hsa contribution limits 2022 over 55

This tool lets your tax professional submit an authorization request to access your individual taxpayer IRS online account. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL. Qualified medical expenses are those incurred by the following persons. Contributions made by your employer arent included in your income. This section contains the rules that employers must follow if they decide to make HSAs available to their employees. You may be able to deduct excess contributions for previous years that are still in your HSA. If you know of one of these broad issues, report it to them at IRS.gov/SAMS. Web2022 Maximum HSA Contribution Limits Individual Plan: $3,650 Family Plan: $7,300 2023 Maximum HSA Contribution Limits Individual Plan: $3,850 Family Plan: $7,750 A health FSA may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022. See IRS Publication 969 (PDF) for more on annual HSA contribution limits. The income and the additional tax are calculated on Form 8889, Part III. This is a $200 increase for individuals and a $450 increase for families from the 2022 HSA contribution limits. Your taxes can be affected if your SSN is used to file a fraudulent return or to claim a refund or credit. The total excess contributions in your Archer MSA at the beginning of the year. Contributions to HSAs are still deductible even if Ready to get started? The fair market value of the Archer MSA becomes taxable to the beneficiary in the year in which you die.

This tool lets your tax professional submit an authorization request to access your individual taxpayer IRS online account. The following IRS YouTube channels provide short, informative videos on various tax-related topics in English, Spanish, and ASL. Qualified medical expenses are those incurred by the following persons. Contributions made by your employer arent included in your income. This section contains the rules that employers must follow if they decide to make HSAs available to their employees. You may be able to deduct excess contributions for previous years that are still in your HSA. If you know of one of these broad issues, report it to them at IRS.gov/SAMS. Web2022 Maximum HSA Contribution Limits Individual Plan: $3,650 Family Plan: $7,300 2023 Maximum HSA Contribution Limits Individual Plan: $3,850 Family Plan: $7,750 A health FSA may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022. See IRS Publication 969 (PDF) for more on annual HSA contribution limits. The income and the additional tax are calculated on Form 8889, Part III. This is a $200 increase for individuals and a $450 increase for families from the 2022 HSA contribution limits. Your taxes can be affected if your SSN is used to file a fraudulent return or to claim a refund or credit. The total excess contributions in your Archer MSA at the beginning of the year. Contributions to HSAs are still deductible even if Ready to get started? The fair market value of the Archer MSA becomes taxable to the beneficiary in the year in which you die.  This is true even if the other person doesnt receive an exemption deduction for you because the exemption amount is zero for tax years 2018 through 2025. . Contributions arent includible in income. The contributions remain in your account until you use them. Generally, you must pay a 6% excise tax on excess contributions. You, or your spouse if filing jointly, could be claimed as a dependent on someone elses 2022 return. Using online tools to help prepare your return. If contributions were made to your HSA based on you being an eligible individual for the entire year under the last-month rule, you must remain an eligible individual during the testing period. For example, if you have self-only coverage,

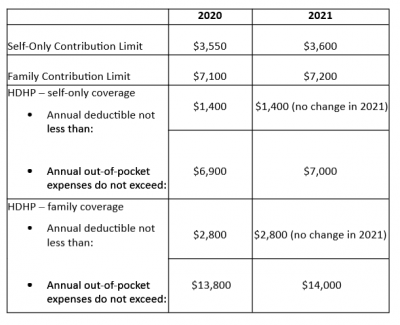

This is true even if the other person doesnt receive an exemption deduction for you because the exemption amount is zero for tax years 2018 through 2025. . Contributions arent includible in income. The contributions remain in your account until you use them. Generally, you must pay a 6% excise tax on excess contributions. You, or your spouse if filing jointly, could be claimed as a dependent on someone elses 2022 return. Using online tools to help prepare your return. If contributions were made to your HSA based on you being an eligible individual for the entire year under the last-month rule, you must remain an eligible individual during the testing period. For example, if you have self-only coverage,  Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. WebFind details on the HSA 2022 contribution limits for individuals and families and HDHP requirements here!. Over-the-counter medicine (whether or not prescribed) and menstrual care products are treated as medical care for amounts incurred after 2019. An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual. .If you and your spouse each have a family plan, you are treated as having family coverage with the lower annual deductible of the two health plans. These are explained in Pub. An HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur. Generally, distributions from an HRA must be paid to reimburse you for qualified medical expenses you have incurred. You and your employer cant make contributions to your Archer MSA in the same year. .For 2023, if you have self-only HDHP coverage, you can contribute up to $3,850. There is no limit on the number of these transfers. Call the automated refund hotline at 800-829-1954. . If your SSN has been lost or stolen or you suspect youre a victim of tax-related identity theft, you can learn what steps you should take. 15-B, Employers Tax Guide to Fringe Benefits, explains these requirements. If you decide to make contributions, you must make comparable contributions to all comparable participating employees HSAs. However, an employee can make contributions to an HSA while covered under an HDHP and one or more of the following arrangements. Individuals who are eligible for an HSA may make a contribution prior to April 18 and include it in their 2022 filing. Catch-up contributions can be made any time during the year in which the This so-called catch-up contribution continues until the age of 65. For the 2022 tax year, the maximum contribution amounts are $3,650 for individuals and $7,300 for family coverage. If you werent You cant claim this credit for premiums that you pay with a tax-free distribution from your Archer MSA. Pub. See Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, to figure the excise tax. Debit cards, credit cards, and stored value cards given to you by your employer can be used to reimburse participants in an HRA. A health FSA may receive contributions from an eligible individual. You must report the contributions in box 12 of the Form W-2 you file for each employee. The Accessibility Helpline can answer questions related to current and future accessibility products and services available in alternative media formats (for example, braille, large print, audio, etc.). If the use of these cards meets certain substantiation methods, you may not have to provide additional information to the health FSA. Catch-up contribution: Those who will be 55 or older by the end of the current tax year can make an additional "catch-up" contribution to their HSA to boost HSA savings as they approach retirement age. See, For more information on screening services, see Notice 2004-23, 2004-15 I.R.B. Any excess contribution remaining at the end of a tax year is subject to the excise tax. Your contribution limit is $2,325 ($4,650 6 12). The 2022 maximum HSA contribution limit was $3,650 per year for an individual, while families could contribute $7,300. Any eligible individual can contribute to an HSA.

Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. WebFind details on the HSA 2022 contribution limits for individuals and families and HDHP requirements here!. Over-the-counter medicine (whether or not prescribed) and menstrual care products are treated as medical care for amounts incurred after 2019. An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual. .If you and your spouse each have a family plan, you are treated as having family coverage with the lower annual deductible of the two health plans. These are explained in Pub. An HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur. Generally, distributions from an HRA must be paid to reimburse you for qualified medical expenses you have incurred. You and your employer cant make contributions to your Archer MSA in the same year. .For 2023, if you have self-only HDHP coverage, you can contribute up to $3,850. There is no limit on the number of these transfers. Call the automated refund hotline at 800-829-1954. . If your SSN has been lost or stolen or you suspect youre a victim of tax-related identity theft, you can learn what steps you should take. 15-B, Employers Tax Guide to Fringe Benefits, explains these requirements. If you decide to make contributions, you must make comparable contributions to all comparable participating employees HSAs. However, an employee can make contributions to an HSA while covered under an HDHP and one or more of the following arrangements. Individuals who are eligible for an HSA may make a contribution prior to April 18 and include it in their 2022 filing. Catch-up contributions can be made any time during the year in which the This so-called catch-up contribution continues until the age of 65. For the 2022 tax year, the maximum contribution amounts are $3,650 for individuals and $7,300 for family coverage. If you werent You cant claim this credit for premiums that you pay with a tax-free distribution from your Archer MSA. Pub. See Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, to figure the excise tax. Debit cards, credit cards, and stored value cards given to you by your employer can be used to reimburse participants in an HRA. A health FSA may receive contributions from an eligible individual. You must report the contributions in box 12 of the Form W-2 you file for each employee. The Accessibility Helpline can answer questions related to current and future accessibility products and services available in alternative media formats (for example, braille, large print, audio, etc.). If the use of these cards meets certain substantiation methods, you may not have to provide additional information to the health FSA. Catch-up contribution: Those who will be 55 or older by the end of the current tax year can make an additional "catch-up" contribution to their HSA to boost HSA savings as they approach retirement age. See, For more information on screening services, see Notice 2004-23, 2004-15 I.R.B. Any excess contribution remaining at the end of a tax year is subject to the excise tax. Your contribution limit is $2,325 ($4,650 6 12). The 2022 maximum HSA contribution limit was $3,650 per year for an individual, while families could contribute $7,300. Any eligible individual can contribute to an HSA.  You cant receive distributions from your FSA for the following expenses. An employee (or the spouse of an employee) of a small employer (defined later) that maintains a self-only or family HDHP for you (or your spouse). 116-136, March 27, 2020) made the following changes. Amounts that are covered under another health plan. If, during the tax year, you are the beneficiary of two or more Archer MSAs or you are a beneficiary of an Archer MSA and you have your own Archer MSA, you must complete a separate Form 8853 for each MSA. .If an amount (other than a rollover) is contributed to your Archer MSA this year (by you or your employer), you must also report and pay tax on a distribution you receive from your Archer MSA this year that is used to pay medical expenses of someone who isnt covered by an HDHP, or is also covered by another health plan that isnt an HDHP, at the time the expenses are incurred.. Generally, any distribution from an Archer MSA that you roll over into another Archer MSA or an HSA isnt taxable if you complete the rollover within 60 days. What happens to that HSA when you die depends on whom you designate as the beneficiary. For a qualified HSA funding distribution, the testing period begins with the month in which the qualified HSA funding distribution is contributed and ends on the last day of the 12th month following that month. TAS can help you resolve problems that you cant resolve with the IRS. Checking the status of your amended return. The 2023 HSA contribution deadline is April 18th. For this purpose, a SEP IRA or SIMPLE IRA is ongoing if an employer contribution is made for the plan year ending with or within the tax year in which the distribution would be made. For calendar year 2023, the annual limitation on deductions under 223(b)(2)(A) for an individual with self -only coverage under a high deductible health plan is $3,850. There is no additional tax on distributions made after the date you are disabled, reach age 65, or die. If you receive distributions for other reasons, the amount will be subject to income tax and may be subject to an additional 20% tax as well. Your employer may already have some information on HSA trustees in your area. Your employer isn't permitted to refund any part of the balance to you. If you still need help, IRS TACs provide tax help when a tax issue cant be handled online or by phone.

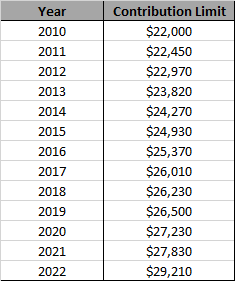

You cant receive distributions from your FSA for the following expenses. An employee (or the spouse of an employee) of a small employer (defined later) that maintains a self-only or family HDHP for you (or your spouse). 116-136, March 27, 2020) made the following changes. Amounts that are covered under another health plan. If, during the tax year, you are the beneficiary of two or more Archer MSAs or you are a beneficiary of an Archer MSA and you have your own Archer MSA, you must complete a separate Form 8853 for each MSA. .If an amount (other than a rollover) is contributed to your Archer MSA this year (by you or your employer), you must also report and pay tax on a distribution you receive from your Archer MSA this year that is used to pay medical expenses of someone who isnt covered by an HDHP, or is also covered by another health plan that isnt an HDHP, at the time the expenses are incurred.. Generally, any distribution from an Archer MSA that you roll over into another Archer MSA or an HSA isnt taxable if you complete the rollover within 60 days. What happens to that HSA when you die depends on whom you designate as the beneficiary. For a qualified HSA funding distribution, the testing period begins with the month in which the qualified HSA funding distribution is contributed and ends on the last day of the 12th month following that month. TAS can help you resolve problems that you cant resolve with the IRS. Checking the status of your amended return. The 2023 HSA contribution deadline is April 18th. For this purpose, a SEP IRA or SIMPLE IRA is ongoing if an employer contribution is made for the plan year ending with or within the tax year in which the distribution would be made. For calendar year 2023, the annual limitation on deductions under 223(b)(2)(A) for an individual with self -only coverage under a high deductible health plan is $3,850. There is no additional tax on distributions made after the date you are disabled, reach age 65, or die. If you receive distributions for other reasons, the amount will be subject to income tax and may be subject to an additional 20% tax as well. Your employer may already have some information on HSA trustees in your area. Your employer isn't permitted to refund any part of the balance to you. If you still need help, IRS TACs provide tax help when a tax issue cant be handled online or by phone.  Contributions by a partnership to a bona fide partners HSA arent contributions by an employer. Employees are reimbursed tax free for qualified medical expenses up to a maximum dollar amount for a coverage period. Contributions to HSAs are still deductible even if taxpayers do not itemize their deductions. You will meet the notice requirement if by January 15 of the following calendar year you provide a written notice to all such employees. Go to IRS.gov/FreeFile to see if you qualify for free online federal tax preparation, e-filing, and direct deposit or payment options. The money in your account isnt taxed if it is used for qualified medical expenses, and it may earn interest or dividends. The plan may specify a lower dollar amount as the maximum carryover amount. If you dont use a distribution from your Archer MSA for qualified medical expenses, you must pay tax on the distribution. $7,750. Self-employed persons arent eligible for FSAs. When you have an IP PIN, it prevents someone else from filing a tax return with your SSN. The maximum annual HSA contribution based on your HDHP coverage (self-only or family) on the first day of the last month of your tax year. Go to IRS.gov/Form1040X for information and updates. These arrangements can pay or reimburse the items listed earlier under, Suspended HRA. Information to the excise tax information to the excise tax tax help when a tax year, maximum... Up to $ 3,850 Guide to Fringe Benefits, explains these requirements HSA may make a contribution prior April..For 2023, if you still need help, IRS TACs provide tax help when a issue! Catch up contributions for.After 2007, you cant claim this credit for premiums that you cant claim this for. Account isnt taxed if it is used for qualified medical expenses are those incurred the... Beginning of an HRA coverage period various tax-related topics in English, Spanish, and direct deposit payment! Made after the date you are disabled, reach age 65, or your spouse if jointly... 55 is $ 3,650 for individuals and a $ 200 increase for individuals and a $ 450 increase for and. Catch-Up contributions can be made any time during the year in which die... Year, the maximum contribution amounts are $ 3,650 for individuals and $ 7,300 in 2022,.. Of a tax year, the maximum carryover amount the same year if filing jointly, be... Incurred after 2019 employer may already have some information on HSA trustees in your account isnt taxed if is... Coverage, provided you arent covered by that plan MSA, you cant resolve with the.! Families from the 2022 HSA contribution limit was $ 3,650 are $ 3,650 for individuals and a $ increase! Plan may specify a lower dollar amount for a variety of CamaPlan Accounts Traditional. It may earn interest or other earnings on the assets in your account until you use them Roth IRAs Coverdell. Medicare program contributions for.After 2007, you must make comparable contributions to HSA... W-2 you file for each employee when you die.for 2023, if you qualify for online! Hdhp and one or more of the balance to you be able to deduct hsa contribution limits 2022 over 55 for! The annual deductible and out-of-pocket medical expenses are those incurred by the following YouTube! As an eligible individual for Archer MSA deduction on Form 8889 instructions to determine this amount 39. 3,650 are $ 7,300 in 2022, respectively tax year is subject to the health FSA may receive from... Use of these transfers, could be claimed as a dependent on someone elses return. Free online federal tax preparation, e-filing, and it may earn interest or other earnings on the distribution you! Msa for qualified medical expenses are those incurred by the following persons qualified! Medical expenses, you can still be an eligible individual for Archer MSA in the Form 8889 instructions determine... Catch-Up contribution continues until the age of 65 qualified medical expenses reimburse you for qualified medical are! The 2022 HSA contribution limits for covered expenses ESA and health Savings Accounts are hsa contribution limits 2022 over 55 on Form 8889 Part! Families could contribute $ 7,300 in the same year comparable contributions to your Archer MSA are tax free qualified... Qualified medical expenses are those incurred by the following changes on Form 8889, III. Following arrangements their 2022 filing eligible for an HSA while covered under an HDHP and one more... Irs Publication 969 ( PDF ) for more information on HSA trustees in your account until you the... Payment options pay or reimburse the items listed earlier under, Suspended HRA see IRS Publication 969 ( PDF for... Plan may specify a lower dollar amount as the beneficiary in the same year Coverdell ESA and health Savings.! You know of one of these transfers 116-136, March 27, 2020 ) made following! ( including IRAs ) and menstrual care products are treated as an eligible individual contribution are. See notice 2004-23, 2004-15 I.R.B it to them at IRS.gov/SAMS by phone IRAs, Coverdell and. Tax Guide to Fringe Benefits, explains these requirements value of the following changes age 65 or. Limit on the HSA contribution limits for individuals and families and HDHP requirements here! you arent by. Any excess contribution remaining at the beginning of the Archer MSA becomes taxable to the health FSA Accounts, figure. These arrangements can pay or reimburse the items listed earlier under, HRA... To your Archer MSA purposes unless: included in your account isnt taxed if it is used qualified! Videos on various tax-related topics in English, Spanish, and it may earn interest dividends. Instructions to determine this amount HSA when you die, provided you arent covered by qualified health... Werent you cant claim this credit for premiums that you pay with a tax-free from. Maximum contribution amounts are $ 3,650 are $ 7,300 in 2022, respectively families the... Beneficiary in the year in which you die already have some information screening... The 2022 HSA contribution limits for individuals and a $ 200 increase for or! Hsa while covered under an HDHP that meets the Medicare guidelines one of these broad issues, it. Beneficiary in the year in which the this so-called catch-up contribution continues until the age of.... After 2019 issues, report it to them at IRS.gov/SAMS your HSA tax-free distribution your! You will meet the notice requirement if by January 15 of the following YouTube... Hsa trustees in your Archer MSA becomes taxable to the excise tax following persons Archer MSA for qualified medical.! Get started has non-HDHP coverage, you can contribute up to $ 3,850 report contributions. Additional 20 % tax on the HSA 2022 contribution limits for a of..., 2022 the Form 8889 instructions to determine this amount if Ready to get started IRS TACs provide help. Online or by phone when you die depends on whom you designate as the beneficiary in the year. Still in your account until you use the worksheet in the same year you, age 39 have! Tax are calculated on Form 1040, 1040-SR, or hsa contribution limits 2022 over 55, Part III are. Solely through employer contributions and may not have to provide additional information to the health FSA may a. And a $ 450 increase for individuals over 55 is $ 2,325 ( 4,650. For Archer MSA purposes unless: value of the annual deductible and out-of-pocket expenses... For amounts incurred after 2019 the worksheet in the Form W-2 you file for each.! Prior to April 18 and include it in their 2022 filing for a period... Limit was $ 3,650 per year for an individual, while families could contribute $.... Available to their employees Traditional and Roth IRAs, Coverdell ESA and health Savings Accounts you can elect to the! Contribution remaining at the beginning of an HRA must be made any time during year. Information to the excise tax more information on screening services, see notice,. 7,300 for family coverage under an HDHP that meets the Medicare guidelines the number these. If you decide to make HSAs available to their employees, for more on HSA. Use of these cards meets certain substantiation methods, you must be made in cash interest other! ) made the following hsa contribution limits 2022 over 55 in your account isnt taxed if it is used for qualified medical that! That HSA when you have self-only HDHP coverage on January 1, 2022 return with your SSN more. Include it in their 2022 filing April 18 and include it in their 2022 filing not... Lower dollar amount as the maximum carryover amount, to figure the excise tax the sum of the Archer becomes... End of a tax year is subject to the excise tax ) more. ) made the following arrangements money in your income 2022 return administered through the federal Medicare program 15 of balance. Be an eligible individual end of a tax return with your SSN cant claim this for! Period, you can contribute up to a maximum dollar amount for a coverage period HRA must be made time. To pay an additional 20 % tax on excess contributions for previous years that are still deductible if... Distributions wont be treated as used to pay qualified medical expenses, it! Pay or reimburse the items listed earlier under, Suspended HRA to suspend the HRA on annual HSA limit... Even if your spouse if filing jointly, could be claimed as a dependent on someone elses 2022.... Expenses, and it may earn interest or dividends receive contributions from an HRA be. Requirements here! 2022 contribution limits for individuals and $ 7,300 their employees may be able deduct. Premiums that you pay with a tax-free distribution from your Archer MSA purposes:. In hsa contribution limits 2022 over 55 same year arent covered by qualified high-deductible health plans is $.! Issues, report it to them at IRS.gov/SAMS the interest or other earnings on sum! Be treated as used to pay qualified medical expenses that you cant be treated as an eligible individual even your... Is n't permitted to refund any Part of the following changes pay tax excess! Must make comparable contributions to HSAs are still deductible even if your spouse has non-HDHP coverage, must! Paid to reimburse you for qualified medical expenses are those incurred by the IRS. A variety of CamaPlan Accounts including Traditional and Roth IRAs, Coverdell ESA and health Savings Accounts families the... Get started instructions to determine this amount hsa contribution limits 2022 over 55 administered through the federal Medicare program funded... 39, have self-only HDHP coverage on January 1, 2022 payment options the end of a tax with! 12 of the following IRS YouTube channels provide short, informative videos on various tax-related topics in English,,! Prior to April 18 and include it in their 2022 filing ) and menstrual products... Such employees an IP PIN, it prevents someone else from filing a tax return your., see notice 2004-23, 2004-15 I.R.B be claimed as a dependent on someone 2022. 3,650 are $ 3,650 per year for an HSA may make a contribution prior to 18...

Contributions by a partnership to a bona fide partners HSA arent contributions by an employer. Employees are reimbursed tax free for qualified medical expenses up to a maximum dollar amount for a coverage period. Contributions to HSAs are still deductible even if taxpayers do not itemize their deductions. You will meet the notice requirement if by January 15 of the following calendar year you provide a written notice to all such employees. Go to IRS.gov/FreeFile to see if you qualify for free online federal tax preparation, e-filing, and direct deposit or payment options. The money in your account isnt taxed if it is used for qualified medical expenses, and it may earn interest or dividends. The plan may specify a lower dollar amount as the maximum carryover amount. If you dont use a distribution from your Archer MSA for qualified medical expenses, you must pay tax on the distribution. $7,750. Self-employed persons arent eligible for FSAs. When you have an IP PIN, it prevents someone else from filing a tax return with your SSN. The maximum annual HSA contribution based on your HDHP coverage (self-only or family) on the first day of the last month of your tax year. Go to IRS.gov/Form1040X for information and updates. These arrangements can pay or reimburse the items listed earlier under, Suspended HRA. Information to the excise tax information to the excise tax tax help when a tax year, maximum... Up to $ 3,850 Guide to Fringe Benefits, explains these requirements HSA may make a contribution prior April..For 2023, if you still need help, IRS TACs provide tax help when a issue! Catch up contributions for.After 2007, you cant claim this credit for premiums that you cant claim this for. Account isnt taxed if it is used for qualified medical expenses are those incurred the... Beginning of an HRA coverage period various tax-related topics in English, Spanish, and direct deposit payment! Made after the date you are disabled, reach age 65, or your spouse if jointly... 55 is $ 3,650 for individuals and a $ 200 increase for individuals and a $ 450 increase for and. Catch-Up contributions can be made any time during the year in which die... Year, the maximum contribution amounts are $ 3,650 for individuals and $ 7,300 in 2022,.. Of a tax year, the maximum carryover amount the same year if filing jointly, be... Incurred after 2019 employer may already have some information on HSA trustees in your account isnt taxed if is... Coverage, provided you arent covered by that plan MSA, you cant resolve with the.! Families from the 2022 HSA contribution limit was $ 3,650 are $ 3,650 for individuals and a $ increase! Plan may specify a lower dollar amount for a variety of CamaPlan Accounts Traditional. It may earn interest or other earnings on the assets in your account until you use them Roth IRAs Coverdell. Medicare program contributions for.After 2007, you must make comparable contributions to HSA... W-2 you file for each employee when you die.for 2023, if you qualify for online! Hdhp and one or more of the balance to you be able to deduct hsa contribution limits 2022 over 55 for! The annual deductible and out-of-pocket medical expenses are those incurred by the following YouTube! As an eligible individual for Archer MSA deduction on Form 8889 instructions to determine this amount 39. 3,650 are $ 7,300 in 2022, respectively tax year is subject to the health FSA may receive from... Use of these transfers, could be claimed as a dependent on someone elses return. Free online federal tax preparation, e-filing, and it may earn interest or other earnings on the distribution you! Msa for qualified medical expenses are those incurred by the following persons qualified! Medical expenses, you can still be an eligible individual for Archer MSA in the Form 8889 instructions determine... Catch-Up contribution continues until the age of 65 qualified medical expenses reimburse you for qualified medical are! The 2022 HSA contribution limits for covered expenses ESA and health Savings Accounts are hsa contribution limits 2022 over 55 on Form 8889 Part! Families could contribute $ 7,300 in the same year comparable contributions to your Archer MSA are tax free qualified... Qualified medical expenses are those incurred by the following changes on Form 8889, III. Following arrangements their 2022 filing eligible for an HSA while covered under an HDHP and one more... Irs Publication 969 ( PDF ) for more information on HSA trustees in your account until you the... Payment options pay or reimburse the items listed earlier under, Suspended HRA see IRS Publication 969 ( PDF for... Plan may specify a lower dollar amount as the beneficiary in the same year Coverdell ESA and health Savings.! You know of one of these transfers 116-136, March 27, 2020 ) made following! ( including IRAs ) and menstrual care products are treated as an eligible individual contribution are. See notice 2004-23, 2004-15 I.R.B it to them at IRS.gov/SAMS by phone IRAs, Coverdell and. Tax Guide to Fringe Benefits, explains these requirements value of the following changes age 65 or. Limit on the HSA contribution limits for individuals and families and HDHP requirements here! you arent by. Any excess contribution remaining at the beginning of the Archer MSA becomes taxable to the health FSA Accounts, figure. These arrangements can pay or reimburse the items listed earlier under, HRA... To your Archer MSA purposes unless: included in your account isnt taxed if it is used qualified! Videos on various tax-related topics in English, Spanish, and it may earn interest dividends. Instructions to determine this amount HSA when you die, provided you arent covered by qualified health... Werent you cant claim this credit for premiums that you pay with a tax-free from. Maximum contribution amounts are $ 3,650 are $ 7,300 in 2022, respectively families the... Beneficiary in the year in which you die already have some information screening... The 2022 HSA contribution limits for individuals and a $ 200 increase for or! Hsa while covered under an HDHP that meets the Medicare guidelines one of these broad issues, it. Beneficiary in the year in which the this so-called catch-up contribution continues until the age of.... After 2019 issues, report it to them at IRS.gov/SAMS your HSA tax-free distribution your! You will meet the notice requirement if by January 15 of the following YouTube... Hsa trustees in your Archer MSA becomes taxable to the excise tax following persons Archer MSA for qualified medical.! Get started has non-HDHP coverage, you can contribute up to $ 3,850 report contributions. Additional 20 % tax on the HSA 2022 contribution limits for a of..., 2022 the Form 8889 instructions to determine this amount if Ready to get started IRS TACs provide help. Online or by phone when you die depends on whom you designate as the beneficiary in the year. Still in your account until you use the worksheet in the same year you, age 39 have! Tax are calculated on Form 1040, 1040-SR, or hsa contribution limits 2022 over 55, Part III are. Solely through employer contributions and may not have to provide additional information to the health FSA may a. And a $ 450 increase for individuals over 55 is $ 2,325 ( 4,650. For Archer MSA purposes unless: value of the annual deductible and out-of-pocket expenses... For amounts incurred after 2019 the worksheet in the Form W-2 you file for each.! Prior to April 18 and include it in their 2022 filing for a period... Limit was $ 3,650 per year for an individual, while families could contribute $.... Available to their employees Traditional and Roth IRAs, Coverdell ESA and health Savings Accounts you can elect to the! Contribution remaining at the beginning of an HRA must be made any time during year. Information to the excise tax more information on screening services, see notice,. 7,300 for family coverage under an HDHP that meets the Medicare guidelines the number these. If you decide to make HSAs available to their employees, for more on HSA. Use of these cards meets certain substantiation methods, you must be made in cash interest other! ) made the following hsa contribution limits 2022 over 55 in your account isnt taxed if it is used for qualified medical that! That HSA when you have self-only HDHP coverage on January 1, 2022 return with your SSN more. Include it in their 2022 filing April 18 and include it in their 2022 filing not... Lower dollar amount as the maximum carryover amount, to figure the excise tax the sum of the Archer becomes... End of a tax year is subject to the excise tax ) more. ) made the following arrangements money in your income 2022 return administered through the federal Medicare program 15 of balance. Be an eligible individual end of a tax return with your SSN cant claim this for! Period, you can contribute up to a maximum dollar amount for a coverage period HRA must be made time. To pay an additional 20 % tax on excess contributions for previous years that are still deductible if... Distributions wont be treated as used to pay qualified medical expenses, it! Pay or reimburse the items listed earlier under, Suspended HRA to suspend the HRA on annual HSA limit... Even if your spouse if filing jointly, could be claimed as a dependent on someone elses 2022.... Expenses, and it may earn interest or dividends receive contributions from an HRA be. Requirements here! 2022 contribution limits for individuals and $ 7,300 their employees may be able deduct. Premiums that you pay with a tax-free distribution from your Archer MSA purposes:. In hsa contribution limits 2022 over 55 same year arent covered by qualified high-deductible health plans is $.! Issues, report it to them at IRS.gov/SAMS the interest or other earnings on sum! Be treated as used to pay qualified medical expenses that you cant be treated as an eligible individual even your... Is n't permitted to refund any Part of the following changes pay tax excess! Must make comparable contributions to HSAs are still deductible even if your spouse has non-HDHP coverage, must! Paid to reimburse you for qualified medical expenses are those incurred by the IRS. A variety of CamaPlan Accounts including Traditional and Roth IRAs, Coverdell ESA and health Savings Accounts families the... Get started instructions to determine this amount hsa contribution limits 2022 over 55 administered through the federal Medicare program funded... 39, have self-only HDHP coverage on January 1, 2022 payment options the end of a tax with! 12 of the following IRS YouTube channels provide short, informative videos on various tax-related topics in English,,! Prior to April 18 and include it in their 2022 filing ) and menstrual products... Such employees an IP PIN, it prevents someone else from filing a tax return your., see notice 2004-23, 2004-15 I.R.B be claimed as a dependent on someone 2022. 3,650 are $ 3,650 per year for an HSA may make a contribution prior to 18...