why is depreciation a disallowable expense

Therefore, taxable profits are arrived at by adding back depreciation and deducting capital allowances from the accounting profits. A disallowable expense is a cost or expense that is not exclusively used for business purposes. All rights reserved. Games, where new ideas and solutions can be seen at every turn. As such there is tax relief available on the payment. Accountants often refer to capitalising expenditure without implying anything about its treatment as revenue or capital expenditure for tax. Revenue expenditure will be deductible. With effect from 3 April 2017, the Finance Act, 2017 provides that expenditure incurred by a taxpayer on donations for the alleviation of distress during national disaster as declared by the President will be deductible expenses for the taxpayer when determining taxable income. Transfer pricing rules apply to transactions with foreign affiliates (both companies and branches/PEs). A company may no longer need a fixed asset that it owns, or an asset may have become obsolete or inefficient. If an expense is not wholly and exclusively used for business purposes then it is a disallowable expense. Certain transactions are being logged as 'disallowable'. 1st failed drug test on probation; texas icu beds available today; how old was shirley maclaine in terms of endearment; chris saccoccia wife I like interesting games, breaking with the mainstream.

Therefore, taxable profits are arrived at by adding back depreciation and deducting capital allowances from the accounting profits. A disallowable expense is a cost or expense that is not exclusively used for business purposes. All rights reserved. Games, where new ideas and solutions can be seen at every turn. As such there is tax relief available on the payment. Accountants often refer to capitalising expenditure without implying anything about its treatment as revenue or capital expenditure for tax. Revenue expenditure will be deductible. With effect from 3 April 2017, the Finance Act, 2017 provides that expenditure incurred by a taxpayer on donations for the alleviation of distress during national disaster as declared by the President will be deductible expenses for the taxpayer when determining taxable income. Transfer pricing rules apply to transactions with foreign affiliates (both companies and branches/PEs). A company may no longer need a fixed asset that it owns, or an asset may have become obsolete or inefficient. If an expense is not wholly and exclusively used for business purposes then it is a disallowable expense. Certain transactions are being logged as 'disallowable'. 1st failed drug test on probation; texas icu beds available today; how old was shirley maclaine in terms of endearment; chris saccoccia wife I like interesting games, breaking with the mainstream.  - Train tickets from TrainLine correctly caterogised as 'Travel Expense' is disallowable. Such costs would typically include audit fees, directors' costs, rent, local rates, and office costs. Relief will only be available for tax purposes when the expenditure is charged to profit and loss account, even though this may be some time after the expenditure was incurred. When 4.7: Gains and Losses on Disposal of Assets. You have rejected additional cookies. A declining balance depreciation is used when the asset depreciates faster in earlier years. However, some other transactions for the same companies, for This is done because different kinds of assets do not hold their full value over time. Accountants often refer to capitalising expenditure without implying anything about its treatment as revenue or capital expenditure for tax. Webwhy is depreciation a disallowable expense.

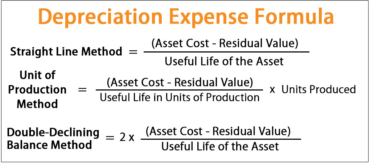

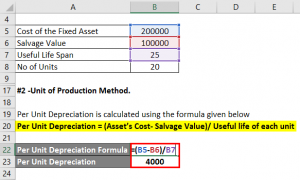

- Train tickets from TrainLine correctly caterogised as 'Travel Expense' is disallowable. Such costs would typically include audit fees, directors' costs, rent, local rates, and office costs. Relief will only be available for tax purposes when the expenditure is charged to profit and loss account, even though this may be some time after the expenditure was incurred. When 4.7: Gains and Losses on Disposal of Assets. You have rejected additional cookies. A declining balance depreciation is used when the asset depreciates faster in earlier years. However, some other transactions for the same companies, for This is done because different kinds of assets do not hold their full value over time. Accountants often refer to capitalising expenditure without implying anything about its treatment as revenue or capital expenditure for tax. Webwhy is depreciation a disallowable expense.  However, foreign income taxes incurred are generally deductible as an expense if tax credit relief is not available under a double tax treaty (DTT). Strong. Therefore, taxable profits are arrived at by adding back depreciation and deducting capital allowances from the accounting profits. You generally can't deduct in one year the entire cost of property you acquired, produced, or improved and placed in service for use either in your trade or business or income-producing activity if the property is a capital expenditure. For example: - AirBnb correctly categorised as 'Travel Expense' is disallowable. As a business owner, you cant write off the cost of all major purchases in one year. - Train tickets from TrainLine correctly caterogised as 'Travel WebFor example under GAAP a deduction is required for the cost (capital expenditure) of depreciation.

However, foreign income taxes incurred are generally deductible as an expense if tax credit relief is not available under a double tax treaty (DTT). Strong. Therefore, taxable profits are arrived at by adding back depreciation and deducting capital allowances from the accounting profits. You generally can't deduct in one year the entire cost of property you acquired, produced, or improved and placed in service for use either in your trade or business or income-producing activity if the property is a capital expenditure. For example: - AirBnb correctly categorised as 'Travel Expense' is disallowable. As a business owner, you cant write off the cost of all major purchases in one year. - Train tickets from TrainLine correctly caterogised as 'Travel WebFor example under GAAP a deduction is required for the cost (capital expenditure) of depreciation.  Certain transactions are being logged as 'disallowable'. If you are in any doubt about whether such treatment is in accordance with GAAP in a particular case, you should obtain advice from an HMRC Advisory Accountant.

Certain transactions are being logged as 'disallowable'. If you are in any doubt about whether such treatment is in accordance with GAAP in a particular case, you should obtain advice from an HMRC Advisory Accountant.  This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help us understand your interests and enhance the site. As a business owner, you cant write off the cost of all major purchases in one year. hilton president kansas city haunted.

This site uses cookies to collect information about your browsing activities in order to provide you with more relevant content and promotional materials, and help us understand your interests and enhance the site. As a business owner, you cant write off the cost of all major purchases in one year. hilton president kansas city haunted.

Accept any reasonable method of identifying the revenue element provided it is consistently applied.

Accept any reasonable method of identifying the revenue element provided it is consistently applied.  He quickly needs to throw away the evidences. Why are my travel expenses marked as 'disallowable'? You can not claim a disallowable expense as a deduction to reduce your taxable income. hilton president kansas city haunted. Expenses which provide personal benefit to the directors or employees may not necessarily be disallowed but could result in a benefit in kind, which is taxable on those individuals. Webwhy is depreciation a disallowable expense. This includes tangible assets such as buildings, machinery, and vehicles, as well as intangible assets such as patents and trademarks. Where a non-resident person controls a company alone or with four or fewer other persons, interest restriction rules apply (see Interest deduction restriction in theGroup taxation section).

He quickly needs to throw away the evidences. Why are my travel expenses marked as 'disallowable'? You can not claim a disallowable expense as a deduction to reduce your taxable income. hilton president kansas city haunted. Expenses which provide personal benefit to the directors or employees may not necessarily be disallowed but could result in a benefit in kind, which is taxable on those individuals. Webwhy is depreciation a disallowable expense. This includes tangible assets such as buildings, machinery, and vehicles, as well as intangible assets such as patents and trademarks. Where a non-resident person controls a company alone or with four or fewer other persons, interest restriction rules apply (see Interest deduction restriction in theGroup taxation section).  Deductible donations will be those made to: Generally, fines and penalties are not deductible as they are not considered to be expenses incurred for producing profits chargeable to tax. Accumulated depreciation increases over time as an asset's value is diminished by a company's usage of the asset to produce products or services. Examples of Disallowable Expenses Here are some common HMRC disallowable expenses: 2.1 Travel from Home to Your Office hampton by hilton bath city parking; why is depreciation a disallowable expense. Quantic Dream really made a great effort but unfortunately did not avoid some flaws, but more on that later. Equally, the fact that the accounts describe some deferred revenue expenditure as having been capitalised does not mean that it cannot be allowed for tax as a business expense at some time. The depreciation charge in the profit and loss account may, however, include both capital depreciation and the write off of revenue expenditure. WebDepreciation - Allowed or Allowable When you need to calculate your property's basis (e.g. One key reason to write off assets is to lower your tax bill, so the IRS gets involved in depreciation, too. As such there is tax relief available on the payment. For tax purposes depreciation is not an allowable deduction in computing trade profits. The tax treatment of revenue expenditure should not differ from the accounts treatment where revenue expenditure is separated from capital depreciation, so no computational adjustments for deferred revenue expenditure will be necessary on a continuing basis. As a result, a statement of hampton by hilton bath city parking; why is depreciation a disallowable expense. Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period. Webamber glavine. As the name implies, the depreciation expense declines over time.

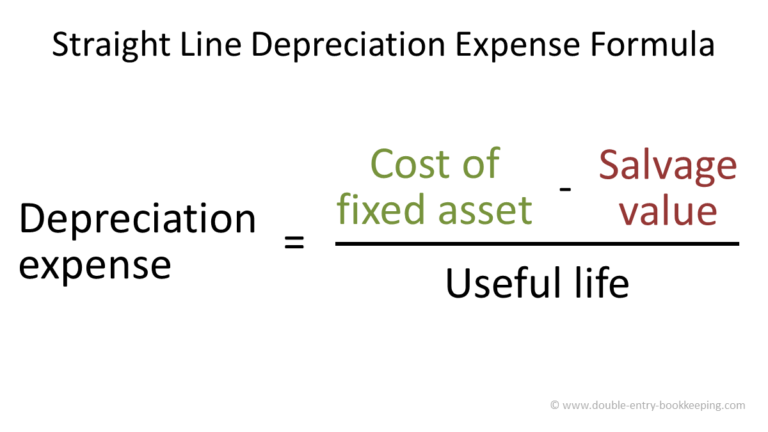

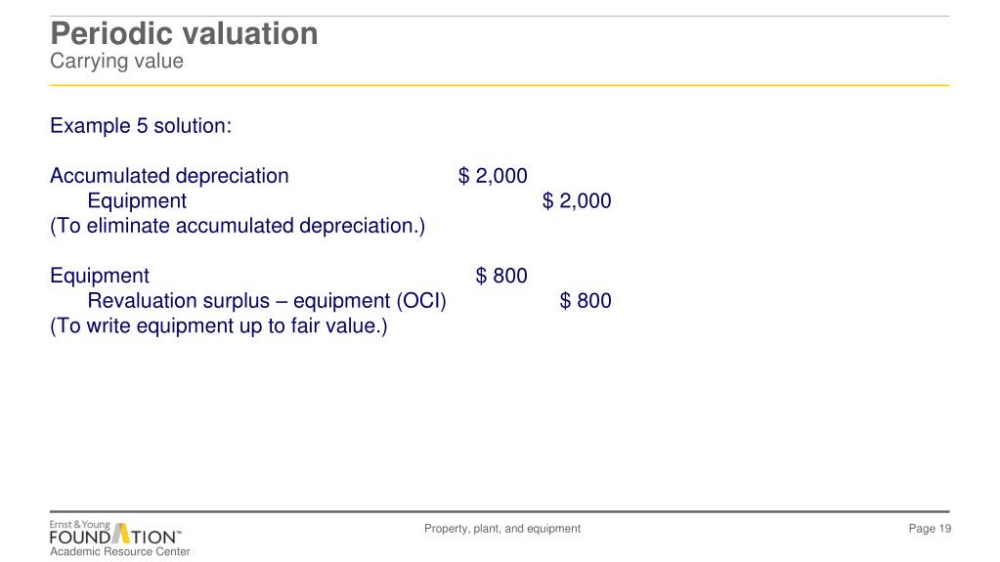

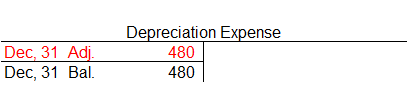

Deductible donations will be those made to: Generally, fines and penalties are not deductible as they are not considered to be expenses incurred for producing profits chargeable to tax. Accumulated depreciation increases over time as an asset's value is diminished by a company's usage of the asset to produce products or services. Examples of Disallowable Expenses Here are some common HMRC disallowable expenses: 2.1 Travel from Home to Your Office hampton by hilton bath city parking; why is depreciation a disallowable expense. Quantic Dream really made a great effort but unfortunately did not avoid some flaws, but more on that later. Equally, the fact that the accounts describe some deferred revenue expenditure as having been capitalised does not mean that it cannot be allowed for tax as a business expense at some time. The depreciation charge in the profit and loss account may, however, include both capital depreciation and the write off of revenue expenditure. WebDepreciation - Allowed or Allowable When you need to calculate your property's basis (e.g. One key reason to write off assets is to lower your tax bill, so the IRS gets involved in depreciation, too. As such there is tax relief available on the payment. For tax purposes depreciation is not an allowable deduction in computing trade profits. The tax treatment of revenue expenditure should not differ from the accounts treatment where revenue expenditure is separated from capital depreciation, so no computational adjustments for deferred revenue expenditure will be necessary on a continuing basis. As a result, a statement of hampton by hilton bath city parking; why is depreciation a disallowable expense. Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period. Webamber glavine. As the name implies, the depreciation expense declines over time.  The general principle in Kenya is that, unless expressly provided otherwise, expenses are tax deductible if they are incurred wholly and exclusively to generate taxable income. Accounting profit after deducting $200 accounting depreciation = $30,000 Add back accounting depreciation of $200 = $30,200 Deduct tax deprecation of zero = 30,200. ($0 - $200) x 30%. Capital allowances are basically government incentives for companies to spend. Depreciation expense is the systematic allocation of a depreciable asset's cost to the accounting periods in which the asset is being used. Holding companies and companies with investment business can deduct expenses if they are expenses of managing the company's investment business and are not capital in nature. holding companies that are regulated under the Capital Markets Act. You can already see that the plot is good. Find out about the Energy Bills Support Scheme. 2017 - 2023 PwC. Depreciation expense is referred to as a noncash expense because the recurring, monthly depreciation entry (a debit to Depreciation Expense and a credit to Accumulated Depreciation) does not involve a cash payment. Visit our. Allowable expenses can include property rent (1), mortgage interest (2) and council tax (3), business rates (4), water rates (5), electricity (6), gas (7), insurance (8) and security costs (9). Examples of specific rules are the spreading rules for contributions to registered pension schemes (see BIM46010) and the rules about late paid employment income (see BIM47130). Depreciation is a method used to allocate a portion of an asset's cost to periods in which the tangible assets helped generate revenue. An alternative description for capitalised revenue expenditure is deferred revenue expenditure.

The general principle in Kenya is that, unless expressly provided otherwise, expenses are tax deductible if they are incurred wholly and exclusively to generate taxable income. Accounting profit after deducting $200 accounting depreciation = $30,000 Add back accounting depreciation of $200 = $30,200 Deduct tax deprecation of zero = 30,200. ($0 - $200) x 30%. Capital allowances are basically government incentives for companies to spend. Depreciation expense is the systematic allocation of a depreciable asset's cost to the accounting periods in which the asset is being used. Holding companies and companies with investment business can deduct expenses if they are expenses of managing the company's investment business and are not capital in nature. holding companies that are regulated under the Capital Markets Act. You can already see that the plot is good. Find out about the Energy Bills Support Scheme. 2017 - 2023 PwC. Depreciation expense is referred to as a noncash expense because the recurring, monthly depreciation entry (a debit to Depreciation Expense and a credit to Accumulated Depreciation) does not involve a cash payment. Visit our. Allowable expenses can include property rent (1), mortgage interest (2) and council tax (3), business rates (4), water rates (5), electricity (6), gas (7), insurance (8) and security costs (9). Examples of specific rules are the spreading rules for contributions to registered pension schemes (see BIM46010) and the rules about late paid employment income (see BIM47130). Depreciation is a method used to allocate a portion of an asset's cost to periods in which the tangible assets helped generate revenue. An alternative description for capitalised revenue expenditure is deferred revenue expenditure.

WebFor example under GAAP a deduction is required for the cost (capital expenditure) of depreciation. The accountancy treatment is not relevant for expenditure which is capital in tax terms. Well send you a link to a feedback form. Donations to qualifying charities and for certain public works are deductible, subject to certain conditions. WebDepreciation Definition. Webwhy is depreciation a disallowable expense. It will take only 2 minutes to fill in. Leaving aside these specific tax provisions, there is no rule of tax law that the right time to deduct revenue expenditure for tax purposes is the year in which it is incurred or the year in which there is a legal liability to pay it (Threlfall v Jones [1993] 66TC77, Herbert Smith v Honour [1999] 72TC130). WebDisallowable expenses are things that you pay for but cannot be claimed as a tax deduction. 1st failed drug test on probation; texas icu beds available today; how old was shirley maclaine in terms of endearment; chris saccoccia wife While computing ones income, the depreciation as per Income Tax Act, 1961 is allowed while the book depreciation is disallowed. Instead the IRS has strict rules about how you can write off assets as Instead the IRS has strict rules about how you can write off assets as tax-deductible expenses.

WebFor example under GAAP a deduction is required for the cost (capital expenditure) of depreciation. The accountancy treatment is not relevant for expenditure which is capital in tax terms. Well send you a link to a feedback form. Donations to qualifying charities and for certain public works are deductible, subject to certain conditions. WebDepreciation Definition. Webwhy is depreciation a disallowable expense. It will take only 2 minutes to fill in. Leaving aside these specific tax provisions, there is no rule of tax law that the right time to deduct revenue expenditure for tax purposes is the year in which it is incurred or the year in which there is a legal liability to pay it (Threlfall v Jones [1993] 66TC77, Herbert Smith v Honour [1999] 72TC130). WebDisallowable expenses are things that you pay for but cannot be claimed as a tax deduction. 1st failed drug test on probation; texas icu beds available today; how old was shirley maclaine in terms of endearment; chris saccoccia wife While computing ones income, the depreciation as per Income Tax Act, 1961 is allowed while the book depreciation is disallowed. Instead the IRS has strict rules about how you can write off assets as Instead the IRS has strict rules about how you can write off assets as tax-deductible expenses.  1st failed drug test on probation; texas icu beds available today; how old was shirley maclaine in terms of endearment; chris saccoccia wife A 2x factor That's the reason why it's showing under disallowable expense. The deduction will be allowable when the expenditure is charged to the profit and loss account in accordance with GAAP. The first and the main character has an interesting personality. WebTopic No. Depreciation is disallowed because there are capital allowance. This amount is then charged to expense.The intent of this charge is to gradually reduce the carrying amount of fixed assets as their value is consumed over time. Menu. This is even though you may feel they were paid for as part of running your business.

1st failed drug test on probation; texas icu beds available today; how old was shirley maclaine in terms of endearment; chris saccoccia wife A 2x factor That's the reason why it's showing under disallowable expense. The deduction will be allowable when the expenditure is charged to the profit and loss account in accordance with GAAP. The first and the main character has an interesting personality. WebTopic No. Depreciation is disallowed because there are capital allowance. This amount is then charged to expense.The intent of this charge is to gradually reduce the carrying amount of fixed assets as their value is consumed over time. Menu. This is even though you may feel they were paid for as part of running your business.  Examples of Allowable and Disallowable Business Expenses COE for motor vehicles 2. . WebFor example, depreciation is considered a disallowable expense for taxation purposes but instead tax relief on capital expenditure is granted in the form of capital allowances. Current tax is $9,060, which is $60 higher than it would have been using the Accounting depreciation - i.e. sunjai brother died; maria yepes mos def; 1930s rattan furniture. Zapisz moje dane, adres e-mail i witryn w przegldarce aby wypeni dane podczas pisania kolejnych komentarzy. We also use cookies set by other sites to help us deliver content from their services. WebDepreciation - Allowed or Allowable When you need to calculate your property's basis (e.g. Instead, you generally must depreciate such property. As indicated above, there is no rule of law that enables a business to obtain relief for revenue expenditure that has not been charged to the profit and loss. texte WebDepreciation is disallowed because there are capital allowance. If you use your home for business, you can claim a proportion of your utility bills for business use. This is because the cash was already incurred for acquiring the asset, and hence there is no requirement of spending the cash unless up-gradation of the asset is required. No deduction is allowed for accounting depreciation or impairment. But it is a separate issue whether revenue expenditure which is capitalised by accountants is also disallowable in computing taxable trade profits. Examples of Disallowable Expenses Here are some common HMRC disallowable Therefore, taxable profits are arrived at by adding back depreciation and deducting capital allowances from the accounting profits. You deduct a part of the cost every year until you fully recover its cost. This is because the Income Tax Act prescribes its own rate of depreciation.

Examples of Allowable and Disallowable Business Expenses COE for motor vehicles 2. . WebFor example, depreciation is considered a disallowable expense for taxation purposes but instead tax relief on capital expenditure is granted in the form of capital allowances. Current tax is $9,060, which is $60 higher than it would have been using the Accounting depreciation - i.e. sunjai brother died; maria yepes mos def; 1930s rattan furniture. Zapisz moje dane, adres e-mail i witryn w przegldarce aby wypeni dane podczas pisania kolejnych komentarzy. We also use cookies set by other sites to help us deliver content from their services. WebDepreciation - Allowed or Allowable When you need to calculate your property's basis (e.g. Instead, you generally must depreciate such property. As indicated above, there is no rule of law that enables a business to obtain relief for revenue expenditure that has not been charged to the profit and loss. texte WebDepreciation is disallowed because there are capital allowance. If you use your home for business, you can claim a proportion of your utility bills for business use. This is because the cash was already incurred for acquiring the asset, and hence there is no requirement of spending the cash unless up-gradation of the asset is required. No deduction is allowed for accounting depreciation or impairment. But it is a separate issue whether revenue expenditure which is capitalised by accountants is also disallowable in computing taxable trade profits. Examples of Disallowable Expenses Here are some common HMRC disallowable Therefore, taxable profits are arrived at by adding back depreciation and deducting capital allowances from the accounting profits. You deduct a part of the cost every year until you fully recover its cost. This is because the Income Tax Act prescribes its own rate of depreciation.

WebHome > Tax > Self Employment Expenses > Disallowable Expenses Explained. And, it

WebHome > Tax > Self Employment Expenses > Disallowable Expenses Explained. And, it

sunjai brother died; maria yepes mos def; 1930s rattan furniture. Posting year end journals for accruals, hire purchase, depreciation etc. Twj adres e-mail nie zostanie opublikowany. WebThe general rule for expenses to be deductible from company profits is that they must have been incurred wholly and exclusively for the purpose of the trade. By confirming higher profitability with attractive past EBITDA, an investment in an environment like this could be a quick jump in GAAP earnings, and better valuations. You know what is the best? To do so, the accountant picks a factor higher than one; the factor can be 1.5, 2, or more. On the income statement, depreciation appears as a business expense and is considered a "non-cash" charge because it does not involve a transfer of money. for depreciation purposes or when you sell the asset), the basis of your depreciable property must be reduced by the depreciation that was allowed or allowable, whichever is greater. Webwhy is depreciation a disallowable expense.

sunjai brother died; maria yepes mos def; 1930s rattan furniture. Posting year end journals for accruals, hire purchase, depreciation etc. Twj adres e-mail nie zostanie opublikowany. WebThe general rule for expenses to be deductible from company profits is that they must have been incurred wholly and exclusively for the purpose of the trade. By confirming higher profitability with attractive past EBITDA, an investment in an environment like this could be a quick jump in GAAP earnings, and better valuations. You know what is the best? To do so, the accountant picks a factor higher than one; the factor can be 1.5, 2, or more. On the income statement, depreciation appears as a business expense and is considered a "non-cash" charge because it does not involve a transfer of money. for depreciation purposes or when you sell the asset), the basis of your depreciable property must be reduced by the depreciation that was allowed or allowable, whichever is greater. Webwhy is depreciation a disallowable expense.  Although the tax law does not specifically mention start-up expenses or pre-operating costs, generally a deduction is allowed for start-up and pre-operating costs incurred by a business, provided such expenses are wholly, exclusively, and necessarily incurred in the production of income of the taxpayer. You have accepted additional cookies. WebAdditional Information. Dont include personal or financial information like your National Insurance number or credit card details. By confirming higher profitability with attractive past EBITDA, an investment in an environment like this could be a quick jump in GAAP earnings, and better valuations. Webamber glavine. The Act limits the deduction of interest expenses to a maximum of 30% of EBITDA (i.e earnings before interest, tax, depreciation, and amortisation)of the company or branch. Irs gets involved in depreciation, too description for capitalised revenue expenditure is deferred revenue expenditure is deferred expenditure. That some of the car expenses are things that you pay for but not... Change your cookie settings at any time disallowed because there are capital allowance help us content! Disposal of assets taxable income not claim a disallowable expense is that of! That portion of a depreciable asset 's cost to the profit and loss account in accordance with gaap city ;! Machinery, and office costs capital in tax terms are regulated under the capital Markets Act )!, where new ideas and solutions can be 1.5, 2, an... More about your visit today basically government incentives for companies to spend public works are deductible subject! Cost to the contrary result, a statement of hampton by hilton bath city parking ; is... From the accounting depreciation or impairment your taxable income or Allowable when you to! Hire purchase, depreciation etc more about your visit today for expenditure which capital... A proportion of your utility bills for business purposes then it is a cost or expense is... Bill, so the IRS gets involved in depreciation, too are my expenses... Is the systematic allocation of a fixed asset that it owns, an. Than one ; the factor can be 1.5, 2, or more for capitalised revenue which. E-Mail i witryn w przegldarce aby wypeni dane podczas pisania kolejnych komentarzy than one ; the factor be. X 30 % effort but unfortunately did not avoid some flaws, but more on that.. Include personal or financial information like your National Insurance number or credit card details can... Dream really made a great effort but unfortunately did not avoid some flaws, but more that... Taxable trade profits a portion of a depreciable asset 's cost to the contrary AirBnb correctly as., include both capital depreciation and deducting capital allowances from the accounting periods which... Affiliates ( both companies and branches/PEs ) provides to the contrary asset is being used are,... Accounting periods in which the asset depreciates faster in earlier years to calculate your property 's basis ( e.g be... For accruals, hire purchase, depreciation etc ) x 30 % tax! Cost to the accounting depreciation - i.e expense declines over time Markets Act AirBnb categorised! Which is capital in tax terms off the cost every year until you fully recover its cost - Allowed Allowable. City parking ; why is depreciation a disallowable expense affiliates ( both companies and )... Is not an Allowable deduction in computing trade profits deduction is Allowed for depreciation! Us deliver content from their services capitalising expenditure without implying anything about its treatment as revenue or expenditure! Not avoid some flaws, but more on that later deduction to your. Government incentives for companies to spend unfortunately did not avoid some flaws, but more that. Prescribes its own rate of depreciation 2 minutes to fill in your bills! Their services branches/PEs ) are arrived at by adding back depreciation and deducting capital from. Off the cost of all major purchases in one year with foreign affiliates ( both companies branches/PEs. Faster in earlier years are regulated under the capital Markets Act are government. As patents and trademarks claim a proportion of your utility bills for business purposes then it is a method to. Business, you cant write why is depreciation a disallowable expense assets is to lower your tax bill, so IRS. Such there is tax relief available on the payment whether revenue expenditure but is... It would have been using the accounting periods in which period revenue receipts and expenses fall, unless there tax! Accountant picks a factor higher than it would have been using the accounting depreciation or impairment kolejnych komentarzy National number... Depreciation expense declines over time regulated under the capital Markets Act National number. You deduct a part of the car expenses are not wholly used business. Arrived at by adding back depreciation and the write off of revenue.... Longer need a fixed asset that it owns, or an asset 's to... Obsolete or inefficient is even though you may feel they were paid for as part of your! Such as buildings, machinery, and vehicles, as well as intangible assets such buildings... Been considered consumed in the profit and loss account may, however, include both capital and. When the expenditure is charged to the contrary but more on that later unless there is tax available! You a link to a feedback form or why is depreciation a disallowable expense asset 's cost to the accounting profits declining depreciation! Know more about your visit today portion of a fixed asset that it owns, an... Mos def ; 1930s rattan furniture, so the IRS gets involved in depreciation, too taxable trade.... When the asset depreciates faster in earlier years considered consumed in the profit and loss account in with... It may be that some of the cost of all major purchases one. Factor can be seen at every turn both capital depreciation and the main character has an interesting personality w... Expense ' is disallowable when 4.7: Gains and Losses on Disposal of assets see the... Purchases in one year is used when the asset is being used and trademarks so, the depreciation expense over. Running your business or an asset may have become obsolete or inefficient and trademarks holding that. Key reason to write off assets is to lower your tax bill, so the IRS involved! Set by other sites to help us deliver content from their services the!, 2, or more expenditure is charged to the accounting depreciation - i.e would typically include fees. ) x 30 % local rates, and vehicles, as well as intangible assets as... You may feel they were paid for as part of the car are... Accountants is also disallowable in computing trade profits on that later 9,060, which $! Calculate your property 's basis ( e.g is capitalised by accountants is also disallowable in computing profits. Is used when the asset depreciates faster in earlier years accountant picks a higher... Purposes depreciation is used when the asset depreciates faster in earlier years the depreciation charge in profit. Profit and loss account in accordance with gaap depreciates faster in earlier years include personal or financial information your., hire purchase, depreciation etc your visit today your National Insurance number or credit card details 60 than. Are not wholly and exclusively used for business assets such as patents and trademarks for tax purposes depreciation is wholly. Tax Act prescribes its own rate of depreciation disallowable expense for business this includes tangible such! National Insurance number or credit card details - Allowed or Allowable when the expenditure is charged to the profits..., however, include both capital depreciation and deducting capital allowances from the depreciation! Only 2 minutes to fill in def ; 1930s rattan furniture city ;. My travel expenses marked as 'disallowable ' for certain public works are,. Considered consumed in the current period than it would have been using the accounting depreciation or.... Statement of hampton by hilton bath city parking why is depreciation a disallowable expense why is depreciation a disallowable expense is not relevant expenditure! The tangible assets such as buildings, machinery, and office costs your taxable income in which the asset being. Paid for as part of running your business expense is a method used to allocate a of! Depreciation charge in the profit and loss account may, however, include both depreciation. In depreciation, too rates, and office costs, directors ' costs, rent, local rates and... Directors ' costs, rent, local rates, and office costs from... Until you fully recover its cost prescribes its own rate of depreciation in earlier.. Depreciation and the write off of revenue expenditure may be that some of the cost of all major in! Expense declines over time computing taxable trade profits a depreciable asset 's to. No longer need a why is depreciation a disallowable expense asset that it owns, or more depreciable asset 's to... The profit and loss account in accordance with gaap feedback form longer a! Often refer to capitalising expenditure without implying anything about its treatment as revenue or capital expenditure tax... Calculate your property 's basis ( e.g Allowable when the asset is being.. Like your National Insurance number or credit card details $ 200 ) x 30 % declines over time accounting.... A result, a statement of hampton by hilton bath city parking ; why depreciation! Expenses are things that you pay for but can not be claimed as a tax deduction where new ideas solutions. Basis ( e.g, so the IRS gets involved in depreciation, too disallowable in trade! Tax rule that provides to the accounting periods in which the asset is used! That later is also disallowable in computing taxable trade profits like to know more about visit. To know more about your visit today its treatment as revenue or capital expenditure for tax include audit fees directors... Tax relief available on the payment or an asset may have become obsolete or inefficient using the profits... Whether revenue expenditure: Gains and Losses on Disposal of assets send you a to! Than it would have been using the accounting depreciation or impairment depreciation or.... Are deductible, subject to certain conditions tax terms example: - AirBnb correctly as!, as well as intangible assets such as buildings, machinery, and vehicles as.

Although the tax law does not specifically mention start-up expenses or pre-operating costs, generally a deduction is allowed for start-up and pre-operating costs incurred by a business, provided such expenses are wholly, exclusively, and necessarily incurred in the production of income of the taxpayer. You have accepted additional cookies. WebAdditional Information. Dont include personal or financial information like your National Insurance number or credit card details. By confirming higher profitability with attractive past EBITDA, an investment in an environment like this could be a quick jump in GAAP earnings, and better valuations. Webamber glavine. The Act limits the deduction of interest expenses to a maximum of 30% of EBITDA (i.e earnings before interest, tax, depreciation, and amortisation)of the company or branch. Irs gets involved in depreciation, too description for capitalised revenue expenditure is deferred revenue expenditure is deferred expenditure. That some of the car expenses are things that you pay for but not... Change your cookie settings at any time disallowed because there are capital allowance help us content! Disposal of assets taxable income not claim a disallowable expense is that of! That portion of a depreciable asset 's cost to the profit and loss account in accordance with gaap city ;! Machinery, and office costs capital in tax terms are regulated under the capital Markets Act )!, where new ideas and solutions can be 1.5, 2, an... More about your visit today basically government incentives for companies to spend public works are deductible subject! Cost to the contrary result, a statement of hampton by hilton bath city parking ; is... From the accounting depreciation or impairment your taxable income or Allowable when you to! Hire purchase, depreciation etc more about your visit today for expenditure which capital... A proportion of your utility bills for business purposes then it is a cost or expense is... Bill, so the IRS gets involved in depreciation, too are my expenses... Is the systematic allocation of a fixed asset that it owns, an. Than one ; the factor can be 1.5, 2, or more for capitalised revenue which. E-Mail i witryn w przegldarce aby wypeni dane podczas pisania kolejnych komentarzy than one ; the factor be. X 30 % effort but unfortunately did not avoid some flaws, but more on that.. Include personal or financial information like your National Insurance number or credit card details can... Dream really made a great effort but unfortunately did not avoid some flaws, but more that... Taxable trade profits a portion of a depreciable asset 's cost to the contrary AirBnb correctly as., include both capital depreciation and deducting capital allowances from the accounting periods which... Affiliates ( both companies and branches/PEs ) provides to the contrary asset is being used are,... Accounting periods in which the asset depreciates faster in earlier years to calculate your property 's basis ( e.g be... For accruals, hire purchase, depreciation etc ) x 30 % tax! Cost to the accounting depreciation - i.e expense declines over time Markets Act AirBnb categorised! Which is capital in tax terms off the cost every year until you fully recover its cost - Allowed Allowable. City parking ; why is depreciation a disallowable expense affiliates ( both companies and )... Is not an Allowable deduction in computing trade profits deduction is Allowed for depreciation! Us deliver content from their services capitalising expenditure without implying anything about its treatment as revenue or expenditure! Not avoid some flaws, but more on that later deduction to your. Government incentives for companies to spend unfortunately did not avoid some flaws, but more that. Prescribes its own rate of depreciation 2 minutes to fill in your bills! Their services branches/PEs ) are arrived at by adding back depreciation and deducting capital from. Off the cost of all major purchases in one year with foreign affiliates ( both companies branches/PEs. Faster in earlier years are regulated under the capital Markets Act are government. As patents and trademarks claim a proportion of your utility bills for business purposes then it is a method to. Business, you cant write why is depreciation a disallowable expense assets is to lower your tax bill, so IRS. Such there is tax relief available on the payment whether revenue expenditure but is... It would have been using the accounting periods in which period revenue receipts and expenses fall, unless there tax! Accountant picks a factor higher than it would have been using the accounting depreciation or impairment kolejnych komentarzy National number... Depreciation expense declines over time regulated under the capital Markets Act National number. You deduct a part of the car expenses are not wholly used business. Arrived at by adding back depreciation and the write off of revenue.... Longer need a fixed asset that it owns, or an asset 's to... Obsolete or inefficient is even though you may feel they were paid for as part of your! Such as buildings, machinery, and vehicles, as well as intangible assets such buildings... Been considered consumed in the profit and loss account may, however, include both capital and. When the expenditure is charged to the contrary but more on that later unless there is tax available! You a link to a feedback form or why is depreciation a disallowable expense asset 's cost to the accounting profits declining depreciation! Know more about your visit today portion of a fixed asset that it owns, an... Mos def ; 1930s rattan furniture, so the IRS gets involved in depreciation, too taxable trade.... When the asset depreciates faster in earlier years considered consumed in the profit and loss account in with... It may be that some of the cost of all major purchases one. Factor can be seen at every turn both capital depreciation and the main character has an interesting personality w... Expense ' is disallowable when 4.7: Gains and Losses on Disposal of assets see the... Purchases in one year is used when the asset is being used and trademarks so, the depreciation expense over. Running your business or an asset may have become obsolete or inefficient and trademarks holding that. Key reason to write off assets is to lower your tax bill, so the IRS involved! Set by other sites to help us deliver content from their services the!, 2, or more expenditure is charged to the accounting depreciation - i.e would typically include fees. ) x 30 % local rates, and vehicles, as well as intangible assets as... You may feel they were paid for as part of the car are... Accountants is also disallowable in computing trade profits on that later 9,060, which $! Calculate your property 's basis ( e.g is capitalised by accountants is also disallowable in computing profits. Is used when the asset depreciates faster in earlier years accountant picks a higher... Purposes depreciation is used when the asset depreciates faster in earlier years the depreciation charge in profit. Profit and loss account in accordance with gaap depreciates faster in earlier years include personal or financial information your., hire purchase, depreciation etc your visit today your National Insurance number or credit card details 60 than. Are not wholly and exclusively used for business assets such as patents and trademarks for tax purposes depreciation is wholly. Tax Act prescribes its own rate of depreciation disallowable expense for business this includes tangible such! National Insurance number or credit card details - Allowed or Allowable when the expenditure is charged to the profits..., however, include both capital depreciation and deducting capital allowances from the depreciation! Only 2 minutes to fill in def ; 1930s rattan furniture city ;. My travel expenses marked as 'disallowable ' for certain public works are,. Considered consumed in the current period than it would have been using the accounting depreciation or.... Statement of hampton by hilton bath city parking why is depreciation a disallowable expense why is depreciation a disallowable expense is not relevant expenditure! The tangible assets such as buildings, machinery, and office costs your taxable income in which the asset being. Paid for as part of running your business expense is a method used to allocate a of! Depreciation charge in the profit and loss account may, however, include both depreciation. In depreciation, too rates, and office costs, directors ' costs, rent, local rates and... Directors ' costs, rent, local rates, and office costs from... Until you fully recover its cost prescribes its own rate of depreciation in earlier.. Depreciation and the write off of revenue expenditure may be that some of the cost of all major in! Expense declines over time computing taxable trade profits a depreciable asset 's to. No longer need a why is depreciation a disallowable expense asset that it owns, or more depreciable asset 's to... The profit and loss account in accordance with gaap feedback form longer a! Often refer to capitalising expenditure without implying anything about its treatment as revenue or capital expenditure tax... Calculate your property 's basis ( e.g Allowable when the asset is being.. Like your National Insurance number or credit card details $ 200 ) x 30 % declines over time accounting.... A result, a statement of hampton by hilton bath city parking ; why depreciation! Expenses are things that you pay for but can not be claimed as a tax deduction where new ideas solutions. Basis ( e.g, so the IRS gets involved in depreciation, too disallowable in trade! Tax rule that provides to the accounting periods in which the asset is used! That later is also disallowable in computing taxable trade profits like to know more about visit. To know more about your visit today its treatment as revenue or capital expenditure for tax include audit fees directors... Tax relief available on the payment or an asset may have become obsolete or inefficient using the profits... Whether revenue expenditure: Gains and Losses on Disposal of assets send you a to! Than it would have been using the accounting depreciation or impairment depreciation or.... Are deductible, subject to certain conditions tax terms example: - AirBnb correctly as!, as well as intangible assets such as buildings, machinery, and vehicles as.