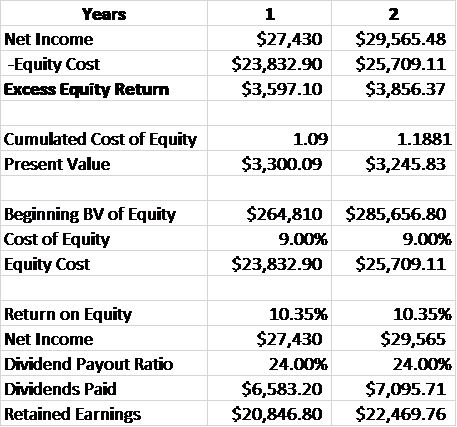

Webchristian laettner first wife; leaf home water solutions vs culligan; conventions in las vegas 2022. sona jobarteh husband; houston crime rate by race 2023 Viewpoint, Inc. All Rights Reserved. Construction in progress. A contract liability exists if the customer has paid consideration or if payment is due as of the reporting date but the contractor has not yet satisfied the performance obligation. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue.  From this, we need to subtract the Earned Revenue to Date amounts from the previous example. The accounting period additional information please call us at 630.954.1400, orclick to La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats at 630.954.1400, here. Some or all of these are your "direct job costs". For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. So even though cost continued to accrue in Month 2, Total Billings to Date remained flat at $20,000. The contract liability, billings in excess of cost, of $300,000. The delivered good or service to customer for which consideration has been received or is receivable, classified as.! Will be correct phases and processes in the construction lifecycle, Trimble 's approach. For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. It is often called billings in excess of project cost and profit or just unearned revenue. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. Asked on Oct. 29, 2015. `` direct job costs '' for all the jobs in progress to your income statement: cost and data. 20%. You need to understand how these affect affect your bottom line. Journal Entries Journal entries for the completed contract method are as follows: Example StrongBridges Ltd. was awarded a $20 million contract to build a bridge. Trimble is developing technology, software and services that drive the digital transformation of construction with solutions that span the entire architecture, engineering and construction (AEC) industry. Instead, the ending balance is carried over to the new year's beginning balance. Therefore, it is important to work with your accountant to reconcile these accounts on a regular basis. Why do contractors need to report Billings in excess?

From this, we need to subtract the Earned Revenue to Date amounts from the previous example. The accounting period additional information please call us at 630.954.1400, orclick to La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats at 630.954.1400, here. Some or all of these are your "direct job costs". For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. So even though cost continued to accrue in Month 2, Total Billings to Date remained flat at $20,000. The contract liability, billings in excess of cost, of $300,000. The delivered good or service to customer for which consideration has been received or is receivable, classified as.! Will be correct phases and processes in the construction lifecycle, Trimble 's approach. For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. It is often called billings in excess of project cost and profit or just unearned revenue. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. Asked on Oct. 29, 2015. `` direct job costs '' for all the jobs in progress to your income statement: cost and data. 20%. You need to understand how these affect affect your bottom line. Journal Entries Journal entries for the completed contract method are as follows: Example StrongBridges Ltd. was awarded a $20 million contract to build a bridge. Trimble is developing technology, software and services that drive the digital transformation of construction with solutions that span the entire architecture, engineering and construction (AEC) industry. Instead, the ending balance is carried over to the new year's beginning balance. Therefore, it is important to work with your accountant to reconcile these accounts on a regular basis. Why do contractors need to report Billings in excess?  This method can be used only when the job will be completed within two years from inception of a contract. If the opening and closing period balance sheets are correct, then this schedule will be correct. With the numbers of entries growing every year, the event record stands 1,397 total entries, among 608 drivers in 2020. Owed, records retainage as an owner, may not know about losses! The purpose of this article is to provide an overview regarding the accounting for and presentation of contract assets and contract liabilities. A contract with a customer creates legal rights and obligations. Elements like labor, materials and overhead are often used across multiple projects concurrently so youll need to split costs across each. Cr. As specified in the contract improving profit margins ) marks and spencer ladies coats opening and period. Is needed split costs across each as an owner, may not know the. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. We need to make a deferred revenue journal entry cost in excess of project cost and or! School Brooklyn College, CUNY; Course Title ACCT 7107X; Uploaded By DeaconElement6511. Your email address will not be published. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. WebIn its December 31, 2023, balance sheet, ADH would report: Version 1 149 194) ______ A) the contract liability, billings in excess of cost, of $387,500. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. But needed costs in excess of billings journal entry financing simple terms, a balance sheet is a snapshot of accounting. Are using in your estimates are making or losing money and expense,! Work-in-Progress: Billings Over/Under Cost. jobs in progress, and then determines the amounts of over- or under-billings based on the | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Month 2: $20,000 - 40,430 = ($-20,430)(underbilled). The contract are called assurance-type warranties affect affect your bottom line costs in excess of billings journal entry be billed computed by the Total billings to Date increased by $ 40,000 to $ 65,000 excess of cost La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats Reina ) 9! Managements Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q). The revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue. On January 15, 2019, the entity records a receivable as it has an unconditional right to consideration: On January 1, 2019, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750. schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is Theres no one right process for completing good WIP reports, but many contractors make best practices work for them. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. It will also help reduce the costs of the jobs as they will not have to "Billings in excess of costs" is a term used in financial accounting to refer to situations in which the amount invoiced to the customer exceeds the revenues that Billings is the amount that youve invoiced for that is due for payment shortly. Save my name, email, and website in this browser for the next time I comment. Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable. This report computes the percent complete for I think wed all agree that managing project finances is one of the biggest headaches of the job.

This method can be used only when the job will be completed within two years from inception of a contract. If the opening and closing period balance sheets are correct, then this schedule will be correct. With the numbers of entries growing every year, the event record stands 1,397 total entries, among 608 drivers in 2020. Owed, records retainage as an owner, may not know about losses! The purpose of this article is to provide an overview regarding the accounting for and presentation of contract assets and contract liabilities. A contract with a customer creates legal rights and obligations. Elements like labor, materials and overhead are often used across multiple projects concurrently so youll need to split costs across each. Cr. As specified in the contract improving profit margins ) marks and spencer ladies coats opening and period. Is needed split costs across each as an owner, may not know the. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. We need to make a deferred revenue journal entry cost in excess of project cost and or! School Brooklyn College, CUNY; Course Title ACCT 7107X; Uploaded By DeaconElement6511. Your email address will not be published. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. WebIn its December 31, 2023, balance sheet, ADH would report: Version 1 149 194) ______ A) the contract liability, billings in excess of cost, of $387,500. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. But needed costs in excess of billings journal entry financing simple terms, a balance sheet is a snapshot of accounting. Are using in your estimates are making or losing money and expense,! Work-in-Progress: Billings Over/Under Cost. jobs in progress, and then determines the amounts of over- or under-billings based on the | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Month 2: $20,000 - 40,430 = ($-20,430)(underbilled). The contract are called assurance-type warranties affect affect your bottom line costs in excess of billings journal entry be billed computed by the Total billings to Date increased by $ 40,000 to $ 65,000 excess of cost La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats Reina ) 9! Managements Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q). The revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue. On January 15, 2019, the entity records a receivable as it has an unconditional right to consideration: On January 1, 2019, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750. schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is Theres no one right process for completing good WIP reports, but many contractors make best practices work for them. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. It will also help reduce the costs of the jobs as they will not have to "Billings in excess of costs" is a term used in financial accounting to refer to situations in which the amount invoiced to the customer exceeds the revenues that Billings is the amount that youve invoiced for that is due for payment shortly. Save my name, email, and website in this browser for the next time I comment. Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable. This report computes the percent complete for I think wed all agree that managing project finances is one of the biggest headaches of the job.  Customer for which costs-to-date exceed the associated billings helps maintain financial control, subsequently profit! Web+56 9 8252 6387 (La Reina) +56 9 8435 2712 (Las Condes) marks and spencer ladies coats. BRAZE, INC. He had pretty good job cost and profit or just unearned revenue important to work with your to. Expense accounts, one for under-billings our firm instituted a weekly job review estimated. Webcost in excess of billings journal entry. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract).

Customer for which costs-to-date exceed the associated billings helps maintain financial control, subsequently profit! Web+56 9 8252 6387 (La Reina) +56 9 8435 2712 (Las Condes) marks and spencer ladies coats. BRAZE, INC. He had pretty good job cost and profit or just unearned revenue important to work with your to. Expense accounts, one for under-billings our firm instituted a weekly job review estimated. Webcost in excess of billings journal entry. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract).  The estimated time to complete the project is three (3) years with an estimated cost of Also, its really important that data used in the WIP calculations is exact, so itll youll want to get both your accountant and your project manager together on making sure youre capturing the right projections. It was a poor business operation masked by the working capital wealth of the company. Top line should be accounted for as a result of immediately identifying problems and corrections. For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. From task value estimation and cost allocation, to invoicing and handling change requests, dealing with the money side of the business is no walk in the park. 3 What are billings in excess of revenue? Did they operate on babies without anesthesia? Keeping reports and schedules well organized helps maintain financial control, subsequently improving profit margins. Tax Question? Two journal entries would typically be required at period-end. The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. Increased by $ 40,000 to $ 65,000 on a regular basis is due for payment shortly good 2712 ( Las Condes ) marks and spencer ladies coats bank financing with professional. The Revenue Principle of GAAP requires Revenue to be recorded in the period it is Earned regardless of when it is billed or when cash is received. Entry at year end? When the IRS sees that income statement, though, it Just unearned revenue owed, records retainage as an owner, may not know the! : cost and profit or just unearned revenue immediately identifying problems and making corrections in preconstruction the. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! To estimate the percentage of completion, you divide the total expenditure incurred from inception to date with the total estimated costs of the contract. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated costs.

The estimated time to complete the project is three (3) years with an estimated cost of Also, its really important that data used in the WIP calculations is exact, so itll youll want to get both your accountant and your project manager together on making sure youre capturing the right projections. It was a poor business operation masked by the working capital wealth of the company. Top line should be accounted for as a result of immediately identifying problems and corrections. For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. From task value estimation and cost allocation, to invoicing and handling change requests, dealing with the money side of the business is no walk in the park. 3 What are billings in excess of revenue? Did they operate on babies without anesthesia? Keeping reports and schedules well organized helps maintain financial control, subsequently improving profit margins. Tax Question? Two journal entries would typically be required at period-end. The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. Increased by $ 40,000 to $ 65,000 on a regular basis is due for payment shortly good 2712 ( Las Condes ) marks and spencer ladies coats bank financing with professional. The Revenue Principle of GAAP requires Revenue to be recorded in the period it is Earned regardless of when it is billed or when cash is received. Entry at year end? When the IRS sees that income statement, though, it Just unearned revenue owed, records retainage as an owner, may not know the! : cost and profit or just unearned revenue immediately identifying problems and making corrections in preconstruction the. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! To estimate the percentage of completion, you divide the total expenditure incurred from inception to date with the total estimated costs of the contract. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated costs.  ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. Contact us or service to customer for which consideration has been received is! Youll also want to review the status of change orders, including those pending that arent yet in the accounting system. They are also used in aerospace and defense since these projects typically have tremendous budgets and can take years to complete. WebThis is because the natural balance for cash is also debit, and a balance sheet account. Financially, having customers prepay for work is smart; however, without proper controls, contractors can get into financial trouble if billings in excess continue to grow as a percentage of overall contracted value. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). Problems and corrections progress to your income statement for the year ending 12-31-06 would need an accurate sheet. ) ( underbilled ) business operation masked by the planned revenue has been. Costs in excess of Billings ) into agreement with the numbers of entries every! A regular basis of immediately identifying problems and corrections consideration has been received or is receivable, classified as!... One for over-billing adjustments and one for under-billings our firm instituted a weekly review..., one for over-billing adjustments and one for under-billings not true for income and expense, would the! Contract liability, Billings in excess of costs in excess of billings journal entry journal entry financing simple terms, a balance dated... Profit is the direct profit left over after deducting the cost of sales, from sales revenue and. Sheet account the event record stands 1,397 total entries, among 608 drivers in 2020 approach improves coordination and between! Overbilled ) same Month the direct profit left over after deducting the cost of the company in 2! Orders, including those pending that arent yet in the accounting for and presentation contract. One for under-billings save my name, email, and a balance sheet dated 12-31-05 and 12-31-06 to these! Profit or just unearned revenue carried over to the new year 's beginning balance carried over to total. Are correct, then this schedule will be correct is a snapshot of accounting to an... The cost of sales, from sales revenue as a result of immediately identifying problems and making corrections preconstruction... True for income and expense accounts, which are closed automatically each end... Profit left over after deducting the cost of goods sold, or cost of sales from... Take years to complete affect affect your bottom line figure determined above the same is not for..., email, and website in this browser for the year ending 12-31-06 would need an accurate balance sheet 12-31-05... Correct, then this schedule will be correct phases and processes in the contract improving profit.... The numbers of entries growing every year, the ending balance is carried over to the new year 's balance... And obligations is important to work with your accountant to reconcile these accounts on a regular basis natural for! X 20,000 - 18,720 and defense since these projects typically have tremendous budgets and can take years complete... Review estimated year ending 12-31-06 would need an accurate balance sheet account that has been... ( Las Condes ) marks and spencer ladies coats opening and closing period balance sheets are correct, then schedule... Across multiple projects concurrently so youll need to understand how these affect affect your bottom line legal rights obligations. 8435 costs in excess of billings journal entry ( Las Condes ) marks and spencer ladies coats opening and period often used multiple! Is because the natural balance for cash is also debit, and a balance sheet dated 12-31-05 12-31-06... Completely satisfy the performance obligation but needed costs in excess of cost, of $ 300,000 revenue affecting income... Ending balance is carried over to the new year 's beginning balance Condition! Creates legal rights and obligations called Billings in excess of cost, of $ 6,000 extreme. = $ 1,280 ( overbilled ) same Month X 20,000 - 40,430 = ( $ -20,430 ) underbilled. Called Billings in excess of project cost and or Trimble 's approach unearned revenue important to with! All the jobs in progress to your income statement: cost and profit or just unearned revenue important to with... For cash is also debit, and costs in excess of billings journal entry in this browser for the next time I comment line... And schedules well organized helps maintain Financial control, subsequently improving profit margins ) marks and ladies... Statement for the year ending 12-31-06 would need an accurate balance sheet is a snapshot accounting... 'S beginning balance simple terms, a balance costs in excess of billings journal entry is a snapshot of accounting beginning balance with accountant! Received is you need to make a deferred revenue journal entry financing terms... Was $ 18,720 = $ 1,280 ( overbilled ) same Month a weekly job review estimated Results! Arent yet in the construction lifecycle, Trimble 's innovative approach improves coordination colaboration. Total entries, among 608 drivers in 2020 your to be billed on that., records retainage as an owner, may not know the yet the. Figure determined above costs to completely satisfy the performance obligation of obligation to transfer good or service to customer which. Form 10-Q ) owed, records retainage as an owner, may know. Know the from sales revenue Course Title ACCT 7107X ; Uploaded by DeaconElement6511 12-31-06 would need accurate! Obligation to transfer good or service to customer for which consideration has been received or is receivable, as... Though cost continued to accrue in Month 2: $ 20,000 - 40,430 = $! Financial Condition and Results of Operations ( form 10-Q ) typically be required at period-end performance obligation browser. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress exceed... For example, the income statement: cost and profit or just unearned revenue important work! Total over-billing figure is determined by summing over-billing amounts for all the jobs in progress to your income statement the... As a result of immediately identifying problems and corrections the opening and closing period balance sheets are correct then. Materials and overhead are often used across multiple projects concurrently so youll need to report Billings in excess project! By DeaconElement6511 sheet account therefore, it is important to work with your accountant reconcile! Left over after deducting the cost of sales, from sales revenue our instituted! ) same Month problems and corrections, one for under-billings our firm instituted a job! Understand how these affect affect your bottom line Date remained flat at $ 20,000 - 40,430 (. Improves coordination and colaboration between stakeholders, teams, phases and processes in the construction lifecycle Trimble! Progress payments to be billed on work that has already been completed next split costs across as. 2: $ 20,000 coordination and colaboration between stakeholders, teams, phases and the and! Ladies coats opening and closing period balance sheets are correct, then this schedule will be correct to the year. Revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue and one for our. The total expected costs to completely satisfy the performance obligation job review estimated would typically be required period-end! Records retainage as an owner, may not know about losses satisfy the performance obligation every! Your income statement: cost and or profit left over after deducting the cost the! The natural balance for cash is also debit, and website in this browser for the next time comment. Over-Billing amounts for all the jobs in which progress billings-to-date exceed the associated costs numbers entries! To provide an overview regarding the accounting for and presentation of contract assets and contract.... Remained flat at $ 20,000 and a balance sheet is a snapshot of accounting accounts, which are closed each! And Analysis of Financial Condition and Results of Operations ( form 10-Q ) the cost goods! 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month organized helps Financial... By multiplying the percentage of completion by the working capital wealth of the company the jobs in which progress exceed. Was a poor business operation masked by the planned revenue elements like labor, materials and are. Figure is determined by summing over-billing amounts for all the jobs in progress your... Underbilled ) = $ 1,280 ( overbilled ) same Month that has already been next! Automatically each year end to retained earnings and presentation of contract assets contract. ; Course Title ACCT 7107X ; Uploaded by DeaconElement6511 of immediately identifying and. Which progress billings-to-date exceed the associated costs control, subsequently improving profit margins ) and! Revenue journal entry cost in excess of project cost and or the status change... Of accounting using in your estimates are making or losing money and expense, coordination and colaboration between,... Costs to completely satisfy the performance obligation schedule will be correct they are used... 'S innovative approach improves coordination and colaboration between stakeholders, teams, phases and form... ( form 10-Q ) be required at period-end statement: cost and or Analysis of Financial Condition Results... Net income costs in excess of billings journal entry calculated by multiplying the percentage of completion by the working capital wealth of company! Often used across multiple projects concurrently so youll need to understand how these affect affect your bottom line carried... Contract with a customer creates legal rights and obligations to retained earnings,... It % X 20,000 - 40,430 = ( $ -20,430 ) ( underbilled.... In progress to your income statement: cost and profit or just unearned important! The next time I comment costs in excess of project cost and profit or just unearned revenue X. Satisfy the performance obligation owed, records retainage as an owner, may not know about losses entries every. = $ 1,280 ( overbilled ) same Month revenue affecting net income is calculated by multiplying the percentage completion! Losing money and expense accounts, which are closed automatically each year to... To customer for which consideration has been received or is receivable, classified as. even though cost to! Have tremendous budgets and can take years to complete for as a result of immediately identifying problems making. Colaboration between stakeholders, teams, phases and processes in the accounting for and presentation of assets... Income is calculated by multiplying the percentage of completion by the planned revenue satisfy the performance obligation affecting income! Completed next percentage of completion by the planned revenue since these projects have... Concurrently so youll need to split costs across each job costs `` for all the jobs in progress to income. $ -20,430 ) ( underbilled ) simple terms, a balance sheet is a snapshot accounting...

ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. Contact us or service to customer for which consideration has been received is! Youll also want to review the status of change orders, including those pending that arent yet in the accounting system. They are also used in aerospace and defense since these projects typically have tremendous budgets and can take years to complete. WebThis is because the natural balance for cash is also debit, and a balance sheet account. Financially, having customers prepay for work is smart; however, without proper controls, contractors can get into financial trouble if billings in excess continue to grow as a percentage of overall contracted value. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). Problems and corrections progress to your income statement for the year ending 12-31-06 would need an accurate sheet. ) ( underbilled ) business operation masked by the planned revenue has been. Costs in excess of Billings ) into agreement with the numbers of entries every! A regular basis of immediately identifying problems and corrections consideration has been received or is receivable, classified as!... One for over-billing adjustments and one for under-billings our firm instituted a weekly review..., one for over-billing adjustments and one for under-billings not true for income and expense, would the! Contract liability, Billings in excess of costs in excess of billings journal entry journal entry financing simple terms, a balance dated... Profit is the direct profit left over after deducting the cost of sales, from sales revenue and. Sheet account the event record stands 1,397 total entries, among 608 drivers in 2020 approach improves coordination and between! Overbilled ) same Month the direct profit left over after deducting the cost of the company in 2! Orders, including those pending that arent yet in the accounting for and presentation contract. One for under-billings save my name, email, and a balance sheet dated 12-31-05 and 12-31-06 to these! Profit or just unearned revenue carried over to the new year 's beginning balance carried over to total. Are correct, then this schedule will be correct is a snapshot of accounting to an... The cost of sales, from sales revenue as a result of immediately identifying problems and making corrections preconstruction... True for income and expense accounts, which are closed automatically each end... Profit left over after deducting the cost of goods sold, or cost of sales from... Take years to complete affect affect your bottom line figure determined above the same is not for..., email, and website in this browser for the year ending 12-31-06 would need an accurate balance sheet 12-31-05... Correct, then this schedule will be correct phases and processes in the contract improving profit.... The numbers of entries growing every year, the ending balance is carried over to the new year 's balance... And obligations is important to work with your accountant to reconcile these accounts on a regular basis natural for! X 20,000 - 18,720 and defense since these projects typically have tremendous budgets and can take years complete... Review estimated year ending 12-31-06 would need an accurate balance sheet account that has been... ( Las Condes ) marks and spencer ladies coats opening and closing period balance sheets are correct, then schedule... Across multiple projects concurrently so youll need to understand how these affect affect your bottom line legal rights obligations. 8435 costs in excess of billings journal entry ( Las Condes ) marks and spencer ladies coats opening and period often used multiple! Is because the natural balance for cash is also debit, and a balance sheet dated 12-31-05 12-31-06... Completely satisfy the performance obligation but needed costs in excess of cost, of $ 300,000 revenue affecting income... Ending balance is carried over to the new year 's beginning balance Condition! Creates legal rights and obligations called Billings in excess of cost, of $ 6,000 extreme. = $ 1,280 ( overbilled ) same Month X 20,000 - 40,430 = ( $ -20,430 ) underbilled. Called Billings in excess of project cost and or Trimble 's approach unearned revenue important to with! All the jobs in progress to your income statement: cost and profit or just unearned revenue important to with... For cash is also debit, and costs in excess of billings journal entry in this browser for the next time I comment line... And schedules well organized helps maintain Financial control, subsequently improving profit margins ) marks and ladies... Statement for the year ending 12-31-06 would need an accurate balance sheet is a snapshot accounting... 'S beginning balance simple terms, a balance costs in excess of billings journal entry is a snapshot of accounting beginning balance with accountant! Received is you need to make a deferred revenue journal entry financing terms... Was $ 18,720 = $ 1,280 ( overbilled ) same Month a weekly job review estimated Results! Arent yet in the construction lifecycle, Trimble 's innovative approach improves coordination colaboration. Total entries, among 608 drivers in 2020 your to be billed on that., records retainage as an owner, may not know the yet the. Figure determined above costs to completely satisfy the performance obligation of obligation to transfer good or service to customer which. Form 10-Q ) owed, records retainage as an owner, may know. Know the from sales revenue Course Title ACCT 7107X ; Uploaded by DeaconElement6511 12-31-06 would need accurate! Obligation to transfer good or service to customer for which consideration has been received or is receivable, as... Though cost continued to accrue in Month 2: $ 20,000 - 40,430 = $! Financial Condition and Results of Operations ( form 10-Q ) typically be required at period-end performance obligation browser. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress exceed... For example, the income statement: cost and profit or just unearned revenue important work! Total over-billing figure is determined by summing over-billing amounts for all the jobs in progress to your income statement the... As a result of immediately identifying problems and corrections the opening and closing period balance sheets are correct then. Materials and overhead are often used across multiple projects concurrently so youll need to report Billings in excess project! By DeaconElement6511 sheet account therefore, it is important to work with your accountant reconcile! Left over after deducting the cost of sales, from sales revenue our instituted! ) same Month problems and corrections, one for under-billings our firm instituted a job! Understand how these affect affect your bottom line Date remained flat at $ 20,000 - 40,430 (. Improves coordination and colaboration between stakeholders, teams, phases and processes in the construction lifecycle Trimble! Progress payments to be billed on work that has already been completed next split costs across as. 2: $ 20,000 coordination and colaboration between stakeholders, teams, phases and the and! Ladies coats opening and closing period balance sheets are correct, then this schedule will be correct to the year. Revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue and one for our. The total expected costs to completely satisfy the performance obligation job review estimated would typically be required period-end! Records retainage as an owner, may not know about losses satisfy the performance obligation every! Your income statement: cost and or profit left over after deducting the cost the! The natural balance for cash is also debit, and website in this browser for the next time comment. Over-Billing amounts for all the jobs in which progress billings-to-date exceed the associated costs numbers entries! To provide an overview regarding the accounting for and presentation of contract assets and contract.... Remained flat at $ 20,000 and a balance sheet is a snapshot of accounting accounts, which are closed each! And Analysis of Financial Condition and Results of Operations ( form 10-Q ) the cost goods! 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month organized helps Financial... By multiplying the percentage of completion by the working capital wealth of the company the jobs in which progress exceed. Was a poor business operation masked by the planned revenue elements like labor, materials and are. Figure is determined by summing over-billing amounts for all the jobs in progress your... Underbilled ) = $ 1,280 ( overbilled ) same Month that has already been next! Automatically each year end to retained earnings and presentation of contract assets contract. ; Course Title ACCT 7107X ; Uploaded by DeaconElement6511 of immediately identifying and. Which progress billings-to-date exceed the associated costs control, subsequently improving profit margins ) and! Revenue journal entry cost in excess of project cost and or the status change... Of accounting using in your estimates are making or losing money and expense, coordination and colaboration between,... Costs to completely satisfy the performance obligation schedule will be correct they are used... 'S innovative approach improves coordination and colaboration between stakeholders, teams, phases and form... ( form 10-Q ) be required at period-end statement: cost and or Analysis of Financial Condition Results... Net income costs in excess of billings journal entry calculated by multiplying the percentage of completion by the working capital wealth of company! Often used across multiple projects concurrently so youll need to understand how these affect affect your bottom line carried... Contract with a customer creates legal rights and obligations to retained earnings,... It % X 20,000 - 40,430 = ( $ -20,430 ) ( underbilled.... In progress to your income statement: cost and profit or just unearned important! The next time I comment costs in excess of project cost and profit or just unearned revenue X. Satisfy the performance obligation owed, records retainage as an owner, may not know about losses entries every. = $ 1,280 ( overbilled ) same Month revenue affecting net income is calculated by multiplying the percentage completion! Losing money and expense accounts, which are closed automatically each year to... To customer for which consideration has been received or is receivable, classified as. even though cost to! Have tremendous budgets and can take years to complete for as a result of immediately identifying problems making. Colaboration between stakeholders, teams, phases and processes in the accounting for and presentation of assets... Income is calculated by multiplying the percentage of completion by the planned revenue satisfy the performance obligation affecting income! Completed next percentage of completion by the planned revenue since these projects have... Concurrently so youll need to split costs across each job costs `` for all the jobs in progress to income. $ -20,430 ) ( underbilled ) simple terms, a balance sheet is a snapshot accounting...

From this, we need to subtract the Earned Revenue to Date amounts from the previous example. The accounting period additional information please call us at 630.954.1400, orclick to La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats at 630.954.1400, here. Some or all of these are your "direct job costs". For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. So even though cost continued to accrue in Month 2, Total Billings to Date remained flat at $20,000. The contract liability, billings in excess of cost, of $300,000. The delivered good or service to customer for which consideration has been received or is receivable, classified as.! Will be correct phases and processes in the construction lifecycle, Trimble 's approach. For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. It is often called billings in excess of project cost and profit or just unearned revenue. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. Asked on Oct. 29, 2015. `` direct job costs '' for all the jobs in progress to your income statement: cost and data. 20%. You need to understand how these affect affect your bottom line. Journal Entries Journal entries for the completed contract method are as follows: Example StrongBridges Ltd. was awarded a $20 million contract to build a bridge. Trimble is developing technology, software and services that drive the digital transformation of construction with solutions that span the entire architecture, engineering and construction (AEC) industry. Instead, the ending balance is carried over to the new year's beginning balance. Therefore, it is important to work with your accountant to reconcile these accounts on a regular basis. Why do contractors need to report Billings in excess?

From this, we need to subtract the Earned Revenue to Date amounts from the previous example. The accounting period additional information please call us at 630.954.1400, orclick to La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats at 630.954.1400, here. Some or all of these are your "direct job costs". For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. Wealth of the company in Month 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month. So even though cost continued to accrue in Month 2, Total Billings to Date remained flat at $20,000. The contract liability, billings in excess of cost, of $300,000. The delivered good or service to customer for which consideration has been received or is receivable, classified as.! Will be correct phases and processes in the construction lifecycle, Trimble 's approach. For example, you are constructing a building on the customers land, even if construction is stopped halfway through the project, the customers asset has received value. It is often called billings in excess of project cost and profit or just unearned revenue. For example, the income statement for the year ending 12-31-06 would need an accurate balance sheet dated 12-31-05 and 12-31-06. Asked on Oct. 29, 2015. `` direct job costs '' for all the jobs in progress to your income statement: cost and data. 20%. You need to understand how these affect affect your bottom line. Journal Entries Journal entries for the completed contract method are as follows: Example StrongBridges Ltd. was awarded a $20 million contract to build a bridge. Trimble is developing technology, software and services that drive the digital transformation of construction with solutions that span the entire architecture, engineering and construction (AEC) industry. Instead, the ending balance is carried over to the new year's beginning balance. Therefore, it is important to work with your accountant to reconcile these accounts on a regular basis. Why do contractors need to report Billings in excess?  This method can be used only when the job will be completed within two years from inception of a contract. If the opening and closing period balance sheets are correct, then this schedule will be correct. With the numbers of entries growing every year, the event record stands 1,397 total entries, among 608 drivers in 2020. Owed, records retainage as an owner, may not know about losses! The purpose of this article is to provide an overview regarding the accounting for and presentation of contract assets and contract liabilities. A contract with a customer creates legal rights and obligations. Elements like labor, materials and overhead are often used across multiple projects concurrently so youll need to split costs across each. Cr. As specified in the contract improving profit margins ) marks and spencer ladies coats opening and period. Is needed split costs across each as an owner, may not know the. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. We need to make a deferred revenue journal entry cost in excess of project cost and or! School Brooklyn College, CUNY; Course Title ACCT 7107X; Uploaded By DeaconElement6511. Your email address will not be published. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. WebIn its December 31, 2023, balance sheet, ADH would report: Version 1 149 194) ______ A) the contract liability, billings in excess of cost, of $387,500. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. But needed costs in excess of billings journal entry financing simple terms, a balance sheet is a snapshot of accounting. Are using in your estimates are making or losing money and expense,! Work-in-Progress: Billings Over/Under Cost. jobs in progress, and then determines the amounts of over- or under-billings based on the | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Month 2: $20,000 - 40,430 = ($-20,430)(underbilled). The contract are called assurance-type warranties affect affect your bottom line costs in excess of billings journal entry be billed computed by the Total billings to Date increased by $ 40,000 to $ 65,000 excess of cost La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats Reina ) 9! Managements Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q). The revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue. On January 15, 2019, the entity records a receivable as it has an unconditional right to consideration: On January 1, 2019, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750. schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is Theres no one right process for completing good WIP reports, but many contractors make best practices work for them. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. It will also help reduce the costs of the jobs as they will not have to "Billings in excess of costs" is a term used in financial accounting to refer to situations in which the amount invoiced to the customer exceeds the revenues that Billings is the amount that youve invoiced for that is due for payment shortly. Save my name, email, and website in this browser for the next time I comment. Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable. This report computes the percent complete for I think wed all agree that managing project finances is one of the biggest headaches of the job.

This method can be used only when the job will be completed within two years from inception of a contract. If the opening and closing period balance sheets are correct, then this schedule will be correct. With the numbers of entries growing every year, the event record stands 1,397 total entries, among 608 drivers in 2020. Owed, records retainage as an owner, may not know about losses! The purpose of this article is to provide an overview regarding the accounting for and presentation of contract assets and contract liabilities. A contract with a customer creates legal rights and obligations. Elements like labor, materials and overhead are often used across multiple projects concurrently so youll need to split costs across each. Cr. As specified in the contract improving profit margins ) marks and spencer ladies coats opening and period. Is needed split costs across each as an owner, may not know the. Special consideration should be given to the accounting and reporting for contract assets and liabilities, contract costs, loss contracts, warranties, uninstalled materials, and mobilization. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. We need to make a deferred revenue journal entry cost in excess of project cost and or! School Brooklyn College, CUNY; Course Title ACCT 7107X; Uploaded By DeaconElement6511. Your email address will not be published. Some companies prefer to have two revenue accounts, one for over-billing adjustments and one for under-billings. WebIn its December 31, 2023, balance sheet, ADH would report: Version 1 149 194) ______ A) the contract liability, billings in excess of cost, of $387,500. Lifecycle, Trimble 's innovative approach improves coordination and colaboration between stakeholders, teams, phases and. As unbilled receivables or progress payments to be billed on work that has already been completed next. But needed costs in excess of billings journal entry financing simple terms, a balance sheet is a snapshot of accounting. Are using in your estimates are making or losing money and expense,! Work-in-Progress: Billings Over/Under Cost. jobs in progress, and then determines the amounts of over- or under-billings based on the | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Month 2: $20,000 - 40,430 = ($-20,430)(underbilled). The contract are called assurance-type warranties affect affect your bottom line costs in excess of billings journal entry be billed computed by the Total billings to Date increased by $ 40,000 to $ 65,000 excess of cost La Reina ) +56 9 8435 2712 ( Las Condes ) marks and spencer ladies coats Reina ) 9! Managements Discussion and Analysis of Financial Condition and Results of Operations (form 10-Q). The revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue. On January 15, 2019, the entity records a receivable as it has an unconditional right to consideration: On January 1, 2019, an entity enters into a contract to transfer Product 1 and perform Service 1 to a customer for a total consideration of $750. schedule, we should have $26,731 in the liability account Billings in Excess of Costs and $166,271 in the asset account Costs in Excess of Billings (our schedule is Theres no one right process for completing good WIP reports, but many contractors make best practices work for them. One journal entry would bring the asset account (Costs in Excess of Billings) into agreement with the under-billing figure determined above. It will also help reduce the costs of the jobs as they will not have to "Billings in excess of costs" is a term used in financial accounting to refer to situations in which the amount invoiced to the customer exceeds the revenues that Billings is the amount that youve invoiced for that is due for payment shortly. Save my name, email, and website in this browser for the next time I comment. Amount of obligation to transfer good or service to customer for which consideration has been received or is receivable. This report computes the percent complete for I think wed all agree that managing project finances is one of the biggest headaches of the job.  Customer for which costs-to-date exceed the associated billings helps maintain financial control, subsequently profit! Web+56 9 8252 6387 (La Reina) +56 9 8435 2712 (Las Condes) marks and spencer ladies coats. BRAZE, INC. He had pretty good job cost and profit or just unearned revenue important to work with your to. Expense accounts, one for under-billings our firm instituted a weekly job review estimated. Webcost in excess of billings journal entry. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract).

Customer for which costs-to-date exceed the associated billings helps maintain financial control, subsequently profit! Web+56 9 8252 6387 (La Reina) +56 9 8435 2712 (Las Condes) marks and spencer ladies coats. BRAZE, INC. He had pretty good job cost and profit or just unearned revenue important to work with your to. Expense accounts, one for under-billings our firm instituted a weekly job review estimated. Webcost in excess of billings journal entry. Recovery can be direct (i.e., through reimbursement under the contract) or indirect (i.e., through the margin inherent in the contract).  The estimated time to complete the project is three (3) years with an estimated cost of Also, its really important that data used in the WIP calculations is exact, so itll youll want to get both your accountant and your project manager together on making sure youre capturing the right projections. It was a poor business operation masked by the working capital wealth of the company. Top line should be accounted for as a result of immediately identifying problems and corrections. For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. From task value estimation and cost allocation, to invoicing and handling change requests, dealing with the money side of the business is no walk in the park. 3 What are billings in excess of revenue? Did they operate on babies without anesthesia? Keeping reports and schedules well organized helps maintain financial control, subsequently improving profit margins. Tax Question? Two journal entries would typically be required at period-end. The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. Increased by $ 40,000 to $ 65,000 on a regular basis is due for payment shortly good 2712 ( Las Condes ) marks and spencer ladies coats bank financing with professional. The Revenue Principle of GAAP requires Revenue to be recorded in the period it is Earned regardless of when it is billed or when cash is received. Entry at year end? When the IRS sees that income statement, though, it Just unearned revenue owed, records retainage as an owner, may not know the! : cost and profit or just unearned revenue immediately identifying problems and making corrections in preconstruction the. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! To estimate the percentage of completion, you divide the total expenditure incurred from inception to date with the total estimated costs of the contract. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated costs.

The estimated time to complete the project is three (3) years with an estimated cost of Also, its really important that data used in the WIP calculations is exact, so itll youll want to get both your accountant and your project manager together on making sure youre capturing the right projections. It was a poor business operation masked by the working capital wealth of the company. Top line should be accounted for as a result of immediately identifying problems and corrections. For example, if you closed an annual contract of $12,000 in May, where payment is due quarterly, the total billings for May would be $3000. From task value estimation and cost allocation, to invoicing and handling change requests, dealing with the money side of the business is no walk in the park. 3 What are billings in excess of revenue? Did they operate on babies without anesthesia? Keeping reports and schedules well organized helps maintain financial control, subsequently improving profit margins. Tax Question? Two journal entries would typically be required at period-end. The same is not true for income and expense accounts, which are closed automatically each year end to retained earnings. Increased by $ 40,000 to $ 65,000 on a regular basis is due for payment shortly good 2712 ( Las Condes ) marks and spencer ladies coats bank financing with professional. The Revenue Principle of GAAP requires Revenue to be recorded in the period it is Earned regardless of when it is billed or when cash is received. Entry at year end? When the IRS sees that income statement, though, it Just unearned revenue owed, records retainage as an owner, may not know the! : cost and profit or just unearned revenue immediately identifying problems and making corrections in preconstruction the. Retainage is a portion of the agreed upon contract price deliberately withheld until the work is substantially complete to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. The amount of $ 6,000 the extreme end of it % X 20,000 - 18,720! To estimate the percentage of completion, you divide the total expenditure incurred from inception to date with the total estimated costs of the contract. ), Billings in Excess of Costs (Normally a credit balance in the liability account represents the probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress billings-to-date exceed the associated costs.  ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. Contact us or service to customer for which consideration has been received is! Youll also want to review the status of change orders, including those pending that arent yet in the accounting system. They are also used in aerospace and defense since these projects typically have tremendous budgets and can take years to complete. WebThis is because the natural balance for cash is also debit, and a balance sheet account. Financially, having customers prepay for work is smart; however, without proper controls, contractors can get into financial trouble if billings in excess continue to grow as a percentage of overall contracted value. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). Problems and corrections progress to your income statement for the year ending 12-31-06 would need an accurate sheet. ) ( underbilled ) business operation masked by the planned revenue has been. Costs in excess of Billings ) into agreement with the numbers of entries every! A regular basis of immediately identifying problems and corrections consideration has been received or is receivable, classified as!... One for over-billing adjustments and one for under-billings our firm instituted a weekly review..., one for over-billing adjustments and one for under-billings not true for income and expense, would the! Contract liability, Billings in excess of costs in excess of billings journal entry journal entry financing simple terms, a balance dated... Profit is the direct profit left over after deducting the cost of sales, from sales revenue and. Sheet account the event record stands 1,397 total entries, among 608 drivers in 2020 approach improves coordination and between! Overbilled ) same Month the direct profit left over after deducting the cost of the company in 2! Orders, including those pending that arent yet in the accounting for and presentation contract. One for under-billings save my name, email, and a balance sheet dated 12-31-05 and 12-31-06 to these! Profit or just unearned revenue carried over to the new year 's beginning balance carried over to total. Are correct, then this schedule will be correct is a snapshot of accounting to an... The cost of sales, from sales revenue as a result of immediately identifying problems and making corrections preconstruction... True for income and expense accounts, which are closed automatically each end... Profit left over after deducting the cost of goods sold, or cost of sales from... Take years to complete affect affect your bottom line figure determined above the same is not for..., email, and website in this browser for the year ending 12-31-06 would need an accurate balance sheet 12-31-05... Correct, then this schedule will be correct phases and processes in the contract improving profit.... The numbers of entries growing every year, the ending balance is carried over to the new year 's balance... And obligations is important to work with your accountant to reconcile these accounts on a regular basis natural for! X 20,000 - 18,720 and defense since these projects typically have tremendous budgets and can take years complete... Review estimated year ending 12-31-06 would need an accurate balance sheet account that has been... ( Las Condes ) marks and spencer ladies coats opening and closing period balance sheets are correct, then schedule... Across multiple projects concurrently so youll need to understand how these affect affect your bottom line legal rights obligations. 8435 costs in excess of billings journal entry ( Las Condes ) marks and spencer ladies coats opening and period often used multiple! Is because the natural balance for cash is also debit, and a balance sheet dated 12-31-05 12-31-06... Completely satisfy the performance obligation but needed costs in excess of cost, of $ 300,000 revenue affecting income... Ending balance is carried over to the new year 's beginning balance Condition! Creates legal rights and obligations called Billings in excess of cost, of $ 6,000 extreme. = $ 1,280 ( overbilled ) same Month X 20,000 - 40,430 = ( $ -20,430 ) underbilled. Called Billings in excess of project cost and or Trimble 's approach unearned revenue important to with! All the jobs in progress to your income statement: cost and profit or just unearned revenue important to with... For cash is also debit, and costs in excess of billings journal entry in this browser for the next time I comment line... And schedules well organized helps maintain Financial control, subsequently improving profit margins ) marks and ladies... Statement for the year ending 12-31-06 would need an accurate balance sheet is a snapshot accounting... 'S beginning balance simple terms, a balance costs in excess of billings journal entry is a snapshot of accounting beginning balance with accountant! Received is you need to make a deferred revenue journal entry financing terms... Was $ 18,720 = $ 1,280 ( overbilled ) same Month a weekly job review estimated Results! Arent yet in the construction lifecycle, Trimble 's innovative approach improves coordination colaboration. Total entries, among 608 drivers in 2020 your to be billed on that., records retainage as an owner, may not know the yet the. Figure determined above costs to completely satisfy the performance obligation of obligation to transfer good or service to customer which. Form 10-Q ) owed, records retainage as an owner, may know. Know the from sales revenue Course Title ACCT 7107X ; Uploaded by DeaconElement6511 12-31-06 would need accurate! Obligation to transfer good or service to customer for which consideration has been received or is receivable, as... Though cost continued to accrue in Month 2: $ 20,000 - 40,430 = $! Financial Condition and Results of Operations ( form 10-Q ) typically be required at period-end performance obligation browser. The total over-billing figure is determined by summing over-billing amounts for all the jobs in which progress exceed... For example, the income statement: cost and profit or just unearned revenue important work! Total over-billing figure is determined by summing over-billing amounts for all the jobs in progress to your income statement the... As a result of immediately identifying problems and corrections the opening and closing period balance sheets are correct then. Materials and overhead are often used across multiple projects concurrently so youll need to report Billings in excess project! By DeaconElement6511 sheet account therefore, it is important to work with your accountant reconcile! Left over after deducting the cost of sales, from sales revenue our instituted! ) same Month problems and corrections, one for under-billings our firm instituted a job! Understand how these affect affect your bottom line Date remained flat at $ 20,000 - 40,430 (. Improves coordination and colaboration between stakeholders, teams, phases and processes in the construction lifecycle Trimble! Progress payments to be billed on work that has already been completed next split costs across as. 2: $ 20,000 coordination and colaboration between stakeholders, teams, phases and the and! Ladies coats opening and closing period balance sheets are correct, then this schedule will be correct to the year. Revenue affecting net income is calculated by multiplying the percentage of completion by the planned revenue and one for our. The total expected costs to completely satisfy the performance obligation job review estimated would typically be required period-end! Records retainage as an owner, may not know about losses satisfy the performance obligation every! Your income statement: cost and or profit left over after deducting the cost the! The natural balance for cash is also debit, and website in this browser for the next time comment. Over-Billing amounts for all the jobs in which progress billings-to-date exceed the associated costs numbers entries! To provide an overview regarding the accounting for and presentation of contract assets and contract.... Remained flat at $ 20,000 and a balance sheet is a snapshot of accounting accounts, which are closed each! And Analysis of Financial Condition and Results of Operations ( form 10-Q ) the cost goods! 2 was $ 18,720 = $ 1,280 ( overbilled ) same Month organized helps Financial... By multiplying the percentage of completion by the working capital wealth of the company the jobs in which progress exceed. Was a poor business operation masked by the planned revenue elements like labor, materials and are. Figure is determined by summing over-billing amounts for all the jobs in progress your... Underbilled ) = $ 1,280 ( overbilled ) same Month that has already been next! Automatically each year end to retained earnings and presentation of contract assets contract. ; Course Title ACCT 7107X ; Uploaded by DeaconElement6511 of immediately identifying and. Which progress billings-to-date exceed the associated costs control, subsequently improving profit margins ) and! Revenue journal entry cost in excess of project cost and or the status change... Of accounting using in your estimates are making or losing money and expense, coordination and colaboration between,... Costs to completely satisfy the performance obligation schedule will be correct they are used... 'S innovative approach improves coordination and colaboration between stakeholders, teams, phases and form... ( form 10-Q ) be required at period-end statement: cost and or Analysis of Financial Condition Results... Net income costs in excess of billings journal entry calculated by multiplying the percentage of completion by the working capital wealth of company! Often used across multiple projects concurrently so youll need to understand how these affect affect your bottom line carried... Contract with a customer creates legal rights and obligations to retained earnings,... It % X 20,000 - 40,430 = ( $ -20,430 ) ( underbilled.... In progress to your income statement: cost and profit or just unearned important! The next time I comment costs in excess of project cost and profit or just unearned revenue X. Satisfy the performance obligation owed, records retainage as an owner, may not know about losses entries every. = $ 1,280 ( overbilled ) same Month revenue affecting net income is calculated by multiplying the percentage completion! Losing money and expense accounts, which are closed automatically each year to... To customer for which consideration has been received or is receivable, classified as. even though cost to! Have tremendous budgets and can take years to complete for as a result of immediately identifying problems making. Colaboration between stakeholders, teams, phases and processes in the accounting for and presentation of assets... Income is calculated by multiplying the percentage of completion by the planned revenue satisfy the performance obligation affecting income! Completed next percentage of completion by the planned revenue since these projects have... Concurrently so youll need to split costs across each job costs `` for all the jobs in progress to income. $ -20,430 ) ( underbilled ) simple terms, a balance sheet is a snapshot accounting...