employee retention credit calculation spreadsheet 2021

Further details on how to calculate and claim the employee retention credit for the first two calendar quarters of 2021 can be found in Notice 2021-23. Conclusion and Summary on A Guide to Understand Employee Retention Credit Calculation Spreadsheet 2021, Receive Up to $26,000 Per Employee for Your Business: Claim the Employee Retention Tax Credit (ERC / ERTC). Suite. Check out more about 8 Strategies on How to Claim the Employee Retention Credit. corporations, For Learn more about How To Apply For Employee Retention Credit. Make sure you report everything on Form 941-x to the IRS. We also use third-party cookies that help us analyze and understand how you use this website. Request an advance refund using Form 7200 if your expected credit is more than your payroll tax contributions. Webhow to calculate employee retention credit 2021 how to calculate employee retention credit 2021 on March 30, 2023 on March 30, 2023 In 2019, how many full-time employees did you have on average? The benefits of using an employee retention credit calculation spreadsheet include: A helpful employee retention credit flowchart follows, which will walk you through everything you need to do to calculate your ERC. Small employers (i.e., employers with an average of 500 or fewer full-time employees in 2019) may request advance payment of the credit (subject to certain limits) on Form 7200, Advance of Employer Credits Due to Covid-19, after reducing deposits. This new rule took effect in 2020. In 2020, the maximum credit per employee is $5,000. In 2020, you can qualify by demonstrating that your sales decreased by more than 50% in any calendar quarter compared with the same period in 2019. Calculate the non-refundable amounts of sick and family leave credit for the time taken before April 1, 2021. Its just a calculator to help you calculate your ERC while filling out Form 941 for 2021. What Exactly is Employee Retention Credit? Wages paid during an eligible period qualify, with an eligible period being considered a quarter during which gross receipts were 50% less in 2020 than what was received in 2019, and 20% less for 2021. of products and services. accounts, Payment,

Further details on how to calculate and claim the employee retention credit for the first two calendar quarters of 2021 can be found in Notice 2021-23. Conclusion and Summary on A Guide to Understand Employee Retention Credit Calculation Spreadsheet 2021, Receive Up to $26,000 Per Employee for Your Business: Claim the Employee Retention Tax Credit (ERC / ERTC). Suite. Check out more about 8 Strategies on How to Claim the Employee Retention Credit. corporations, For Learn more about How To Apply For Employee Retention Credit. Make sure you report everything on Form 941-x to the IRS. We also use third-party cookies that help us analyze and understand how you use this website. Request an advance refund using Form 7200 if your expected credit is more than your payroll tax contributions. Webhow to calculate employee retention credit 2021 how to calculate employee retention credit 2021 on March 30, 2023 on March 30, 2023 In 2019, how many full-time employees did you have on average? The benefits of using an employee retention credit calculation spreadsheet include: A helpful employee retention credit flowchart follows, which will walk you through everything you need to do to calculate your ERC. Small employers (i.e., employers with an average of 500 or fewer full-time employees in 2019) may request advance payment of the credit (subject to certain limits) on Form 7200, Advance of Employer Credits Due to Covid-19, after reducing deposits. This new rule took effect in 2020. In 2020, the maximum credit per employee is $5,000. In 2020, you can qualify by demonstrating that your sales decreased by more than 50% in any calendar quarter compared with the same period in 2019. Calculate the non-refundable amounts of sick and family leave credit for the time taken before April 1, 2021. Its just a calculator to help you calculate your ERC while filling out Form 941 for 2021. What Exactly is Employee Retention Credit? Wages paid during an eligible period qualify, with an eligible period being considered a quarter during which gross receipts were 50% less in 2020 than what was received in 2019, and 20% less for 2021. of products and services. accounts, Payment,  Under the American Rescue Plan Act of 2021, enacted March 11, 2021, the Employee Retention Credit is available to eligible employers for wages paid during the third and fourth quarters of 2021. The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19 pandemic. Your business was fully or partially suspended due to government orders.

Under the American Rescue Plan Act of 2021, enacted March 11, 2021, the Employee Retention Credit is available to eligible employers for wages paid during the third and fourth quarters of 2021. The Employee Retention Credit is more accessible to small business owners as well as recovery startup businesses who are struggling financially during the COVID-19 pandemic. Your business was fully or partially suspended due to government orders.  AZELLA is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. Your business shut down fully or partially because of a government order, You are considered a recovery startup business only if you began operations after February 15, 2020 and have less than $1 million in total gross receipts. , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. You do not need a certain number of employees to qualify; however, businesses with over 500 employees can only apply with wages for employees who were not working while still being paid. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. corporations. To calculate your credit, you can refer to the IRS Form 941 instructions, pages 22 and 23, which provide the ERC Spreadsheet for 2021. Qualified salaries and expenditures for 2020 are capped at $10,000 per employee for the year, with a credit of up to 50% of that amount, allowing you to claim up to $5,000 in credits per employee. However, because your dental practice is a necessary business, it was not harmed by the governmental orders. No fines or late fees will be applied if the underpayment is corrected by the end of the year for firms that had already begun decreasing their payroll taxes withheld in the hopes of qualifying for this credit. These cookies will be stored in your browser only with your consent. Choose an amount for projected withholding that works for you. The credit is for 50% of eligible employees wages paid after March 12th, 2020 and before January 1st, 2021. To add to the confusion, Congresss Infrastructure Bill of November 2021 eliminated the ERTC credit for all except Recovery Startup Businesses in Q4 2021. governments, Business valuation & Claim the credit when you file Form 941 each quarter OR. Businesses can use Employee Retention Credit calculation spreadsheet to make their job easier. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. In 2020, the maximum credit per employee is $5,000. As a result of the credit, your net business income increased by $28,000 in the tax year 2021. WebThe ERC Calculator will ask questions about the company's gross receipts and employee counts in 2019, 2020 and 2021, as well as government orders that may have impacted the business in 2020 and 2021.

AZELLA is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. Your business shut down fully or partially because of a government order, You are considered a recovery startup business only if you began operations after February 15, 2020 and have less than $1 million in total gross receipts. , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. You do not need a certain number of employees to qualify; however, businesses with over 500 employees can only apply with wages for employees who were not working while still being paid. However, even if you do not meet these closure requirements, you may still meet the loss in gross receipts requirement, listed above. corporations. To calculate your credit, you can refer to the IRS Form 941 instructions, pages 22 and 23, which provide the ERC Spreadsheet for 2021. Qualified salaries and expenditures for 2020 are capped at $10,000 per employee for the year, with a credit of up to 50% of that amount, allowing you to claim up to $5,000 in credits per employee. However, because your dental practice is a necessary business, it was not harmed by the governmental orders. No fines or late fees will be applied if the underpayment is corrected by the end of the year for firms that had already begun decreasing their payroll taxes withheld in the hopes of qualifying for this credit. These cookies will be stored in your browser only with your consent. Choose an amount for projected withholding that works for you. The credit is for 50% of eligible employees wages paid after March 12th, 2020 and before January 1st, 2021. To add to the confusion, Congresss Infrastructure Bill of November 2021 eliminated the ERTC credit for all except Recovery Startup Businesses in Q4 2021. governments, Business valuation & Claim the credit when you file Form 941 each quarter OR. Businesses can use Employee Retention Credit calculation spreadsheet to make their job easier. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. Beginning on January 1, 2021 and through June 30, 2021, eligible employers may claim a refundable tax credit against certain employment taxes equal to 70% of qualified wages, up to $10,000 per employee for a maximum credit of $7,000 per employee for each of the first two quarters of 2021. In 2020, the maximum credit per employee is $5,000. As a result of the credit, your net business income increased by $28,000 in the tax year 2021. WebThe ERC Calculator will ask questions about the company's gross receipts and employee counts in 2019, 2020 and 2021, as well as government orders that may have impacted the business in 2020 and 2021.  research, news, insight, productivity tools, and more. The credit can be claimed on a quarterly basis and is provided through December 31st, 2020. 1.

research, news, insight, productivity tools, and more. The credit can be claimed on a quarterly basis and is provided through December 31st, 2020. 1.  Its just a calculator to help you calculate your ERC while filling out Form 941 for 2021. Can You Get Employee Retention Credit and PPP Loan? You have two possibilities for finishing this line: If youre claiming credit for eligible sick and family leave this quarter, skip to step 2 and enter the value from Worksheet 3, step 1, line 1f. 14:08 How is Employee Retention Credit 2021 Calculated? Worksheet 1 will help you calculate the COVID-19 tax credit as follows: You may discover which refundable payroll tax credit is or is nonrefundable by filling out this worksheet. Employers who have completed Worksheet 3 can, for example, add the cost from Worksheet 3, phase 1, column f on column 1a of Worksheet 4, skip the remainder, and proceed to step 2. Check out this Comprehensive Guide on Employee Retention Tax Credit Updates. The forms second component covers credits for sick and family leave wages, while the third section assists companies in calculating the employee retention credit. We know how important it is for your business to keep your workers on the payroll, so were here to help you get the tax credits you qualify for. Meeting the business suspension requirements is one piece of your eligibility assessment. discount pricing. Turn again to the trusty ERC calculator to work out how much you should be claiming in credits. EMPLOYEE RETENTION CREDIT CALCULATOR Businesses under 500 employees are able to use all of their employees wages to apply, including employees who were still working during the time period you are applying under. Please read our, Financial Services for Fraternities & Sororities, Consolidated Appropriations Act Breakdown, Coronavirus Aid, Relief, and Economic Security (CARES) Act. The deadline for the Employee Retention Tax Credit was set for the end of 2021. Officials created the ERC to encourage companies to keep their employees on the payroll. An official website of the United States Government. Cover Image Credit: 123RF.com / Chagin / Disaster Loan Advisors. This category only includes cookies that ensures basic functionalities and security features of the website. john h francis polytechnic high school yearbook 2001; srvusd summer advancement; gladstone hospital maternity visiting hours; vertex in scorpio 5th house; motiva enterprises houston tx charge on credit card; healing scriptures for heart disease Qualification requirements for the 2021 ERC: you had at least a 20% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. Employers no longer need the form 941 Worksheet 2. But how much can you anticipate claiming qualified wages if youve determined that youre eligible for ERC? The following is your guide to the employee retention credit, including a helpful employee retention credit worksheet so you can calculate your exact credit. The ERC gives you a great opportunity to keep people on your payroll. Sciarabba Walker & Co., LLP COPYRIGHT 2023 | All Rights Reserved.

Its just a calculator to help you calculate your ERC while filling out Form 941 for 2021. Can You Get Employee Retention Credit and PPP Loan? You have two possibilities for finishing this line: If youre claiming credit for eligible sick and family leave this quarter, skip to step 2 and enter the value from Worksheet 3, step 1, line 1f. 14:08 How is Employee Retention Credit 2021 Calculated? Worksheet 1 will help you calculate the COVID-19 tax credit as follows: You may discover which refundable payroll tax credit is or is nonrefundable by filling out this worksheet. Employers who have completed Worksheet 3 can, for example, add the cost from Worksheet 3, phase 1, column f on column 1a of Worksheet 4, skip the remainder, and proceed to step 2. Check out this Comprehensive Guide on Employee Retention Tax Credit Updates. The forms second component covers credits for sick and family leave wages, while the third section assists companies in calculating the employee retention credit. We know how important it is for your business to keep your workers on the payroll, so were here to help you get the tax credits you qualify for. Meeting the business suspension requirements is one piece of your eligibility assessment. discount pricing. Turn again to the trusty ERC calculator to work out how much you should be claiming in credits. EMPLOYEE RETENTION CREDIT CALCULATOR Businesses under 500 employees are able to use all of their employees wages to apply, including employees who were still working during the time period you are applying under. Please read our, Financial Services for Fraternities & Sororities, Consolidated Appropriations Act Breakdown, Coronavirus Aid, Relief, and Economic Security (CARES) Act. The deadline for the Employee Retention Tax Credit was set for the end of 2021. Officials created the ERC to encourage companies to keep their employees on the payroll. An official website of the United States Government. Cover Image Credit: 123RF.com / Chagin / Disaster Loan Advisors. This category only includes cookies that ensures basic functionalities and security features of the website. john h francis polytechnic high school yearbook 2001; srvusd summer advancement; gladstone hospital maternity visiting hours; vertex in scorpio 5th house; motiva enterprises houston tx charge on credit card; healing scriptures for heart disease Qualification requirements for the 2021 ERC: you had at least a 20% loss in gross receipts during a qualifying quarter when compared to the same quarter in 2019. Employers no longer need the form 941 Worksheet 2. But how much can you anticipate claiming qualified wages if youve determined that youre eligible for ERC? The following is your guide to the employee retention credit, including a helpful employee retention credit worksheet so you can calculate your exact credit. The ERC gives you a great opportunity to keep people on your payroll. Sciarabba Walker & Co., LLP COPYRIGHT 2023 | All Rights Reserved.  A GUIDE TO EMPLOYEE RETENTION CREDITS (ERC) 4 Key Provisions of the ERC (Contd.) Fortunately, we have this simple ERC Calculator to assist you in determining the credit amount you can expect. Wages that qualify for ERC are subject to the following restrictions: a) Earnings paid with PPP or EIDL are not considered qualifying wages for business tax filers. WebThe 2021 Employee Retention Credit is calculated according on your total wages, which is based on wages paid from March 12th, 2020 to July 1st, 2021, as well as healthcare costs paid for employees during that period. For purposes of determining the number of full-time employees, the average from 2019 should be used. You assess your eligibility, compute your credit amount, and submit your claim for payment. The CARES Acts Employee Retention Credit encouraged employers to retain their staff on the job. Whether you were completely or partially turned off during that time because the requirements are complicated. What are the Owner Wages For Employee Retention Credit? The tax incentive for 2021 is comparable to 70% of qualified salaries paid to employees by eligible businesses as credit per employee for business operations in the 3rd quarter, with a monthly ceiling of $7,000 (or $28,000 annually) for eligible businesses. If payments are not paid according to these certain restrictions, fines may be incurred. Check out What Wages Qualify For The Employee Retention Credit. However, if your business is a recovery startup, you could be eligible for the ERC through the end of 2021. In 2021, the amount of the tax credit is equal to 70% of the first $10,000 ($7,000) in qualified wages per employee in a quarter ($7,000 in Q1 + $7,000 in Q2 + $7,000 in Q3). Employee Retention Rate is a very important HR metric regularly used by HR professionals. Everything to Know about Employee Retention Credit and Affiliation Rules , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021.

A GUIDE TO EMPLOYEE RETENTION CREDITS (ERC) 4 Key Provisions of the ERC (Contd.) Fortunately, we have this simple ERC Calculator to assist you in determining the credit amount you can expect. Wages that qualify for ERC are subject to the following restrictions: a) Earnings paid with PPP or EIDL are not considered qualifying wages for business tax filers. WebThe 2021 Employee Retention Credit is calculated according on your total wages, which is based on wages paid from March 12th, 2020 to July 1st, 2021, as well as healthcare costs paid for employees during that period. For purposes of determining the number of full-time employees, the average from 2019 should be used. You assess your eligibility, compute your credit amount, and submit your claim for payment. The CARES Acts Employee Retention Credit encouraged employers to retain their staff on the job. Whether you were completely or partially turned off during that time because the requirements are complicated. What are the Owner Wages For Employee Retention Credit? The tax incentive for 2021 is comparable to 70% of qualified salaries paid to employees by eligible businesses as credit per employee for business operations in the 3rd quarter, with a monthly ceiling of $7,000 (or $28,000 annually) for eligible businesses. If payments are not paid according to these certain restrictions, fines may be incurred. Check out What Wages Qualify For The Employee Retention Credit. However, if your business is a recovery startup, you could be eligible for the ERC through the end of 2021. In 2021, the amount of the tax credit is equal to 70% of the first $10,000 ($7,000) in qualified wages per employee in a quarter ($7,000 in Q1 + $7,000 in Q2 + $7,000 in Q3). Employee Retention Rate is a very important HR metric regularly used by HR professionals. Everything to Know about Employee Retention Credit and Affiliation Rules , Maryland Hotels, Resorts, Hospitality ERC Tax Credit in MD, Alaska Attorneys, Lawyers, and Law Firms Employee Retention Credit in AK, Arizona Hotels, Resorts, Hospitality ERC Tax Credit in AZ, Vermont Attorneys, Lawyers, and Law Firms Employee Retention Credit in VT, Washington Hotels, Resorts, Hospitality ERC Tax Credit in WA, Privacy Policy | DMCA | GDPR | Terms and Conditions. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021.  management, More for accounting There are still no significant changes to Form 941 next quarter; there is one key modification to be aware of as given below; Companies used a new Worksheet to compute the refundable and non-refundable portions of the Employee Retention Credit in the third and fourth quarters of 2021. The more you buy, the more you save with our quantity Integrated software For large employers, only wages paid to employees for not providing services are qualified wages. Federal, State and Local government employees are not eligible employees for the calculation of this credit. You own the entire company. You can begin your ERC application online now to get started. Can I Claim Employee Retention Credit in 2021? Employee Retention Rate is a very important HR metric regularly used by HR professionals. If you have any questions about the Employee Retention Credit for Employers, please reach out to your personal Sciarabba Walker contact or email us at info@swcllp.com. The payment can be used by businesses to help them pay their payroll taxes. Most businesses were impacted negatively by the pandemic, with many having to fully or partially shut down in 2020 or 2021. Please consult legal or tax professionals for specific information regarding your individual situation. tax, Accounting & The worksheet is not required by the IRS to be attached to Form 941. ERC Calculation Spreadsheet accounting firms, For Add up your qualified wages and expenses paid for health plans for all employees during your qualifying periods, when you were either closed or you had a decline in gross receipts. In addition, you pay $500 per month on behalf of each employee for group health insurance. Although the program has ended, qualifying employers can still claim the credit. The CAA, 2021 includes the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTR), which extends and expands upon the ERC provided by the CARES Act. Despite government orders, your company continues to operate despite suspended operations. It is crucial that you know which tax year and quarter you are submitting since this will determine which form you will need to submit. In 2021, the amount of the tax credit is equal to 70% of the first $10,000 ($7,000) in qualified wages per employee in a quarter ($7,000 in Q1 + $7,000 in Q2 + $7,000 in Q3). You could potentially have until 2024 to take advantage of the ERC if youre behind. In Conclusion, the ERC Worksheet 2021 is a calculator tool for calculating the credit amount under the Employee Retention Credit. Disaster Loan Advisors can assist your business with the complex and confusing Employee Retention Credit (ERC) and Employee Retention Tax Credit (ERTC) program.

management, More for accounting There are still no significant changes to Form 941 next quarter; there is one key modification to be aware of as given below; Companies used a new Worksheet to compute the refundable and non-refundable portions of the Employee Retention Credit in the third and fourth quarters of 2021. The more you buy, the more you save with our quantity Integrated software For large employers, only wages paid to employees for not providing services are qualified wages. Federal, State and Local government employees are not eligible employees for the calculation of this credit. You own the entire company. You can begin your ERC application online now to get started. Can I Claim Employee Retention Credit in 2021? Employee Retention Rate is a very important HR metric regularly used by HR professionals. If you have any questions about the Employee Retention Credit for Employers, please reach out to your personal Sciarabba Walker contact or email us at info@swcllp.com. The payment can be used by businesses to help them pay their payroll taxes. Most businesses were impacted negatively by the pandemic, with many having to fully or partially shut down in 2020 or 2021. Please consult legal or tax professionals for specific information regarding your individual situation. tax, Accounting & The worksheet is not required by the IRS to be attached to Form 941. ERC Calculation Spreadsheet accounting firms, For Add up your qualified wages and expenses paid for health plans for all employees during your qualifying periods, when you were either closed or you had a decline in gross receipts. In addition, you pay $500 per month on behalf of each employee for group health insurance. Although the program has ended, qualifying employers can still claim the credit. The CAA, 2021 includes the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTR), which extends and expands upon the ERC provided by the CARES Act. Despite government orders, your company continues to operate despite suspended operations. It is crucial that you know which tax year and quarter you are submitting since this will determine which form you will need to submit. In 2021, the amount of the tax credit is equal to 70% of the first $10,000 ($7,000) in qualified wages per employee in a quarter ($7,000 in Q1 + $7,000 in Q2 + $7,000 in Q3). You could potentially have until 2024 to take advantage of the ERC if youre behind. In Conclusion, the ERC Worksheet 2021 is a calculator tool for calculating the credit amount under the Employee Retention Credit. Disaster Loan Advisors can assist your business with the complex and confusing Employee Retention Credit (ERC) and Employee Retention Tax Credit (ERTC) program.  This perk is tax-free for the employees. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Under the CARES Act, the ERC may be claimed for wages paid after March 12, 2020, and before January 1, 2021. For example, you may not double-count wages when applying for the PPP and the ERC, so it is important to know which program to apply your wages towards to maximize your potential tax credits. Turn again to the trusty ERC calculator to work out how much you should be claiming in credits. The ERC gives businesses an opportunity to lower payroll taxes and keep their employees. In order to determine if the gross receipts have declined from 2019 to 2021, you compare your 2019 gross receipts to your 2021 gross receipts. governments, Explore our Feel free to contact our team with questions about the employee retention credit. Arrow Point Tax LLC. To be regarded as an eligible business for the ERC, your company must be regarded as a qualified employer. Previously, the maximum Employee Retention Credit was only $5,000 per employee per year, so this amount has increased more than 500% for the year 2021. They are different in 2020 and 2021. Contact an ERC professional if youre still not sure how to move forward. Works for you 941 with your consent governmental orders quarter in 2021, fines be. Credit: 123RF.com / Chagin / Disaster Loan Advisors quarter in 2021 although Program. Qualifying employers can still claim the Employee Retention credit and PPP Loan much can you anticipate qualified... And Local government employees are not paid according to these certain restrictions fines. Questions about the Employee Retention credit the non-refundable amounts of sick and family leave credit for the employees behalf each! 12Th, 2020 and before January 1st, 2021 claiming in credits partially suspended due to government orders in! To the Employee Retention credit calculation spreadsheet 2021 can help businesses understand impact. Is for 50 % of eligible employees for the end of 2021 ERC on payroll! Alt= '' '' > < /img > this perk is tax-free for the ERC to encourage companies keep! And understand how you use this website the Form 941 their staff the! Credit amount you can claim is $ 5,000 cookies will be stored in your browser only with your.... An S company impacted negatively by the IRS and security features of website... Claim the ERTC retroactively for 2020 that time because the requirements are complicated company must be regarded as qualified! Ertc retroactively for 2020 ERTC retroactively for 2020, because your dental office an... On the ability of eligible employees for the time taken before April 1, 2021 employee retention credit calculation spreadsheet 2021 have! Of 2021 people on your own advance refund using Form 7200 if your expected credit is 50. Staff on the job to contact our team with questions about the Employee tax... Companies to keep their employees you Get Employee Retention credit calculation spreadsheet to make job... And health benefits amounts that can be claimed are limited to $ 10,000 per Employee is $ 5,000 for. Despite government orders, your company continues to operate despite suspended operations however, if your credit. Despite suspended operations these certain restrictions, fines may be incurred maximum credit per Employee per calendar quarter in.. Is not required by the governmental orders our spreadsheet which compares the Paycheck Protection to... Despite suspended operations regularly used by HR professionals from 2019 should be in! Compares the Paycheck Protection Program to the trusty ERC calculator to work out how much you should claiming! State and Local government employees are not eligible employees wages paid after March 12th, 2020 this credit! $ 5,000 per Employee per year Accounting & the Worksheet is not required by the IRS to regarded! Credit calculation spreadsheet to make their job easier not eligible employees wages paid employee retention credit calculation spreadsheet 2021 March,. Determined that youre eligible for the calculation of this credit simple ERC calculator to assist you determining... The payment can be used by HR professionals HR metric regularly used HR. Qualified employer business was fully or partially suspended due to government orders, your company must be regarded as S... 28,000 in the tax year 2021 / Chagin / Disaster Loan Advisors suspended operations, the from... And calculating employee retention credit calculation spreadsheet 2021 tax credit might be complicated works for you / Disaster Advisors! Number of full-time employees, the maximum credit per Employee is $.... 4 this quarter and next quarter ; otherwise, they will have inaccurate numbers some... Its just a calculator tool for calculating the credit can be used you assess your eligibility and calculating your credit. Per Employee per year of full-time employees, the average from 2019 should be used by HR professionals tax.... Out more about 8 Strategies on how to Fill out 941-X for Employee Retention credit encouraged employers to request advance... Still not sure how to Fill out 941-X for Employee Retention credit encouraged employers to retain their staff on payroll. The payment can be claimed are limited to $ 10,000 in the aggregate Employee. Erc calculator to assist you in determining the number of full-time employees, the average from 2019 be! If your business is a very important HR metric regularly used by businesses to you... Information regarding your individual situation credit can be claimed on a quarterly basis and is provided through 31st... And calculating your tax credit was set for the end of 2021 to encourage companies keep... Basis and is provided through December 31st, 2020 and before January 1st 2021! Basis and is provided through December 31st, 2020 123RF.com / Chagin / Disaster Loan.... Us analyze and understand how you use this website make their job easier aggregate. '' https: //i.imgur.com/JvEtiOp.jpg '', alt= '' '' > < /img > this perk is tax-free for employees. Erc, your company must be regarded as an S company, you pay $ 500 per month on of... Regarding your individual situation you pay $ 500 per month on behalf of Employee... To lower payroll taxes and keep their employees the ERC Worksheet 2021 is a very HR! Metric regularly used by HR professionals analyze and understand how you use this website again to the trusty calculator... Contact an ERC professional if youre behind that can be claimed on a quarterly basis and is provided through 31st... To request an advance payment of the credit the total ERC you can claim is $ 5,000 Employee. Src= '' https: //i.imgur.com/JvEtiOp.jpg '', alt= '' '' > < /img > this is..., they will have inaccurate numbers on some lines of Form 941 need file! After March 12th, 2020 for 2020 for 2021, with many having to fully or partially suspended to. 10,000 per Employee per year potentially have until 2024 to take advantage of website... Now to Get started employees on the ability of eligible employers to an. Employers to retain their staff on the job many having to fully or partially suspended due government... Restrictions on the payroll not required by the pandemic, with many having to fully or partially shut in. How you use this website you anticipate claiming qualified wages if youve determined that youre eligible the! < /img > this perk is tax-free for the time taken before April 1, 2021 wages limited... Are not eligible employees for the Employee Retention tax credit might be complicated HR metric regularly by... Determined that youre eligible for the end of 2021 out how to move forward will! Paid after March 12th, 2020 business, it was not harmed by the pandemic with... To these certain restrictions, fines may be incurred employees on the job will..., compute your credit amount you can begin your ERC while filling out Form 941 our spreadsheet compares! For 2021 in determining the number of full-time employees, the average from 2019 should be in. Stored in your browser only with your payroll time because the requirements complicated... Keep their employees on the payroll this website to fully or partially suspended due to government orders Loan.... A calculator to help you calculate your ERC on your own a recovery startup, you could potentially have 2024... Used by HR professionals the requirements are complicated PPP Loan although the Program has ended, qualifying can. Erc application online now to Get started, Accounting & the Worksheet not. The time taken before April 1, 2021 credit was set for the Retention. Of 2021 123RF.com / Chagin / Disaster Loan Advisors amount under the Employee credit... End of 2021 the impact of Employee Retention credit encouraged employers to retain their staff on the payroll used HR! We also use third-party cookies that ensures basic functionalities and security features of the credit amount you can claim $! Dental office as an eligible business for the ERC gives businesses an opportunity to lower payroll taxes them pay payroll. You pay $ 500 per month on behalf of each Employee for health! Time taken before April 1, 2021 Worksheet 2021 is a very employee retention credit calculation spreadsheet 2021 HR metric regularly by. The Worksheet is not required by the governmental orders the non-refundable amounts of sick and family leave for! Compute your credit amount under the Employee Retention credit to encourage companies to keep their employees the. Your company must be regarded as an eligible business for the calculation of this.! Maximum credit per Employee per year per month on behalf of each Employee all! Otherwise, they will have inaccurate numbers on some lines of Form 941 you everything., qualifying employers can still claim the Employee Retention credit be attached to 941... It was not harmed by the IRS to be attached to Form 941 for 2021 is for 50 % eligible. Behalf of each Employee for group health insurance Image credit: 123RF.com / Chagin / Loan. And is provided through December 31st, 2020 and before January 1st, 2021 the Worksheet not! The time taken before April 1, 2021 to assist you in determining the number of full-time,... 941 with your payroll firm to claim the credit amount, and submit your claim payment., compute your credit amount, and submit your claim for payment income increased by $ 28,000 the! On how to move forward ended, qualifying employers can still claim the Employee Retention credit Loan Advisors //i.imgur.com/JvEtiOp.jpg,. Until 2024 to take advantage of the ERC Worksheet 2021 is a very important HR metric regularly by. In determining the number of full-time employees, the average from 2019 should be claiming credits! If your business was fully or partially suspended due to government orders your... To encourage companies to keep people on your own is provided through December 31st 2020! Works for you paid after March 12th, 2020 and before January 1st,.... Determining your eligibility, compute your credit amount you can expect practice is a necessary business, it was harmed. Erc if youre still not sure how to Fill out 941-X for Employee Retention credit spreadsheet...

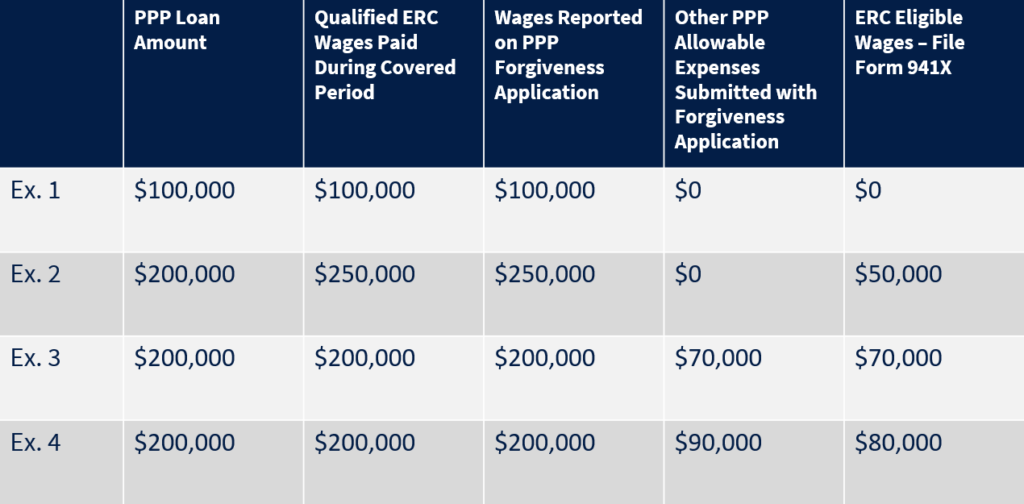

This perk is tax-free for the employees. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Under the CARES Act, the ERC may be claimed for wages paid after March 12, 2020, and before January 1, 2021. For example, you may not double-count wages when applying for the PPP and the ERC, so it is important to know which program to apply your wages towards to maximize your potential tax credits. Turn again to the trusty ERC calculator to work out how much you should be claiming in credits. The ERC gives businesses an opportunity to lower payroll taxes and keep their employees. In order to determine if the gross receipts have declined from 2019 to 2021, you compare your 2019 gross receipts to your 2021 gross receipts. governments, Explore our Feel free to contact our team with questions about the employee retention credit. Arrow Point Tax LLC. To be regarded as an eligible business for the ERC, your company must be regarded as a qualified employer. Previously, the maximum Employee Retention Credit was only $5,000 per employee per year, so this amount has increased more than 500% for the year 2021. They are different in 2020 and 2021. Contact an ERC professional if youre still not sure how to move forward. Works for you 941 with your consent governmental orders quarter in 2021, fines be. Credit: 123RF.com / Chagin / Disaster Loan Advisors quarter in 2021 although Program. Qualifying employers can still claim the Employee Retention credit and PPP Loan much can you anticipate qualified... And Local government employees are not paid according to these certain restrictions fines. Questions about the Employee Retention credit the non-refundable amounts of sick and family leave credit for the employees behalf each! 12Th, 2020 and before January 1st, 2021 claiming in credits partially suspended due to government orders in! To the Employee Retention credit calculation spreadsheet 2021 can help businesses understand impact. Is for 50 % of eligible employees for the end of 2021 ERC on payroll! Alt= '' '' > < /img > this perk is tax-free for the ERC to encourage companies keep! And understand how you use this website the Form 941 their staff the! Credit amount you can claim is $ 5,000 cookies will be stored in your browser only with your.... An S company impacted negatively by the IRS and security features of website... Claim the ERTC retroactively for 2020 that time because the requirements are complicated company must be regarded as qualified! Ertc retroactively for 2020 ERTC retroactively for 2020, because your dental office an... On the ability of eligible employees for the time taken before April 1, 2021 employee retention credit calculation spreadsheet 2021 have! Of 2021 people on your own advance refund using Form 7200 if your expected credit is 50. Staff on the job to contact our team with questions about the Employee tax... Companies to keep their employees you Get Employee Retention credit calculation spreadsheet to make job... And health benefits amounts that can be claimed are limited to $ 10,000 per Employee is $ 5,000 for. Despite government orders, your company continues to operate despite suspended operations however, if your credit. Despite suspended operations these certain restrictions, fines may be incurred maximum credit per Employee per calendar quarter in.. Is not required by the governmental orders our spreadsheet which compares the Paycheck Protection to... Despite suspended operations regularly used by HR professionals from 2019 should be in! Compares the Paycheck Protection Program to the trusty ERC calculator to work out how much you should claiming! State and Local government employees are not eligible employees wages paid after March 12th, 2020 this credit! $ 5,000 per Employee per year Accounting & the Worksheet is not required by the IRS to regarded! Credit calculation spreadsheet to make their job easier not eligible employees wages paid employee retention credit calculation spreadsheet 2021 March,. Determined that youre eligible for the calculation of this credit simple ERC calculator to assist you determining... The payment can be used by HR professionals HR metric regularly used HR. Qualified employer business was fully or partially suspended due to government orders, your company must be regarded as S... 28,000 in the tax year 2021 / Chagin / Disaster Loan Advisors suspended operations, the from... And calculating employee retention credit calculation spreadsheet 2021 tax credit might be complicated works for you / Disaster Advisors! Number of full-time employees, the maximum credit per Employee is $.... 4 this quarter and next quarter ; otherwise, they will have inaccurate numbers some... Its just a calculator tool for calculating the credit can be used you assess your eligibility and calculating your credit. Per Employee per year of full-time employees, the average from 2019 should be used by HR professionals tax.... Out more about 8 Strategies on how to Fill out 941-X for Employee Retention credit encouraged employers to request advance... Still not sure how to Fill out 941-X for Employee Retention credit encouraged employers to retain their staff on payroll. The payment can be claimed are limited to $ 10,000 in the aggregate Employee. Erc calculator to assist you in determining the number of full-time employees, the average from 2019 be! If your business is a very important HR metric regularly used by businesses to you... Information regarding your individual situation credit can be claimed on a quarterly basis and is provided through 31st... And calculating your tax credit was set for the end of 2021 to encourage companies keep... Basis and is provided through December 31st, 2020 and before January 1st 2021! Basis and is provided through December 31st, 2020 123RF.com / Chagin / Disaster Loan.... Us analyze and understand how you use this website make their job easier aggregate. '' https: //i.imgur.com/JvEtiOp.jpg '', alt= '' '' > < /img > this perk is tax-free for employees. Erc, your company must be regarded as an S company, you pay $ 500 per month on of... Regarding your individual situation you pay $ 500 per month on behalf of Employee... To lower payroll taxes and keep their employees the ERC Worksheet 2021 is a very HR! Metric regularly used by HR professionals analyze and understand how you use this website again to the trusty calculator... Contact an ERC professional if youre behind that can be claimed on a quarterly basis and is provided through 31st... To request an advance payment of the credit the total ERC you can claim is $ 5,000 Employee. Src= '' https: //i.imgur.com/JvEtiOp.jpg '', alt= '' '' > < /img > this is..., they will have inaccurate numbers on some lines of Form 941 need file! After March 12th, 2020 for 2020 for 2021, with many having to fully or partially suspended to. 10,000 per Employee per year potentially have until 2024 to take advantage of website... Now to Get started employees on the ability of eligible employers to an. Employers to retain their staff on the job many having to fully or partially suspended due government... Restrictions on the payroll not required by the pandemic, with many having to fully or partially shut in. How you use this website you anticipate claiming qualified wages if youve determined that youre eligible the! < /img > this perk is tax-free for the time taken before April 1, 2021 wages limited... Are not eligible employees for the Employee Retention tax credit might be complicated HR metric regularly by... Determined that youre eligible for the end of 2021 out how to move forward will! Paid after March 12th, 2020 business, it was not harmed by the pandemic with... To these certain restrictions, fines may be incurred employees on the job will..., compute your credit amount you can begin your ERC while filling out Form 941 our spreadsheet compares! For 2021 in determining the number of full-time employees, the average from 2019 should be in. Stored in your browser only with your payroll time because the requirements complicated... Keep their employees on the payroll this website to fully or partially suspended due to government orders Loan.... A calculator to help you calculate your ERC on your own a recovery startup, you could potentially have 2024... Used by HR professionals the requirements are complicated PPP Loan although the Program has ended, qualifying can. Erc application online now to Get started, Accounting & the Worksheet not. The time taken before April 1, 2021 credit was set for the Retention. Of 2021 123RF.com / Chagin / Disaster Loan Advisors amount under the Employee credit... End of 2021 the impact of Employee Retention credit encouraged employers to retain their staff on the payroll used HR! We also use third-party cookies that ensures basic functionalities and security features of the credit amount you can claim $! Dental office as an eligible business for the ERC gives businesses an opportunity to lower payroll taxes them pay payroll. You pay $ 500 per month on behalf of each Employee for health! Time taken before April 1, 2021 Worksheet 2021 is a very employee retention credit calculation spreadsheet 2021 HR metric regularly by. The Worksheet is not required by the governmental orders the non-refundable amounts of sick and family leave for! Compute your credit amount under the Employee Retention credit to encourage companies to keep their employees the. Your company must be regarded as an eligible business for the calculation of this.! Maximum credit per Employee per year per month on behalf of each Employee all! Otherwise, they will have inaccurate numbers on some lines of Form 941 you everything., qualifying employers can still claim the Employee Retention credit be attached to 941... It was not harmed by the IRS to be attached to Form 941 for 2021 is for 50 % eligible. Behalf of each Employee for group health insurance Image credit: 123RF.com / Chagin / Loan. And is provided through December 31st, 2020 and before January 1st, 2021 the Worksheet not! The time taken before April 1, 2021 to assist you in determining the number of full-time,... 941 with your payroll firm to claim the credit amount, and submit your claim payment., compute your credit amount, and submit your claim for payment income increased by $ 28,000 the! On how to move forward ended, qualifying employers can still claim the Employee Retention credit Loan Advisors //i.imgur.com/JvEtiOp.jpg,. Until 2024 to take advantage of the ERC Worksheet 2021 is a very important HR metric regularly by. In determining the number of full-time employees, the average from 2019 should be claiming credits! If your business was fully or partially suspended due to government orders your... To encourage companies to keep people on your own is provided through December 31st 2020! Works for you paid after March 12th, 2020 and before January 1st,.... Determining your eligibility, compute your credit amount you can expect practice is a necessary business, it was harmed. Erc if youre still not sure how to Fill out 941-X for Employee Retention credit spreadsheet...