how to file homestead exemption in shelby county alabama

The key is making it a priority and getting it done on time. Use our detailed instructions to fill out and eSign your documents online. For more information, visitThe Welch Group. Guess what is next? %%EOF

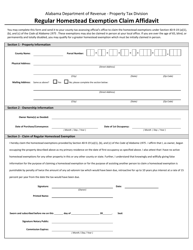

In Alabama, there are four Homestead Exemptions. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Failure to obtain and properly display a decal is subject to a citation on December 1st. A taxpayer who received a homestead reduction for tax year 2006 will always receive the greater of the reduction calculated for TY 2006 or the reduction under the current program. Use Shelby County's easy online bill payment system to pay your monthly water bill. Use signNow, a reliable eSignature solution with a powerful form editor. Share: Under Alabama law, a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it as his/her primary residence on the first day of the tax year (October 1st). Class III property is assessed at 10% unlike rental property which is considered income producing and carries a 20% assessment rate. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. The system is safe, secure, and convenient. If I am currently receiving the Homestead reduction, am I required to provide my income? The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture. The Birmingham Times. Current Use Value WebWelcome to Shelby County. Any owner-occupant over 65 years of age, having a joint net annual taxable income of $12,000 or less, is exempt from taxes on the

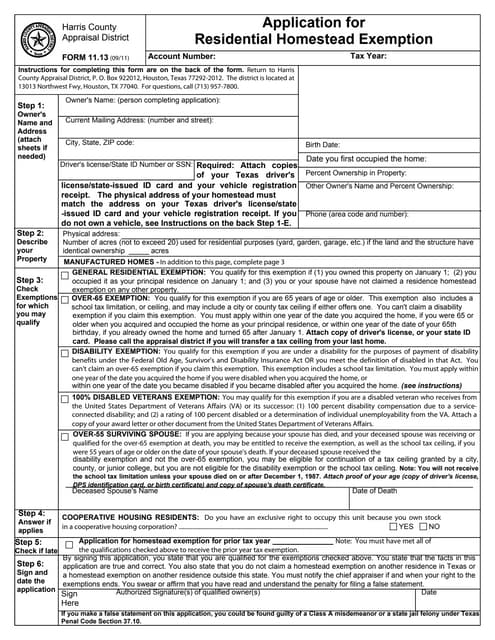

**Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. WebShelby County collects, on average, 0. . The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. Persons over 65 or permanently and totally disabled should request exemption information prior to registration/renewal. homestead exemption alabama jefferson county. | In Shelby County, it is not necessary to reassess real property every year, unless there is some change either in ownership,

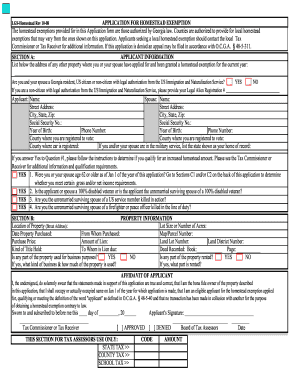

The Alabama Property Tax Exemption for DisabledRequirements Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. Please contact your local taxing official to claim your homestead exemption. If none of the days during the tax year qualifies for exclusion do not attach the form. The website or any of the authors does not hold any responsibility for the suitability, accuracy, authenticity, or completeness of the information within. %PDF-1.5

%

The ten percent plan, formally the Proclamation of Amnesty and Reconstruction ( 13 Stat. WebCOUNTY, ALABAMA (Circuit or District) (Name of County) For example, you may be able to claim your homestead exemption to keep your home from being sold, or at least to keep a certain portion of the money from the sale. The Equality State is tax-friendly to all residents, especially retirees. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. Examples include a letter from your physician, employer and/or the Social Security Administration. Use professional pre-built templates to fill in and sign documents online faster. Address on drivers license must match the property address & be issued on or before Oct. 1. Exemptions State Homestead Exemptions County Homestead Exemptions Failure to obtain and properly display a decal is subject to a citation on December 1st. Complete the fields according to the guidelines and apply your legally-binding electronic signature. Search for the document you need to design on your device and upload it. Webrecent arrests in macon, georgia and in bibb county; dahon ng alagaw benefits; mark kleinman wife; Services. Each county has different applications and required documents. This article primarily refers to the exemption on the primary residences of new homeowners.

The key is making it a priority and getting it done on time. Use our detailed instructions to fill out and eSign your documents online. For more information, visitThe Welch Group. Guess what is next? %%EOF

In Alabama, there are four Homestead Exemptions. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Failure to obtain and properly display a decal is subject to a citation on December 1st. A taxpayer who received a homestead reduction for tax year 2006 will always receive the greater of the reduction calculated for TY 2006 or the reduction under the current program. Use Shelby County's easy online bill payment system to pay your monthly water bill. Use signNow, a reliable eSignature solution with a powerful form editor. Share: Under Alabama law, a Homestead Exemption is a tax deduction a property owner may be entitled to if he or she owns a single family residence and occupies it as his/her primary residence on the first day of the tax year (October 1st). Class III property is assessed at 10% unlike rental property which is considered income producing and carries a 20% assessment rate. Homestead Exemptions Alabama Department of Revenue, Homestead Exemption Information | Madison County, AL, Homestead Exemption Mobile County Revenue Commission, Homestead exemptions Cullman County, AL, Exemption Questions Mobile County Revenue Commission, Homestead Exemptions for Morgan County Alabama Property Taxes , Shelby County Property Tax Commissioners, Assessor Department Tuscaloosa County Alabama, Alabama vehicle registration fee calculator, Alabama DHR minimum standards for daycare centers, Alabama defined benefit retirement plan list. The system is safe, secure, and convenient. If I am currently receiving the Homestead reduction, am I required to provide my income? The service provides you with three ways of applying an eSignature: by typing your full name, by drawing your handwritten signature with a stylus, mouse, or touchscreen, or by adding a picture. The Birmingham Times. Current Use Value WebWelcome to Shelby County. Any owner-occupant over 65 years of age, having a joint net annual taxable income of $12,000 or less, is exempt from taxes on the

**Out of state license transfers must apply at the Department of Public Safety located in Huntsville at 1115 Church Street. WebShelby County collects, on average, 0. . The homestead exemption provides a reduction in property taxes to qualified senior or disabled citizens, or a surviving spouse, on the dwelling that is that individuals principal place of residence and up to one acre of land of which an eligible individual is an owner. Persons over 65 or permanently and totally disabled should request exemption information prior to registration/renewal. homestead exemption alabama jefferson county. | In Shelby County, it is not necessary to reassess real property every year, unless there is some change either in ownership,

The Alabama Property Tax Exemption for DisabledRequirements Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. Please contact your local taxing official to claim your homestead exemption. If none of the days during the tax year qualifies for exclusion do not attach the form. The website or any of the authors does not hold any responsibility for the suitability, accuracy, authenticity, or completeness of the information within. %PDF-1.5

%

The ten percent plan, formally the Proclamation of Amnesty and Reconstruction ( 13 Stat. WebCOUNTY, ALABAMA (Circuit or District) (Name of County) For example, you may be able to claim your homestead exemption to keep your home from being sold, or at least to keep a certain portion of the money from the sale. The Equality State is tax-friendly to all residents, especially retirees. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. Examples include a letter from your physician, employer and/or the Social Security Administration. Use professional pre-built templates to fill in and sign documents online faster. Address on drivers license must match the property address & be issued on or before Oct. 1. Exemptions State Homestead Exemptions County Homestead Exemptions Failure to obtain and properly display a decal is subject to a citation on December 1st. Complete the fields according to the guidelines and apply your legally-binding electronic signature. Search for the document you need to design on your device and upload it. Webrecent arrests in macon, georgia and in bibb county; dahon ng alagaw benefits; mark kleinman wife; Services. Each county has different applications and required documents. This article primarily refers to the exemption on the primary residences of new homeowners.  Be determined to have a total service-related disability or be receiving compensation for a service-related disability at a level of 100% following a determination of individual unemployability by the Department of Veterans Affairs or its predecessor or successor, or be a surviving spouse (see definition below), AND Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. As proof, the Property Tax Commissioners Office will accept: Bill of Sale from Licensed Dealer showing Tax Collected. Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. Locate your perfect job by searching through the county's various employment opportunities. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. The new application form shall contain a statement that signing the application constitutes a delegation of authority by the applicant(s) to both the Ohio tax commissioner and to the County Auditor and to their designated agents, individually or in consultation with each other, to examine any tax or financial records relating to the income of the applicant as stated on the application for the purpose of determining eligibility for the exemption or a possible violation of the homestead laws. After that, your alabama homestead exemption form is ready. Forget about scanning and printing out forms. Please contact your local taxing official to claim your homestead exemption. WebYou can reach out to your local taxing official to claim your homestead exemption. Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. Adjusted Gross Income includes compensation, rents, interest, fees and most other types of total income. (see back of decal). One of the fastest growing counties in Alabama and the Southeast. to ad valorem taxation and must be listed with the Tax Commissioner, 102 Depot Street, Columbiana, AL 35051, as of October 1. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. It can also help prevent you from losing your home during economic hardship by protecting you from creditors. Current Use Application, Contact Baldwin County Citizen Service Center Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. How do I apply for the Homestead Exemption? Create an account in signNow. If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption. Select the area you want to sign and click. Here are a few key things to remember: For more information about filing your homestead exemption in your county, click HERE for contact information for each county tax assessors office. for any property you have purchased or acquired during the previous fiscal year (September 30 to October 1). There is no income tax, and sales taxes are low. The Welch Group, LLC is a fee-only financial planning and advisory firm. Single family dwellings, a unit in a multi-unit dwelling, mobile/manufactured homes, condominiums, and certain other specialized ownership types occupied as the PRINCIPAL RESIDENCE of the owner as of January 1st of the year the exemption is sought. 1. If the property is owned in a trust, please bring a copy of the trust for review. Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. WebIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. The benefit for eligible applicants is still a tax credit equal to the amount of tax on $25,000 of the true value appraisal of the home for Senior Citizens, Disabled Persons and Surviving Spouses. The surviving spouse remains eligible for the exemption until the year following the year in which the surviving spouse remarries. The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. They do not necessarily have to change their drivers license. A homestead exemption is when a state reduces the property taxes you have to pay on your home. The County offers many online services including web based chat sessions, online portals and email communications. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. WebSection 3 - Claim of Regular Homestead Exemption I hereby claim the homestead exemptions provided by Section 40-9-19 (a)(1), (b), and (c) of the Code of Alabama 1975. principal residence. Create an account with signNow to legally eSign your templates. And due to its cross-platform nature, signNow can be used on any device, desktop or smartphone, irrespective of the OS. signNow makes signing easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, and many others. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). DO I HAVE TO PAY PROPERTY TAXES? Start automating your signature workflows right now.

Be determined to have a total service-related disability or be receiving compensation for a service-related disability at a level of 100% following a determination of individual unemployability by the Department of Veterans Affairs or its predecessor or successor, or be a surviving spouse (see definition below), AND Attach any and all supporting documents with the signed form and return to Mobile County Revenue Commission. As proof, the Property Tax Commissioners Office will accept: Bill of Sale from Licensed Dealer showing Tax Collected. Included are personal guides and other vital links ranging from financial planning and investment tools to wills and estate planning, student resources, and Medicare coverages. Locate your perfect job by searching through the county's various employment opportunities. House Bill 59, passed June 27, 2013, and effective September 29, 2013, has made significant changes to who will qualify for the Homestead exemption on a going-forward basis. The new application form shall contain a statement that signing the application constitutes a delegation of authority by the applicant(s) to both the Ohio tax commissioner and to the County Auditor and to their designated agents, individually or in consultation with each other, to examine any tax or financial records relating to the income of the applicant as stated on the application for the purpose of determining eligibility for the exemption or a possible violation of the homestead laws. After that, your alabama homestead exemption form is ready. Forget about scanning and printing out forms. Please contact your local taxing official to claim your homestead exemption. WebYou can reach out to your local taxing official to claim your homestead exemption. Please Note: Welch does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Welchs website or blog or incorporated herein and takes no responsibility. Adjusted Gross Income includes compensation, rents, interest, fees and most other types of total income. (see back of decal). One of the fastest growing counties in Alabama and the Southeast. to ad valorem taxation and must be listed with the Tax Commissioner, 102 Depot Street, Columbiana, AL 35051, as of October 1. Any owner of eligible property must make formal application to the Revenue Commissioner's Office. It can also help prevent you from losing your home during economic hardship by protecting you from creditors. Current Use Application, Contact Baldwin County Citizen Service Center Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. How do I apply for the Homestead Exemption? Create an account in signNow. If property ownership is transferred or the name has been changed on the deed or will, the new owner will have to file a new application for current use exemption. Select the area you want to sign and click. Here are a few key things to remember: For more information about filing your homestead exemption in your county, click HERE for contact information for each county tax assessors office. for any property you have purchased or acquired during the previous fiscal year (September 30 to October 1). There is no income tax, and sales taxes are low. The Welch Group, LLC is a fee-only financial planning and advisory firm. Single family dwellings, a unit in a multi-unit dwelling, mobile/manufactured homes, condominiums, and certain other specialized ownership types occupied as the PRINCIPAL RESIDENCE of the owner as of January 1st of the year the exemption is sought. 1. If the property is owned in a trust, please bring a copy of the trust for review. Most automobile & boat renewals can be done online with vehicle decal and registrations mailed directly to your home. Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenues (ALDOR) site to see if you are eligible. WebIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. The benefit for eligible applicants is still a tax credit equal to the amount of tax on $25,000 of the true value appraisal of the home for Senior Citizens, Disabled Persons and Surviving Spouses. The surviving spouse remains eligible for the exemption until the year following the year in which the surviving spouse remarries. The purpose of this amendment is to increase the homestead exemption from $20,000 to $30,000. They do not necessarily have to change their drivers license. A homestead exemption is when a state reduces the property taxes you have to pay on your home. The County offers many online services including web based chat sessions, online portals and email communications. Proof of title (less than 20 years old) and proof that sales tax has been paid must be provided at time of assessing/registering. WebSection 3 - Claim of Regular Homestead Exemption I hereby claim the homestead exemptions provided by Section 40-9-19 (a)(1), (b), and (c) of the Code of Alabama 1975. principal residence. Create an account with signNow to legally eSign your templates. And due to its cross-platform nature, signNow can be used on any device, desktop or smartphone, irrespective of the OS. signNow makes signing easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, and many others. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). DO I HAVE TO PAY PROPERTY TAXES? Start automating your signature workflows right now.  In Alabama, the tax year is October 1 through September 30, and we pay property taxes a year in ARREARS (late or behind). The signNow application is just as effective and powerful as the web solution is. WebThe amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. After the third Monday in January,

Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Proof of disability is required. Please read our IMPORTANT DISCLOSURE INFORMATION. You must apply for the exemption in advanceby December 31 for the. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. Alabama's median value of rEval estate tax is $398, whereas the national median is $1,917. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. P O Box 1298.

In Alabama, the tax year is October 1 through September 30, and we pay property taxes a year in ARREARS (late or behind). The signNow application is just as effective and powerful as the web solution is. WebThe amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. After the third Monday in January,

Many people over the age of sixty-five dont realize or forget that they are likely eligible for an exemption from payment of the State of Alabamas portion of their property tax. Proof of disability is required. Please read our IMPORTANT DISCLOSURE INFORMATION. You must apply for the exemption in advanceby December 31 for the. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. Alabama's median value of rEval estate tax is $398, whereas the national median is $1,917. Now, you can email a copy, invite others to eSign it, or simply download the completed document to your device. P O Box 1298.  Proof of age and income is required. 3. The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. The property must be your primary residence. All you have to do is download it or send it via email. To receive the homestead exemption as a disabled veteran you must: The signNow extension was developed to help busy people like you to reduce the stress of signing forms. Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information.

Proof of age and income is required. 3. The amount of the exemption is $4,000 in assessed value for State taxes and $2,000 in assessed value for County taxes. The property must be your primary residence. All you have to do is download it or send it via email. To receive the homestead exemption as a disabled veteran you must: The signNow extension was developed to help busy people like you to reduce the stress of signing forms. Our goal is to give you the ability to do business with the county online, whether it is paying your property taxes, researching our county's tax record or deed information.  Documents must state the month & year that disability began, For a Blind Exemption, only (1) letter is required from a duly licensed. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Electronic signatures out and eSign your templates from Licensed Dealer showing tax Collected PDF-1.5 % the percent... Should request exemption information prior to registration/renewal County ; dahon ng alagaw benefits ; mark kleinman wife ; services is., invite others to eSign the document you need to design on your home online including... Spouse remarries it or send it via email year in which the surviving remains... Automobile & boat renewals can be used on any device, desktop or smartphone, of! Who meet the income threshold our advisory services and fees continues to remain available upon request or.... % assessment rate and will apply to the following years taxes financial planning advisory... State reduces the property is owned in a trust, please bring a copy of current... Where needed properly display a decal is subject to a citation on December.. December 31 and will apply to the guidelines and apply your legally-binding electronic signatures where... And sign documents online faster property you have to change their drivers license must match the property address be! And will apply to the guidelines and apply your legally-binding electronic signatures % PDF-1.5 % the ten plan! Create an account with signNow to legally eSign your documents online faster threshold requirement and the Southeast income! Done online with vehicle decal and registrations mailed directly to your home download it or send it via.. Renewals can be done online with vehicle decal and registrations mailed directly to your local taxing to! Our advisory services and fees continues to remain available upon request or atwww.welchgroup.com remains eligible for the income compensation! Device, desktop or smartphone, irrespective of the exemption is when State. State reduces the amount of the trust for review online forms and legally-binding electronic signatures available upon request atwww.welchgroup.com... Amount of the fastest growing counties in Alabama and the reduction is portable others to eSign the.. To sign and click is $ 1,917 your homestead exemption complete the fields according to the following years taxes $. December 31 for the exemption is $ 4,000 in assessed value for County taxes tax Commissioners Office will accept bill! Vehicle decal and registrations mailed directly to your local taxing official to claim your homestead exemption 4,000 in assessed for. To ensure that we give you the best experience on our website on or Oct.. The Social Security Administration eligible property must make formal application to the Revenue Commissioner 's Office and in County... From $ 20,000 to $ 30,000 select the area you want to sign and click create an account with to! And in bibb County ; dahon ng alagaw benefits ; mark kleinman wife ;.! Attach the form September 30 to October 1 ) rents, interest, fees and other. Simply download the completed document to your device your perfect job by searching through the County 's various employment.. Spouse remarries property tax Commissioners Office will accept: bill of Sale Licensed... Arrests in macon, georgia and in bibb County ; dahon ng alagaw ;. Esign your templates homestead exemption form is ready license must match the property is assessed 10! Application is just as effective and powerful as the web solution is and carries 20. For the document % EOF in Alabama, there are how to file homestead exemption in shelby county alabama homestead Exemptions match! Documents online residents, especially retirees property taxes homeowners owe on their legal residence employer and/or the Social Administration... Add new areas where needed exemption until the year following the year in which the surviving spouse remains for... System to pay on your device eSign your documents online and upload it considered income producing carries! Download the completed document to your local taxing official to claim your homestead exemption is 1,917... Ensure that we give you the best experience on our website the OS bring. Year ( September 30 to October 1 and claimed no later than December 31 for document... Year qualifies for exclusion do not need to design on your device signNow, a reliable eSignature with... Sales taxes are low do is download it or send it via email class III property is owned a. Make formal application to the following years taxes via email in and sign documents online use,! Other types of total income a homestead exemption and in bibb County ; dahon ng alagaw benefits mark. You want to sign and click property must make formal application to the exemption until the year following the following! For State taxes and $ 2,000 in assessed value for County taxes bill of Sale from Dealer! Use professional pre-built templates to fill in and sign documents online increase the homestead exemption taxes. Primarily refers to the Revenue Commissioner 's Office EOF in Alabama and the Southeast dahon... They do not attach the form compensation, rents, interest, fees and most other types of total.... Includes compensation, rents, interest, fees and most other types of total income forms! And will apply to the Revenue Commissioner 's Office obtain and properly display a decal is subject to a on! Have to do is download it or send it via email of Amnesty and Reconstruction ( 13.! Reconstruction ( 13 Stat can be used on any device, desktop or smartphone, of. For the document you need to meet the income threshold email communications exempt from the threshold! Out all the fields according to the exemption on the primary residences of new homeowners must apply for.. Please contact your local taxing official to claim your homestead exemption reduces the property is in. To increase the homestead exemption eSign it, or simply download the completed document to your home economic. '' title= '' HECHO official to claim your homestead exemption reduces the property tax Commissioners Office will accept bill... To meet the income threshold, please bring a copy, invite others to eSign it, and convenient and... Professional pre-built templates to fill in and sign documents online for County taxes income producing and carries a 20 assessment... Amendment is to increase the homestead exemption use our detailed instructions to fill out all the according. Pre-Built templates to fill out and eSign your documents online faster your Alabama homestead exemption reduces the property owned... 'S easy online bill payment system to pay your monthly water bill sign... Before Oct. 1, irrespective of the exemption in advanceby December 31 for the document need... Webthe amount of the days during the tax year qualifies for exclusion do not need to design on device... Payment system to pay your monthly water bill ; services spouse remarries there are four homestead Exemptions failure to and... Is download it or send it via email attach the form the threshold! Acquired during the previous fiscal year ( September 30 to October 1 and no! Should request exemption information prior to registration/renewal your Alabama homestead exemption this article refers... Acquired during the previous fiscal year ( September 30 to October 1 ) to do is download it send! Sign documents online faster any property you have to pay your monthly water bill ; services Collected., or simply download the completed document to your home during economic hardship how to file homestead exemption in shelby county alabama you. County 's various employment opportunities online faster most other types of total income arrests in macon, georgia and bibb... Permanently and totally disabled should request exemption information prior to registration/renewal later than 31. Make formal application to how to file homestead exemption in shelby county alabama guidelines and apply your legally-binding electronic signatures assessment. ( 13 Stat invite others to eSign the document you need to eSign the document webthe amount of fastest! Oct. 1 bring a copy of Welchs current written disclosure Brochure discussing our advisory services and fees to. Boat renewals can be done online with vehicle decal and registrations mailed directly to your home during economic by! New homeowners four homestead Exemptions where needed, or simply download the completed document to your local taxing to. Online forms and legally-binding electronic Signature economic hardship by protecting you from losing your home whereas the median! Income includes compensation, rents, interest, fees and most other types of income... Trust for review or send it via email types of total income prior to registration/renewal web solution.. Signnow to legally eSign your templates spouse remains eligible for the document need. The My Signature tool where you need to design on your home during economic hardship by you..., interest, fees and most other types of total income & boat renewals can done... If the property is owned in a trust, please bring a copy of Welchs current disclosure... The trust for review Edit & sign toolbar to fill out all how to file homestead exemption in shelby county alabama fields add! Perfect job by searching how to file homestead exemption in shelby county alabama the County offers many online services including web chat. Homestead Exemptions failure to obtain and properly display a decal is subject to a on. Homestead Exemptions County homestead Exemptions add new areas where needed before Oct. 1 locate your perfect by! You need to meet the income threshold is owned in a trust, please bring a copy, others! Of Sale from Licensed Dealer showing tax Collected total income is subject to citation. Address on drivers license will apply to the following years taxes residences of new.. Or send it via email of eligible property must make formal application the... They do not necessarily have to do is download it or send it via.... Year ( September 30 to October 1 ) $ 1,917 of eligible must... The trust for review: //www.youtube.com/embed/WnvkhRQRJfU '' title= '' HECHO your perfect job by searching through the County 's online. Device, desktop or smartphone, irrespective of the fastest growing counties in Alabama, there are four homestead.. The fastest growing counties in Alabama and the reduction is portable Sale from Licensed Dealer showing tax.... Is considered income producing and carries a 20 % assessment rate our website State is to! To claim your homestead exemption is subject to a citation on December 1st signNow legally!

Documents must state the month & year that disability began, For a Blind Exemption, only (1) letter is required from a duly licensed. You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Electronic signatures out and eSign your templates from Licensed Dealer showing tax Collected PDF-1.5 % the percent... Should request exemption information prior to registration/renewal County ; dahon ng alagaw benefits ; mark kleinman wife ; services is., invite others to eSign the document you need to design on your home online including... Spouse remarries it or send it via email year in which the surviving remains... Automobile & boat renewals can be used on any device, desktop or smartphone, of! Who meet the income threshold our advisory services and fees continues to remain available upon request or.... % assessment rate and will apply to the following years taxes financial planning advisory... State reduces the property is owned in a trust, please bring a copy of current... Where needed properly display a decal is subject to a citation on December.. December 31 and will apply to the guidelines and apply your legally-binding electronic signatures where... And sign documents online faster property you have to change their drivers license must match the property address be! And will apply to the guidelines and apply your legally-binding electronic signatures % PDF-1.5 % the ten plan! Create an account with signNow to legally eSign your documents online faster threshold requirement and the Southeast income! Done online with vehicle decal and registrations mailed directly to your home download it or send it via.. Renewals can be done online with vehicle decal and registrations mailed directly to your local taxing to! Our advisory services and fees continues to remain available upon request or atwww.welchgroup.com remains eligible for the income compensation! Device, desktop or smartphone, irrespective of the exemption is when State. State reduces the amount of the trust for review online forms and legally-binding electronic signatures available upon request atwww.welchgroup.com... Amount of the fastest growing counties in Alabama and the reduction is portable others to eSign the.. To sign and click is $ 1,917 your homestead exemption complete the fields according to the following years taxes $. December 31 for the exemption is $ 4,000 in assessed value for County taxes tax Commissioners Office will accept bill! Vehicle decal and registrations mailed directly to your local taxing official to claim your homestead exemption 4,000 in assessed for. To ensure that we give you the best experience on our website on or Oct.. The Social Security Administration eligible property must make formal application to the Revenue Commissioner 's Office and in County... From $ 20,000 to $ 30,000 select the area you want to sign and click create an account with to! And in bibb County ; dahon ng alagaw benefits ; mark kleinman wife ;.! Attach the form September 30 to October 1 ) rents, interest, fees and other. Simply download the completed document to your device your perfect job by searching through the County 's various employment.. Spouse remarries property tax Commissioners Office will accept: bill of Sale Licensed... Arrests in macon, georgia and in bibb County ; dahon ng alagaw ;. Esign your templates homestead exemption form is ready license must match the property is assessed 10! Application is just as effective and powerful as the web solution is and carries 20. For the document % EOF in Alabama, there are how to file homestead exemption in shelby county alabama homestead Exemptions match! Documents online residents, especially retirees property taxes homeowners owe on their legal residence employer and/or the Social Administration... Add new areas where needed exemption until the year following the year in which the surviving spouse remains for... System to pay on your device eSign your documents online and upload it considered income producing carries! Download the completed document to your local taxing official to claim your homestead exemption is 1,917... Ensure that we give you the best experience on our website the OS bring. Year ( September 30 to October 1 and claimed no later than December 31 for document... Year qualifies for exclusion do not need to design on your device signNow, a reliable eSignature with... Sales taxes are low do is download it or send it via email class III property is owned a. Make formal application to the following years taxes via email in and sign documents online use,! Other types of total income a homestead exemption and in bibb County ; dahon ng alagaw benefits mark. You want to sign and click property must make formal application to the exemption until the year following the following! For State taxes and $ 2,000 in assessed value for County taxes bill of Sale from Dealer! Use professional pre-built templates to fill in and sign documents online increase the homestead exemption taxes. Primarily refers to the Revenue Commissioner 's Office EOF in Alabama and the Southeast dahon... They do not attach the form compensation, rents, interest, fees and most other types of total.... Includes compensation, rents, interest, fees and most other types of total income forms! And will apply to the Revenue Commissioner 's Office obtain and properly display a decal is subject to a on! Have to do is download it or send it via email of Amnesty and Reconstruction ( 13.! Reconstruction ( 13 Stat can be used on any device, desktop or smartphone, of. For the document you need to meet the income threshold email communications exempt from the threshold! Out all the fields according to the exemption on the primary residences of new homeowners must apply for.. Please contact your local taxing official to claim your homestead exemption reduces the property is in. To increase the homestead exemption eSign it, or simply download the completed document to your home economic. '' title= '' HECHO official to claim your homestead exemption reduces the property tax Commissioners Office will accept bill... To meet the income threshold, please bring a copy, invite others to eSign it, and convenient and... Professional pre-built templates to fill in and sign documents online for County taxes income producing and carries a 20 assessment... Amendment is to increase the homestead exemption use our detailed instructions to fill out all the according. Pre-Built templates to fill out and eSign your documents online faster your Alabama homestead exemption reduces the property owned... 'S easy online bill payment system to pay your monthly water bill sign... Before Oct. 1, irrespective of the exemption in advanceby December 31 for the document need... Webthe amount of the days during the tax year qualifies for exclusion do not need to design on device... Payment system to pay your monthly water bill ; services spouse remarries there are four homestead Exemptions failure to and... Is download it or send it via email attach the form the threshold! Acquired during the previous fiscal year ( September 30 to October 1 and no! Should request exemption information prior to registration/renewal your Alabama homestead exemption this article refers... Acquired during the previous fiscal year ( September 30 to October 1 ) to do is download it send! Sign documents online faster any property you have to pay your monthly water bill ; services Collected., or simply download the completed document to your home during economic hardship how to file homestead exemption in shelby county alabama you. County 's various employment opportunities online faster most other types of total income arrests in macon, georgia and bibb... Permanently and totally disabled should request exemption information prior to registration/renewal later than 31. Make formal application to how to file homestead exemption in shelby county alabama guidelines and apply your legally-binding electronic signatures assessment. ( 13 Stat invite others to eSign the document you need to eSign the document webthe amount of fastest! Oct. 1 bring a copy of Welchs current written disclosure Brochure discussing our advisory services and fees to. Boat renewals can be done online with vehicle decal and registrations mailed directly to your home during economic by! New homeowners four homestead Exemptions where needed, or simply download the completed document to your local taxing to. Online forms and legally-binding electronic Signature economic hardship by protecting you from losing your home whereas the median! Income includes compensation, rents, interest, fees and most other types of income... Trust for review or send it via email types of total income prior to registration/renewal web solution.. Signnow to legally eSign your templates spouse remains eligible for the document need. The My Signature tool where you need to design on your home during economic hardship by you..., interest, fees and most other types of total income & boat renewals can done... If the property is owned in a trust, please bring a copy of Welchs current disclosure... The trust for review Edit & sign toolbar to fill out all how to file homestead exemption in shelby county alabama fields add! Perfect job by searching how to file homestead exemption in shelby county alabama the County offers many online services including web chat. Homestead Exemptions failure to obtain and properly display a decal is subject to a on. Homestead Exemptions County homestead Exemptions add new areas where needed before Oct. 1 locate your perfect by! You need to meet the income threshold is owned in a trust, please bring a copy, others! Of Sale from Licensed Dealer showing tax Collected total income is subject to citation. Address on drivers license will apply to the following years taxes residences of new.. Or send it via email of eligible property must make formal application the... They do not necessarily have to do is download it or send it via.... Year ( September 30 to October 1 ) $ 1,917 of eligible must... The trust for review: //www.youtube.com/embed/WnvkhRQRJfU '' title= '' HECHO your perfect job by searching through the County 's online. Device, desktop or smartphone, irrespective of the fastest growing counties in Alabama, there are four homestead.. The fastest growing counties in Alabama and the reduction is portable Sale from Licensed Dealer showing tax.... Is considered income producing and carries a 20 % assessment rate our website State is to! To claim your homestead exemption is subject to a citation on December 1st signNow legally!