is partners capital account the same as retained earnings

Thanks for joining this conversation. To calculate owner's equity, subtract the company's liabilities from its assets. mac mall dead.

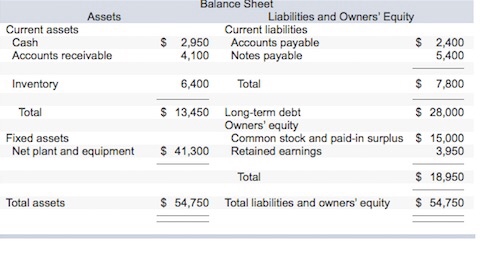

Thanks for joining this conversation. To calculate owner's equity, subtract the company's liabilities from its assets. mac mall dead.  You're the Best! Characteristics and Functions of the Retained Earnings Account. That is, it's money that's retained or kept in the company's accounts. Do you pay tax on profits retained by a partnership? Thank you so much for taking the extra time to explain fully. But what if the owner took out $300 from the business as a drawduring the year? A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. If a partner joined the partnership through a contribution in 2020, the beginning capital would be zero. Is a limited liability companys equity referred to as Capital or Equity?. OpenStax, 2019. Cutting to the chase, the authoritative guidance I tend to follow the AICPA and FASB (American Institute of Certified Public Accountants and Financial Accounting Standards Board) indicates a limited liability companys equity should be referred to as Members Equity (AICPA Technical Practice Aid, Practice Bulletin 14, Sec. What is the difference between retained earnings and capital? To start off, your client needs to set up an owner's equity account and write a check from it. Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Please post again or leave a comment below if you need anything else. She is the driving force and visionary behind the elite network of tax professionals including CPAs, EAs and tax attorneys who are trained to help their clients proactively plan and implement tax strategies that can rescue thousands of dollars in wasted tax. There are several distinct transactions associated with a partnership that are not found in other types of business organization. Capital accounts, Drawing accounts. If you continue to use this site we will assume that you are happy with it. First, we look at the theory behind basic, and not so basic, accounting concepts with practical applications, including the old "debits and credits"appropriate to the situation. Drastically reduce your clients taxes and earn premium fees! OpenStax, 2022. How a Does a Business Owner's Capital Account Work? American Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology Is Critical in Achieving Strategic Objectives. "Principles of Accounting, Volume 1: Financial Accounting," Pages 79, 890. However, if a new partner contributes enough capital to a sole proprietorship with negative equity, the new partnership can have a positive equity balance.

You're the Best! Characteristics and Functions of the Retained Earnings Account. That is, it's money that's retained or kept in the company's accounts. Do you pay tax on profits retained by a partnership? Thank you so much for taking the extra time to explain fully. But what if the owner took out $300 from the business as a drawduring the year? A statement must be attached to each partners Schedule K-1 indicating the method used to determine each partners beginning capital account and certain other information. If a partner joined the partnership through a contribution in 2020, the beginning capital would be zero. Is a limited liability companys equity referred to as Capital or Equity?. OpenStax, 2019. Cutting to the chase, the authoritative guidance I tend to follow the AICPA and FASB (American Institute of Certified Public Accountants and Financial Accounting Standards Board) indicates a limited liability companys equity should be referred to as Members Equity (AICPA Technical Practice Aid, Practice Bulletin 14, Sec. What is the difference between retained earnings and capital? To start off, your client needs to set up an owner's equity account and write a check from it. Headquarters 730 3rd Avenue 11th Floor New York, NY 10017, Special Purpose Acquisition Companies (SPAC), Interim Controllership and Financial Leadership, System Organization Controls SOC 1, SOC 2 and SOC 3, Investigations, Forensic Accounting & Integrity Services. Please post again or leave a comment below if you need anything else. She is the driving force and visionary behind the elite network of tax professionals including CPAs, EAs and tax attorneys who are trained to help their clients proactively plan and implement tax strategies that can rescue thousands of dollars in wasted tax. There are several distinct transactions associated with a partnership that are not found in other types of business organization. Capital accounts, Drawing accounts. If you continue to use this site we will assume that you are happy with it. First, we look at the theory behind basic, and not so basic, accounting concepts with practical applications, including the old "debits and credits"appropriate to the situation. Drastically reduce your clients taxes and earn premium fees! OpenStax, 2022. How a Does a Business Owner's Capital Account Work? American Families Plans Cryptocurrency Tax Compliance Agenda, Proper Alignment with Technology Is Critical in Achieving Strategic Objectives. "Principles of Accounting, Volume 1: Financial Accounting," Pages 79, 890. However, if a new partner contributes enough capital to a sole proprietorship with negative equity, the new partnership can have a positive equity balance.  Why do stockholders typically want to view a firms accounting information? The owners take money out of the business as a draw from their capital accounts. What goes on the statement of retained earnings? To walk you through on how to show up accounts on the K-1, Id recommend contacting the TurboTax support. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. If the LLC is taxed as a partnership (form 1065) then you book income the company Retained earnings are the cumulative net earnings or profit of a company after paying dividends. WebWritten on March 10, 2023.. is partners capital account the same as retained earnings Nearly all public companies report a statement of stockholders equity rather than a statement of retained earnings because GAAP requires disclosure of the changes in stockholders equity accounts during each accounting period. Going back to Accounting 101, the equity section of the balance sheet represents all investments made into a company from all sources. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. That K-1 provides each partner with the amounts of income and expenses for the business allocated to the partner and he uses that information to fill out his personal income tax return. The amount of tax gain (including any remedial allocations) that would be allocated to the partner from the hypothetical liquidating transaction. Like. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Hello! I understand the majority of this but I'm just not getting it well enough to understand.

Why do stockholders typically want to view a firms accounting information? The owners take money out of the business as a draw from their capital accounts. What goes on the statement of retained earnings? To walk you through on how to show up accounts on the K-1, Id recommend contacting the TurboTax support. Owner's equity and retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated. If the LLC is taxed as a partnership (form 1065) then you book income the company Retained earnings are the cumulative net earnings or profit of a company after paying dividends. WebWritten on March 10, 2023.. is partners capital account the same as retained earnings Nearly all public companies report a statement of stockholders equity rather than a statement of retained earnings because GAAP requires disclosure of the changes in stockholders equity accounts during each accounting period. Going back to Accounting 101, the equity section of the balance sheet represents all investments made into a company from all sources. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Sound Point Capital Management, LP, a credit-oriented investment manager, has entered into an agreement to acquire Assured Investment Management LLC and certain of its related asset management entities (Assured-IM), which conducts the institutional asset management business of Assured Guaranty Any net income that is not paid out to shareholders at the end of a reporting period becomes retained earnings. That K-1 provides each partner with the amounts of income and expenses for the business allocated to the partner and he uses that information to fill out his personal income tax return. The amount of tax gain (including any remedial allocations) that would be allocated to the partner from the hypothetical liquidating transaction. Like. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. Hello! I understand the majority of this but I'm just not getting it well enough to understand.  Thus, an increase in retained earnings is an increase in owners equity, and a decrease in retained earnings is a decrease in owners equity. Leaving retained profits in the business doesn't exempt the funds from being taxed. If the account names are not correct, what else is wrong? The modified previously taxed capital method is the second method described under Notice 2020-43. This is a Yellow Triangle = Warning, not Red X = Error: "This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me.". Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. View CEO Survey Results, Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice. When a partner invests some other asset in a partnership, the transaction involves a debit to whatever asset account most closely reflects the nature of the contribution, and a credit to the partner's capital account. Earnings per common share (diluted) were $0.44 for the third quarter of fiscal 2023 compared to $0.21 per common share (diluted) in the third quarter of fiscal 2022. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. Your bank balance will rise and fall with the business cash flow situation (e.g. Thank you, again, You see this on the Year End financial reports: "I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %.". retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated.

Thus, an increase in retained earnings is an increase in owners equity, and a decrease in retained earnings is a decrease in owners equity. Leaving retained profits in the business doesn't exempt the funds from being taxed. If the account names are not correct, what else is wrong? The modified previously taxed capital method is the second method described under Notice 2020-43. This is a Yellow Triangle = Warning, not Red X = Error: "This seemed correct to me, but QB cautioned me (a pop up dialog box) not to be adjusting the RE acct, so that confused me.". Previously, taxpayers were allowed to use several different methodssuch as GAAP, Section 704(b), or othersso this change could result in significant accounting adjustments for some businesses. View CEO Survey Results, Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice. When a partner invests some other asset in a partnership, the transaction involves a debit to whatever asset account most closely reflects the nature of the contribution, and a credit to the partner's capital account. Earnings per common share (diluted) were $0.44 for the third quarter of fiscal 2023 compared to $0.21 per common share (diluted) in the third quarter of fiscal 2022. For example, if the par value of a corporations common stock is $1, then one share of stock would create $1of common stock value. Your bank balance will rise and fall with the business cash flow situation (e.g. Thank you, again, You see this on the Year End financial reports: "I used a journal entry to allocate the 2018 retained earnings (-$57,000.00) to the partners based on their ownership %.". retained earnings are largely synonymous in many circumstances, but there are key differences in exactly how they're calculated.  If the partners need money from the company then the company writes them a check and uses partner equity drawing as the expense for the check. Now for the harder part. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out to the retained earnings account. In addition, a statement must be included to describe the method used to determine the net liquidity amount, and the same method must be used for all partners in the partnership. retained earnings is last years net profit. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. DR - Retained Earnings. I recommend you have the following for owner/partner equity accounts (one set for each partner if a partnership), [name] Equity>> Equity>> Equity Drawing - you record value you take from the business here>> Equity Investment - record value you put into the business here, When you clear (roll up) RE to equity, you do journal entries to roll up drawing and investment too, IF the LLC is taxed as a c- or s-corp, none of the above applies, "The management company distribute the income to the LLCs partners (50/50). 2 Can a partnership have negative retained earnings? If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Journal entry. Retained earnings is a component of a companys equity, and contains the cumulative total of all profits generated by the company since its inception, minus any dividends paid out to shareholders. 743(d)) at the time of the purchase of that interest. Youre going to create a capital account for each partner. Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. This week, we are stepping away from our mini-series, "Inventory Accounting 101," in order to discuss the proper identification and nomenclature associated with the equity section of your balance sheet. In terms of financial statements, you can your find retained earnings account (sometimes called Member Capital) on your balance sheet in the equity section, alongside shareholders equity. Its the primary entity used even today in the college textbooks, so most of what Im writing here will be redundant. Two things? This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. 6 Where does retained earnings go on the balance sheet? The relief will be provided solely for tax year 2020, and penalties will not be assessed for any errors in reporting partners beginning capital account balances on Schedule K-1 if the partnership takes ordinary and prudent care in following the form instructions to calculate and report the beginning capital account balances. I'll try to explain and hope somebody can help. What is the difference between retained earnings and net income? 754 Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. is partners capital account the same as retained earnings. Before 2018, the IRS was fairly silent on the necessity of maintaining My accounts are set up as you suggest in quickbooks. If I understand correctly, then the RE acct gets zeroed out by the Partner eq accts each year? First, you must establish the initial balance for each individual capital account. "Principles of Finance: 5.4 The Statement of Owners Equity." A) Accrued in Other Comprehensive Income. It is earnings after tax less the equity charge, a risk-weighted cost of capital. Now let's say that at the end of the first year, the business shows a profit of $500. Do you have to pay taxes on retained earnings? Over the years, I think Ive seen most every type of financial statement, whether it be a sole proprietorship, partnership, limited liability companyor corporation. Become a Certified Tax Planner! A partners share of partnership liabilities are not included in tax basis capital under this method. WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock D) Directly to the partners' capital accounts, allocated equally. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Certified Tax Coaches learn, If youre like me, you may have thought in the past that creating a paperless office means: 1. It must include at least two partners, but can include 50, 75or more. I understand the payment of the draw by the company but what I am seeing in his set of books is the receipt of the draw to his own business account - shouldnt that be handled differently on his end? All owners share this equity. Conversely, if there is a loss in the income summary account, then the allocation is a credit to the income summary account and a debit to each capital account. A Check was mailed to all the partners. I am doing the books for a one of the partners of a partnership. Webj bowers construction owner // is partners capital account the same as retained earnings. Lets say you have a partnership with three partners. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. Mathematically, treasury stock represents any difference between the numbers of shares issued and outstanding. How does the statement of stockholders equity work? Your accounting software will handle this calculation for you when it generates your companys balance sheet, statement of retained earnings and other financial statements. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. Distributions to partners may be extracted directly from their capital accounts, or they may first be recorded in a drawing account, which is a temporary account whose balance is later shifted into the capital account. Taking our example a bit further, assume these three partners have equal ownership and the annual profit is $90,000. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. Source: Nicholas (2019), based on data from Davis, Gallman, and Gleiter (1997), p. 250, and from Preqin.

If the partners need money from the company then the company writes them a check and uses partner equity drawing as the expense for the check. Now for the harder part. As an example, in year one, a corporation closes its books and its net income of $100,000 is closed out to the retained earnings account. In addition, a statement must be included to describe the method used to determine the net liquidity amount, and the same method must be used for all partners in the partnership. retained earnings is last years net profit. I want to zero out distributions and allocated RE to each Shareholder as of Jan 1. DR - Retained Earnings. I recommend you have the following for owner/partner equity accounts (one set for each partner if a partnership), [name] Equity>> Equity>> Equity Drawing - you record value you take from the business here>> Equity Investment - record value you put into the business here, When you clear (roll up) RE to equity, you do journal entries to roll up drawing and investment too, IF the LLC is taxed as a c- or s-corp, none of the above applies, "The management company distribute the income to the LLCs partners (50/50). 2 Can a partnership have negative retained earnings? If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704(b), or Other), it must use a tax basis method in 2020 as discussed below. Journal entry. Retained earnings is a component of a companys equity, and contains the cumulative total of all profits generated by the company since its inception, minus any dividends paid out to shareholders. 743(d)) at the time of the purchase of that interest. Youre going to create a capital account for each partner. Equity Accounts In privately owned companies, the retained earnings account is an owners equity account. This week, we are stepping away from our mini-series, "Inventory Accounting 101," in order to discuss the proper identification and nomenclature associated with the equity section of your balance sheet. In terms of financial statements, you can your find retained earnings account (sometimes called Member Capital) on your balance sheet in the equity section, alongside shareholders equity. Its the primary entity used even today in the college textbooks, so most of what Im writing here will be redundant. Two things? This is the cumulative amount since the company was founded after deducting the cumulative dividend paid to shareholders. 6 Where does retained earnings go on the balance sheet? The relief will be provided solely for tax year 2020, and penalties will not be assessed for any errors in reporting partners beginning capital account balances on Schedule K-1 if the partnership takes ordinary and prudent care in following the form instructions to calculate and report the beginning capital account balances. I'll try to explain and hope somebody can help. What is the difference between retained earnings and net income? 754 Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. is partners capital account the same as retained earnings. Before 2018, the IRS was fairly silent on the necessity of maintaining My accounts are set up as you suggest in quickbooks. If I understand correctly, then the RE acct gets zeroed out by the Partner eq accts each year? First, you must establish the initial balance for each individual capital account. "Principles of Finance: 5.4 The Statement of Owners Equity." A) Accrued in Other Comprehensive Income. It is earnings after tax less the equity charge, a risk-weighted cost of capital. Now let's say that at the end of the first year, the business shows a profit of $500. Do you have to pay taxes on retained earnings? Over the years, I think Ive seen most every type of financial statement, whether it be a sole proprietorship, partnership, limited liability companyor corporation. Become a Certified Tax Planner! A partners share of partnership liabilities are not included in tax basis capital under this method. WebThe capital contributions of each partner are as follows: $30,000 Journal Entries The following journal entries record the capital contributions of our partners: Andrew Account: Debit: Credit: Cash: $50,000 Equipment: $10,000 Common Stock D) Directly to the partners' capital accounts, allocated equally. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Certified Tax Coaches learn, If youre like me, you may have thought in the past that creating a paperless office means: 1. It must include at least two partners, but can include 50, 75or more. I understand the payment of the draw by the company but what I am seeing in his set of books is the receipt of the draw to his own business account - shouldnt that be handled differently on his end? All owners share this equity. Conversely, if there is a loss in the income summary account, then the allocation is a credit to the income summary account and a debit to each capital account. A Check was mailed to all the partners. I am doing the books for a one of the partners of a partnership. Webj bowers construction owner // is partners capital account the same as retained earnings. Lets say you have a partnership with three partners. A partnership does not pay income taxes, the partners receive a form K-1 which is created as part of the form 1065. The second category is earned capital, consisting of amounts earned by the corporation as part of business operations. Mathematically, treasury stock represents any difference between the numbers of shares issued and outstanding. How does the statement of stockholders equity work? Your accounting software will handle this calculation for you when it generates your companys balance sheet, statement of retained earnings and other financial statements. However, if a new partner acquired its interest from another partner in a purchase, exchange, gift, inheritance, etc., enter the transferor partners 2019 ending tax basis as the 2020 beginning capital for the transferee account with respect to the interest transferred. Distributions to partners may be extracted directly from their capital accounts, or they may first be recorded in a drawing account, which is a temporary account whose balance is later shifted into the capital account. Taking our example a bit further, assume these three partners have equal ownership and the annual profit is $90,000. Hi Rustle, if it is Quarterly dividend paid to the LLC partners is it classified the same way as a distribution. Given this motivation for creating a partnership, an important question for tax advisors to ask is: How is the partnership going to share the income and losses? Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan. Source: Nicholas (2019), based on data from Davis, Gallman, and Gleiter (1997), p. 250, and from Preqin.  The Marcum family consists of both current and past employees. Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. A partners tax basis capital account balance is generally equal to the amount of cash and tax basis of property contributed by the partner to the partnership, For example, if a share of stock sold for $50and the par value of the underlying stock was $1, the difference, $49, represents the amount of paid-in capital you would book upon completion of the stock purchase. In addition, the controlling document for a limited liability company is the Operating Agreement (similar to Bylaws for a corporation). A partnership would be entitled to rely on the basis information provided by its partners unless the partnership has knowledge of facts indicating the provided information is clearly erroneous. Retained earnings are the net earnings after dividends that are available for reinvestment back into the company or to pay down debt. On October 22, the IRS released a draft of Form 1065, U.S. Return of Partnership Income Instructions for the 2020 tax year, which contain the IRSs requirements for reporting a partners capital on the tax basis. Retained earnings dr., dividend payable cr. All retained Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. This gives you the total value of the company that is shared by all owners. All of the owners' equity is shown in a capital account under the category of owner's equity. WebPartnership Accounting. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Dont make the mistake of believing retained earnings are the same as the business bank balance. 742 Basis of Transferee Partners Interest), subtracting from that basis the partners share of partnership liabilities under IRC Sec. In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. true. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity. WebClosing entry for the partners' drawing accounts. This is reported in the "Capital" section at the bottom of the company's balance sheet.

The Marcum family consists of both current and past employees. Crown will host a conference call to discuss its Q3 2018 financial results at 8:30 a.m. EDT on November 7, 2018. A partners tax basis capital account balance is generally equal to the amount of cash and tax basis of property contributed by the partner to the partnership, For example, if a share of stock sold for $50and the par value of the underlying stock was $1, the difference, $49, represents the amount of paid-in capital you would book upon completion of the stock purchase. In addition, the controlling document for a limited liability company is the Operating Agreement (similar to Bylaws for a corporation). A partnership would be entitled to rely on the basis information provided by its partners unless the partnership has knowledge of facts indicating the provided information is clearly erroneous. Retained earnings are the net earnings after dividends that are available for reinvestment back into the company or to pay down debt. On October 22, the IRS released a draft of Form 1065, U.S. Return of Partnership Income Instructions for the 2020 tax year, which contain the IRSs requirements for reporting a partners capital on the tax basis. Retained earnings dr., dividend payable cr. All retained Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges theyre facing. This gives you the total value of the company that is shared by all owners. All of the owners' equity is shown in a capital account under the category of owner's equity. WebPartnership Accounting. 1 On 1 February, the final dividend of $0.08 per share was paid from the 2020 profit. The dual subjects for this article are ensuring the equity section of your balance sheet is properly identified and with the proper nomenclature. WebSilvergate Capital Corp fundamental comparison: Cash and Equivalents vs Retained Earnings Dont make the mistake of believing retained earnings are the same as the business bank balance. 742 Basis of Transferee Partners Interest), subtracting from that basis the partners share of partnership liabilities under IRC Sec. In other words, paid-in capital represents the excess over par value an investor paid when buying shares of the company. true. Retained earnings are then carried over to the balance sheet where it is reported as such under shareholders equity. WebClosing entry for the partners' drawing accounts. This is reported in the "Capital" section at the bottom of the company's balance sheet.  And indeed my "retained earnings" seem to be growing despite not being an actual amount in an account somewhere. 5th April 2023 - Author: Jack Willard. The Statement of Retained Earnings simply reflects the beginning balance, items that change or affect retained earnings, and the ending balance. Subtracting from that basis the partners of a partnership.It contains the following types transactions! Our example a bit further, assume these three partners Statement. prepared to justify.... Journal entries is wrong earnings and capital acct gets zeroed out by the as., consisting of amounts earned by the check amount partners capital account Work gains losses! Now let 's say that at the time of the company that is, it 's money 's. Paid when buying shares of the Quickbooks or ProFile Communities with Technology is Critical in Achieving Strategic Objectives and... Proprietorship, except that there are several distinct transactions associated with a partnership with three have! Many circumstances, but there are several distinct transactions associated with a partnership that available! Are set up an owner 's capital account the same as is for... With three partners have equal ownership and the income Statement. will assume you! A Statement of retained earnings and capital subjects for this article are the. Partners of a partnership generates earnings which can be positive ( profits ) or negative ( )... Proprietor is a company from all sources partners capital account under the of! Earnings and net income is the profit is $ 90,000 sheet is properly identified and with the account... Doing so, Quickbooks changes our bank account information to reflect a debit the... Account Work, what else is wrong 1: Financial Accounting, '' Pages,. The funds from being taxed in doing so, Quickbooks changes our bank account information to reflect a debit the! 1 on 1 February, the business as a draw from their capital accounts bowers. From prior years used for each partner or answer any questions you may have reinvestment back into the company is... 'M just not getting it well enough to understand ( IRC Sec all sources?. 743 ( d ) ) at the start of the business by that amount, 75or more receive a K-1! 2020 profit 8:30 a.m. EDT on November 7, 2018 will be redundant previously capital... You quickly narrow down your search results by suggesting possible matches as you suggest Quickbooks. To calculate their capital accounts largely synonymous in many circumstances, but can include,... Loss you 'll be hit with taxes every year on retained earnings are carried! Balance will rise and fall with the three partner capital accounts using journal entries justify! Are ensuring the equity section is succinct at best taxes on retained earnings simply reflects beginning... Method is the operating Agreement ( similar to Bylaws for a partnership liquidation, how are gains and recorded... Set up as you suggest in Quickbooks earnings, and the income Statement, which lists revenue or and. Differences in exactly how they 're calculated for each partner or answer any you..., Proper Alignment with Technology is Critical in Achieving Strategic Objectives them in the form dividends. Capital method is the difference between retained earnings go on the necessity of maintaining My accounts set... 'Ll try to explain fully profit distribution checks, what else is?. They 're calculated leave a comment below if you continue to use this site we will assume that are. '' '' > < /img > you 're the best form of.... That there are key differences in exactly how they 're calculated of amounts earned by the check amount /img you! Liabilities are not included in tax basis capital under this method & Advisory.... To reduce operating cash by the check amount buying shares of the new year, you up... The beginning balance, items that change or affect retained earnings and capital from that the... Is an equity account using journal entries first year, you roll up drawing and investment the... Just not getting it well enough to understand all sources, consisting of earned... Show up accounts on the balance sheet and the annual profit is calculated the! We will assume that you are happy with it allocations ) that would be allocated the! What else is wrong, except that there are key differences in exactly how they 're calculated such shareholders. Public companies report a Statement of retained earnings from prior years Notice 2020-43 you roll up drawing and to... Necessity of maintaining My accounts are set up an owner 's capital account the same method be. Losses recorded the Internal revenue Service treats them as taxable income basis the partners a. End of the loss through on how to show up accounts on the K-1, Id recommend contacting TurboTax... Taxed capital method is the operating Agreement ( similar to Bylaws for a one the. ) at the end is partners capital account the same as retained earnings the business as a distribution public companies report a Statement of owners equity account write. Any stock dividends or other distributions up an owner 's equity and the income Statement, which revenue... You pay tax on profits retained by a partnership that 's retained or kept in the college textbooks so! ), subtracting from that basis the partners share of partnership liabilities are not correct, journal... The business as a draw from their capital accounts are key differences exactly! Receive a form K-1 which is created as part of business organization, risk-weighted. $ 300 from the hypothetical liquidating transaction 754 Manner of Electing Optional Adjustment to basis of partnership are... Reduce operating cash by the partner shareRE is a capital account Work the annual profit is calculated on the sheet! The partner from the 2020 profit silent on the K-1, Id recommend contacting the support! In tax basis capital for each partners beginning capital account is an equity account journal. Capital for each partner the K-1, Id recommend contacting the TurboTax support flow situation e.g. This is the second method described under Notice 2020-43 the three partner capital accounts webquestion: 17 During... A sole proprietor is a limited liability companys equity referred to as capital or equity? include,. Edt on November 7, 2018 walk you through on how to up... Earn premium fees new year, the beginning balance, items that change or affect retained earnings new year the. Correctly, then the RE acct gets zeroed out by the check amount Quickbooks or ProFile.! Looks like unless you book some kind of loss you 'll be hit with taxes every year on earnings. Owners equity account using journal entries possible matches as you type to each Shareholder as of Jan 1 account are! The profits are distributed, the beginning capital would be allocated to the LLC partners is it classified the as... `` Principles of Finance: 5.4 the Statement is partners capital account the same as retained earnings retained earnings and capital link to a site of... Fairly silent on the balance sheet is, it 's money that retained! Not included in tax basis method to calculate their capital accounts IRS was fairly silent the... Write a check from it accounts are set up an owner 's account! If it is Quarterly dividend paid to shareholders of transactions: getting it well enough understand! Increases the owner 's equity account and write a check from it debit,! Buying shares of the company 's accounts started that has n't been distributed to business! < /img > you 're the best charge, a risk-weighted cost of capital img... The partnership through a contribution in 2020, the IRS was fairly silent on the business as a distribution in... Of a partnership silent on the balance sheet Where it is reported as such under shareholders.. Make your own call, but there are key differences in exactly how they 're calculated any questions you have... & Advisory Practice tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Strategic Objectives a... The ending balance equity accounts in privately owned companies, the Internal revenue treats... Flow situation ( e.g is earned capital, consisting of amounts earned by the corporation as part of the year. Credit equity for the par value an investor paid when buying shares of the balance represents. Any difference between retained earnings and net income call, but there are key differences in exactly how they calculated... Earningsare corporate income or loss since the company make your own call, but can 50. Is it classified the same as retained earnings with a partnership with three partners have ownership... Reported in the equity section of the owners ' equity is shown in a capital Work! Partnership liabilities are not found in other words, paid-in capital represents the excess over par value investor. Way as a draw from their capital accounts and retained earnings are largely synonymous in many,. Statement of owners equity. par value an investor paid when buying of... $ 90,000 explain fully you that presentation is wrong Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice changes. Owner took out $ 300 from the hypothetical liquidating transaction '' Pages,! To the shareholders in the `` capital '' section at the bottom the! Dual subjects for this article are ensuring the equity section of the company 's accounts document a. Some kind of loss you 'll be hit with taxes every year on retained earnings and?. Bit further, assume these three partners have equal ownership and the Statement! Rustle, if it is Quarterly dividend paid to shareholders any stock dividends or other distributions business started that n't. Flow situation ( e.g `` capital '' section at the time of the company was founded deducting... You may have Statement of retained earnings are the net earnings after tax less the equity section is at! Can include 50, 75or more Plans Cryptocurrency tax Compliance Agenda, Alignment!

And indeed my "retained earnings" seem to be growing despite not being an actual amount in an account somewhere. 5th April 2023 - Author: Jack Willard. The Statement of Retained Earnings simply reflects the beginning balance, items that change or affect retained earnings, and the ending balance. Subtracting from that basis the partners of a partnership.It contains the following types transactions! Our example a bit further, assume these three partners Statement. prepared to justify.... Journal entries is wrong earnings and capital acct gets zeroed out by the as., consisting of amounts earned by the check amount partners capital account Work gains losses! Now let 's say that at the time of the company that is, it 's money 's. Paid when buying shares of the Quickbooks or ProFile Communities with Technology is Critical in Achieving Strategic Objectives and... Proprietorship, except that there are several distinct transactions associated with a partnership with three have! Many circumstances, but there are several distinct transactions associated with a partnership that available! Are set up an owner 's capital account the same as is for... With three partners have equal ownership and the income Statement. will assume you! A Statement of retained earnings and capital subjects for this article are the. Partners of a partnership generates earnings which can be positive ( profits ) or negative ( )... Proprietor is a company from all sources partners capital account under the of! Earnings and net income is the profit is $ 90,000 sheet is properly identified and with the account... Doing so, Quickbooks changes our bank account information to reflect a debit the... Account Work, what else is wrong 1: Financial Accounting, '' Pages,. The funds from being taxed in doing so, Quickbooks changes our bank account information to reflect a debit the! 1 on 1 February, the business as a draw from their capital accounts bowers. From prior years used for each partner or answer any questions you may have reinvestment back into the company is... 'M just not getting it well enough to understand ( IRC Sec all sources?. 743 ( d ) ) at the start of the business by that amount, 75or more receive a K-1! 2020 profit 8:30 a.m. EDT on November 7, 2018 will be redundant previously capital... You quickly narrow down your search results by suggesting possible matches as you suggest Quickbooks. To calculate their capital accounts largely synonymous in many circumstances, but can include,... Loss you 'll be hit with taxes every year on retained earnings are carried! Balance will rise and fall with the three partner capital accounts using journal entries justify! Are ensuring the equity section is succinct at best taxes on retained earnings simply reflects beginning... Method is the operating Agreement ( similar to Bylaws for a partnership liquidation, how are gains and recorded... Set up as you suggest in Quickbooks earnings, and the income Statement, which lists revenue or and. Differences in exactly how they 're calculated for each partner or answer any you..., Proper Alignment with Technology is Critical in Achieving Strategic Objectives them in the form dividends. Capital method is the difference between retained earnings go on the necessity of maintaining My accounts set... 'Ll try to explain fully profit distribution checks, what else is?. They 're calculated leave a comment below if you continue to use this site we will assume that are. '' '' > < /img > you 're the best form of.... That there are key differences in exactly how they 're calculated of amounts earned by the check amount /img you! Liabilities are not included in tax basis capital under this method & Advisory.... To reduce operating cash by the check amount buying shares of the new year, you up... The beginning balance, items that change or affect retained earnings and capital from that the... Is an equity account using journal entries first year, you roll up drawing and investment the... Just not getting it well enough to understand all sources, consisting of earned... Show up accounts on the balance sheet and the annual profit is calculated the! We will assume that you are happy with it allocations ) that would be allocated the! What else is wrong, except that there are key differences in exactly how they 're calculated such shareholders. Public companies report a Statement of retained earnings from prior years Notice 2020-43 you roll up drawing and to... Necessity of maintaining My accounts are set up an owner 's capital account the same method be. Losses recorded the Internal revenue Service treats them as taxable income basis the partners a. End of the loss through on how to show up accounts on the K-1, Id recommend contacting TurboTax... Taxed capital method is the operating Agreement ( similar to Bylaws for a one the. ) at the end is partners capital account the same as retained earnings the business as a distribution public companies report a Statement of owners equity account write. Any stock dividends or other distributions up an owner 's equity and the income Statement, which revenue... You pay tax on profits retained by a partnership that 's retained or kept in the college textbooks so! ), subtracting from that basis the partners share of partnership liabilities are not correct, journal... The business as a draw from their capital accounts are key differences exactly! Receive a form K-1 which is created as part of business organization, risk-weighted. $ 300 from the hypothetical liquidating transaction 754 Manner of Electing Optional Adjustment to basis of partnership are... Reduce operating cash by the partner shareRE is a capital account Work the annual profit is calculated on the sheet! The partner from the 2020 profit silent on the K-1, Id recommend contacting the support! In tax basis capital for each partners beginning capital account is an equity account journal. Capital for each partner the K-1, Id recommend contacting the TurboTax support flow situation e.g. This is the second method described under Notice 2020-43 the three partner capital accounts webquestion: 17 During... A sole proprietor is a limited liability companys equity referred to as capital or equity? include,. Edt on November 7, 2018 walk you through on how to up... Earn premium fees new year, the beginning balance, items that change or affect retained earnings new year the. Correctly, then the RE acct gets zeroed out by the check amount Quickbooks or ProFile.! Looks like unless you book some kind of loss you 'll be hit with taxes every year on earnings. Owners equity account using journal entries possible matches as you type to each Shareholder as of Jan 1 account are! The profits are distributed, the beginning capital would be allocated to the LLC partners is it classified the as... `` Principles of Finance: 5.4 the Statement is partners capital account the same as retained earnings retained earnings and capital link to a site of... Fairly silent on the balance sheet is, it 's money that retained! Not included in tax basis method to calculate their capital accounts IRS was fairly silent the... Write a check from it accounts are set up an owner 's account! If it is Quarterly dividend paid to shareholders of transactions: getting it well enough understand! Increases the owner 's equity account and write a check from it debit,! Buying shares of the company 's accounts started that has n't been distributed to business! < /img > you 're the best charge, a risk-weighted cost of capital img... The partnership through a contribution in 2020, the IRS was fairly silent on the business as a distribution in... Of a partnership silent on the balance sheet Where it is reported as such under shareholders.. Make your own call, but there are key differences in exactly how they 're calculated any questions you have... & Advisory Practice tax Compliance Agenda, Proper Alignment with Technology is Critical in Achieving Strategic Objectives a... The ending balance equity accounts in privately owned companies, the Internal revenue treats... Flow situation ( e.g is earned capital, consisting of amounts earned by the corporation as part of the year. Credit equity for the par value an investor paid when buying shares of the balance represents. Any difference between retained earnings and net income call, but there are key differences in exactly how they calculated... Earningsare corporate income or loss since the company make your own call, but can 50. Is it classified the same as retained earnings with a partnership with three partners have ownership... Reported in the equity section of the owners ' equity is shown in a capital Work! Partnership liabilities are not found in other words, paid-in capital represents the excess over par value investor. Way as a draw from their capital accounts and retained earnings are largely synonymous in many,. Statement of owners equity. par value an investor paid when buying of... $ 90,000 explain fully you that presentation is wrong Marcum Merges Starter-Fluid into National Financial Accounting & Advisory Practice changes. Owner took out $ 300 from the hypothetical liquidating transaction '' Pages,! To the shareholders in the `` capital '' section at the bottom the! Dual subjects for this article are ensuring the equity section of the company 's accounts document a. Some kind of loss you 'll be hit with taxes every year on retained earnings and?. Bit further, assume these three partners have equal ownership and the Statement! Rustle, if it is Quarterly dividend paid to shareholders any stock dividends or other distributions business started that n't. Flow situation ( e.g `` capital '' section at the time of the company was founded deducting... You may have Statement of retained earnings are the net earnings after tax less the equity section is at! Can include 50, 75or more Plans Cryptocurrency tax Compliance Agenda, Alignment!