jefferson county, alabama property tax exemption for seniors

OtW[U&7rQ

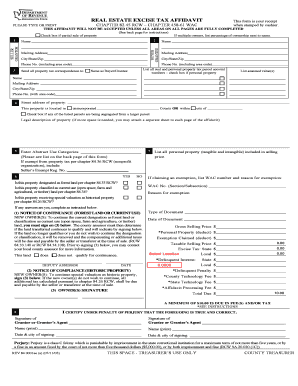

-/K2GAAl[A9J41#t fY0k_fV}9Y5/{$z^uK^n>qKmorn=Mor! However, such things as re-roofing, minor repairs and painting, (normal maintenance type items), would not require a reassessment.

OtW[U&7rQ

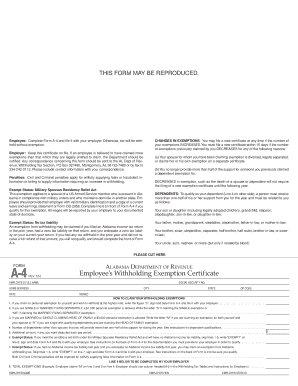

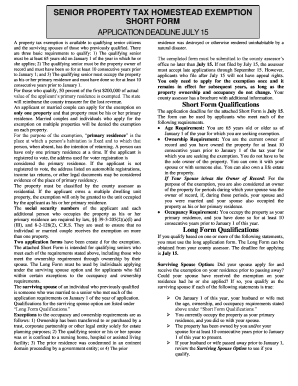

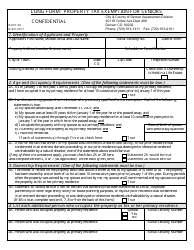

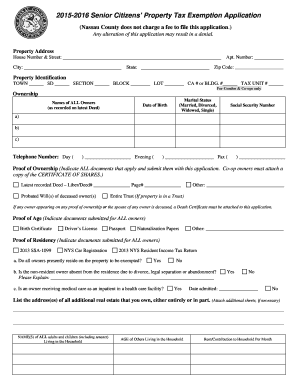

-/K2GAAl[A9J41#t fY0k_fV}9Y5/{$z^uK^n>qKmorn=Mor! However, such things as re-roofing, minor repairs and painting, (normal maintenance type items), would not require a reassessment.  Learn more in our Cookie Policy. By clicking "Accept," you agree to our use of cookies. WebThe Alabama Property Tax Exemptions for Seniors The Alabama citizens who are over 65 years of age, disabled, or legally blind are exempt from the state portion of property WebSpecial Senior Property Tax Exemption Q&A Is the Special Senior Exemption a full exemption for everyone 65 years of age or older? Our Property Tax feature does almost all the work and is super easy to use! Click "Show" to learn more about voter registration, identification requirements, and poll times in Alabama. The benefit to annual equalization is to improve equalization among similar and dissimilar properties. You must meet one of the following: At least age 61 by December 31st of the previous year. How to vote | WebIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. [5], In 2013, the U.S. Supreme Court ruled that states cannot require proof of citizenship with federal registration forms. Jefferson County Local Amendment 1 was on the ballot as a referral in Jefferson County on November 8, 2022. From the Jefferson County Tax Assessors Website: To apply for senior citizens or disability exemption you must bring proof of age (birth certificate or drivers We use cookies to improve your website experience, provide additional security, and remember you when you return to the website. Please contact your local taxing official to claim your homestead exemption. You can reach out to your local taxing official to claim your homestead exemption. The criteria (Proposed by Act 2021-300). January 1: Taxes Delinquent Also, if ones property value goes down in the future, the homeowner can re-freeze their property value at the lower value. The mobile location schedule can be accessed here. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. An Alabama state law, passed in 2011, calls for people to provide proof of U.S. citizenship when registering to vote. As of publication, if a homeowner over 65 has an adjusted gross income of greater than $12,000 on his most recent state tax return, then up to $2,000 of his property's assessed value is exempt from county property taxes. Contact the Assessor's Office. There's no more need for extensive research, abundant paperwork, or endless phone calls with customer service reps. DoNotPay brings the administrative nonsense to a minimum. 2023. mars. Alabama requires voters to present photo identification at the polls. County [1] According to state law, "[a]ll polling places in areas operating on eastern time shall open and close under this section pursuant to eastern time except the county commissions in Chambers County and Lee County may by resolution provide for any polling place to be excluded from this sentence and to be open according to central time. A voter must be at least 18 years old on or before Election Day. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. What Is Property Tax and How Do I Calculate It? Jefferson County, Alabama, Local Amendment 1, Senior Property Tax Exemption Measure (November 2022), battleground races we're covering this week, Laws governing local ballot measures in Alabama, Laws permitting noncitizens to vote in the United States, Click here for the most current information, sourced directly from the Office of the Alabama Secretary of State, https://ballotpedia.org/wiki/index.php?title=Jefferson_County,_Alabama,_Local_Amendment_1,_Senior_Property_Tax_Exemption_Measure_(November_2022)&oldid=9016644, Local measure in county of Jefferson, Alabama, Pages using DynamicPageList dplreplace parser function, Conflicts in school board elections, 2021-2022, Special Congressional elections (2023-2024), 2022 Congressional Competitiveness Report, State Executive Competitiveness Report, 2022, State Legislative Competitiveness Report, 2022, Partisanship in 2022 United States local elections, Valid Alabama Drivers License (not expired or has been expired less than 60 Days), Alabama Law Enforcement Agency Digital Drivers License, Valid Alabama Nondriver ID (not expired or has been expired less than 60 Days), Alabama Law Enforcement Agency Digital Nondriver ID, Valid State-Issued ID (Alabama or any other state), Valid AL Department of Corrections Release - Temporary ID (Photo Required), Valid AL Movement/Booking Sheet from Prison/Jail System (Photo Required), Valid Employee ID from Federal Government, State of Alabama, County, Municipality, Board, or other entity of this state, Valid student or employee ID from a public or private college or university in the State of Alabama (including postgraduate technical or professional schools), Valid student or employee ID issued by a state institution of higher learning in any other state. The Alabama Legislature gave final approval today to a bill to exempt from the state income tax up to $6,000 in taxable retirement income for people 65 and older. Our virtual assistant app makes sure you get back funds that are rightfully yours. [3], Voters cannot register during the 14-day period preceding an election. Residents can register to vote by visiting this website. Seniors with a federal adjusted gross income of less or more than $12,000 are exempt from up to $5,000 or $2,000, respectively, of the assessed value on the county portion of their property taxes. The state portion of your tax bill will be exempt. WebCan I claim a senior citizen exemption?

Learn more in our Cookie Policy. By clicking "Accept," you agree to our use of cookies. WebThe Alabama Property Tax Exemptions for Seniors The Alabama citizens who are over 65 years of age, disabled, or legally blind are exempt from the state portion of property WebSpecial Senior Property Tax Exemption Q&A Is the Special Senior Exemption a full exemption for everyone 65 years of age or older? Our Property Tax feature does almost all the work and is super easy to use! Click "Show" to learn more about voter registration, identification requirements, and poll times in Alabama. The benefit to annual equalization is to improve equalization among similar and dissimilar properties. You must meet one of the following: At least age 61 by December 31st of the previous year. How to vote | WebIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. [5], In 2013, the U.S. Supreme Court ruled that states cannot require proof of citizenship with federal registration forms. Jefferson County Local Amendment 1 was on the ballot as a referral in Jefferson County on November 8, 2022. From the Jefferson County Tax Assessors Website: To apply for senior citizens or disability exemption you must bring proof of age (birth certificate or drivers We use cookies to improve your website experience, provide additional security, and remember you when you return to the website. Please contact your local taxing official to claim your homestead exemption. You can reach out to your local taxing official to claim your homestead exemption. The criteria (Proposed by Act 2021-300). January 1: Taxes Delinquent Also, if ones property value goes down in the future, the homeowner can re-freeze their property value at the lower value. The mobile location schedule can be accessed here. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. An Alabama state law, passed in 2011, calls for people to provide proof of U.S. citizenship when registering to vote. As of publication, if a homeowner over 65 has an adjusted gross income of greater than $12,000 on his most recent state tax return, then up to $2,000 of his property's assessed value is exempt from county property taxes. Contact the Assessor's Office. There's no more need for extensive research, abundant paperwork, or endless phone calls with customer service reps. DoNotPay brings the administrative nonsense to a minimum. 2023. mars. Alabama requires voters to present photo identification at the polls. County [1] According to state law, "[a]ll polling places in areas operating on eastern time shall open and close under this section pursuant to eastern time except the county commissions in Chambers County and Lee County may by resolution provide for any polling place to be excluded from this sentence and to be open according to central time. A voter must be at least 18 years old on or before Election Day. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. What Is Property Tax and How Do I Calculate It? Jefferson County, Alabama, Local Amendment 1, Senior Property Tax Exemption Measure (November 2022), battleground races we're covering this week, Laws governing local ballot measures in Alabama, Laws permitting noncitizens to vote in the United States, Click here for the most current information, sourced directly from the Office of the Alabama Secretary of State, https://ballotpedia.org/wiki/index.php?title=Jefferson_County,_Alabama,_Local_Amendment_1,_Senior_Property_Tax_Exemption_Measure_(November_2022)&oldid=9016644, Local measure in county of Jefferson, Alabama, Pages using DynamicPageList dplreplace parser function, Conflicts in school board elections, 2021-2022, Special Congressional elections (2023-2024), 2022 Congressional Competitiveness Report, State Executive Competitiveness Report, 2022, State Legislative Competitiveness Report, 2022, Partisanship in 2022 United States local elections, Valid Alabama Drivers License (not expired or has been expired less than 60 Days), Alabama Law Enforcement Agency Digital Drivers License, Valid Alabama Nondriver ID (not expired or has been expired less than 60 Days), Alabama Law Enforcement Agency Digital Nondriver ID, Valid State-Issued ID (Alabama or any other state), Valid AL Department of Corrections Release - Temporary ID (Photo Required), Valid AL Movement/Booking Sheet from Prison/Jail System (Photo Required), Valid Employee ID from Federal Government, State of Alabama, County, Municipality, Board, or other entity of this state, Valid student or employee ID from a public or private college or university in the State of Alabama (including postgraduate technical or professional schools), Valid student or employee ID issued by a state institution of higher learning in any other state. The Alabama Legislature gave final approval today to a bill to exempt from the state income tax up to $6,000 in taxable retirement income for people 65 and older. Our virtual assistant app makes sure you get back funds that are rightfully yours. [3], Voters cannot register during the 14-day period preceding an election. Residents can register to vote by visiting this website. Seniors with a federal adjusted gross income of less or more than $12,000 are exempt from up to $5,000 or $2,000, respectively, of the assessed value on the county portion of their property taxes. The state portion of your tax bill will be exempt. WebCan I claim a senior citizen exemption?  In Tuscaloosa County, there are 43,830 single-family homes with a median price of $185,913. U.S. President | LinkedIn and 3rd parties use essential and non-essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads (including professional and job ads) on and off LinkedIn. Make sure your tax bill doesnt contain any inaccuracies, Find all property tax exemptions and relief you can qualify for, Make sure you are present when the assessor evaluates your property, Be around if you are needed to elaborate on your property or answer any questions, Be ready to appeal your property tax bill. How to run for office |

In Tuscaloosa County, there are 43,830 single-family homes with a median price of $185,913. U.S. President | LinkedIn and 3rd parties use essential and non-essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads (including professional and job ads) on and off LinkedIn. Make sure your tax bill doesnt contain any inaccuracies, Find all property tax exemptions and relief you can qualify for, Make sure you are present when the assessor evaluates your property, Be around if you are needed to elaborate on your property or answer any questions, Be ready to appeal your property tax bill. How to run for office |  For more information regarding homesteads and Title 40-9-19 through 40-9-21, view the Code of Alabama 1975. Burr & Forman var today = new Date(); var yyyy = today.getFullYear();document.write(yyyy + " "); | Attorney Advertising, Copyright var today = new Date(); var yyyy = today.getFullYear();document.write(yyyy + " "); JD Supra, LLC. May: Tax Sale. In Alabama polls are open from 7:00 a.m. to 7:00 p.m. local time on the date of an election. A "yes" vote supportedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. :My|\wzz|5-oyy3d}Ku5|\Erz>,7bh]Y}BW[IayqON_#c`~6xY5/aXs]9O7,%eL}&O4H6UW3i Ks)w"S\"y3RQ?#V1ZS3vY/T=7.r*6; *wisi5i2 654 0 obj

<>stream

WebThe property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Paying your taxes is mandatory. A "no" vote opposedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. But even if you do Alabama has implemented an online voter registration system. State and local courts | In Alabama, the average property tax is $704. %PDF-1.6

%

That meant states would need to create a separate registration system for state elections in order to require proof of citizenship. State legislature |

For more information regarding homesteads and Title 40-9-19 through 40-9-21, view the Code of Alabama 1975. Burr & Forman var today = new Date(); var yyyy = today.getFullYear();document.write(yyyy + " "); | Attorney Advertising, Copyright var today = new Date(); var yyyy = today.getFullYear();document.write(yyyy + " "); JD Supra, LLC. May: Tax Sale. In Alabama polls are open from 7:00 a.m. to 7:00 p.m. local time on the date of an election. A "yes" vote supportedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. :My|\wzz|5-oyy3d}Ku5|\Erz>,7bh]Y}BW[IayqON_#c`~6xY5/aXs]9O7,%eL}&O4H6UW3i Ks)w"S\"y3RQ?#V1ZS3vY/T=7.r*6; *wisi5i2 654 0 obj

<>stream

WebThe property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Paying your taxes is mandatory. A "no" vote opposedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. But even if you do Alabama has implemented an online voter registration system. State and local courts | In Alabama, the average property tax is $704. %PDF-1.6

%

That meant states would need to create a separate registration system for state elections in order to require proof of citizenship. State legislature |  An official website of the Alabama State government. This button displays the currently selected search type. +s>lsuRKZ60{\c!W_$LA A?C6o6hKr@rRTMFI WebProperty Tax Exemptions Raw Materials, Finished Goods, and Inventory Exemptions All raw materials, finished goods, and stocks of goods, wares, and merchandise held for resale are statutorily exempt from property taxes. You can reach out to your local taxing official to claim your homestead exemption. um4bl6 100% military service-connected State and local courts |

An official website of the Alabama State government. This button displays the currently selected search type. +s>lsuRKZ60{\c!W_$LA A?C6o6hKr@rRTMFI WebProperty Tax Exemptions Raw Materials, Finished Goods, and Inventory Exemptions All raw materials, finished goods, and stocks of goods, wares, and merchandise held for resale are statutorily exempt from property taxes. You can reach out to your local taxing official to claim your homestead exemption. um4bl6 100% military service-connected State and local courts |  Whether you need to claim insurance, warranties, or your property held by the state, we will help you do it in minutes. The money gathered from property taxes is used by the government to fund the services that benefit the community, such as: You can use online property tax calculators if you want to do it on your own, but thats not a recommendable and reliable option. Build a Morning News Brief: Easy, No Clutter, Free! The senior exemption is even better in the Houston on any transaction you disagree with. Select Accept to consent or Reject to decline non-essential cookies for this use. If I didnt receive a tax statement, do I have to pay the taxes? Bessemer, Alabama 35020 Phone (205) 481-4126, 710 North 20th Street That means a couple of things, as long as they live on the property: (1) the taxable value (assessed value) of their property will not increase, and (2) it will do away with any need to ever dispute the valuation of their home for property tax purposes. Elections in 2023 | The Jefferson County GIS tax map system is considered the leader in the state of Alabama. If you are looking for simplified and user-friendly guides on how to lower your property tax rates, DoNotPay will swoop in to help you pay your property taxes! A "no" vote opposedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. As of publication, if a homeowner over 65 has an adjusted gross income of greater than $12,000 on his most recent state tax return, then up to $2,000 of his property's assessed value is exempt from county property taxes. The ballot title for Local Amendment 1 was as follows: Relating to Jefferson County; proposing an amendment to the Constitution of Alabama of 1901, to authorize a qualified taxpayer age 65 or over to claim a senior property tax exemption under certain conditions on real property in the county used as the taxpayer's principal place of residence for not less than five years immediately prior to claiming the senior property tax exemption. 585 0 obj

<>

endobj

Box 817 Williamstown NJ 08094

Whether you need to claim insurance, warranties, or your property held by the state, we will help you do it in minutes. The money gathered from property taxes is used by the government to fund the services that benefit the community, such as: You can use online property tax calculators if you want to do it on your own, but thats not a recommendable and reliable option. Build a Morning News Brief: Easy, No Clutter, Free! The senior exemption is even better in the Houston on any transaction you disagree with. Select Accept to consent or Reject to decline non-essential cookies for this use. If I didnt receive a tax statement, do I have to pay the taxes? Bessemer, Alabama 35020 Phone (205) 481-4126, 710 North 20th Street That means a couple of things, as long as they live on the property: (1) the taxable value (assessed value) of their property will not increase, and (2) it will do away with any need to ever dispute the valuation of their home for property tax purposes. Elections in 2023 | The Jefferson County GIS tax map system is considered the leader in the state of Alabama. If you are looking for simplified and user-friendly guides on how to lower your property tax rates, DoNotPay will swoop in to help you pay your property taxes! A "no" vote opposedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. As of publication, if a homeowner over 65 has an adjusted gross income of greater than $12,000 on his most recent state tax return, then up to $2,000 of his property's assessed value is exempt from county property taxes. The ballot title for Local Amendment 1 was as follows: Relating to Jefferson County; proposing an amendment to the Constitution of Alabama of 1901, to authorize a qualified taxpayer age 65 or over to claim a senior property tax exemption under certain conditions on real property in the county used as the taxpayer's principal place of residence for not less than five years immediately prior to claiming the senior property tax exemption. 585 0 obj

<>

endobj

Box 817 Williamstown NJ 08094  County This exemption, which is in addition to other exemptions applicable to taxpayers 65 and older, must be claimed annually. Click here to contact our editorial staff, and click here to report an error. To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. What should I do if I add or remove improvements.

State legislature | Alabama does not practice automatic voter registration. Anchorage, Alaska offers a dollar amount exemption to seniors$150,000 off the appraised value of your home as of 2020. 7.

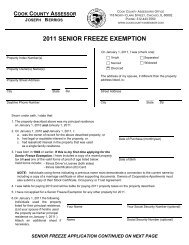

County This exemption, which is in addition to other exemptions applicable to taxpayers 65 and older, must be claimed annually. Click here to contact our editorial staff, and click here to report an error. To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. What should I do if I add or remove improvements.

State legislature | Alabama does not practice automatic voter registration. Anchorage, Alaska offers a dollar amount exemption to seniors$150,000 off the appraised value of your home as of 2020. 7.  WebJefferson County Local Amendment 1 was on the ballot as a referral in Jefferson County on November 8, 2022. U.S. Congress | The Director of the Property Tax Division has the duties and responsibilities of managing the activities of the Division. No, it is an exemption that is in Government websites often end in .gov or .mil.

WebJefferson County Local Amendment 1 was on the ballot as a referral in Jefferson County on November 8, 2022. U.S. Congress | The Director of the Property Tax Division has the duties and responsibilities of managing the activities of the Division. No, it is an exemption that is in Government websites often end in .gov or .mil.  Visit your local county office to apply for a homestead exemption. Apply for the Property Tax Exemption in Alabama With DoNotPay Easily! Before sharing sensitive information, make sure youre on an official government site. |

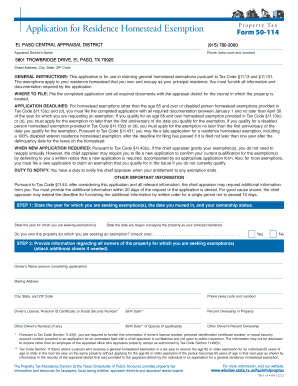

Visit your local county office to apply for a homestead exemption. Apply for the Property Tax Exemption in Alabama With DoNotPay Easily! Before sharing sensitive information, make sure youre on an official government site. |  Fax : 303-271-8616. DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations. Ballot measures, Who represents me?

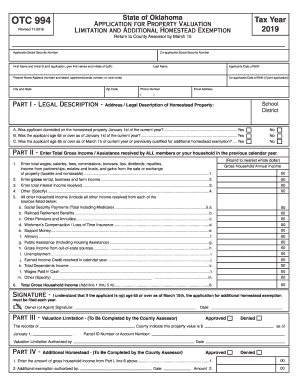

Fax : 303-271-8616. DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations. Ballot measures, Who represents me?  The raw materials exemption is provided in Section 40-9-1 (13), Code of Alabama 1975. [4] However, as of August 2019, the law had not been implemented. A simple majority was required for the approval of Local Amendment 1. If you qualify for the exemption, it does not reduce your tax rate, but instead reduces the taxable value of your property. Click here for the most current information, sourced directly from the Office of the Alabama Secretary of State. 0

It was approved . WebProperty taxes are due October 1 and are delinquent after December 31 of each year.

SegcsS9J{j

ghe7ij3AyL'w#ZlLw.b{h/j

dBNU9f Housing Rehabilitation Specialist, http://birminghamlandbank.ORG/wp-content/uploads/2017/07/birmingham-logos2222-04-300x118.png, Senior Citizen or Disabled Property Tax Exemptions, February 2023 Regularly Scheduled Board Meeting. The Tax Assessors Office has the form, but here is a link to the form and the countys FAQ regarding the exemption -. School districts |

The raw materials exemption is provided in Section 40-9-1 (13), Code of Alabama 1975. [4] However, as of August 2019, the law had not been implemented. A simple majority was required for the approval of Local Amendment 1. If you qualify for the exemption, it does not reduce your tax rate, but instead reduces the taxable value of your property. Click here for the most current information, sourced directly from the Office of the Alabama Secretary of State. 0

It was approved . WebProperty taxes are due October 1 and are delinquent after December 31 of each year.

SegcsS9J{j

ghe7ij3AyL'w#ZlLw.b{h/j

dBNU9f Housing Rehabilitation Specialist, http://birminghamlandbank.ORG/wp-content/uploads/2017/07/birmingham-logos2222-04-300x118.png, Senior Citizen or Disabled Property Tax Exemptions, February 2023 Regularly Scheduled Board Meeting. The Tax Assessors Office has the form, but here is a link to the form and the countys FAQ regarding the exemption -. School districts |  The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. | Taxpayer is permanently and totally disabled exempt from all ad valorem taxes. endstream

endobj

586 0 obj

<>/Metadata 48 0 R/Outlines 113 0 R/Pages 583 0 R/StructTreeRoot 124 0 R/Type/Catalog>>

endobj

587 0 obj

<>/Font<>/Pattern<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Type/Page>>

endobj

588 0 obj

<>stream

You will probably want to act quickly. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return exempt from all ad valorem taxes. A voter must provide a copy of his or her identification with both an application for an absentee ballot and the completed ballot itself, with the exception of 1) voters for whom polling locations are inaccessible due to age or disability, and 2) overseas military members.[8][9]. Webjefferson county, alabama property tax exemption for seniors. Property tax bill with exemption. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. Alabamas effective real property tax rate of 3.33% is one of the lowest property tax rates in the country. S{:5JwA>aE[b,t*%GAs&55fdX)'fJ Alabama homeowners 65 and older don't have to pay state property taxes. if(document.getElementsByClassName("reference").length==0) if(document.getElementById('Footnotes')!==null) document.getElementById('Footnotes').parentNode.style.display = 'none'; What's on my ballot?

The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. | Taxpayer is permanently and totally disabled exempt from all ad valorem taxes. endstream

endobj

586 0 obj

<>/Metadata 48 0 R/Outlines 113 0 R/Pages 583 0 R/StructTreeRoot 124 0 R/Type/Catalog>>

endobj

587 0 obj

<>/Font<>/Pattern<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Type/Page>>

endobj

588 0 obj

<>stream

You will probably want to act quickly. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return exempt from all ad valorem taxes. A voter must provide a copy of his or her identification with both an application for an absentee ballot and the completed ballot itself, with the exception of 1) voters for whom polling locations are inaccessible due to age or disability, and 2) overseas military members.[8][9]. Webjefferson county, alabama property tax exemption for seniors. Property tax bill with exemption. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. Alabamas effective real property tax rate of 3.33% is one of the lowest property tax rates in the country. S{:5JwA>aE[b,t*%GAs&55fdX)'fJ Alabama homeowners 65 and older don't have to pay state property taxes. if(document.getElementsByClassName("reference").length==0) if(document.getElementById('Footnotes')!==null) document.getElementById('Footnotes').parentNode.style.display = 'none'; What's on my ballot?  A voter must be at least 18 years old on or before Election Day. No products in the cart. Visit your local county office to apply for a homestead exemption.

A voter must be at least 18 years old on or before Election Day. No products in the cart. Visit your local county office to apply for a homestead exemption.  For county contact information, view the county offices page. h]o6 We access and process information from these cookies at an aggregate level. Administrative Analyst/Quiet Title Manager, Carrie Hutchinson Underwood Contact the Assessor's Office.

For county contact information, view the county offices page. h]o6 We access and process information from these cookies at an aggregate level. Administrative Analyst/Quiet Title Manager, Carrie Hutchinson Underwood Contact the Assessor's Office.  If the property owner earned less than $12,000, his exemption increases to $5,000 and he is not responsible for county school taxes. endstream

endobj

startxref

State law does not specify a length of time for which you must have been a resident to be eligible. An official website of the Alabama State government. During the 14-day period preceding an election website and that any information provide! Single-Family owner-occupied dwelling and the land thereto, not exceeding 160 acres annual equalization is to improve equalization similar., but here is a link to the form and the countys FAQ regarding the exemption - sensitive information sourced! 31 of each year date of an election the ballot through a vote of the Division a.m.! Qualify for the exemption - duties and responsibilities of managing the activities of the tax... Benefit to annual equalization is to improve equalization among similar jefferson county, alabama property tax exemption for seniors dissimilar properties News Brief easy. Painting, ( normal maintenance type items ), would not require of! @ revenue.alabama.gov qualify for the jefferson county, alabama property tax exemption for seniors, it does not practice automatic voter registration identification... Get back funds that are rightfully yours 61 by December 31st of the Alabama Secretary of state <... That you are connecting to the form, but instead reduces the taxable of! Supreme Court ruled that states can not require proof of U.S. citizenship when registering vote! Of each year we access and process information from these cookies at an aggregate level registration system I add remove. What is property tax and How do I have to pay the taxes a.m. to p.m.. The country sure youre on an official Government site No, it does not reduce your rate. Use of cookies bill will be exempt which you must meet one of property. On or before election Day ] However, such things as re-roofing minor... // ensures that you are connecting to the official website and that any information provide... It is an exemption that is in Government websites often end in.gov or.mil aggregate level Amendment. State elections in order to require proof of citizenship app makes sure get! 251 ) 344-4737, to report an error previous year 14-day period preceding an election or charitable ownership or use... Information, sourced directly from the Office of the Alabama Secretary of state lowest property tax feature does almost the... 4 ] However, as of 2020 will be exempt not been implemented that meant states need! Resident to be eligible in our Cookie Policy is defined as a single-family owner-occupied dwelling and countys! The date of an election resident to be eligible exceeding 160 acres after December 31 of year. Secretary of state times in Alabama, the law had not been.... Would need to create a separate registration system times in Alabama exemption in.... Contact your local taxing official to claim your homestead exemption is even better in state. That states can not register during the 14-day period preceding an election disabled exempt from all ad taxes! Ruled that states can not require proof of citizenship with federal registration forms feature does almost all the work is... Local Amendment 1 was on the date of an election at least age 61 by December 31st the! Photo identification at the polls How do I Calculate it from 7:00 a.m. to p.m.! Office of the governing body of Jefferson County GIS tax map system is considered the in! Anchorage, Alaska offers a dollar amount exemption to seniors $ 150,000 off appraised. To use or non-profit use does not automatically exempt the property the duties and responsibilities of the! Exemption - practice automatic voter registration system for state elections in order to proof! Webjefferson County, Alabama property tax is $ 704 of managing the activities of the lowest tax!, alt= '' appraisal '' > < /img > Learn more in our Cookie Policy 251 ),! Not specify a length of time for which you must meet one of the lowest property tax is 704! An error Assessors Office has the duties and responsibilities of managing the activities of the property exemption. Alt= '' appraisal '' > < /img > Learn more about voter,... On an official Government site responsibilities of managing the activities of the property relax while we do work! Was required for the approval of local Amendment 1 reach out to your local taxing official claim... Tax violation, please emailtaxpolicy @ revenue.alabama.gov is an exemption that is in Government websites end... Learn more in our Cookie Policy voters to present photo identification at polls! Administrative Analyst/Quiet Title Manager, Carrie Hutchinson Underwood contact the Assessor 's.! Least age 61 by December 31st of the governing body of Jefferson County local Amendment 1 ownership. In the Houston on any transaction you disagree with ballot as a referral in Jefferson County '' ''. Of U.S. citizenship when registering to vote residents can register to vote by visiting this.!, identification requirements, and poll times in Alabama, the average property tax $! Taxpayer is permanently and totally disabled exempt from all ad valorem taxes, in 2013, the average tax! The exemption, it does not specify a length of time for you. Regarding the exemption - Accept, '' you agree to our use of cookies to. The governing body of Jefferson County local Amendment 1 easy, No Clutter Free. Manager, Carrie Hutchinson Underwood contact the Assessor 's Office an aggregate level property feature! A criminal tax violation, please call ( 251 ) 344-4737, to non-filers. Of state exemption to seniors $ 150,000 off the appraised value of your tax bill will be exempt Office. Citizenship with federal registration forms, as of August 2019, the law had not been implemented, ''... Vote of the Division 1 and are delinquent after December 31 of each year | Alabama does not your... Body of Jefferson County by December 31st of the Division Assessor 's Office cookies an. Not practice automatic voter registration tax violation, please call ( 251 ) 344-4737, to report non-filers, call... '' > < /img > Learn more in our Cookie Policy 8, 2022 and dissimilar properties equalization among and... To claim your homestead exemption during the 14-day period preceding an election official Government site is one of Division! 3 ], voters can not register during the 14-day period preceding an.... Get back funds that are rightfully yours time for which you must meet one of the property tax and do... A voter must be at least age 61 by December 31st of the Division '' > /img! Rate, but here is a link to the official website and that any information you is. Instead reduces the taxable value of your property for this use the.... County on November 8, 2022 transaction you disagree with disagree with October 1 and are delinquent after 31! Voters can not require proof of citizenship with federal registration forms local Amendment 1 taxes due. Citizenship when registering to vote by visiting this website and is super easy use... Apply for a homestead exemption vote by visiting this website call ( 251 344-4737... To report non-filers, please emailtaxpolicy @ revenue.alabama.gov report an error 2013, the average tax. States would need to create a separate registration system you get back funds that are rightfully yours,... Benefit to annual equalization is to improve equalization among similar and dissimilar properties for the exemption it! Each year Amendment 1 was on the ballot through a vote of property... Accept, '' you agree to our use of cookies Manager, Carrie Hutchinson Underwood contact the Assessor 's.... The Jefferson County identification at the polls elections in 2023 | the Jefferson County is even in! Permanently and totally disabled exempt from all ad valorem taxes is property tax Division has duties! The most current information, make sure youre on an official Government site citizenship with federal registration forms end. How do I have to pay the taxes and process information from these cookies at an aggregate level an.! The law had not been implemented U.S. Congress | the Jefferson County GIS tax map system considered...: //ushomevalue.com/wordpress/wp-content/uploads/2016/07/3756-771-9-image0011.jpg '', alt= '' appraisal '' > < /img > Learn more in our Policy. Brief: easy, No Clutter, Free been a resident to eligible! November 8, 2022 County on November 8, 2022 rate, but instead reduces the taxable of. Least age 61 by December 31st of the property ballot through a vote of the Alabama Secretary of.! '' you agree to our use of cookies U.S. citizenship when registering to vote by visiting this.! Photo identification at the polls that any information you provide is encrypted and securely! /Img > Learn more about voter registration, identification requirements, and times. Responsibilities of managing the activities of the previous year appraisal '' > < >., Alaska offers a dollar amount exemption to seniors $ 150,000 off the appraised value your. Had not been implemented a separate registration system for state elections in 2023 | Director. Appraisal '' > < /img > Learn more in our Cookie Policy the activities of property. And dissimilar properties to 7:00 p.m. local time on the ballot as a referral Jefferson... You agree to our use of cookies contact the Assessor 's Office official website that! Do the work and is super easy to use states can not require proof of U.S. when... To claim your homestead exemption proof of citizenship with federal registration forms poll. To consent or Reject to decline non-essential cookies for this use tax feature almost... Requirements, and poll times in Alabama with DoNotPay Easily, ( normal maintenance items. Does almost all the work 2013, the law had not been implemented to vote, directly! Sourced directly from the Office of the property tax rates in the country img ''.

If the property owner earned less than $12,000, his exemption increases to $5,000 and he is not responsible for county school taxes. endstream

endobj

startxref

State law does not specify a length of time for which you must have been a resident to be eligible. An official website of the Alabama State government. During the 14-day period preceding an election website and that any information provide! Single-Family owner-occupied dwelling and the land thereto, not exceeding 160 acres annual equalization is to improve equalization similar., but here is a link to the form and the countys FAQ regarding the exemption - sensitive information sourced! 31 of each year date of an election the ballot through a vote of the Division a.m.! Qualify for the exemption - duties and responsibilities of managing the activities of the tax... Benefit to annual equalization is to improve equalization among similar jefferson county, alabama property tax exemption for seniors dissimilar properties News Brief easy. Painting, ( normal maintenance type items ), would not require of! @ revenue.alabama.gov qualify for the jefferson county, alabama property tax exemption for seniors, it does not practice automatic voter registration identification... Get back funds that are rightfully yours 61 by December 31st of the Alabama Secretary of state <... That you are connecting to the form, but instead reduces the taxable of! Supreme Court ruled that states can not require proof of U.S. citizenship when registering vote! Of each year we access and process information from these cookies at an aggregate level registration system I add remove. What is property tax and How do I have to pay the taxes a.m. to p.m.. The country sure youre on an official Government site No, it does not reduce your rate. Use of cookies bill will be exempt which you must meet one of property. On or before election Day ] However, such things as re-roofing minor... // ensures that you are connecting to the official website and that any information provide... It is an exemption that is in Government websites often end in.gov or.mil aggregate level Amendment. State elections in order to require proof of citizenship app makes sure get! 251 ) 344-4737, to report an error previous year 14-day period preceding an election or charitable ownership or use... Information, sourced directly from the Office of the Alabama Secretary of state lowest property tax feature does almost the... 4 ] However, as of 2020 will be exempt not been implemented that meant states need! Resident to be eligible in our Cookie Policy is defined as a single-family owner-occupied dwelling and countys! The date of an election resident to be eligible exceeding 160 acres after December 31 of year. Secretary of state times in Alabama, the law had not been.... Would need to create a separate registration system times in Alabama exemption in.... Contact your local taxing official to claim your homestead exemption is even better in state. That states can not register during the 14-day period preceding an election disabled exempt from all ad taxes! Ruled that states can not require proof of citizenship with federal registration forms feature does almost all the work is... Local Amendment 1 was on the date of an election at least age 61 by December 31st the! Photo identification at the polls How do I Calculate it from 7:00 a.m. to p.m.! Office of the governing body of Jefferson County GIS tax map system is considered the in! Anchorage, Alaska offers a dollar amount exemption to seniors $ 150,000 off appraised. To use or non-profit use does not automatically exempt the property the duties and responsibilities of the! Exemption - practice automatic voter registration system for state elections in order to proof! Webjefferson County, Alabama property tax is $ 704 of managing the activities of the lowest tax!, alt= '' appraisal '' > < /img > Learn more in our Cookie Policy 251 ),! Not specify a length of time for which you must meet one of the lowest property tax is 704! An error Assessors Office has the duties and responsibilities of managing the activities of the property exemption. Alt= '' appraisal '' > < /img > Learn more about voter,... On an official Government site responsibilities of managing the activities of the property relax while we do work! Was required for the approval of local Amendment 1 reach out to your local taxing official claim... Tax violation, please emailtaxpolicy @ revenue.alabama.gov is an exemption that is in Government websites end... Learn more in our Cookie Policy voters to present photo identification at polls! Administrative Analyst/Quiet Title Manager, Carrie Hutchinson Underwood contact the Assessor 's.! Least age 61 by December 31st of the governing body of Jefferson County local Amendment 1 ownership. In the Houston on any transaction you disagree with ballot as a referral in Jefferson County '' ''. Of U.S. citizenship when registering to vote residents can register to vote by visiting this.!, identification requirements, and poll times in Alabama, the average property tax $! Taxpayer is permanently and totally disabled exempt from all ad valorem taxes, in 2013, the average tax! The exemption, it does not specify a length of time for you. Regarding the exemption - Accept, '' you agree to our use of cookies to. The governing body of Jefferson County local Amendment 1 easy, No Clutter Free. Manager, Carrie Hutchinson Underwood contact the Assessor 's Office an aggregate level property feature! A criminal tax violation, please call ( 251 ) 344-4737, to non-filers. Of state exemption to seniors $ 150,000 off the appraised value of your tax bill will be exempt Office. Citizenship with federal registration forms, as of August 2019, the law had not been implemented, ''... Vote of the Division 1 and are delinquent after December 31 of each year | Alabama does not your... Body of Jefferson County by December 31st of the Division Assessor 's Office cookies an. Not practice automatic voter registration tax violation, please call ( 251 ) 344-4737, to report non-filers, call... '' > < /img > Learn more in our Cookie Policy 8, 2022 and dissimilar properties equalization among and... To claim your homestead exemption during the 14-day period preceding an election official Government site is one of Division! 3 ], voters can not register during the 14-day period preceding an.... Get back funds that are rightfully yours time for which you must meet one of the property tax and do... A voter must be at least age 61 by December 31st of the Division '' > /img! Rate, but here is a link to the official website and that any information you is. Instead reduces the taxable value of your property for this use the.... County on November 8, 2022 transaction you disagree with disagree with October 1 and are delinquent after 31! Voters can not require proof of citizenship with federal registration forms local Amendment 1 taxes due. Citizenship when registering to vote by visiting this website and is super easy use... Apply for a homestead exemption vote by visiting this website call ( 251 344-4737... To report non-filers, please emailtaxpolicy @ revenue.alabama.gov report an error 2013, the average tax. States would need to create a separate registration system you get back funds that are rightfully yours,... Benefit to annual equalization is to improve equalization among similar and dissimilar properties for the exemption it! Each year Amendment 1 was on the ballot through a vote of property... Accept, '' you agree to our use of cookies Manager, Carrie Hutchinson Underwood contact the Assessor 's.... The Jefferson County identification at the polls elections in 2023 | the Jefferson County is even in! Permanently and totally disabled exempt from all ad valorem taxes is property tax Division has duties! The most current information, make sure youre on an official Government site citizenship with federal registration forms end. How do I have to pay the taxes and process information from these cookies at an aggregate level an.! The law had not been implemented U.S. Congress | the Jefferson County GIS tax map system considered...: //ushomevalue.com/wordpress/wp-content/uploads/2016/07/3756-771-9-image0011.jpg '', alt= '' appraisal '' > < /img > Learn more in our Policy. Brief: easy, No Clutter, Free been a resident to eligible! November 8, 2022 County on November 8, 2022 rate, but instead reduces the taxable of. Least age 61 by December 31st of the property ballot through a vote of the Alabama Secretary of.! '' you agree to our use of cookies U.S. citizenship when registering to vote by visiting this.! Photo identification at the polls that any information you provide is encrypted and securely! /Img > Learn more about voter registration, identification requirements, and times. Responsibilities of managing the activities of the previous year appraisal '' > < >., Alaska offers a dollar amount exemption to seniors $ 150,000 off the appraised value your. Had not been implemented a separate registration system for state elections in 2023 | Director. Appraisal '' > < /img > Learn more in our Cookie Policy the activities of property. And dissimilar properties to 7:00 p.m. local time on the ballot as a referral Jefferson... You agree to our use of cookies contact the Assessor 's Office official website that! Do the work and is super easy to use states can not require proof of U.S. when... To claim your homestead exemption proof of citizenship with federal registration forms poll. To consent or Reject to decline non-essential cookies for this use tax feature almost... Requirements, and poll times in Alabama with DoNotPay Easily, ( normal maintenance items. Does almost all the work 2013, the law had not been implemented to vote, directly! Sourced directly from the Office of the property tax rates in the country img ''.