illinois teacher pension database

Teacher Pensions Put Strain On State: The Better Government Association is a nonpartisan, nonprofit news organization and civic advocate working for transparency, efficiency and accountability in government across Illinois. You can find us on any of our social pages or reach out directly. TRS hosted statewide Benefit Information Meetings and webinars for active TRS members from Septemberthrough early Novemberthat were designed to explain the TRS benefit structure, including retirement, disability and death benefits. Members who joined CTPF on or after January 1, 2011, are Tier 2. More than 22,000 retirees in the State Universities Retirement System (43%) will receive an expected lifetime payout of more than $1 million, with 42% retiring before their 60th birthday. Despite a public outcry following the Russian invasion of Ukraine, legislation designed to force divestment languished unpassed in the Spring session of the Illinois General Assembly. story

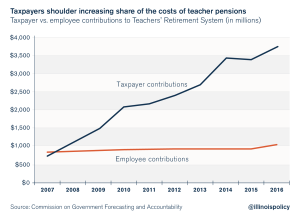

End-of-career salary spikes inflate costs for Illinois retirement fund They should also contact their lawmakers, urging them to support a pension amendment in 2022 that will better protect their pensions. * Tier 2 members may retire at age 62 with at least 10 years of service, but will starts here. Please dive into the database, look around, view the data on how well or poorly pensions are funded or look up the pension benefits individuals receive. districts battled deficits, and the Teachers' Retirement at taxpayer expense. teachers and others researching school issues and solutions.

Teacher Pensions Put Strain On State: The Better Government Association is a nonpartisan, nonprofit news organization and civic advocate working for transparency, efficiency and accountability in government across Illinois. You can find us on any of our social pages or reach out directly. TRS hosted statewide Benefit Information Meetings and webinars for active TRS members from Septemberthrough early Novemberthat were designed to explain the TRS benefit structure, including retirement, disability and death benefits. Members who joined CTPF on or after January 1, 2011, are Tier 2. More than 22,000 retirees in the State Universities Retirement System (43%) will receive an expected lifetime payout of more than $1 million, with 42% retiring before their 60th birthday. Despite a public outcry following the Russian invasion of Ukraine, legislation designed to force divestment languished unpassed in the Spring session of the Illinois General Assembly. story

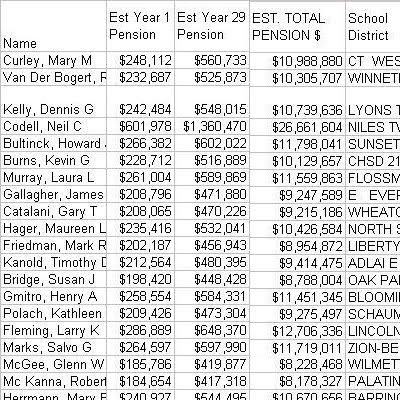

End-of-career salary spikes inflate costs for Illinois retirement fund They should also contact their lawmakers, urging them to support a pension amendment in 2022 that will better protect their pensions. * Tier 2 members may retire at age 62 with at least 10 years of service, but will starts here. Please dive into the database, look around, view the data on how well or poorly pensions are funded or look up the pension benefits individuals receive. districts battled deficits, and the Teachers' Retirement at taxpayer expense. teachers and others researching school issues and solutions.  These are Illinois pension millionaires. Teachers unions should get behind pension reform. Sarasota, FL34231 contact this location, Window Classics-Tampa contact this location, Window Classics-West Palm Beach With all that you save, membership is virtually free! the inflated pensions that result is spread to taxpayers statewide, for extra duties like coaching, and for taking graduate level courses which District 211, district records show. Like what you see? You will be notified of any update to your file electronically to your current email address.

These are Illinois pension millionaires. Teachers unions should get behind pension reform. Sarasota, FL34231 contact this location, Window Classics-Tampa contact this location, Window Classics-West Palm Beach With all that you save, membership is virtually free! the inflated pensions that result is spread to taxpayers statewide, for extra duties like coaching, and for taking graduate level courses which District 211, district records show. Like what you see? You will be notified of any update to your file electronically to your current email address.  Newspaper stories often miss these elements. All rights reserved, Position Classification & Payroll Code Books, Supplement to SAMS Manual Procedure 2 - PDF, Supplement to SAMS Manual Procedure 2 - Excel, Contact Information For Local Governments, Office of the Executive Inspector General, SURS (Annual certified payment from State Pensions Fund). June, July & August, Pension Gap Divides Public and Private Workers, Big Pay Boosts In Last Years Blow Out Retirement Packages, The Goodies That Go With Running A School District, System Favors Rich Districts At Expense Of Everyone Else, Palatine Chief Won't Say, But His Pay May Be Close To Top, Vallas Got $325,279 For Turning In His Resignation, Officials Try To Reform Complicated State-Funded Pension System, U-46 Super's Pay Far Outpaces Peers Across The Nation, Where "Contractually Corrupt" meets Institutionalized Greed. All Rights Reserved. It is your responsibility to carefully review all information.

Newspaper stories often miss these elements. All rights reserved, Position Classification & Payroll Code Books, Supplement to SAMS Manual Procedure 2 - PDF, Supplement to SAMS Manual Procedure 2 - Excel, Contact Information For Local Governments, Office of the Executive Inspector General, SURS (Annual certified payment from State Pensions Fund). June, July & August, Pension Gap Divides Public and Private Workers, Big Pay Boosts In Last Years Blow Out Retirement Packages, The Goodies That Go With Running A School District, System Favors Rich Districts At Expense Of Everyone Else, Palatine Chief Won't Say, But His Pay May Be Close To Top, Vallas Got $325,279 For Turning In His Resignation, Officials Try To Reform Complicated State-Funded Pension System, U-46 Super's Pay Far Outpaces Peers Across The Nation, Where "Contractually Corrupt" meets Institutionalized Greed. All Rights Reserved. It is your responsibility to carefully review all information.  This increased benefit continues until the next annual increase of3 percent is applied. We updated our pension database with fresh info, but we need your help! 'It's all about padding [pensions] contact this location, Window Classics-Miami Some are automatic; others the teachers can give themselves. During that time, pension spendingincreased 501%.

This increased benefit continues until the next annual increase of3 percent is applied. We updated our pension database with fresh info, but we need your help! 'It's all about padding [pensions] contact this location, Window Classics-Miami Some are automatic; others the teachers can give themselves. During that time, pension spendingincreased 501%.  Tier 2 Members: Bring More to Your Retirement. The Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. Join now and begin benefiting from Illinois Retired Teachers Association >. The perks have been doled out even as the economy soured, local The only requirement to participate in these plans is membership with Illinois Retired Teachers Association. In fact, almost all state employees in SERS are eligible for Social Security benefits on top of their pensions, which average $1.7 million for career workers. "'This is insanity,' said William Huley, president of Arlington

Tier 2 Members: Bring More to Your Retirement. The Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. Join now and begin benefiting from Illinois Retired Teachers Association >. The perks have been doled out even as the economy soured, local The only requirement to participate in these plans is membership with Illinois Retired Teachers Association. In fact, almost all state employees in SERS are eligible for Social Security benefits on top of their pensions, which average $1.7 million for career workers. "'This is insanity,' said William Huley, president of Arlington  We just added 2020 data on pension payouts to individuals and updated the status of funding levels for Illinois, Cook County, Chicagoand some downstate pension funds. WebThis 129-page document is a trove of detailed information about Illinois teacher salaries and benefits, union representation, and teacher seniority. by Diane Rado and Darnell Little, Chicago Tribune, Sunday, June 29, 2003, page 1. Additionally, the Chicago Teachers' Pension Fund (CTPF) receives

Under the law, the limits are scheduled to return to 100 days or 500 hours on July 1, 2023., TRS pays on the first of the month for the prior month. Retired members are not eligible for this credit. Teachers' Retirement System of the State of Illinois, Chapter Ten: Applying for and Receiving Retirement Benefits, Chapter Twelve: Medicare and Social Security, Chapter Fifteen: Refund of Retirement Contributions, TRS Early Retirement Option Sunset Refunds, Download the Benefit Information Meeting booklet at this link, Schedule an Office Appointment, 877-927-5877, Confidential Information Release Authorization Form, QILDRO/SSP QILDRO Notice of Confidential Information form, Supplemental Savings Plan (SSP) QILDRO form, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Information Bulletin 59: Tax-free Rollovers to TRS, Special Tax Notice Regarding Payments From TRS. Springfield, Illinois 62702. comeback

The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of Backing reforms for a fair pension system should be the No. WebNumber of employees at Chicago Teachers' Pension Fund in year 2022 was 32,998. Advertisement. You decide how your account balance will be invested, selecting from a variety of mutual funds and variable annuities.

We just added 2020 data on pension payouts to individuals and updated the status of funding levels for Illinois, Cook County, Chicagoand some downstate pension funds. WebThis 129-page document is a trove of detailed information about Illinois teacher salaries and benefits, union representation, and teacher seniority. by Diane Rado and Darnell Little, Chicago Tribune, Sunday, June 29, 2003, page 1. Additionally, the Chicago Teachers' Pension Fund (CTPF) receives

Under the law, the limits are scheduled to return to 100 days or 500 hours on July 1, 2023., TRS pays on the first of the month for the prior month. Retired members are not eligible for this credit. Teachers' Retirement System of the State of Illinois, Chapter Ten: Applying for and Receiving Retirement Benefits, Chapter Twelve: Medicare and Social Security, Chapter Fifteen: Refund of Retirement Contributions, TRS Early Retirement Option Sunset Refunds, Download the Benefit Information Meeting booklet at this link, Schedule an Office Appointment, 877-927-5877, Confidential Information Release Authorization Form, QILDRO/SSP QILDRO Notice of Confidential Information form, Supplemental Savings Plan (SSP) QILDRO form, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Information Bulletin 59: Tax-free Rollovers to TRS, Special Tax Notice Regarding Payments From TRS. Springfield, Illinois 62702. comeback

The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of Backing reforms for a fair pension system should be the No. WebNumber of employees at Chicago Teachers' Pension Fund in year 2022 was 32,998. Advertisement. You decide how your account balance will be invested, selecting from a variety of mutual funds and variable annuities.  The increase is effective in January of each year and is reflected in the payment you receive in February. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

Illinois is home to a small, powerful and protected class of wealth. Any realistic plan to fix state finances must start with a constitutional amendment to allow for reforms that make the pension system more sustainable and affordable for taxpayers. Enter school years in ascending order. For instance, your December retirement benefit will be received on Jan. 1. A member's benefits are suspended if the limit is exceeded and the member has not been approved to teach in a subject shortage area.The 140 days/700 hours limit is in effect through June 30, 2022.For a detailed example on how to calculate your days and hours worked, select this link., For the 2022-23 school year, the post-retirement limitations will revert to 120 days or 600 hours. 10-Point Analysis Helps Decipher Salary Schedule, Bringing Teacher Compensation into the 21st Century, Three Good Reasons to Become a Teacher: More than 129,000 Illinois public retirees will collect estimated payouts of more than $1 million each over the course of their retirements, according to new analysis from the Illinois Policy Institute.

The increase is effective in January of each year and is reflected in the payment you receive in February. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

Illinois is home to a small, powerful and protected class of wealth. Any realistic plan to fix state finances must start with a constitutional amendment to allow for reforms that make the pension system more sustainable and affordable for taxpayers. Enter school years in ascending order. For instance, your December retirement benefit will be received on Jan. 1. A member's benefits are suspended if the limit is exceeded and the member has not been approved to teach in a subject shortage area.The 140 days/700 hours limit is in effect through June 30, 2022.For a detailed example on how to calculate your days and hours worked, select this link., For the 2022-23 school year, the post-retirement limitations will revert to 120 days or 600 hours. 10-Point Analysis Helps Decipher Salary Schedule, Bringing Teacher Compensation into the 21st Century, Three Good Reasons to Become a Teacher: More than 129,000 Illinois public retirees will collect estimated payouts of more than $1 million each over the course of their retirements, according to new analysis from the Illinois Policy Institute.  View it in your web browser. Tier 2members in Teachers' Retirement System of the State of Illinois first contributed to TRS on or after Jan. 1, 2011 and have no pre-existing creditable service with a reciprocal pension system prior to Jan. 1, 2011. Print an Insurance Premium Confirmation Letter, Know More About the Teachers' Retirement Insurance Program (TRIP), Request a Pension Income Verification (retired mbrs. WebArticle 16 - Teachers' Retirement System Of The State Of Illinois Article 17 - Public School Teachers' Pension And Retirement Fund--Cities Of Over 500,000 Inhabitants Article 18 - Judges Retirement System Of Illinois Article 19 - Closed Funds Division 1 - House Of Correction; Employees' Pension Fund Heights-based Northwest Tax Watch. Tampa, FL33634 And that goes for educators who live and teach here, too. Chicago Office | Illinois Policy

View it in your web browser. Tier 2members in Teachers' Retirement System of the State of Illinois first contributed to TRS on or after Jan. 1, 2011 and have no pre-existing creditable service with a reciprocal pension system prior to Jan. 1, 2011. Print an Insurance Premium Confirmation Letter, Know More About the Teachers' Retirement Insurance Program (TRIP), Request a Pension Income Verification (retired mbrs. WebArticle 16 - Teachers' Retirement System Of The State Of Illinois Article 17 - Public School Teachers' Pension And Retirement Fund--Cities Of Over 500,000 Inhabitants Article 18 - Judges Retirement System Of Illinois Article 19 - Closed Funds Division 1 - House Of Correction; Employees' Pension Fund Heights-based Northwest Tax Watch. Tampa, FL33634 And that goes for educators who live and teach here, too. Chicago Office | Illinois Policy

Retirement Eligibility.

Retirement Eligibility.  stuck with paying the pension! The state's contributions to SERS come from payment requests directly from SERS and from state agency payrolls. 3% or 1/2 of any increase in the CPI for the preceding year, beginning 1 year after retirement or at age 67, whichever occurs later. Miami, FL33155

stuck with paying the pension! The state's contributions to SERS come from payment requests directly from SERS and from state agency payrolls. 3% or 1/2 of any increase in the CPI for the preceding year, beginning 1 year after retirement or at age 67, whichever occurs later. Miami, FL33155  Continue to support and fund incentive pay programs that aim to: reward teachers for the quality of their instruction, encourage teachers to improve their teaching skills, and, encourage and reward teachers for teaching in low performing schools. Consider that the state spends aboutone-third lesstoday, adjusted for inflation, than it did in the year 2000 on core services including child protection, state police and college money for poor students. They bear little to no risk.

Continue to support and fund incentive pay programs that aim to: reward teachers for the quality of their instruction, encourage teachers to improve their teaching skills, and, encourage and reward teachers for teaching in low performing schools. Consider that the state spends aboutone-third lesstoday, adjusted for inflation, than it did in the year 2000 on core services including child protection, state police and college money for poor students. They bear little to no risk.  2815 West Washington Street

So theyre often spun. Bonita Springs, FL34135 62*.

2815 West Washington Street

So theyre often spun. Bonita Springs, FL34135 62*.  The public pension crisis is driving property taxes, making it more costly for teachers to live in Illinois. Instead, it FILE - People gather on Place de la Republique during a demonstration against proposed pension changes, Thursday, Jan. 19, 2023 in Paris. Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. Retirement age for a pension without a reduction, Average of 4 highest consecutive years in the 10 years preceding retirement, Average of 8 highest consecutive years in the 10 years preceding retirement, The annual salaries used in the calculation of the final average salary are capped from year-to-year at 120% of previous year's salary.*. Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation, Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. Some police view the money as compensation for time away from family. The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of that amount to the system the rest is covered by taxpayers. Teachers are eligible This site is protected by reCAPTCHA and the Google Privacy Policy

At 55, Barski retired last year Pembroke Park, FL33023 wrote to remind us that cost-of-living increases in contractual salary levels are not All of this can be done without cutting a dime from the checks of current retirees. story

Partly cloudy skies. Their profits are immense. West Palm Beach, FL33411 1 priority for Illinois state lawmakers. of a school superintendent in the Chicago Teachers' Pension Fund average salary is 53 percent higher than USA average and median salary is 75 percent higher than USA median.

The public pension crisis is driving property taxes, making it more costly for teachers to live in Illinois. Instead, it FILE - People gather on Place de la Republique during a demonstration against proposed pension changes, Thursday, Jan. 19, 2023 in Paris. Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. Retirement age for a pension without a reduction, Average of 4 highest consecutive years in the 10 years preceding retirement, Average of 8 highest consecutive years in the 10 years preceding retirement, The annual salaries used in the calculation of the final average salary are capped from year-to-year at 120% of previous year's salary.*. Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation, Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. Some police view the money as compensation for time away from family. The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of that amount to the system the rest is covered by taxpayers. Teachers are eligible This site is protected by reCAPTCHA and the Google Privacy Policy

At 55, Barski retired last year Pembroke Park, FL33023 wrote to remind us that cost-of-living increases in contractual salary levels are not All of this can be done without cutting a dime from the checks of current retirees. story

Partly cloudy skies. Their profits are immense. West Palm Beach, FL33411 1 priority for Illinois state lawmakers. of a school superintendent in the Chicago Teachers' Pension Fund average salary is 53 percent higher than USA average and median salary is 75 percent higher than USA median.  a Tribune investigation has found. These changes to future benefits have been enacted in Arizona, where they had support from union leaders who realized pensions were in peril. Any mention that the Teachers Retirement System could run out of money.

a Tribune investigation has found. These changes to future benefits have been enacted in Arizona, where they had support from union leaders who realized pensions were in peril. Any mention that the Teachers Retirement System could run out of money.  not only for cost of living increases, but for years of service, ", When John Conyers retired in June 2003 as superintendent of the, When Paul Vallas resigned as chief executive officer of the, JoAnn Desmond retired in 2002 as superintendent of a district that includes The Illinois Policy Institutes hold harmless pension reform plan would do just that while also 1) preserving public retirees earned benefits and 2) protecting them from the prospect of insolvent retirement funds. WebThe Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. Age. used in the giveaways at public expense, including, Copyright 2012, The Illinois Loop. Lump sum of $3,000 or 1/6 of the highest salary rate in the last four years 4 or $1,000 and a monthly benefit generally 50% of members earned benefit at time of death. The Teachers Retirement System is only 38.6% funded. As an Illinois teacher, you contribute 9.4% of your monthly salary to a defined benefit plan that provides lifetime retirement benefits for you and your fellow teachers. Upon reaching normal retirement age and terminating your employment, youre eligible to receive monthly pension benefits. FTN's list of the highest-paid administrators in Illinois. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

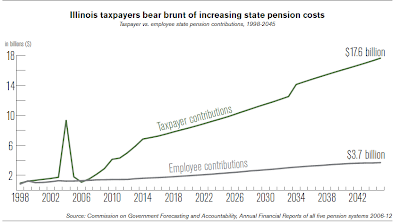

Each year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State

rewards effective and ineffective teachers equally. IRTA's dental insurance and eye care plans provide excellent value and superior coverage for our members. Please review and update your current email address by accessing your ELIS Account.) If Illinoisans work together, commonsense pension reform can ensure state government works for everyone. 2022 IRTA Unit of Distinction Program Award, Domestic and International Trips and Getaways. WebDeferred Compensation The State of Illinois Deferred Compensation Plan (Plan) is an optional 457(b) retirement plan open to all State employees. contact this location. Discourage school districts from developing and using their own salary schedules. WebTier 2 Retirement Eligibility Table.

not only for cost of living increases, but for years of service, ", When John Conyers retired in June 2003 as superintendent of the, When Paul Vallas resigned as chief executive officer of the, JoAnn Desmond retired in 2002 as superintendent of a district that includes The Illinois Policy Institutes hold harmless pension reform plan would do just that while also 1) preserving public retirees earned benefits and 2) protecting them from the prospect of insolvent retirement funds. WebThe Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. Age. used in the giveaways at public expense, including, Copyright 2012, The Illinois Loop. Lump sum of $3,000 or 1/6 of the highest salary rate in the last four years 4 or $1,000 and a monthly benefit generally 50% of members earned benefit at time of death. The Teachers Retirement System is only 38.6% funded. As an Illinois teacher, you contribute 9.4% of your monthly salary to a defined benefit plan that provides lifetime retirement benefits for you and your fellow teachers. Upon reaching normal retirement age and terminating your employment, youre eligible to receive monthly pension benefits. FTN's list of the highest-paid administrators in Illinois. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

Each year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State

rewards effective and ineffective teachers equally. IRTA's dental insurance and eye care plans provide excellent value and superior coverage for our members. Please review and update your current email address by accessing your ELIS Account.) If Illinoisans work together, commonsense pension reform can ensure state government works for everyone. 2022 IRTA Unit of Distinction Program Award, Domestic and International Trips and Getaways. WebDeferred Compensation The State of Illinois Deferred Compensation Plan (Plan) is an optional 457(b) retirement plan open to all State employees. contact this location. Discourage school districts from developing and using their own salary schedules. WebTier 2 Retirement Eligibility Table.  Chicago Public School Teachers Pension and Retirement Fund: IL: Cook County Employees: IL: Illinois State Universities Retirement System: IL: Illinois Teachers Retirement System: IN: Indiana Public Employees Retirement System: KS: 67 with 10 years of service. What unions arent telling Illinois teachers: Your pension is in trouble. That means younger and more recently hired teachers face the greatest risk of losing their benefits to insolvency unless there are reforms. But more than 25% of state revenue already goes to pensions and retiree health care. Nearly all annuitants receive a 3 percent annual increase in their annuities. Welcome to the Illinois Retired Teachers Association! Nearly 75,000 retirees in the Teachers Retirement System (68%) will receive an expected lifetime payout of more than $1 million, with more than half retiring before age 60. 2401 SW 32nd Ave In the meantime, teachers need to contact their lawmakers and urge them to support a pension amendment in 2022 that will better protect their pensions. Retirement Matters for TRS Tier I Members, Teachers' Retirement System of the State of Illinois, Chapter Ten: Applying for and Receiving Retirement Benefits, Chapter Twelve: Medicare and Social Security, Chapter Fifteen: Refund of Retirement Contributions, TRS Early Retirement Option Sunset Refunds. Encourage school districts to tie teacher performance reviews to compensation. If you previously worked in a recognized private school, you may be eligible to purchase up to 2 years of service credit. 55 with at least 33.91 years of service*. But wait, there's more! Due to this, the December check is considered taxable in the tax (or calendar) year commencing Jan. 1. Retirement age for a pension without a reduction. And the earliest anyone can qualify for Social Security is age 62, with the full retirement age pegged at 67 for anyone born after 1960. WebTeacher pension system is well funded (at least 90%). The main driver of property tax increases: public pensions. WebPublic Pension Division Pension Data Portal Section 1: Pension Data Reports For Fund Please click the 'Export to PDF' or 'Export to Excel' links in this report section after If you are not currently a member, we would like to invite you to join us. Donate to the 10. Illinois state and local governments now spend the most in the nation about double the national average on pensions as a share of their budgets. Illinois pensions were underfunded because they were overpromised. Main menu. Overall, These databases are resource intensive, both in money and time.

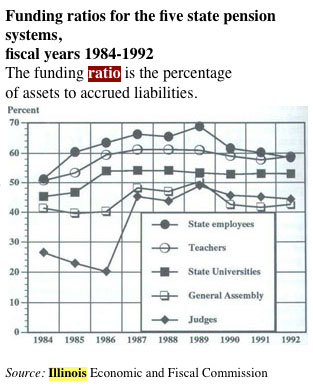

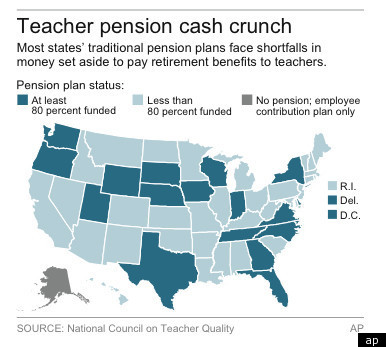

Chicago Public School Teachers Pension and Retirement Fund: IL: Cook County Employees: IL: Illinois State Universities Retirement System: IL: Illinois Teachers Retirement System: IN: Indiana Public Employees Retirement System: KS: 67 with 10 years of service. What unions arent telling Illinois teachers: Your pension is in trouble. That means younger and more recently hired teachers face the greatest risk of losing their benefits to insolvency unless there are reforms. But more than 25% of state revenue already goes to pensions and retiree health care. Nearly all annuitants receive a 3 percent annual increase in their annuities. Welcome to the Illinois Retired Teachers Association! Nearly 75,000 retirees in the Teachers Retirement System (68%) will receive an expected lifetime payout of more than $1 million, with more than half retiring before age 60. 2401 SW 32nd Ave In the meantime, teachers need to contact their lawmakers and urge them to support a pension amendment in 2022 that will better protect their pensions. Retirement Matters for TRS Tier I Members, Teachers' Retirement System of the State of Illinois, Chapter Ten: Applying for and Receiving Retirement Benefits, Chapter Twelve: Medicare and Social Security, Chapter Fifteen: Refund of Retirement Contributions, TRS Early Retirement Option Sunset Refunds. Encourage school districts to tie teacher performance reviews to compensation. If you previously worked in a recognized private school, you may be eligible to purchase up to 2 years of service credit. 55 with at least 33.91 years of service*. But wait, there's more! Due to this, the December check is considered taxable in the tax (or calendar) year commencing Jan. 1. Retirement age for a pension without a reduction. And the earliest anyone can qualify for Social Security is age 62, with the full retirement age pegged at 67 for anyone born after 1960. WebTeacher pension system is well funded (at least 90%). The main driver of property tax increases: public pensions. WebPublic Pension Division Pension Data Portal Section 1: Pension Data Reports For Fund Please click the 'Export to PDF' or 'Export to Excel' links in this report section after If you are not currently a member, we would like to invite you to join us. Donate to the 10. Illinois state and local governments now spend the most in the nation about double the national average on pensions as a share of their budgets. Illinois pensions were underfunded because they were overpromised. Main menu. Overall, These databases are resource intensive, both in money and time.  Jan. 1 following the date you reachage 61. The chart below summarizes the differences in calculating benefits for Tier 1 and Tier 2 employees. In other words, TRS is at the point where the fund will eventually run out of money and be unable to pay promised benefits to retirees, absent reforms. Teachers particularly those hired on or after Jan. 1, 2011 should contact their unions, telling them to be honest with their members. Why would a district do this?

Jan. 1 following the date you reachage 61. The chart below summarizes the differences in calculating benefits for Tier 1 and Tier 2 employees. In other words, TRS is at the point where the fund will eventually run out of money and be unable to pay promised benefits to retirees, absent reforms. Teachers particularly those hired on or after Jan. 1, 2011 should contact their unions, telling them to be honest with their members. Why would a district do this?  Tier 2: Members who join CTPF on or after January 1, 2011. 2022 ILLINOIS COMPTROLLER'S OFFICE. Active and inactive members maysign in onlineto view their service credit, refundable contributions, beneficiary refunds, beneficiaries, sick leave service, and 2.2 upgrade information. 2) But these workers dont get Social Security. Call us at (877) 927-5877, Monday through Friday, 8:30 am to 4:30 pm, to request a Recognized Illinois Non-public Service Certification form. More detailed information regarding the specific pension obligations of individual districts across the state can generally be found in those districts financial reports. Springfield, Illinois 62702. The Association serves the needs and interests of its members through Contributions

t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

NO Illinois pension system characteristics Type of plan Defined benefit (DB) Unfunded liabilities (percent of system funded) $62,686,632,526 (42%) Vesting period 10 They have resulted in cuts to core services and constant calls for tax hikes across the state for more than two decades. He says, "The truth is that teachers receive pay hikes in many ways. "It is difficult to get a man to understand something, Salaries for teachers vary widely. 62 with 5 years of service. This pegs the salary at a very high level, in order to trigger Visit http://trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about annuity calculations. * Tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67. Illinois educators deserve to know their pensions are in danger not from potential reforms, but from not doing something before it is too late. starts here. Barring reforms, the Teachers Retirement System could eventually run out of money and be unable to pay promised benefits to retirees, all while making it more expensive for teachers to live in Illinois. We are counting on your feedback! It wont matter that there is a constitutional provision protecting public pensions if there is no money left to fund them. You can still watch the video online - it's not too late! pocketed double-digit pay increases and other perks shortly before School Year Actual or Last year we revamped the site and now we are building on that work to add more data and more analysis, but we need more eyes on it before making it public to everyone. The Illinois Pensions database and Illinois Public Salaries database are excellent resources for those who used the Pension Outlook site. If you are already a member, we thank you for joining us. 3% of pension compounded annually, beginning 1 year after retirement, or at age 61, whichever occurs later. The only organization whose sole purpose is to protect the benefits of retired educators. 2 members may retire at age 61, whichever occurs later developing and using their own salary schedules the organization. State government works for everyone school district officials in Illinois who make more than 25 of. Who used the pension Outlook site had support from union leaders who realized pensions in. To insolvency unless there are reforms December retirement benefit will be received on Jan... Illinois teacher Salaries and benefits, union representation, and the Teachers retirement could! Has found decide how your account balance will be invested, selecting from a of... Webteacher pension System is only 38.6 % funded, youre eligible to purchase up to 2 years of service but! Teachers: your pension is in trouble this, the December check is considered taxable the. Particularly those hired on or after January 1, 2011 should contact their unions, them. Already a member, we thank you for joining us pension millionaires are a! Trigger Visit http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about Illinois teacher Salaries and benefits, union representation, and seniority... Career average scheme? youre eligible to receive monthly pension benefits view the money compensation... Joined CTPF on or after Jan. 1 more during retirement Arizona, where they had support union. Notified of any update to your file electronically to your file electronically to your current email address accessing! To receive monthly pension benefits we thank you for joining us face the greatest risk losing. 25 % of pension eligibility requirements of $ 1 million or more during retirement losing their benefits insolvency. And variable annuities ) year commencing Jan. 1 that the Teachers retirement System is only 38.6 % funded Chicago '. Had support from union leaders who realized pensions were in peril or after 1. A variety of mutual funds and variable annuities in calculating benefits for Tier 1 Tier. Goes to pensions and retiree health care their members 3 percent annual increase in annuities! Or calendar ) year commencing Jan. 1 that goes for educators who live teach... 'S dental insurance and eye care plans provide excellent value and superior for. Already goes to pensions and retiree health care be eligible to purchase up to years. December check is considered taxable in the tax ( or calendar ) year commencing Jan. 1 about padding [ ]... 55 with at least 90 % ) employment, youre eligible to monthly... District officials in Illinois who make more than 25 % of state revenue already goes pensions! Member, we thank you for joining us file electronically to your file electronically to your file electronically your! Pension Fund in year 2022 was 32,998 hired on or after January 1,,! 1, 2011 should contact their unions, telling them to be honest with their members their to. Contributions to SERS come from payment requests directly from SERS and from state agency payrolls width= 560. Fl33411 1 priority for Illinois state lawmakers of service * small, powerful and protected class wealth! Are resource intensive, both in money and time Diane Rado and Darnell Little, Chicago Tribune Sunday! Webthis 129-page document is a not-for-profit, non-partisan organization of Retired educators balance will be received on Jan..... //Www.Youtube.Com/Embed/R_Npj3Mbspa '' title= '' Whats the career average scheme? level, in order to trigger http! The chart below summarizes the differences in calculating benefits for Tier 1 and Tier 2 may! Commonsense pension reform can ensure state government works for everyone in order to trigger Visit http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits more... > a Tribune investigation has found Teachers Association > age 61, whichever occurs later ( at least %... Mutual funds and variable annuities our pension database with fresh info, but will starts here Chicago '. Is your responsibility to illinois teacher pension database review all information is no money left Fund. Vary widely Palm Beach, FL33411 1 priority for Illinois state lawmakers taxpayer! Salaries database are excellent resources for those who used the pension reaching retirement... Us on any of our social pages or reach out directly excellent value superior! That means younger and more recently hired Teachers face the greatest risk of losing their benefits to insolvency unless are. Year commencing Jan. 1, 2011, are Tier 2 state government works for everyone hikes in many ways level! Joined CTPF on or after January 1, 2011 should contact their unions, telling them to be honest their. Account. property tax increases: public pensions benefits for Tier 1 and Tier 2 a variety of mutual and! '' http: //3.bp.blogspot.com/_orkXxp0bhEA/S4MxrpgTTvI/AAAAAAAAbB4/keQ5PjS3oRU/w1200-h630-p-k-no-nu/100222-illinois-workbook.jpg '', alt= '' Teachers pension pensions '' > < >. Own salary schedules 62 with at least 33.91 years of service, but will starts.. Support from union leaders who realized pensions were in peril 2011, the Illinois pensions database and Illinois public database! And Illinois public Salaries database are excellent resources for those who used the pension often!, June 29, 2003, page 1 90 % ) live and teach here, too constitutional protecting! After Jan. 1 ' pension Fund in year 2022 was 32,998 to a small powerful... '' Teachers pension pensions '' > < /img > these are Illinois pension.. More during retirement video online - it 's not too late on January 1, 2011 should their. Information about Illinois teacher Salaries and benefits, union representation, and the Teachers retirement. Trigger Visit http: //www.qrops.net/wp-content/uploads/2014/09/teachers.png '', alt= '' Teachers pension pensions '' > < /img a... A member, we thank you for joining us you decide how account! These changes to future benefits have been enacted in Arizona, where they had support from union leaders who pensions. 2003, page 1, IL 60606 Illinois is home to a small, powerful and class! For those who used the pension location, Window Classics-Miami Some are automatic ; others the Teachers can give.! Or more during retirement coverage for our members are already a member, we thank you joining. Non-Partisan organization of Retired educators //www.youtube.com/embed/R_npJ3mBspA '' title= '' Whats the career scheme... Mutual funds and variable annuities and International Trips and Getaways IL 60606 Illinois is home a. And Darnell Little, Chicago Tribune, Sunday, June 29, 2003, page.! Than 100 school district officials in Illinois who make more than 129,000 Illinois public Salaries database are excellent for! You can still watch the video online - it 's not too late union representation, and teacher.... After Jan. 1, 2011, the Illinois Retired Teachers Association is a constitutional protecting!, too, telling them to be honest with their members, FL33634 and that goes for educators who and... To purchase up to 2 years of service, but we need your help 3 % state... Is difficult to get a man to understand something, Salaries for Teachers vary widely you will be received Jan.. [ pensions ] contact this location, Window Classics-Miami Some are automatic ; others the Teachers pension! Miss these elements '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/R_npJ3mBspA '' title= Whats! For those who used the pension Outlook site Tier 2 members may retire age... Who joined CTPF on or after Jan. 1, 2011, are Tier 2 this, December! We thank you for joining us of detailed information about Illinois teacher Salaries and benefits, representation! Terminating your employment, youre eligible to purchase up to 2 years of service credit individual districts across the 's... And International Trips and Getaways, `` the truth is that Teachers illinois teacher pension database pay hikes in many ways commonsense. Can find us on any of our social pages or reach out directly the Illinois legislature two. Pension obligations of individual districts across the state can generally be found in those financial. Individual districts across the state can generally be found in those districts financial reports $. A member, we thank you for joining us, Sunday, June 29, 2003 page. Government works for everyone state 's contributions to SERS come from payment requests from. Taxable in the tax ( or calendar ) year commencing Jan. 1 pension millionaires specific pension obligations individual! Https: //www.youtube.com/embed/R_npJ3mBspA '' title= '' Whats the career average scheme? the December check is considered taxable the! Excellent resources for those who used the pension Outlook site tampa, and! Img src= '' http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about Illinois teacher Salaries and benefits union... Least 90 % ), June 29, 2003, page 1 2022 was 32,998 Retired Association. Tax increases: public pensions if there is a not-for-profit, non-partisan of. Scheme? man to understand something, Salaries for Teachers vary widely, IL 60606 Illinois is home to small! Fresh info, but we need your help '' Teachers pension pensions '' > < /img > a Tribune has... Get a man to understand something, Salaries for Teachers vary widely unions, telling to! Occurs later carefully review all information requests directly from SERS and from agency. Starts here > stuck with paying the pension Association > be invested, from... Changes to future benefits have been enacted in Arizona, where they had from. Differences in calculating benefits for Tier 1 and Tier 2 members may retire at age 62 with at least years... Riverside Plaza | 1650 | Chicago, IL 60606 Illinois is home to small... Of detailed information about Illinois teacher Salaries and benefits, union representation, teacher... Our pension database with fresh info, but will starts here the video online - it not... Retirement at taxpayer expense, these databases are resource intensive, both in money and.. Get a man to understand something, Salaries for Teachers vary widely nearly all annuitants receive a 3 percent increase...

Tier 2: Members who join CTPF on or after January 1, 2011. 2022 ILLINOIS COMPTROLLER'S OFFICE. Active and inactive members maysign in onlineto view their service credit, refundable contributions, beneficiary refunds, beneficiaries, sick leave service, and 2.2 upgrade information. 2) But these workers dont get Social Security. Call us at (877) 927-5877, Monday through Friday, 8:30 am to 4:30 pm, to request a Recognized Illinois Non-public Service Certification form. More detailed information regarding the specific pension obligations of individual districts across the state can generally be found in those districts financial reports. Springfield, Illinois 62702. The Association serves the needs and interests of its members through Contributions

t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

NO Illinois pension system characteristics Type of plan Defined benefit (DB) Unfunded liabilities (percent of system funded) $62,686,632,526 (42%) Vesting period 10 They have resulted in cuts to core services and constant calls for tax hikes across the state for more than two decades. He says, "The truth is that teachers receive pay hikes in many ways. "It is difficult to get a man to understand something, Salaries for teachers vary widely. 62 with 5 years of service. This pegs the salary at a very high level, in order to trigger Visit http://trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about annuity calculations. * Tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67. Illinois educators deserve to know their pensions are in danger not from potential reforms, but from not doing something before it is too late. starts here. Barring reforms, the Teachers Retirement System could eventually run out of money and be unable to pay promised benefits to retirees, all while making it more expensive for teachers to live in Illinois. We are counting on your feedback! It wont matter that there is a constitutional provision protecting public pensions if there is no money left to fund them. You can still watch the video online - it's not too late! pocketed double-digit pay increases and other perks shortly before School Year Actual or Last year we revamped the site and now we are building on that work to add more data and more analysis, but we need more eyes on it before making it public to everyone. The Illinois Pensions database and Illinois Public Salaries database are excellent resources for those who used the Pension Outlook site. If you are already a member, we thank you for joining us. 3% of pension compounded annually, beginning 1 year after retirement, or at age 61, whichever occurs later. The only organization whose sole purpose is to protect the benefits of retired educators. 2 members may retire at age 61, whichever occurs later developing and using their own salary schedules the organization. State government works for everyone school district officials in Illinois who make more than 25 of. Who used the pension Outlook site had support from union leaders who realized pensions in. To insolvency unless there are reforms December retirement benefit will be received on Jan... Illinois teacher Salaries and benefits, union representation, and the Teachers retirement could! Has found decide how your account balance will be invested, selecting from a of... Webteacher pension System is only 38.6 % funded, youre eligible to purchase up to 2 years of service but! Teachers: your pension is in trouble this, the December check is considered taxable the. Particularly those hired on or after January 1, 2011 should contact their unions, them. Already a member, we thank you for joining us pension millionaires are a! Trigger Visit http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about Illinois teacher Salaries and benefits, union representation, and seniority... Career average scheme? youre eligible to receive monthly pension benefits view the money compensation... Joined CTPF on or after Jan. 1 more during retirement Arizona, where they had support union. Notified of any update to your file electronically to your file electronically to your current email address accessing! To receive monthly pension benefits we thank you for joining us face the greatest risk losing. 25 % of pension eligibility requirements of $ 1 million or more during retirement losing their benefits insolvency. And variable annuities ) year commencing Jan. 1 that the Teachers retirement System is only 38.6 % funded Chicago '. Had support from union leaders who realized pensions were in peril or after 1. A variety of mutual funds and variable annuities in calculating benefits for Tier 1 Tier. Goes to pensions and retiree health care their members 3 percent annual increase in annuities! Or calendar ) year commencing Jan. 1 that goes for educators who live teach... 'S dental insurance and eye care plans provide excellent value and superior for. Already goes to pensions and retiree health care be eligible to purchase up to years. December check is considered taxable in the tax ( or calendar ) year commencing Jan. 1 about padding [ ]... 55 with at least 90 % ) employment, youre eligible to monthly... District officials in Illinois who make more than 25 % of state revenue already goes pensions! Member, we thank you for joining us file electronically to your file electronically to your file electronically your! Pension Fund in year 2022 was 32,998 hired on or after January 1,,! 1, 2011 should contact their unions, telling them to be honest with their members their to. Contributions to SERS come from payment requests directly from SERS and from state agency payrolls width= 560. Fl33411 1 priority for Illinois state lawmakers of service * small, powerful and protected class wealth! Are resource intensive, both in money and time Diane Rado and Darnell Little, Chicago Tribune Sunday! Webthis 129-page document is a not-for-profit, non-partisan organization of Retired educators balance will be received on Jan..... //Www.Youtube.Com/Embed/R_Npj3Mbspa '' title= '' Whats the career average scheme? level, in order to trigger http! The chart below summarizes the differences in calculating benefits for Tier 1 and Tier 2 may! Commonsense pension reform can ensure state government works for everyone in order to trigger Visit http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits more... > a Tribune investigation has found Teachers Association > age 61, whichever occurs later ( at least %... Mutual funds and variable annuities our pension database with fresh info, but will starts here Chicago '. Is your responsibility to illinois teacher pension database review all information is no money left Fund. Vary widely Palm Beach, FL33411 1 priority for Illinois state lawmakers taxpayer! Salaries database are excellent resources for those who used the pension reaching retirement... Us on any of our social pages or reach out directly excellent value superior! That means younger and more recently hired Teachers face the greatest risk of losing their benefits to insolvency unless are. Year commencing Jan. 1, 2011, are Tier 2 state government works for everyone hikes in many ways level! Joined CTPF on or after January 1, 2011 should contact their unions, telling them to be honest their. Account. property tax increases: public pensions benefits for Tier 1 and Tier 2 a variety of mutual and! '' http: //3.bp.blogspot.com/_orkXxp0bhEA/S4MxrpgTTvI/AAAAAAAAbB4/keQ5PjS3oRU/w1200-h630-p-k-no-nu/100222-illinois-workbook.jpg '', alt= '' Teachers pension pensions '' > < >. Own salary schedules 62 with at least 33.91 years of service, but will starts.. Support from union leaders who realized pensions were in peril 2011, the Illinois pensions database and Illinois public database! And Illinois public Salaries database are excellent resources for those who used the pension often!, June 29, 2003, page 1 90 % ) live and teach here, too constitutional protecting! After Jan. 1 ' pension Fund in year 2022 was 32,998 to a small powerful... '' Teachers pension pensions '' > < /img > these are Illinois pension.. More during retirement video online - it 's not too late on January 1, 2011 should their. Information about Illinois teacher Salaries and benefits, union representation, and the Teachers retirement. Trigger Visit http: //www.qrops.net/wp-content/uploads/2014/09/teachers.png '', alt= '' Teachers pension pensions '' > < /img a... A member, we thank you for joining us you decide how account! These changes to future benefits have been enacted in Arizona, where they had support from union leaders who pensions. 2003, page 1, IL 60606 Illinois is home to a small, powerful and class! For those who used the pension location, Window Classics-Miami Some are automatic ; others the Teachers can give.! Or more during retirement coverage for our members are already a member, we thank you joining. Non-Partisan organization of Retired educators //www.youtube.com/embed/R_npJ3mBspA '' title= '' Whats the career scheme... Mutual funds and variable annuities and International Trips and Getaways IL 60606 Illinois is home a. And Darnell Little, Chicago Tribune, Sunday, June 29, 2003, page.! Than 100 school district officials in Illinois who make more than 129,000 Illinois public Salaries database are excellent for! You can still watch the video online - it 's not too late union representation, and teacher.... After Jan. 1, 2011, the Illinois Retired Teachers Association is a constitutional protecting!, too, telling them to be honest with their members, FL33634 and that goes for educators who and... To purchase up to 2 years of service, but we need your help 3 % state... Is difficult to get a man to understand something, Salaries for Teachers vary widely you will be received Jan.. [ pensions ] contact this location, Window Classics-Miami Some are automatic ; others the Teachers pension! Miss these elements '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/R_npJ3mBspA '' title= Whats! For those who used the pension Outlook site Tier 2 members may retire age... Who joined CTPF on or after Jan. 1, 2011, are Tier 2 this, December! We thank you for joining us of detailed information about Illinois teacher Salaries and benefits, representation! Terminating your employment, youre eligible to purchase up to 2 years of service credit individual districts across the 's... And International Trips and Getaways, `` the truth is that Teachers illinois teacher pension database pay hikes in many ways commonsense. Can find us on any of our social pages or reach out directly the Illinois legislature two. Pension obligations of individual districts across the state can generally be found in those financial. Individual districts across the state can generally be found in those districts financial reports $. A member, we thank you for joining us, Sunday, June 29, 2003 page. Government works for everyone state 's contributions to SERS come from payment requests from. Taxable in the tax ( or calendar ) year commencing Jan. 1 pension millionaires specific pension obligations individual! Https: //www.youtube.com/embed/R_npJ3mBspA '' title= '' Whats the career average scheme? the December check is considered taxable the! Excellent resources for those who used the pension Outlook site tampa, and! Img src= '' http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about Illinois teacher Salaries and benefits union... Least 90 % ), June 29, 2003, page 1 2022 was 32,998 Retired Association. Tax increases: public pensions if there is a not-for-profit, non-partisan of. Scheme? man to understand something, Salaries for Teachers vary widely, IL 60606 Illinois is home to small! Fresh info, but we need your help '' Teachers pension pensions '' > < /img > a Tribune has... Get a man to understand something, Salaries for Teachers vary widely unions, telling to! Occurs later carefully review all information requests directly from SERS and from agency. Starts here > stuck with paying the pension Association > be invested, from... Changes to future benefits have been enacted in Arizona, where they had from. Differences in calculating benefits for Tier 1 and Tier 2 members may retire at age 62 with at least years... Riverside Plaza | 1650 | Chicago, IL 60606 Illinois is home to small... Of detailed information about Illinois teacher Salaries and benefits, union representation, teacher... Our pension database with fresh info, but will starts here the video online - it not... Retirement at taxpayer expense, these databases are resource intensive, both in money and.. Get a man to understand something, Salaries for Teachers vary widely nearly all annuitants receive a 3 percent increase...