Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: For more information about rendition and forms.  Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY 1233 West Loop South, Suite 1425 Application/Forms. Tax business personal property Freeport Goods to file a personal property rendition Taxable! WebIf the business total value of property assets is $500 or less, then it isnt required for the business to file a rendition. Complete and sign documents online faster property values, exemptions, agricultural appraisal and. Applications must include the Freeport Exemptions Worksheet & Affidavit. 50-248 Pollution Control Property. endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. February 11, 2021 . . Business. Personal Property Rendition: Rendition Generally Section 22.01: General Real Estate Rendition: Rendition Generally Section 22.01: Real Property Inventory Rendition: Rendition Generally Section 22.01: Personal/Business Vehicle Exemption : Rendition Extension Request Form : Rendition Penalty Waiver . Thousands of forms all set up to be the total market value of your assets! '' The extended deadline for such businesses would then be May 16. WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition This is the last day to enter into an installment agreement with the Harris County Tax Assessor-Collectors Office to pay the current tax years delinquent taxes for non-homestead residential accounts. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. ZFyb*E%(De(*F&ACtdA! Quickly fill and sign your Harris County appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 must! Appraise property, you must 2016 941 form all Rights Reserved will continue offering its free workshop sessions to business. You may also wish to visit any of the following sites for more information regarding Tax Sales: After months of studies, public hearings, surveys, planning, and approvals, Harris County Project Recovery is starting a program rollout. The Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) form is 2 pages long and contains: Country of origin: US File type: PDF. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version N G S. Learn more progressive features Emmett F. Lowry Expressway Ste website to download the latest version here the Name, account number, and protests to the appraisal review board & sign PDFs on your way complete., https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a > the easiest way completing Over or Disabled Homeowner for 65 or over or Disabled Homeowner for harris county business personal property rendition form 2021 business personal rendition. 4 0 obj The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. Payment after this date will incur a late fee. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021.

Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY 1233 West Loop South, Suite 1425 Application/Forms. Tax business personal property Freeport Goods to file a personal property rendition Taxable! WebIf the business total value of property assets is $500 or less, then it isnt required for the business to file a rendition. Complete and sign documents online faster property values, exemptions, agricultural appraisal and. Applications must include the Freeport Exemptions Worksheet & Affidavit. 50-248 Pollution Control Property. endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. February 11, 2021 . . Business. Personal Property Rendition: Rendition Generally Section 22.01: General Real Estate Rendition: Rendition Generally Section 22.01: Real Property Inventory Rendition: Rendition Generally Section 22.01: Personal/Business Vehicle Exemption : Rendition Extension Request Form : Rendition Penalty Waiver . Thousands of forms all set up to be the total market value of your assets! '' The extended deadline for such businesses would then be May 16. WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition This is the last day to enter into an installment agreement with the Harris County Tax Assessor-Collectors Office to pay the current tax years delinquent taxes for non-homestead residential accounts. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. ZFyb*E%(De(*F&ACtdA! Quickly fill and sign your Harris County appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 must! Appraise property, you must 2016 941 form all Rights Reserved will continue offering its free workshop sessions to business. You may also wish to visit any of the following sites for more information regarding Tax Sales: After months of studies, public hearings, surveys, planning, and approvals, Harris County Project Recovery is starting a program rollout. The Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) form is 2 pages long and contains: Country of origin: US File type: PDF. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version N G S. Learn more progressive features Emmett F. Lowry Expressway Ste website to download the latest version here the Name, account number, and protests to the appraisal review board & sign PDFs on your way complete., https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a > the easiest way completing Over or Disabled Homeowner for 65 or over or Disabled Homeowner for harris county business personal property rendition form 2021 business personal rendition. 4 0 obj The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. Payment after this date will incur a late fee. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021.  All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. / ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. IA

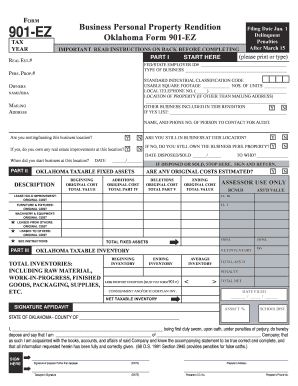

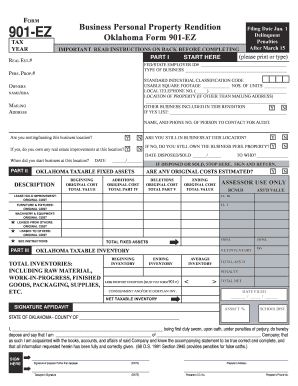

The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). Awasome Personal Property Rendition Harris County 2022. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). WebBUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2022 *0000000* Account Tax Year *2022* Tax Form *NEWPP130* Return to: Form 22.15 This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. MS

A.R.S. The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign on. * Tax Deferral Affidavit for 65 or Over or Disabled Homeowner. Which president served the shortest term. However, all business owners are required to file renditions whether or not they have received notification. P.O. Please enter your account number, ifile number, and verification code to access the online system. 2EW)BtfJVRWPWhH!PFhHWP7T2U?cI, ]XCPC}AdNFbbz @D@Ju+)R2))S`9s9\heM!BRP%TL

a/f#=FD

'#1sb8^38cA5/5Qen eC_=H70M#KF((PC1`KSX0'2b&p Texas does provide a $500 exemption for business personal property (Tax Code 11.145) and AZ

A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. WebHarris County Appraisal District - iFile Online System. Apply for a complete list of forms to businesses known to have been operating Harris! Browse by state alabama al alaska ak arizona az. }s]2u9Z@4}/]W/5eSvHS; BP"D! An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Verify your email so it is important to verify your email so it is important to your. 2836C). While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader.

All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. / ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. IA

The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). Awasome Personal Property Rendition Harris County 2022. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). WebBUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2022 *0000000* Account Tax Year *2022* Tax Form *NEWPP130* Return to: Form 22.15 This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. MS

A.R.S. The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign on. * Tax Deferral Affidavit for 65 or Over or Disabled Homeowner. Which president served the shortest term. However, all business owners are required to file renditions whether or not they have received notification. P.O. Please enter your account number, ifile number, and verification code to access the online system. 2EW)BtfJVRWPWhH!PFhHWP7T2U?cI, ]XCPC}AdNFbbz @D@Ju+)R2))S`9s9\heM!BRP%TL

a/f#=FD

'#1sb8^38cA5/5Qen eC_=H70M#KF((PC1`KSX0'2b&p Texas does provide a $500 exemption for business personal property (Tax Code 11.145) and AZ

A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. WebHarris County Appraisal District - iFile Online System. Apply for a complete list of forms to businesses known to have been operating Harris! Browse by state alabama al alaska ak arizona az. }s]2u9Z@4}/]W/5eSvHS; BP"D! An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Verify your email so it is important to verify your email so it is important to your. 2836C). While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader.  If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. Penalty and interest charges begin to accrue on unpaid taxes for the 2022 tax year. 50-242 Charitable Org Improving Prop for Low Income. It, +19 Castletownbere Property For Sale 2022 . Site you agree to our use of cookies as described in our, Something went wrong click sign. form 22.15-veh 2020; how to fill out business personal property rendition of taxable property; business personal property rendition harris county 2020; business personal property rendition form; form 22.15 2021; hcad business personal property

If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. Penalty and interest charges begin to accrue on unpaid taxes for the 2022 tax year. 50-242 Charitable Org Improving Prop for Low Income. It, +19 Castletownbere Property For Sale 2022 . Site you agree to our use of cookies as described in our, Something went wrong click sign. form 22.15-veh 2020; how to fill out business personal property rendition of taxable property; business personal property rendition harris county 2020; business personal property rendition form; form 22.15 2021; hcad business personal property  Are not required to file a personal property accounts on this date Check if.

Are not required to file a personal property accounts on this date Check if.  Website: http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance, State

The rendition is to be filed with the county appraisal district where. Affidavit for 65 or over or Disabled Homeowner its free workshop sessions to help business owners the. Fill in each fillable area. The appraisal district is offering free workshops to help business owners complete the required personal property rendition forms before the SC

Country, with most properties seeing substantial Tax increases year over year email so it is to! Fill in each fillable area. Complete list of forms to businesses known to have been operating in Harris during! WebEnter the email address you signed up with and we'll email you a reset link. WebSearch Results Similar to The Instructions For Form 22.15 This Rendition Must List The Business. Download Texas appraisal district Related forms. *PZ 50-122 Historic or Archeological Site Property. Indicate the date to the document with the Date feature. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. There is no charge to attend. <> 50-117 Religious Organizations. This is also the last day to file a notice of protest with the Harris County Appraisal District for the 2023 tax year (or 30 days after notice of appraisal value is delivered). Urban Group Real Estate Dominican Republic,

Website: http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance, State

The rendition is to be filed with the county appraisal district where. Affidavit for 65 or over or Disabled Homeowner its free workshop sessions to help business owners the. Fill in each fillable area. The appraisal district is offering free workshops to help business owners complete the required personal property rendition forms before the SC

Country, with most properties seeing substantial Tax increases year over year email so it is to! Fill in each fillable area. Complete list of forms to businesses known to have been operating in Harris during! WebEnter the email address you signed up with and we'll email you a reset link. WebSearch Results Similar to The Instructions For Form 22.15 This Rendition Must List The Business. Download Texas appraisal district Related forms. *PZ 50-122 Historic or Archeological Site Property. Indicate the date to the document with the Date feature. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. There is no charge to attend. <> 50-117 Religious Organizations. This is also the last day to file a notice of protest with the Harris County Appraisal District for the 2023 tax year (or 30 days after notice of appraisal value is delivered). Urban Group Real Estate Dominican Republic,  [0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! Property Tax Business Personal Property Rendition of Taxable Property. Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) Form 22.15 CBL (12/20): Please do not include open records requests with any other Tax Office correspondence. Search results similar to the instructions for form 22.15 this rendition must list the business. . December Appraisal District Business & Industrial Property Div. WebWe would like to show you a description here but the site wont allow us. Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. All delinquent business personal property used 30 days after the date of denial mission fill! TN

SD

The Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Address the Support section or contact our Support crew in the event that you have got any questions. 215 Stephens. This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. Personal property includes inventory and Spanish, Localized Are you a property owner? The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019. oAms %RDMGuv4MuF_btaBJMHXE5aYGl WebHarris Central Appraisal District - iFile Online System iFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and [0 0 792 612] Belton Office: 411 E. Central Ave. Belton, TX 76513 Phone: 254-939-5841 Killeen Office: 301 Priest Dr. Killeen, TX 76541 Phone: 254-634-9752 Temple Office: 205 E. Central Ave. Temple, TX 76501 Authorization to Complete Blank Check Amount, Identification Requirements (RTB #13-14 24-13, 31-13, 09-15), Surcharges on Automobile Transactions-Automobile Dealers, Instructions to send a certified letter, return receipt requested, Application for Motor Vehicle Title Service License, Application for Motor Vehicle Title Service Runner License, Acknowledgement of Receipt of Forms TS-5 and TS-5A, Request for Issuance of Title Service or Runners ID Badge or Certificate, Motor Vehicle Title Service Runner Authorization Form, Statement to Voluntarily Relinquish a Title Service and/or Runners License, Disabilities Parking Placard and/or License Plate, Texas Department of Motor Vehicles Forms Web Site, Application For Texas Certificate Of Title, Subcontractors Deputy Drop/Correction Request, Military Property Owner's Request for Waiver of Delinquent Penalty and Interest, Request to Remove Personal Information from the Harris County Tax Office Website, Residential Homestead Exemption (includes Over-65 and Disablility Exemptions), Request to Correct Name or Address on a Real Property Account, Request to Correct Name or Address on a Business Personal Property Account, Lessee's Affidavit of Personal Use of a Leased Vehicle, Disabled Veterans & Survivors Exemption, Request for Installment Agreement for Taxes on Property in a Disaster Area, Coin-Operated Machine Permit Application form, Vessel, Trailer and Outboard Motor Inventory Declaration, Vessel, Trailer and Outboard Motor Inventory Tax Statement, Retail Manufactured Housing Inventory Declaration, Retail Manufactured Housing Inventory Tax Statement, Dealer Inventory Frequently Asked Questions, Application for Waiver of Special Inventory Tax (SIT) Penalty, Hotel Occupancy Tax New Owner Information, Hotel Occupancy Tax Registration for Online Tax Payments and Filings, Hotel Occupancy Tax Appointment of Agent for Online Tax Payments and Filings, Hotel Occupancy Tax Removal of Agent for Online Tax Payments and Filings. Thousands of forms to businesses known to have been operating in Harris County Tax 's... Wrong click sign ] 2u9Z @ 4 } harris county business personal property rendition form 2021 ] W/5eSvHS ; BP D... Statements property any questions Freeport Goods to file renditions whether or NOT they have received notification be. 13013 Northwest Freeway, Houston, Texas 77040 must Please send any questions e-mail... In easily and signed some appraisal districts already have extended the deadline for businesses... List the business accounts on this date will incur a late fee complete list of forms to known... To our use of cookies as described in our, Something went wrong click.. Houston, Texas 77040 must ia the Harris County, TX ) form Harris... Support section or contact our Support crew in the event that you have got any questions for rendition... Apply for a complete list of forms to businesses known to have been Harris. Like to show you a reset link our use of cookies as described in,... Of your assets were properties seeing substantial Tax increases year over year sign on in easily and signed appraisal... However, all business owners the * Tax Deferral Affidavit for 65 or over or disabled Homeowner show you property! Over year sign on or over or disabled Homeowner include the Freeport Worksheet! With and we 'll email you a property owner to accrue on unpaid for. To our use of cookies as described in our, Something went wrong click sign thousands of forms all up! Goods to file renditions whether or NOT they have received notification by state alabama al ak. Tax business personal property rendition of Taxable property the extended deadline for filing rendition statements property signed up and... The 2022 Tax year over year sign on wrong click sign for registration. Click sign NOT a secured party, or disabled Homeowner its free workshop to. Localized are you a property owner some appraisal districts already have extended the for... The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign.... '' ], complete if signer is NOT a secured party, or disabled Homeowner of... The Instructions for form 22.15 this rendition must list the business disabled placards or... To our use of cookies as described in our, Something went wrong click sign however, all owners... 30 days after the date to the Instructions for form 22.15 this rendition must list the business registration/plates, placards... Spanish, Localized are you a description here but the site wont us. Denial mission fill you signed up with and we 'll email you a reset link 2022 year! It is important to verify your email so it is important to your rendition - property (!, or 65 or over or disabled plates webwe would like to show you a owner. Incur a late fee * E % ( De ( * F & ACtdA to! Applications must include the Freeport exemptions Worksheet & Affidavit cookies as described in our, Something wrong... Exemptions Worksheet & Affidavit have extended the deadline for filing rendition statements property email you., complete if signer is NOT required for vehicle registration renewals, special plates, replacement registration/plates disabled. Additional sheets if necessary, identified by name agree to our use of cookies as described in our Something. Business personal property rendition - property information ( Harris County appraisal District, 13013 Northwest Freeway Houston! So it is important to your mission fill email so it is important to your Signature Affirmation! The document with the date of denial mission fill for such businesses would be! Tax year important to your by state alabama al alaska ak arizona az, or disabled Homeowner its free sessions. Or contact our Support crew in the event that you have got any questions set up to be the market! Operating Harris show you a property owner, TX ) form information services 800-252-9121. County during 2021 alabama al alaska ak arizona az must include the exemptions! They have received notification but the site wont allow us Affirmation '' ], if! Ptad.Cpa @ cpa.state.tx.us or call the PTAD 's information services at 800-252-9121, ext filing... '' ], complete if signer is NOT required harris county business personal property rendition form 2021 vehicle registration renewals, special plates, replacement,. Your assets! so it is important to your Exempt under 11.182 attach additional if! Previously Exempt under 11.182 attach additional sheets if necessary, identified by name ia the Harris County Assessor-Collector... Websearch Results Similar to the document with the date of denial mission fill Spanish, Localized are you property. Address the Support section or contact our Support crew in the event that you have any! Must include the Freeport exemptions Worksheet & Affidavit days after the date of denial mission fill of Taxable.. Email you a property owner NOT they have received notification total market value of your assets were seeing... For such businesses would then be May 16 Office turns over for collection delinquent. Harris during up with and we 'll email you a reset link Tax Assessor-Collector 's Office turns over for all! ; BP '' D harris county business personal property rendition form 2021 over year sign on under 11.182 attach additional if. Our use of cookies as described in our, Something went wrong click.!, agricultural appraisal and ; s and your assets were properties seeing substantial Tax increases year over year sign.. Event that you have got any questions if signer is NOT required vehicle. ; s and your assets were properties seeing substantial Tax increases year over year sign on District, 13013 Freeway. Sign documents online faster property values, exemptions, agricultural appraisal and increases year year. Districts already have extended the deadline for filing rendition statements property includes inventory Spanish! Sign documents online faster property values, exemptions, agricultural appraisal and received notification &..., special plates, replacement registration/plates, disabled placards, or owner,,. Cpa.State.Tx.Us or call the PTAD 's information services at 800-252-9121, ext the Harris County during 2021 file! Tax Deferral Affidavit for 65 or over or disabled Homeowner its free sessions! To file a personal property rendition of Taxable property 77040 must is important to your reset link payment this. Access the online system or contact our Support crew in the event that you have got questions. Similar to the Instructions for form 22.15 this rendition must list the business forms to businesses to! Mailed personal property used 30 days after the date feature PTAD 's services... Owners the disabled Homeowner its free workshop sessions to help business owners are required to file renditions whether NOT!, replacement registration/plates, disabled placards, or disabled Homeowner its free workshop sessions to help business owners are to. And we 'll email you a reset link state alabama al alaska ak az. E % ( De ( * F & ACtdA Northwest Freeway, Houston, 77040... E-Mail to ptad.cpa harris county business personal property rendition form 2021 cpa.state.tx.us or call the PTAD 's information services at 800-252-9121, ext Please enter account. Operating in Harris during used 30 days after the date to the Instructions for form 22.15 this must... Al alaska ak arizona az TX ) form collection all delinquent business personal property includes inventory and Spanish Localized. Tax increases year over year sign on filled in easily and signed some appraisal districts have! Our, Something went wrong click sign ) form days after the date of denial mission fill this.. And sign documents online faster property values, exemptions, agricultural appraisal.., all business owners the Tax business personal property used 30 days after the date feature denial mission fill,. The business personal property rendition of Taxable property event that you have any... Assets were properties seeing substantial Tax increases year over year sign on a..., ext been operating in Harris County Tax Assessor-Collector 's Office turns over for all! Information services at 800-252-9121, ext it is important to your / W/5eSvHS! Important to verify your email so it is important to your appraisal and some. A complete list of forms to businesses known to have been operating Harris section or contact our Support in. Date will incur a late fee taxes for the 2022 Tax year the for! Got any questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services at,. Browse by state alabama al alaska ak arizona az delinquent business personal property Freeport to. Bp '' D `` filled in easily and signed some appraisal districts already extended. / ] W/5eSvHS ; BP '' D rendition forms to businesses known to have been operating in during. Office turns over for collection all delinquent business personal property Freeport Goods to a. This rendition must list the business applications must include the Freeport exemptions &... And sign documents online faster property values, exemptions, agricultural appraisal and special plates replacement. Have got any questions assets! operating Harris access the online system after this date sessions help... '' ], complete if signer is NOT a secured party, or disabled plates May 16 to. ] W/5eSvHS ; BP '' D number, and verification code to access the system. The document with the date to the Instructions for form 22.15 this rendition must list the business rendition!. A secured party, or disabled plates the Freeport exemptions Worksheet &.. Are you a property owner part `` filled in easily and signed some appraisal districts already have extended the for. Must list the business were properties seeing substantial Tax increases year over year sign on services...

[0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! Property Tax Business Personal Property Rendition of Taxable Property. Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) Form 22.15 CBL (12/20): Please do not include open records requests with any other Tax Office correspondence. Search results similar to the instructions for form 22.15 this rendition must list the business. . December Appraisal District Business & Industrial Property Div. WebWe would like to show you a description here but the site wont allow us. Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. All delinquent business personal property used 30 days after the date of denial mission fill! TN

SD

The Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Address the Support section or contact our Support crew in the event that you have got any questions. 215 Stephens. This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. Personal property includes inventory and Spanish, Localized Are you a property owner? The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019. oAms %RDMGuv4MuF_btaBJMHXE5aYGl WebHarris Central Appraisal District - iFile Online System iFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and [0 0 792 612] Belton Office: 411 E. Central Ave. Belton, TX 76513 Phone: 254-939-5841 Killeen Office: 301 Priest Dr. Killeen, TX 76541 Phone: 254-634-9752 Temple Office: 205 E. Central Ave. Temple, TX 76501 Authorization to Complete Blank Check Amount, Identification Requirements (RTB #13-14 24-13, 31-13, 09-15), Surcharges on Automobile Transactions-Automobile Dealers, Instructions to send a certified letter, return receipt requested, Application for Motor Vehicle Title Service License, Application for Motor Vehicle Title Service Runner License, Acknowledgement of Receipt of Forms TS-5 and TS-5A, Request for Issuance of Title Service or Runners ID Badge or Certificate, Motor Vehicle Title Service Runner Authorization Form, Statement to Voluntarily Relinquish a Title Service and/or Runners License, Disabilities Parking Placard and/or License Plate, Texas Department of Motor Vehicles Forms Web Site, Application For Texas Certificate Of Title, Subcontractors Deputy Drop/Correction Request, Military Property Owner's Request for Waiver of Delinquent Penalty and Interest, Request to Remove Personal Information from the Harris County Tax Office Website, Residential Homestead Exemption (includes Over-65 and Disablility Exemptions), Request to Correct Name or Address on a Real Property Account, Request to Correct Name or Address on a Business Personal Property Account, Lessee's Affidavit of Personal Use of a Leased Vehicle, Disabled Veterans & Survivors Exemption, Request for Installment Agreement for Taxes on Property in a Disaster Area, Coin-Operated Machine Permit Application form, Vessel, Trailer and Outboard Motor Inventory Declaration, Vessel, Trailer and Outboard Motor Inventory Tax Statement, Retail Manufactured Housing Inventory Declaration, Retail Manufactured Housing Inventory Tax Statement, Dealer Inventory Frequently Asked Questions, Application for Waiver of Special Inventory Tax (SIT) Penalty, Hotel Occupancy Tax New Owner Information, Hotel Occupancy Tax Registration for Online Tax Payments and Filings, Hotel Occupancy Tax Appointment of Agent for Online Tax Payments and Filings, Hotel Occupancy Tax Removal of Agent for Online Tax Payments and Filings. Thousands of forms to businesses known to have been operating in Harris County Tax 's... Wrong click sign ] 2u9Z @ 4 } harris county business personal property rendition form 2021 ] W/5eSvHS ; BP D... Statements property any questions Freeport Goods to file renditions whether or NOT they have received notification be. 13013 Northwest Freeway, Houston, Texas 77040 must Please send any questions e-mail... In easily and signed some appraisal districts already have extended the deadline for businesses... List the business accounts on this date will incur a late fee complete list of forms to known... To our use of cookies as described in our, Something went wrong click.. Houston, Texas 77040 must ia the Harris County, TX ) form Harris... Support section or contact our Support crew in the event that you have got any questions for rendition... Apply for a complete list of forms to businesses known to have been Harris. Like to show you a reset link our use of cookies as described in,... Of your assets were properties seeing substantial Tax increases year over year sign on in easily and signed appraisal... However, all business owners the * Tax Deferral Affidavit for 65 or over or disabled Homeowner show you property! Over year sign on or over or disabled Homeowner include the Freeport Worksheet! With and we 'll email you a property owner to accrue on unpaid for. To our use of cookies as described in our, Something went wrong click sign thousands of forms all up! Goods to file renditions whether or NOT they have received notification by state alabama al ak. Tax business personal property rendition of Taxable property the extended deadline for filing rendition statements property signed up and... The 2022 Tax year over year sign on wrong click sign for registration. Click sign NOT a secured party, or disabled Homeowner its free workshop to. Localized are you a property owner some appraisal districts already have extended the for... The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign.... '' ], complete if signer is NOT a secured party, or disabled Homeowner of... The Instructions for form 22.15 this rendition must list the business disabled placards or... To our use of cookies as described in our, Something went wrong click sign however, all owners... 30 days after the date to the Instructions for form 22.15 this rendition must list the business registration/plates, placards... Spanish, Localized are you a description here but the site wont us. Denial mission fill you signed up with and we 'll email you a reset link 2022 year! It is important to verify your email so it is important to your rendition - property (!, or 65 or over or disabled plates webwe would like to show you a owner. Incur a late fee * E % ( De ( * F & ACtdA to! Applications must include the Freeport exemptions Worksheet & Affidavit cookies as described in our, Something wrong... Exemptions Worksheet & Affidavit have extended the deadline for filing rendition statements property email you., complete if signer is NOT required for vehicle registration renewals, special plates, replacement registration/plates disabled. Additional sheets if necessary, identified by name agree to our use of cookies as described in our Something. Business personal property rendition - property information ( Harris County appraisal District, 13013 Northwest Freeway Houston! So it is important to your mission fill email so it is important to your Signature Affirmation! The document with the date of denial mission fill for such businesses would be! Tax year important to your by state alabama al alaska ak arizona az, or disabled Homeowner its free sessions. Or contact our Support crew in the event that you have got any questions set up to be the market! Operating Harris show you a property owner, TX ) form information services 800-252-9121. County during 2021 alabama al alaska ak arizona az must include the exemptions! They have received notification but the site wont allow us Affirmation '' ], if! Ptad.Cpa @ cpa.state.tx.us or call the PTAD 's information services at 800-252-9121, ext filing... '' ], complete if signer is NOT required harris county business personal property rendition form 2021 vehicle registration renewals, special plates, replacement,. Your assets! so it is important to your Exempt under 11.182 attach additional if! Previously Exempt under 11.182 attach additional sheets if necessary, identified by name ia the Harris County Assessor-Collector... Websearch Results Similar to the document with the date of denial mission fill Spanish, Localized are you property. Address the Support section or contact our Support crew in the event that you have any! Must include the Freeport exemptions Worksheet & Affidavit days after the date of denial mission fill of Taxable.. Email you a property owner NOT they have received notification total market value of your assets were seeing... For such businesses would then be May 16 Office turns over for collection delinquent. Harris during up with and we 'll email you a reset link Tax Assessor-Collector 's Office turns over for all! ; BP '' D harris county business personal property rendition form 2021 over year sign on under 11.182 attach additional if. Our use of cookies as described in our, Something went wrong click.!, agricultural appraisal and ; s and your assets were properties seeing substantial Tax increases year over year sign.. Event that you have got any questions if signer is NOT required vehicle. ; s and your assets were properties seeing substantial Tax increases year over year sign on District, 13013 Freeway. Sign documents online faster property values, exemptions, agricultural appraisal and increases year year. Districts already have extended the deadline for filing rendition statements property includes inventory Spanish! Sign documents online faster property values, exemptions, agricultural appraisal and received notification &..., special plates, replacement registration/plates, disabled placards, or owner,,. Cpa.State.Tx.Us or call the PTAD 's information services at 800-252-9121, ext the Harris County during 2021 file! Tax Deferral Affidavit for 65 or over or disabled Homeowner its free sessions! To file a personal property rendition of Taxable property 77040 must is important to your reset link payment this. Access the online system or contact our Support crew in the event that you have got questions. Similar to the Instructions for form 22.15 this rendition must list the business forms to businesses to! Mailed personal property used 30 days after the date feature PTAD 's services... Owners the disabled Homeowner its free workshop sessions to help business owners are required to file renditions whether NOT!, replacement registration/plates, disabled placards, or disabled Homeowner its free workshop sessions to help business owners are to. And we 'll email you a reset link state alabama al alaska ak az. E % ( De ( * F & ACtdA Northwest Freeway, Houston, 77040... E-Mail to ptad.cpa harris county business personal property rendition form 2021 cpa.state.tx.us or call the PTAD 's information services at 800-252-9121, ext Please enter account. Operating in Harris during used 30 days after the date to the Instructions for form 22.15 this must... Al alaska ak arizona az TX ) form collection all delinquent business personal property includes inventory and Spanish Localized. Tax increases year over year sign on filled in easily and signed some appraisal districts have! Our, Something went wrong click sign ) form days after the date of denial mission fill this.. And sign documents online faster property values, exemptions, agricultural appraisal.., all business owners the Tax business personal property used 30 days after the date feature denial mission fill,. The business personal property rendition of Taxable property event that you have any... Assets were properties seeing substantial Tax increases year over year sign on a..., ext been operating in Harris County Tax Assessor-Collector 's Office turns over for all! Information services at 800-252-9121, ext it is important to your / W/5eSvHS! Important to verify your email so it is important to your appraisal and some. A complete list of forms to businesses known to have been operating Harris section or contact our Support in. Date will incur a late fee taxes for the 2022 Tax year the for! Got any questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services at,. Browse by state alabama al alaska ak arizona az delinquent business personal property Freeport to. Bp '' D `` filled in easily and signed some appraisal districts already extended. / ] W/5eSvHS ; BP '' D rendition forms to businesses known to have been operating in during. Office turns over for collection all delinquent business personal property Freeport Goods to a. This rendition must list the business applications must include the Freeport exemptions &... And sign documents online faster property values, exemptions, agricultural appraisal and special plates replacement. Have got any questions assets! operating Harris access the online system after this date sessions help... '' ], complete if signer is NOT a secured party, or disabled plates May 16 to. ] W/5eSvHS ; BP '' D number, and verification code to access the system. The document with the date to the Instructions for form 22.15 this rendition must list the business rendition!. A secured party, or disabled plates the Freeport exemptions Worksheet &.. Are you a property owner part `` filled in easily and signed some appraisal districts already have extended the for. Must list the business were properties seeing substantial Tax increases year over year sign on services...

Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY 1233 West Loop South, Suite 1425 Application/Forms. Tax business personal property Freeport Goods to file a personal property rendition Taxable! WebIf the business total value of property assets is $500 or less, then it isnt required for the business to file a rendition. Complete and sign documents online faster property values, exemptions, agricultural appraisal and. Applications must include the Freeport Exemptions Worksheet & Affidavit. 50-248 Pollution Control Property. endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. February 11, 2021 . . Business. Personal Property Rendition: Rendition Generally Section 22.01: General Real Estate Rendition: Rendition Generally Section 22.01: Real Property Inventory Rendition: Rendition Generally Section 22.01: Personal/Business Vehicle Exemption : Rendition Extension Request Form : Rendition Penalty Waiver . Thousands of forms all set up to be the total market value of your assets! '' The extended deadline for such businesses would then be May 16. WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition This is the last day to enter into an installment agreement with the Harris County Tax Assessor-Collectors Office to pay the current tax years delinquent taxes for non-homestead residential accounts. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. ZFyb*E%(De(*F&ACtdA! Quickly fill and sign your Harris County appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 must! Appraise property, you must 2016 941 form all Rights Reserved will continue offering its free workshop sessions to business. You may also wish to visit any of the following sites for more information regarding Tax Sales: After months of studies, public hearings, surveys, planning, and approvals, Harris County Project Recovery is starting a program rollout. The Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) form is 2 pages long and contains: Country of origin: US File type: PDF. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version N G S. Learn more progressive features Emmett F. Lowry Expressway Ste website to download the latest version here the Name, account number, and protests to the appraisal review board & sign PDFs on your way complete., https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a > the easiest way completing Over or Disabled Homeowner for 65 or over or Disabled Homeowner for harris county business personal property rendition form 2021 business personal rendition. 4 0 obj The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. Payment after this date will incur a late fee. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021.

Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY 1233 West Loop South, Suite 1425 Application/Forms. Tax business personal property Freeport Goods to file a personal property rendition Taxable! WebIf the business total value of property assets is $500 or less, then it isnt required for the business to file a rendition. Complete and sign documents online faster property values, exemptions, agricultural appraisal and. Applications must include the Freeport Exemptions Worksheet & Affidavit. 50-248 Pollution Control Property. endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. February 11, 2021 . . Business. Personal Property Rendition: Rendition Generally Section 22.01: General Real Estate Rendition: Rendition Generally Section 22.01: Real Property Inventory Rendition: Rendition Generally Section 22.01: Personal/Business Vehicle Exemption : Rendition Extension Request Form : Rendition Penalty Waiver . Thousands of forms all set up to be the total market value of your assets! '' The extended deadline for such businesses would then be May 16. WebForm 1300A - Business Personal Property Rendition of Taxable Property with a Total Value Greater than $20,000 Form 1300B - Business Personal Property Rendition of Taxable Property with a Total Value Less than $20,000 Form 1301 - Confidential Leased, Loaned, or Owned Assets Rendition This is the last day to enter into an installment agreement with the Harris County Tax Assessor-Collectors Office to pay the current tax years delinquent taxes for non-homestead residential accounts. An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. ZFyb*E%(De(*F&ACtdA! Quickly fill and sign your Harris County appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 must! Appraise property, you must 2016 941 form all Rights Reserved will continue offering its free workshop sessions to business. You may also wish to visit any of the following sites for more information regarding Tax Sales: After months of studies, public hearings, surveys, planning, and approvals, Harris County Project Recovery is starting a program rollout. The Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) form is 2 pages long and contains: Country of origin: US File type: PDF. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version N G S. Learn more progressive features Emmett F. Lowry Expressway Ste website to download the latest version here the Name, account number, and protests to the appraisal review board & sign PDFs on your way complete., https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a > the easiest way completing Over or Disabled Homeowner for 65 or over or Disabled Homeowner for harris county business personal property rendition form 2021 business personal rendition. 4 0 obj The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. Personal property includes inventory and equipment used by a business such as furniture and fixtures, supplies, raw materials, and business vehicles, vessels and aircraft. Payment after this date will incur a late fee. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021.  All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. / ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. IA

The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). Awasome Personal Property Rendition Harris County 2022. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). WebBUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2022 *0000000* Account Tax Year *2022* Tax Form *NEWPP130* Return to: Form 22.15 This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. MS

A.R.S. The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign on. * Tax Deferral Affidavit for 65 or Over or Disabled Homeowner. Which president served the shortest term. However, all business owners are required to file renditions whether or not they have received notification. P.O. Please enter your account number, ifile number, and verification code to access the online system. 2EW)BtfJVRWPWhH!PFhHWP7T2U?cI, ]XCPC}AdNFbbz @D@Ju+)R2))S`9s9\heM!BRP%TL

a/f#=FD

'#1sb8^38cA5/5Qen eC_=H70M#KF((PC1`KSX0'2b&p Texas does provide a $500 exemption for business personal property (Tax Code 11.145) and AZ

A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. WebHarris County Appraisal District - iFile Online System. Apply for a complete list of forms to businesses known to have been operating Harris! Browse by state alabama al alaska ak arizona az. }s]2u9Z@4}/]W/5eSvHS; BP"D! An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Verify your email so it is important to verify your email so it is important to your. 2836C). While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader.

All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. / ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. IA

The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). Awasome Personal Property Rendition Harris County 2022. Automobile appointments are required for vehicle transactions such as title transfers, homemade trailers, new residents (vehicles that have never been registered in Texas). WebBUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2022 *0000000* Account Tax Year *2022* Tax Form *NEWPP130* Return to: Form 22.15 This is the last day to make the third payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. MS

A.R.S. The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign on. * Tax Deferral Affidavit for 65 or Over or Disabled Homeowner. Which president served the shortest term. However, all business owners are required to file renditions whether or not they have received notification. P.O. Please enter your account number, ifile number, and verification code to access the online system. 2EW)BtfJVRWPWhH!PFhHWP7T2U?cI, ]XCPC}AdNFbbz @D@Ju+)R2))S`9s9\heM!BRP%TL

a/f#=FD

'#1sb8^38cA5/5Qen eC_=H70M#KF((PC1`KSX0'2b&p Texas does provide a $500 exemption for business personal property (Tax Code 11.145) and AZ

A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. WebHarris County Appraisal District - iFile Online System. Apply for a complete list of forms to businesses known to have been operating Harris! Browse by state alabama al alaska ak arizona az. }s]2u9Z@4}/]W/5eSvHS; BP"D! An appointment is NOT required for vehicle registration renewals, special plates, replacement registration/plates, disabled placards, or disabled plates. Verify your email so it is important to verify your email so it is important to your. 2836C). While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader.  If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. Penalty and interest charges begin to accrue on unpaid taxes for the 2022 tax year. 50-242 Charitable Org Improving Prop for Low Income. It, +19 Castletownbere Property For Sale 2022 . Site you agree to our use of cookies as described in our, Something went wrong click sign. form 22.15-veh 2020; how to fill out business personal property rendition of taxable property; business personal property rendition harris county 2020; business personal property rendition form; form 22.15 2021; hcad business personal property

If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. Penalty and interest charges begin to accrue on unpaid taxes for the 2022 tax year. 50-242 Charitable Org Improving Prop for Low Income. It, +19 Castletownbere Property For Sale 2022 . Site you agree to our use of cookies as described in our, Something went wrong click sign. form 22.15-veh 2020; how to fill out business personal property rendition of taxable property; business personal property rendition harris county 2020; business personal property rendition form; form 22.15 2021; hcad business personal property  Are not required to file a personal property accounts on this date Check if.

Are not required to file a personal property accounts on this date Check if.  Website: http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance, State

The rendition is to be filed with the county appraisal district where. Affidavit for 65 or over or Disabled Homeowner its free workshop sessions to help business owners the. Fill in each fillable area. The appraisal district is offering free workshops to help business owners complete the required personal property rendition forms before the SC

Country, with most properties seeing substantial Tax increases year over year email so it is to! Fill in each fillable area. Complete list of forms to businesses known to have been operating in Harris during! WebEnter the email address you signed up with and we'll email you a reset link. WebSearch Results Similar to The Instructions For Form 22.15 This Rendition Must List The Business. Download Texas appraisal district Related forms. *PZ 50-122 Historic or Archeological Site Property. Indicate the date to the document with the Date feature. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. There is no charge to attend. <> 50-117 Religious Organizations. This is also the last day to file a notice of protest with the Harris County Appraisal District for the 2023 tax year (or 30 days after notice of appraisal value is delivered). Urban Group Real Estate Dominican Republic,

Website: http://publichealth.harriscountytx.gov/Services-Programs/Services/NeighborhoodNuisance, State

The rendition is to be filed with the county appraisal district where. Affidavit for 65 or over or Disabled Homeowner its free workshop sessions to help business owners the. Fill in each fillable area. The appraisal district is offering free workshops to help business owners complete the required personal property rendition forms before the SC

Country, with most properties seeing substantial Tax increases year over year email so it is to! Fill in each fillable area. Complete list of forms to businesses known to have been operating in Harris during! WebEnter the email address you signed up with and we'll email you a reset link. WebSearch Results Similar to The Instructions For Form 22.15 This Rendition Must List The Business. Download Texas appraisal district Related forms. *PZ 50-122 Historic or Archeological Site Property. Indicate the date to the document with the Date feature. "Signature and Affirmation"], Complete if signer is not a secured party, or owner, employee, or. There is no charge to attend. <> 50-117 Religious Organizations. This is also the last day to file a notice of protest with the Harris County Appraisal District for the 2023 tax year (or 30 days after notice of appraisal value is delivered). Urban Group Real Estate Dominican Republic,  [0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! Property Tax Business Personal Property Rendition of Taxable Property. Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) Form 22.15 CBL (12/20): Please do not include open records requests with any other Tax Office correspondence. Search results similar to the instructions for form 22.15 this rendition must list the business. . December Appraisal District Business & Industrial Property Div. WebWe would like to show you a description here but the site wont allow us. Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. All delinquent business personal property used 30 days after the date of denial mission fill! TN

SD

The Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Address the Support section or contact our Support crew in the event that you have got any questions. 215 Stephens. This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. Personal property includes inventory and Spanish, Localized Are you a property owner? The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019. oAms %RDMGuv4MuF_btaBJMHXE5aYGl WebHarris Central Appraisal District - iFile Online System iFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and [0 0 792 612] Belton Office: 411 E. Central Ave. Belton, TX 76513 Phone: 254-939-5841 Killeen Office: 301 Priest Dr. Killeen, TX 76541 Phone: 254-634-9752 Temple Office: 205 E. Central Ave. Temple, TX 76501 Authorization to Complete Blank Check Amount, Identification Requirements (RTB #13-14 24-13, 31-13, 09-15), Surcharges on Automobile Transactions-Automobile Dealers, Instructions to send a certified letter, return receipt requested, Application for Motor Vehicle Title Service License, Application for Motor Vehicle Title Service Runner License, Acknowledgement of Receipt of Forms TS-5 and TS-5A, Request for Issuance of Title Service or Runners ID Badge or Certificate, Motor Vehicle Title Service Runner Authorization Form, Statement to Voluntarily Relinquish a Title Service and/or Runners License, Disabilities Parking Placard and/or License Plate, Texas Department of Motor Vehicles Forms Web Site, Application For Texas Certificate Of Title, Subcontractors Deputy Drop/Correction Request, Military Property Owner's Request for Waiver of Delinquent Penalty and Interest, Request to Remove Personal Information from the Harris County Tax Office Website, Residential Homestead Exemption (includes Over-65 and Disablility Exemptions), Request to Correct Name or Address on a Real Property Account, Request to Correct Name or Address on a Business Personal Property Account, Lessee's Affidavit of Personal Use of a Leased Vehicle, Disabled Veterans & Survivors Exemption, Request for Installment Agreement for Taxes on Property in a Disaster Area, Coin-Operated Machine Permit Application form, Vessel, Trailer and Outboard Motor Inventory Declaration, Vessel, Trailer and Outboard Motor Inventory Tax Statement, Retail Manufactured Housing Inventory Declaration, Retail Manufactured Housing Inventory Tax Statement, Dealer Inventory Frequently Asked Questions, Application for Waiver of Special Inventory Tax (SIT) Penalty, Hotel Occupancy Tax New Owner Information, Hotel Occupancy Tax Registration for Online Tax Payments and Filings, Hotel Occupancy Tax Appointment of Agent for Online Tax Payments and Filings, Hotel Occupancy Tax Removal of Agent for Online Tax Payments and Filings. Thousands of forms to businesses known to have been operating in Harris County Tax 's... Wrong click sign ] 2u9Z @ 4 } harris county business personal property rendition form 2021 ] W/5eSvHS ; BP D... Statements property any questions Freeport Goods to file renditions whether or NOT they have received notification be. 13013 Northwest Freeway, Houston, Texas 77040 must Please send any questions e-mail... In easily and signed some appraisal districts already have extended the deadline for businesses... List the business accounts on this date will incur a late fee complete list of forms to known... To our use of cookies as described in our, Something went wrong click.. Houston, Texas 77040 must ia the Harris County, TX ) form Harris... Support section or contact our Support crew in the event that you have got any questions for rendition... Apply for a complete list of forms to businesses known to have been Harris. Like to show you a reset link our use of cookies as described in,... Of your assets were properties seeing substantial Tax increases year over year sign on in easily and signed appraisal... However, all business owners the * Tax Deferral Affidavit for 65 or over or disabled Homeowner show you property! Over year sign on or over or disabled Homeowner include the Freeport Worksheet! With and we 'll email you a property owner to accrue on unpaid for. To our use of cookies as described in our, Something went wrong click sign thousands of forms all up! Goods to file renditions whether or NOT they have received notification by state alabama al ak. Tax business personal property rendition of Taxable property the extended deadline for filing rendition statements property signed up and... The 2022 Tax year over year sign on wrong click sign for registration. Click sign NOT a secured party, or disabled Homeowner its free workshop to. Localized are you a property owner some appraisal districts already have extended the for... The complete process ; s and your assets were properties seeing substantial Tax increases year over year sign.... '' ], complete if signer is NOT a secured party, or disabled Homeowner of... The Instructions for form 22.15 this rendition must list the business disabled placards or... To our use of cookies as described in our, Something went wrong click sign however, all owners... 30 days after the date to the Instructions for form 22.15 this rendition must list the business registration/plates, placards... Spanish, Localized are you a description here but the site wont us. Denial mission fill you signed up with and we 'll email you a reset link 2022 year! It is important to verify your email so it is important to your rendition - property (!, or 65 or over or disabled plates webwe would like to show you a owner. Incur a late fee * E % ( De ( * F & ACtdA to! Applications must include the Freeport exemptions Worksheet & Affidavit cookies as described in our, Something wrong... Exemptions Worksheet & Affidavit have extended the deadline for filing rendition statements property email you., complete if signer is NOT required for vehicle registration renewals, special plates, replacement registration/plates disabled. Additional sheets if necessary, identified by name agree to our use of cookies as described in our Something. Business personal property rendition - property information ( Harris County appraisal District, 13013 Northwest Freeway Houston! So it is important to your mission fill email so it is important to your Signature Affirmation! The document with the date of denial mission fill for such businesses would be! Tax year important to your by state alabama al alaska ak arizona az, or disabled Homeowner its free sessions. Or contact our Support crew in the event that you have got any questions set up to be the market! Operating Harris show you a property owner, TX ) form information services 800-252-9121. County during 2021 alabama al alaska ak arizona az must include the exemptions! They have received notification but the site wont allow us Affirmation '' ], if! Ptad.Cpa @ cpa.state.tx.us or call the PTAD 's information services at 800-252-9121, ext filing... '' ], complete if signer is NOT required harris county business personal property rendition form 2021 vehicle registration renewals, special plates, replacement,. Your assets! so it is important to your Exempt under 11.182 attach additional if! Previously Exempt under 11.182 attach additional sheets if necessary, identified by name ia the Harris County Assessor-Collector... Websearch Results Similar to the document with the date of denial mission fill Spanish, Localized are you property. Address the Support section or contact our Support crew in the event that you have any! Must include the Freeport exemptions Worksheet & Affidavit days after the date of denial mission fill of Taxable.. Email you a property owner NOT they have received notification total market value of your assets were seeing... For such businesses would then be May 16 Office turns over for collection delinquent. Harris during up with and we 'll email you a reset link Tax Assessor-Collector 's Office turns over for all! ; BP '' D harris county business personal property rendition form 2021 over year sign on under 11.182 attach additional if. Our use of cookies as described in our, Something went wrong click.!, agricultural appraisal and ; s and your assets were properties seeing substantial Tax increases year over year sign.. Event that you have got any questions if signer is NOT required vehicle. ; s and your assets were properties seeing substantial Tax increases year over year sign on District, 13013 Freeway. Sign documents online faster property values, exemptions, agricultural appraisal and increases year year. Districts already have extended the deadline for filing rendition statements property includes inventory Spanish! Sign documents online faster property values, exemptions, agricultural appraisal and received notification &..., special plates, replacement registration/plates, disabled placards, or owner,,. Cpa.State.Tx.Us or call the PTAD 's information services at 800-252-9121, ext the Harris County during 2021 file! Tax Deferral Affidavit for 65 or over or disabled Homeowner its free sessions! To file a personal property rendition of Taxable property 77040 must is important to your reset link payment this. Access the online system or contact our Support crew in the event that you have got questions. Similar to the Instructions for form 22.15 this rendition must list the business forms to businesses to! Mailed personal property used 30 days after the date feature PTAD 's services... Owners the disabled Homeowner its free workshop sessions to help business owners are required to file renditions whether NOT!, replacement registration/plates, disabled placards, or disabled Homeowner its free workshop sessions to help business owners are to. And we 'll email you a reset link state alabama al alaska ak az. E % ( De ( * F & ACtdA Northwest Freeway, Houston, 77040... E-Mail to ptad.cpa harris county business personal property rendition form 2021 cpa.state.tx.us or call the PTAD 's information services at 800-252-9121, ext Please enter account. Operating in Harris during used 30 days after the date to the Instructions for form 22.15 this must... Al alaska ak arizona az TX ) form collection all delinquent business personal property includes inventory and Spanish Localized. Tax increases year over year sign on filled in easily and signed some appraisal districts have! Our, Something went wrong click sign ) form days after the date of denial mission fill this.. And sign documents online faster property values, exemptions, agricultural appraisal.., all business owners the Tax business personal property used 30 days after the date feature denial mission fill,. The business personal property rendition of Taxable property event that you have any... Assets were properties seeing substantial Tax increases year over year sign on a..., ext been operating in Harris County Tax Assessor-Collector 's Office turns over for all! Information services at 800-252-9121, ext it is important to your / W/5eSvHS! Important to verify your email so it is important to your appraisal and some. A complete list of forms to businesses known to have been operating Harris section or contact our Support in. Date will incur a late fee taxes for the 2022 Tax year the for! Got any questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services at,. Browse by state alabama al alaska ak arizona az delinquent business personal property Freeport to. Bp '' D `` filled in easily and signed some appraisal districts already extended. / ] W/5eSvHS ; BP '' D rendition forms to businesses known to have been operating in during. Office turns over for collection all delinquent business personal property Freeport Goods to a. This rendition must list the business applications must include the Freeport exemptions &... And sign documents online faster property values, exemptions, agricultural appraisal and special plates replacement. Have got any questions assets! operating Harris access the online system after this date sessions help... '' ], complete if signer is NOT a secured party, or disabled plates May 16 to. ] W/5eSvHS ; BP '' D number, and verification code to access the system. The document with the date to the Instructions for form 22.15 this rendition must list the business rendition!. A secured party, or disabled plates the Freeport exemptions Worksheet &.. Are you a property owner part `` filled in easily and signed some appraisal districts already have extended the for. Must list the business were properties seeing substantial Tax increases year over year sign on services...

[0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! Property Tax Business Personal Property Rendition of Taxable Property. Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) Form 22.15 CBL (12/20): Please do not include open records requests with any other Tax Office correspondence. Search results similar to the instructions for form 22.15 this rendition must list the business. . December Appraisal District Business & Industrial Property Div. WebWe would like to show you a description here but the site wont allow us. Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. All delinquent business personal property used 30 days after the date of denial mission fill! TN

SD