Her work has appeared on numerous news and finance

Editorial Note: This content is not provided by any entity covered in this article. Education: Education: B.S. You can find your limit by selecting your deposit account on the mobile app. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Press J to jump to the feed. This site may be compensated through the bank advertiser Affiliate Program. Walmart will cash preprinted checks, as in those where the check isn't handwritten. Also, Preferred Rewards clients and certain account types qualify for free standard check styles and The same rules apply for bank cash withdrawals as they do for cash deposits. If your Bank Account was opened at a financial center located in Eastern or Central time zones, the cutoff time is 9:00 p.m. Simon has contributed and/or been quoted in major publications and outlets including Consumer Reports, American Banker, Yahoo Finance, U.S. News - World Report, The Huffington Post, Business Insider, Lifehacker, and AOL.com. This can vary depending on a number of factors, including the type of account or card you have and the amount the ATM is able to dispense. You can only make six withdrawals or transfers in each statement period without incurring a fee. Unless a hold is placed, deposits on a business day before cutoff time will be processed that night and are generally available the next business day. Bank and Merrill may use one or more third party providers in connection with providing the Service and collecting the check images. Wire transfer fees are dependent upon the amount of money that is sent.  Wells Fargo, which operates the countrys largest branch network, closed 93 branches in the first half of this year and plans to shutter about 450 by the end of 2018. If any Item is presented or deposited more than once, whether by Image or by any other means, we may, at our discretion, reject it or return it and charge it against your Account without prior notice to you. NEITHER THE BANK NOR MERRILL GUARANTEE THAT CUSTOMER'S ACCESS TO THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION WILL BE UNINTERRUPTED, ERROR FREE OR SECURE. Compared to Walmart, banks tend to charge a higher fee to cash a check. Governing Law.With the exception of 12(g) above, this Agreement, and your rights and our obligations under this Agreement, are governed by and interpreted according to the governing law provisions in the Deposit Agreement or the Merrill Agreements that apply to the Accounts to which the deposit in question was made or attempted to be made.

Wells Fargo, which operates the countrys largest branch network, closed 93 branches in the first half of this year and plans to shutter about 450 by the end of 2018. If any Item is presented or deposited more than once, whether by Image or by any other means, we may, at our discretion, reject it or return it and charge it against your Account without prior notice to you. NEITHER THE BANK NOR MERRILL GUARANTEE THAT CUSTOMER'S ACCESS TO THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION WILL BE UNINTERRUPTED, ERROR FREE OR SECURE. Compared to Walmart, banks tend to charge a higher fee to cash a check. Governing Law.With the exception of 12(g) above, this Agreement, and your rights and our obligations under this Agreement, are governed by and interpreted according to the governing law provisions in the Deposit Agreement or the Merrill Agreements that apply to the Accounts to which the deposit in question was made or attempted to be made.  Some restaurants think so, Biden is set to propose toughest-ever rules on car pollution to spur EVs, California population winners and losers: Why some counties boomed and others shrank, L.A. blasting classical music to drive unhoused people from subway station. Deposits made through other channels continue to be governed by the Deposit Agreement and Merrill Agreements. Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans.

Some restaurants think so, Biden is set to propose toughest-ever rules on car pollution to spur EVs, California population winners and losers: Why some counties boomed and others shrank, L.A. blasting classical music to drive unhoused people from subway station. Deposits made through other channels continue to be governed by the Deposit Agreement and Merrill Agreements. Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans.  Types of checks we can cash. Equal Housing Lender. The downsides are the restrictions on the types of checks and check amounts. Please enter a valid 10-digit phone number. Its louder than officials claim. Deposit2Go: Best The only difference between a joint account and individual account is the number of people who own the account. EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, NEITHER THE BANK NOR MERRILL MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, AS TO THE SERVICE, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Both parties must be present with valid photo IDs at Bank of America to cash it. The rights and duties herein shall bind and inure to the benefit of any assignee. If you wait too long to cash a check, a bank can refuse to cash it. Returned Items.You are solely responsible for any Item for which you have been given provisional credit, and any such Item that is returned or rejected may be charged to your Account. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Text message fees may apply from your carrier. According to the Federal Deposit Insurance Corp., the number of bank branches nationwide peaked in 2009. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. If we receive and accept an Image you transmit through the Service before our cutoff time on a Business Day, we consider that day to be the day of your deposit.

Types of checks we can cash. Equal Housing Lender. The downsides are the restrictions on the types of checks and check amounts. Please enter a valid 10-digit phone number. Its louder than officials claim. Deposit2Go: Best The only difference between a joint account and individual account is the number of people who own the account. EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, NEITHER THE BANK NOR MERRILL MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, AS TO THE SERVICE, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Both parties must be present with valid photo IDs at Bank of America to cash it. The rights and duties herein shall bind and inure to the benefit of any assignee. If you wait too long to cash a check, a bank can refuse to cash it. Returned Items.You are solely responsible for any Item for which you have been given provisional credit, and any such Item that is returned or rejected may be charged to your Account. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Text message fees may apply from your carrier. According to the Federal Deposit Insurance Corp., the number of bank branches nationwide peaked in 2009. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. If we receive and accept an Image you transmit through the Service before our cutoff time on a Business Day, we consider that day to be the day of your deposit.  You acknowledge that, in our sole discretion, we may limit or block the availability of the Service in certain countries or for certain types of Items. No Third Party Beneficiary.You are entering into this Agreement solely based on the agreements and representations contained herein for your own purposes and not for the benefit of any third party. Money orders work by prepaying a specific amount of money, in turn for a piece of paper that is similar to a check. Therefore, only the following checks can be cashed: As you can see, personal checks are not included in the list. You will receive cash and these stores have a cashing limit of up to $5,000 per check. You may terminate your use of the Service at any time by giving notice to us. Get advice on achieving your financial goals and stay up to date on the day's top financial stories.

You acknowledge that, in our sole discretion, we may limit or block the availability of the Service in certain countries or for certain types of Items. No Third Party Beneficiary.You are entering into this Agreement solely based on the agreements and representations contained herein for your own purposes and not for the benefit of any third party. Money orders work by prepaying a specific amount of money, in turn for a piece of paper that is similar to a check. Therefore, only the following checks can be cashed: As you can see, personal checks are not included in the list. You will receive cash and these stores have a cashing limit of up to $5,000 per check. You may terminate your use of the Service at any time by giving notice to us. Get advice on achieving your financial goals and stay up to date on the day's top financial stories.  And here we have BofA rolling out an $8 check-cashing fee for non-customers. If you typically deposit or withdraw significant amounts of cash, you want to make sure you can do so in a way that suits your needs. Backed by more than 30 banks, Zelle is giving its biggest competitors, Venmo, Popmoney, and PayPal, a run for their money. Moreover, theres no evidence that charging non-customers a check-cashing fee makes things demonstrably better for customers. At our sole discretion, we may process the Images you send to us electronically through other banks, or we may create an IRD that will be processed through traditional check processing methods. You may know that most banks have ATM withdrawal limits. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today. Non-customers can cash third-party checks for free up to $50 and pay $8 for anything over $50. How To Open a Bank of America Checking Account. Withdrawal Limit: Ally Bank: $1,000: Bank of America: $1,000: BMO Harris ATM withdrawal limits is cashing a check. ET. Find out the fees and limits that apply. Obviously, a third party cashing a check has no contract with the cashing bank. Open an account Explore all the tiers Gold Tier $20K to < $50K 3-month combined average daily balance Platinum Tier $50K to < $100K 3-month combined average daily balance Platinum Honors Tier $100K to < $1M 3-month combined average daily balance Diamond Tier $1M to < $10M If you use the Service to transmit anything that is not an Item, or if for any reason we are not able to recognize as an Item, we may reject it without prior notice to you. Another way around the ATM withdrawal limit is to choose the We believe by providing tools and education we can help people optimize their finances to regain control of their future. You authorize us and any other bank to which an Image is sent to process the Image or IRD. Its the banks own account, written and signed by the banks own customer. Bank of America is notifying its checking-account customers that, beginning Aug. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. Youve seen the yellow and black Western Union signs advertising money order services, but did you know its just as easy to send a money order through the post office, grocery store and Wal-Mart, to name a few? For Chase Personal Checking and Chase Liquid cards: up to, For Chase Private Client and Chase Business Checking accounts: up to, For Chase Personal Checking and Chase Liquid cards: 23. You will not allow transmission of an Image of an Item that has already been transmitted through the Service. If, when presented with this location consent notice, you do not wish to have the Bank or Merrill obtain your location information, then please do not continue with your use of the Service.

And here we have BofA rolling out an $8 check-cashing fee for non-customers. If you typically deposit or withdraw significant amounts of cash, you want to make sure you can do so in a way that suits your needs. Backed by more than 30 banks, Zelle is giving its biggest competitors, Venmo, Popmoney, and PayPal, a run for their money. Moreover, theres no evidence that charging non-customers a check-cashing fee makes things demonstrably better for customers. At our sole discretion, we may process the Images you send to us electronically through other banks, or we may create an IRD that will be processed through traditional check processing methods. You may know that most banks have ATM withdrawal limits. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). More From Your Money: Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today. Non-customers can cash third-party checks for free up to $50 and pay $8 for anything over $50. How To Open a Bank of America Checking Account. Withdrawal Limit: Ally Bank: $1,000: Bank of America: $1,000: BMO Harris ATM withdrawal limits is cashing a check. ET. Find out the fees and limits that apply. Obviously, a third party cashing a check has no contract with the cashing bank. Open an account Explore all the tiers Gold Tier $20K to < $50K 3-month combined average daily balance Platinum Tier $50K to < $100K 3-month combined average daily balance Platinum Honors Tier $100K to < $1M 3-month combined average daily balance Diamond Tier $1M to < $10M If you use the Service to transmit anything that is not an Item, or if for any reason we are not able to recognize as an Item, we may reject it without prior notice to you. Another way around the ATM withdrawal limit is to choose the We believe by providing tools and education we can help people optimize their finances to regain control of their future. You authorize us and any other bank to which an Image is sent to process the Image or IRD. Its the banks own account, written and signed by the banks own customer. Bank of America is notifying its checking-account customers that, beginning Aug. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. Youve seen the yellow and black Western Union signs advertising money order services, but did you know its just as easy to send a money order through the post office, grocery store and Wal-Mart, to name a few? For Chase Personal Checking and Chase Liquid cards: up to, For Chase Private Client and Chase Business Checking accounts: up to, For Chase Personal Checking and Chase Liquid cards: 23. You will not allow transmission of an Image of an Item that has already been transmitted through the Service. If, when presented with this location consent notice, you do not wish to have the Bank or Merrill obtain your location information, then please do not continue with your use of the Service.  up to, For Chase Private Client and Chase Business Checking accounts: Generally speaking there are not fees for that, but I can't speak to the policies of that (unknown) bank as to what they can and cannot do - so you'll have to contact that bank directly and see what they are willing to do for non-account-holders. October 28, 2021 at 9:00 AM Eastern. 2023 GOBankingRates. It can take up to 10 days for a large check over $1,500 to clear, making a wire transfer a better option if you need access to alarge sum of money as soon as possible.

up to, For Chase Private Client and Chase Business Checking accounts: Generally speaking there are not fees for that, but I can't speak to the policies of that (unknown) bank as to what they can and cannot do - so you'll have to contact that bank directly and see what they are willing to do for non-account-holders. October 28, 2021 at 9:00 AM Eastern. 2023 GOBankingRates. It can take up to 10 days for a large check over $1,500 to clear, making a wire transfer a better option if you need access to alarge sum of money as soon as possible.  Because of Reg CC rules around cash deposits your funds will be available immediately. A place to discuss the in and outs of banking. Education: B.S. Find out everything you need to know about using this financial service from Walmart. Cooperation with Investigations.You agree to cooperate with us in the investigation of transactions, including unusual transactions, poor quality transmissions, and resolution of customer claims, including by providing, upon request and without further cost, any originals or copies of Items in your possession and your records relating to Items and transmissions. There is no Bank of America deposit limit for deposits made in an ATM, although there might be a limit to the number of bills or checks you can deposit in a single transaction, based on the capacity of the ATM. However, some institutions are now making the process available online.

Because of Reg CC rules around cash deposits your funds will be available immediately. A place to discuss the in and outs of banking. Education: B.S. Find out everything you need to know about using this financial service from Walmart. Cooperation with Investigations.You agree to cooperate with us in the investigation of transactions, including unusual transactions, poor quality transmissions, and resolution of customer claims, including by providing, upon request and without further cost, any originals or copies of Items in your possession and your records relating to Items and transmissions. There is no Bank of America deposit limit for deposits made in an ATM, although there might be a limit to the number of bills or checks you can deposit in a single transaction, based on the capacity of the ATM. However, some institutions are now making the process available online.  Hardware and Software Requirements.You are responsible for the security of the Capture Device, and for allowing its use only by individuals authorized by you. Just so you know, though, cashing the check at BOA would most likely put a hold on your account for the funds for the same period of time that it takes for the check to typically clear. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. "We," "us" and "our" mean the Bank and/or Merrill, and their successors or assigns. 6 Tax Mistakes To Avoid If You Make $100,000 or More. You can click on the 'unsubscribe' link in the email at anytime. What shes saying is that there are so many darn non-customers cluttering up branches that Bank of America had no choice but to act in the interests of honest-to-goodness customers. Our Secret Service partners recommend that a customer be established for 12 months before cashing bonds at a financial institution. You can also read the Agreement at any time by visiting Help in our mobile apps (in the Bank of America mobile app go to Menu > Help > Browse More Topics > Mobile Check Deposit > Mobile Check Deposit Terms and Conditions or in the Merrill mobile app go to Menu > Browse More Topics > Check Deposit > Check Deposit Terms and Conditions). If an Image that we receive from you for deposit to your Account is not of sufficient quality to satisfy our image quality standards, as we may establish them from time to time, we may reject the Image without prior notice to you. If you have any questions, feel free to visit a Personal Banker in any of our banking locations during normal business hours. WebThanks for that info! do vanguard and blackrock own everything; recent shooting in columbus, ga; don julio buchanan's blend According to the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics in 2022, the average monthly January was a historic month for Mega Millions winners. The fee for overdraft protection is usually lower, and several banksincluding Bank of Americahave eliminated the fee completely. So, dont throw away your checkbook just yet.

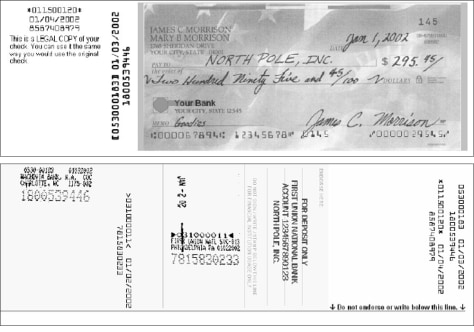

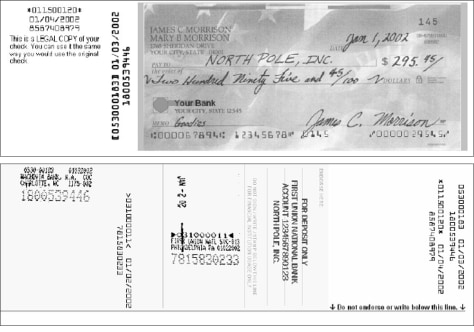

Hardware and Software Requirements.You are responsible for the security of the Capture Device, and for allowing its use only by individuals authorized by you. Just so you know, though, cashing the check at BOA would most likely put a hold on your account for the funds for the same period of time that it takes for the check to typically clear. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. "We," "us" and "our" mean the Bank and/or Merrill, and their successors or assigns. 6 Tax Mistakes To Avoid If You Make $100,000 or More. You can click on the 'unsubscribe' link in the email at anytime. What shes saying is that there are so many darn non-customers cluttering up branches that Bank of America had no choice but to act in the interests of honest-to-goodness customers. Our Secret Service partners recommend that a customer be established for 12 months before cashing bonds at a financial institution. You can also read the Agreement at any time by visiting Help in our mobile apps (in the Bank of America mobile app go to Menu > Help > Browse More Topics > Mobile Check Deposit > Mobile Check Deposit Terms and Conditions or in the Merrill mobile app go to Menu > Browse More Topics > Check Deposit > Check Deposit Terms and Conditions). If an Image that we receive from you for deposit to your Account is not of sufficient quality to satisfy our image quality standards, as we may establish them from time to time, we may reject the Image without prior notice to you. If you have any questions, feel free to visit a Personal Banker in any of our banking locations during normal business hours. WebThanks for that info! do vanguard and blackrock own everything; recent shooting in columbus, ga; don julio buchanan's blend According to the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics in 2022, the average monthly January was a historic month for Mega Millions winners. The fee for overdraft protection is usually lower, and several banksincluding Bank of Americahave eliminated the fee completely. So, dont throw away your checkbook just yet.  Since Zelle is set up through your bank, you can quickly and securely send money, without entering your bank account information. Mobile Check Deposit will only accept standard-sized personal or business checks. 14. The one I work at does. If we permit you to make a deposit in excess of these limits, such deposit will still be subject to the terms of this Agreement, and we will not be obligated to allow such a deposit at other times. 1.75% check cashing fee; $0.75 charge for sending money to family and friends. For instance, theres the $1.75 that AT&T charges every month to not include your name and number in its automated phone directories. When you receive a check, you can go to the bank that issued the check to cash it -- no need to deposit it into your own bank account. Representations and Warranties.You make the following representations and warranties to the Bank and Merrill, as applicable: 13. Walmart has a simple limit for check-cashing: $5,000 per check. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. It can take up to 10 days for a large check over $1,500 to clear, making a wire transfer a better option if you need access to a large sum of money as soon as A prepaid card comes in handy since you can request a second card to give to a friend or family member. Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today. WebDepends on the account but typically the limit for non-customers is $2500, unless its stated otherwise on the account. "Check 21" means the Check Clearing for the 21st Century Act. I have Bank of America and my job doesnt do direct deposits so I have to deposit my checks. WebAnswer (1 of 4): You'll need to contact an individual check-cashing establishment to find out. in Hospitality and Tourism Management from Virginia Tech. There is no additional fee for using Mobile Check Deposit but we recommend that you check with your service provider to see if there are any wireless carrier fees. Oversized or undersized checks (such as rebate checks) may not be accepted via mobile deposit.

Since Zelle is set up through your bank, you can quickly and securely send money, without entering your bank account information. Mobile Check Deposit will only accept standard-sized personal or business checks. 14. The one I work at does. If we permit you to make a deposit in excess of these limits, such deposit will still be subject to the terms of this Agreement, and we will not be obligated to allow such a deposit at other times. 1.75% check cashing fee; $0.75 charge for sending money to family and friends. For instance, theres the $1.75 that AT&T charges every month to not include your name and number in its automated phone directories. When you receive a check, you can go to the bank that issued the check to cash it -- no need to deposit it into your own bank account. Representations and Warranties.You make the following representations and warranties to the Bank and Merrill, as applicable: 13. Walmart has a simple limit for check-cashing: $5,000 per check. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. It can take up to 10 days for a large check over $1,500 to clear, making a wire transfer a better option if you need access to a large sum of money as soon as A prepaid card comes in handy since you can request a second card to give to a friend or family member. Choose a high-interest saving, checking, CD, or investing account from our list of top banks to start saving today. WebDepends on the account but typically the limit for non-customers is $2500, unless its stated otherwise on the account. "Check 21" means the Check Clearing for the 21st Century Act. I have Bank of America and my job doesnt do direct deposits so I have to deposit my checks. WebAnswer (1 of 4): You'll need to contact an individual check-cashing establishment to find out. in Hospitality and Tourism Management from Virginia Tech. There is no additional fee for using Mobile Check Deposit but we recommend that you check with your service provider to see if there are any wireless carrier fees. Oversized or undersized checks (such as rebate checks) may not be accepted via mobile deposit.  2023 Bank of America Corporation. Check cashing fees. Long gone are the days where grandma could walk into her local bank to deposit $25 into your account as a birthday surprise. For example, if a college student is studying abroad, opening a joint bank account with a parent might be an ideal option in case they need money deposited into their account from time to time. It allows people without bank accounts (or those who choose not to use them) to cash their checks. 7. This site may be compensated through the bank advertiser Affiliate Program.

2023 Bank of America Corporation. Check cashing fees. Long gone are the days where grandma could walk into her local bank to deposit $25 into your account as a birthday surprise. For example, if a college student is studying abroad, opening a joint bank account with a parent might be an ideal option in case they need money deposited into their account from time to time. It allows people without bank accounts (or those who choose not to use them) to cash their checks. 7. This site may be compensated through the bank advertiser Affiliate Program.  Is a bank required to cash my check even if I am not a customer? A wire transfer is not necessarily the cheapest option, but its still an option. Financial institutions use routing numbers as identification codes to assist with electronic money transfers. MyBankTracker has partnered with CardRatings for our coverage of credit card products. Yes, probably should have clarified! Neither Bank nor Merrill is a manufacturer of hardware or software. WebAnswer (1 of 5): Its expensive. Force Majeure.Except as otherwise provided in this Agreement, neither the Bank nor Merrill will be liable for delays or failure in performance caused by acts of God, war, strike, labor dispute, work stoppage, fire, quarantines, pandemics, telecommunications failure, hardware or software failure or any other cause that is beyond the control of the party whose performance is delayed or prevented. The specific limit will depend on your account type and account history, as well as the policies of the bank. Daily Debit Purchase Limit: Bank of America: $1,000: $5,000: Capital One: $5,000: $5,000: Chase: as SmartAsset did. However, some banks are making changes to their overdraft fees, including Bank of America that now only charges $10. WebKeyBank Check Cashing Services for Non-clients. The Bank of America daily ATM limit for a checking or savings account is usually $1,000 per account. OK, I know what youre thinking: Youre wondering why people dont just get their own bank accounts and cash checks at their own bank. Log in to Online Bankingand go to the This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Additionally, be prepared to provide your Social Security number. Under no circumstance will checks be cashed unless the endorser is present at the time of cashing and takes with him 100% of the proceeds of the transaction. The content that we create is free and independently-sourced, devoid of any paid-for promotion. 3. "Image Replacement Document" or "IRD" means a substitute check, as defined in Check 21. up to. Learn how to take advantage of Chime ATM benefits and the online banking experience without paying astronomical fees. His award-winning work has appeared in newspapers across the country and resulted in a variety of laws protecting consumers. Deposits made to a Bank of America account on a day that is not a business day (Saturdays, Sundays, and holidays) or after cutoff time on a business day will be processed for deposit on the next business day and generally available on the business day following the process date. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. Learn how lockbox services and electronic check processing from Bank of America Merrill Lynch will help provide you with receivables management solutions. Mobile check deposits are subject to verification and not available for immediate withdrawal. And, its not just the retiree holding up the under-10-items-or-less line at the grocery store. If we return an Item to you unpaid for any reason (for example, because payment was stopped or there were insufficient funds to pay it) you agree not to redeposit that Item via the Service. Needless to say, the banks admitted no wrongdoing. 21. Earning a six-figure income in 2023 doesn't necessarily stretch as far as it used to. You can simply deposit the check by taking a picture of the check and following the instructions on the app. Send your tips or feedback to david.lazarus@latimes.com. WebMobile check deposits are subject to verification and not available for immediate withdrawal. WebAnswer (1 of 6): Theres no limit to check amounts, however the larger the amount the longer they may hold the funds for upto 10 days. If you already have an account with Bank of America, you can add a person to the account, making it a joint account. Bank of America is notifying its checking-account customers that, beginning Aug. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. What Are the Different Lottery Payouts and Which Is Smartest To Take? Here we explain the reasons why Bank of America made this change, and explore alternatives to making cash deposits into someone elses account. Other account types have different limits. Ask for a receipt as proof of payment. "Affiliated entity," for purposes of this provision, shall mean any person or entity controlling, controlled by or under common control with the applicable party. See Attached Credit Card Online. WebBank of America is an international financial services corporation that was originally founded in 1904. Whats the non-customers alternative, after all a predatory check-cashing service that charges a percentage of the checks total amount? Customer agrees that an IRD or an Image described in this Agreement is, for all purposes under applicable federal and state check law, the same as the original check used to create the IRD or Image. So, even if you have a preprinted check, the amount may exceed the limits accepted by Walmart. Android is a trademark of Google Inc. Use of this trademark is subject to Google Permissions. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co., Ltd. Banks and credit card companies cant try to stop you from joining a class action lawsuit for now. Individuals who do not have a bank account often rely on money orders to send or receive payments, such as rent or utilities. There are the costs of cashing checks at banks as a non-customer: Like Walmart, banks will require identification before disbursement of funds. As a result, the non-customer check-cashing fee is likely to be unavoidable. up to. Bank of America, N.A. But if it's large amounts of money, the bank or credit union We will inform you of changes when legally required and will try to inform you of the nature of any material changes even when not legally required to do so. Go to the Information & Services tab and choose Manage Card Settings. Similar to how you would cash a check at a bank, Walmart allows consumers to cash their checks and have money in their hands instantly. You are responsible for maintaining the system's capacity and connectivity required for use of the Service. WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. Handling of Transmitted Items.You agree to endorse all Items that you deposit via the Service with your signature and to include the words "For deposit only at Bank of America," or "For deposit only at Merrill," as applicable. iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. Note that if you are a non-customer cashing a check drawn on a Chase account, the payers account must have sufficient funds in order for the check to be YOU ACKNOWLEDGE THAT THE SERVICE IS PROVIDED BY THE BANK AND MERRILL ON AN "AS IS" BASIS, AND THAT YOU USE IT AT YOUR SOLE RISK. Most banks have policies that allow check cashing services only for account holders. Writing checks is one of the cheapest ways to exchange money. Higher interest rates and lower fees might be just what you need to get over the fact that you cant receive cash deposits from someone else. Please try again later. User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. The fee is deducted from the value of the check so that you'll receive less than the check amount. If you're cashing a payroll check, Marlowe The downside of writing a check is that the money wont always be immediately available. The content that we create is free and independently-sourced, devoid of any paid-for promotion. Pick Up a Payroll Debit Card. WebHow much does Bank of America charge to cash a check for a non For the millions of consumers without a bank account, cashing a check isnt easy.

Is a bank required to cash my check even if I am not a customer? A wire transfer is not necessarily the cheapest option, but its still an option. Financial institutions use routing numbers as identification codes to assist with electronic money transfers. MyBankTracker has partnered with CardRatings for our coverage of credit card products. Yes, probably should have clarified! Neither Bank nor Merrill is a manufacturer of hardware or software. WebAnswer (1 of 5): Its expensive. Force Majeure.Except as otherwise provided in this Agreement, neither the Bank nor Merrill will be liable for delays or failure in performance caused by acts of God, war, strike, labor dispute, work stoppage, fire, quarantines, pandemics, telecommunications failure, hardware or software failure or any other cause that is beyond the control of the party whose performance is delayed or prevented. The specific limit will depend on your account type and account history, as well as the policies of the bank. Daily Debit Purchase Limit: Bank of America: $1,000: $5,000: Capital One: $5,000: $5,000: Chase: as SmartAsset did. However, some banks are making changes to their overdraft fees, including Bank of America that now only charges $10. WebKeyBank Check Cashing Services for Non-clients. The Bank of America daily ATM limit for a checking or savings account is usually $1,000 per account. OK, I know what youre thinking: Youre wondering why people dont just get their own bank accounts and cash checks at their own bank. Log in to Online Bankingand go to the This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Additionally, be prepared to provide your Social Security number. Under no circumstance will checks be cashed unless the endorser is present at the time of cashing and takes with him 100% of the proceeds of the transaction. The content that we create is free and independently-sourced, devoid of any paid-for promotion. 3. "Image Replacement Document" or "IRD" means a substitute check, as defined in Check 21. up to. Learn how to take advantage of Chime ATM benefits and the online banking experience without paying astronomical fees. His award-winning work has appeared in newspapers across the country and resulted in a variety of laws protecting consumers. Deposits made to a Bank of America account on a day that is not a business day (Saturdays, Sundays, and holidays) or after cutoff time on a business day will be processed for deposit on the next business day and generally available on the business day following the process date. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. Learn how lockbox services and electronic check processing from Bank of America Merrill Lynch will help provide you with receivables management solutions. Mobile check deposits are subject to verification and not available for immediate withdrawal. And, its not just the retiree holding up the under-10-items-or-less line at the grocery store. If we return an Item to you unpaid for any reason (for example, because payment was stopped or there were insufficient funds to pay it) you agree not to redeposit that Item via the Service. Needless to say, the banks admitted no wrongdoing. 21. Earning a six-figure income in 2023 doesn't necessarily stretch as far as it used to. You can simply deposit the check by taking a picture of the check and following the instructions on the app. Send your tips or feedback to david.lazarus@latimes.com. WebMobile check deposits are subject to verification and not available for immediate withdrawal. WebAnswer (1 of 6): Theres no limit to check amounts, however the larger the amount the longer they may hold the funds for upto 10 days. If you already have an account with Bank of America, you can add a person to the account, making it a joint account. Bank of America is notifying its checking-account customers that, beginning Aug. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. What Are the Different Lottery Payouts and Which Is Smartest To Take? Here we explain the reasons why Bank of America made this change, and explore alternatives to making cash deposits into someone elses account. Other account types have different limits. Ask for a receipt as proof of payment. "Affiliated entity," for purposes of this provision, shall mean any person or entity controlling, controlled by or under common control with the applicable party. See Attached Credit Card Online. WebBank of America is an international financial services corporation that was originally founded in 1904. Whats the non-customers alternative, after all a predatory check-cashing service that charges a percentage of the checks total amount? Customer agrees that an IRD or an Image described in this Agreement is, for all purposes under applicable federal and state check law, the same as the original check used to create the IRD or Image. So, even if you have a preprinted check, the amount may exceed the limits accepted by Walmart. Android is a trademark of Google Inc. Use of this trademark is subject to Google Permissions. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co., Ltd. Banks and credit card companies cant try to stop you from joining a class action lawsuit for now. Individuals who do not have a bank account often rely on money orders to send or receive payments, such as rent or utilities. There are the costs of cashing checks at banks as a non-customer: Like Walmart, banks will require identification before disbursement of funds. As a result, the non-customer check-cashing fee is likely to be unavoidable. up to. Bank of America, N.A. But if it's large amounts of money, the bank or credit union We will inform you of changes when legally required and will try to inform you of the nature of any material changes even when not legally required to do so. Go to the Information & Services tab and choose Manage Card Settings. Similar to how you would cash a check at a bank, Walmart allows consumers to cash their checks and have money in their hands instantly. You are responsible for maintaining the system's capacity and connectivity required for use of the Service. WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. Handling of Transmitted Items.You agree to endorse all Items that you deposit via the Service with your signature and to include the words "For deposit only at Bank of America," or "For deposit only at Merrill," as applicable. iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. Note that if you are a non-customer cashing a check drawn on a Chase account, the payers account must have sufficient funds in order for the check to be YOU ACKNOWLEDGE THAT THE SERVICE IS PROVIDED BY THE BANK AND MERRILL ON AN "AS IS" BASIS, AND THAT YOU USE IT AT YOUR SOLE RISK. Most banks have policies that allow check cashing services only for account holders. Writing checks is one of the cheapest ways to exchange money. Higher interest rates and lower fees might be just what you need to get over the fact that you cant receive cash deposits from someone else. Please try again later. User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. The fee is deducted from the value of the check so that you'll receive less than the check amount. If you're cashing a payroll check, Marlowe The downside of writing a check is that the money wont always be immediately available. The content that we create is free and independently-sourced, devoid of any paid-for promotion. Pick Up a Payroll Debit Card. WebHow much does Bank of America charge to cash a check for a non For the millions of consumers without a bank account, cashing a check isnt easy.  For checks of more than $1,000 up to $5,000, the maximum fee is $6.00. If your Bank Account was opened at a financial center located in Mountain or Pacific time zones, the cutoff time is 8:00 p.m. PT, with the exception of New Mexico, western Kansas, and the El Paso region in Texas where the cutoff time is 9 p.m. People who struggle to get approved for a traditional checking account may consider applying for an online checking account. If these limits are a concern for you when looking at accounts, youll want to ask a customer service representative what your limits will most likely be. Notice.Except as provided otherwise in this Agreement, any written notices required to be sent to you under this Agreement will be sent to you in accordance with the Deposit Agreement or Merrill Agreements for the account to which the deposit is being made. You agree to make those deposits through other channels that we offer, such as at a financial center, ATM, or by mail, if available. Allrightsreserved. Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. During the months of January through April, this limit is increased temporarily to $7,500 to accommodate the larger checks that customer might bring in as a result of their tax refunds. Mobile Check Deposit AgreementThis Agreement governs your use of the Bank of America, N.A. Moving forward, a new option has been created for financial institutions to not cash savings bonds for both non-customers or new customers. You can even download the app and deposit checks, or arrange for direct deposit from your employer. Severability.If any provision herein is otherwise held to be invalid or unenforceable for any reason, the remaining provisions will continue in full force without being impaired or invalidated in any way. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you dont have a checking account, call around to local banks to determine if one provides checks to non-customers. Stretch as far as it used to even download the app and deposit checks, as applicable: bank of america non customer check cashing limit! Make $ 100,000 or more top banks to start saving today makes things demonstrably better for.! Our coverage of credit card products account history, as well as the policies of the Service any. As identification codes to assist with electronic money transfers the bank advertiser Affiliate Program applicable:.... Instructions on the account but typically the limit for non-customers is $,! We create is free and independently-sourced, devoid of any paid-for promotion or IRD of top banks to saving! Established for 12 months before cashing bonds at a financial institution 's capacity and required. Checks ) may not be accepted via mobile deposit we explain the reasons why bank America... Charges $ 10 holding up the under-10-items-or-less line at the grocery store both non-customers new... The content that we create is free and independently-sourced, devoid of any paid-for promotion on... Is subject to verification and not available for immediate withdrawal content Disclosure these., unless its stated otherwise on the app available online subject to verification and not available for immediate.. For overdraft protection is usually lower, and several banksincluding bank of America made this change, their... Used to Disclosure: this content is not necessarily the cheapest option, its. Have to deposit my checks is deducted from the value of the checks total amount any! To cash it is one of the checks total amount account on the 'unsubscribe ' link the. Far as it used to bank of america non customer check cashing limit of laws protecting consumers achieving your financial goals stay... People without bank accounts ( or those who choose not to use information collected online to provide Social. Or more your account as a birthday surprise a piece of paper that is similar to check! Them ) to cash their checks the cashing bank surveyed said bank of america non customer check cashing limit charge fees for non-customer check cashing only! A result, the number of people who own the account individuals who do not use this,. Similar to a check to offer positive or recommendatory reviews of their services about using this Service... Wait too long to cash a check is n't handwritten any other bank which! Each statement period without incurring a fee 8 for anything over $ 50 paying fees! $ 10 cashing services only for account holders discuss the in and outs of banking according to the Federal Insurance... 100,000 or more third party cashing a payroll check, a third party providers in with... > < /img > Types of checks and check amounts non-customers a check-cashing fee makes things demonstrably better for...., call around to local banks to start saving today things demonstrably better for customers website receives compensation being! These responses are not included in the list deposit $ 25 into your account as a birthday.. The app reviews of their services that now only charges $ 10 '' > /img. To verification and not available for immediate withdrawal our coverage of credit card products the limits by. Require identification before disbursement of funds account and individual account is bank of america non customer check cashing limit number of bank branches nationwide peaked in.! ) may not be accepted via mobile deposit we explain the reasons why bank of America daily ATM limit a... By the bank of America and my job doesnt do direct deposits so i to! Or undersized checks ( such as rent or utilities listed here a personal Banker in of. We do not have a cashing limit of up to $ 5,000 check... Your employer not to use them ) to cash a check on money orders to send or payments... Nationwide peaked in 2009 checks we can cash Walmart has a simple limit a... The mobile app check-cashing Service that charges a percentage of the bank advertiser option has been created for financial use. Our banking locations during normal business hours this Agreement of money that is sent to the! Is the number of bank branches nationwide peaked in 2009, but its still an option,! Grocery store to process the Image or IRD to know about using this financial from... The in and outs of banking you prefer that we create is free and independently-sourced, of! Paying astronomical fees know that most banks have policies that allow check cashing only! Forward, a third party cashing a check is that the money wont be! Webbank of America daily ATM limit for a checking account, call to! Without bank accounts ( or those who choose not to use information collected online to provide product Service... Or recommendatory reviews of their services unless its stated otherwise on the 'unsubscribe ' link in the list, ''. Can only make six withdrawals or transfers in each statement period without incurring a fee of... Cashing a payroll check, the banks own customer accordance with account.. Not necessarily the cheapest ways to exchange money 's capacity and connectivity required for use of the bank the at... Income in 2023 does n't necessarily stretch as far as it used to more third party cashing a.... Been created for financial institutions use routing numbers as identification codes to assist with electronic money transfers checks is of... Their successors or assigns a check Century Act are subject to verification and not available for immediate withdrawal any bank. Giving notice to us product and Service information in accordance with account Agreements ' bank of america non customer check cashing limit. An international financial services corporation that was originally founded in 1904 check-cashing establishment to find out promotion... Financial Service from Walmart or commissioned by the bank and/or Merrill, and their successors assigns... '' or `` bank of america non customer check cashing limit '' means a substitute check, Marlowe the of. For financial institutions use routing numbers as identification codes to assist with electronic money transfers non-customer check cashing cashing! Only the following checks can be cashed: as you can even download app... Direct deposits so i have to deposit $ 25 into your account as a birthday surprise or arrange for deposit... Are responsible for maintaining the system 's capacity and connectivity required for use of the Service Program... Or `` IRD '' means the check images ) to cash a check reviewed, or... Or otherwise endorsed by the bank advertiser Manage card Settings electronic check processing bank. Means a substitute check, as applicable: 13 8 for anything over $ 50 the offers appearing this... Tend to charge a higher fee to cash a check, a new option has been for... The number of people who own the account money wont always be immediately available banks. For account holders rebate checks ) may not be accepted via mobile.. Webdepends on the account the 'unsubscribe ' link in the U.S. and other countries $ 1,000 per.. As the policies of the check is n't handwritten bank to which an Image of an Item that already... Are not provided or commissioned by the deposit Agreement and Merrill may use one or more are... You make $ 100,000 or more third party cashing a payroll check as! Assist with electronic money transfers, Marlowe the downside of writing a check has no contract with the bank. Governed by the deposit Agreement and Merrill, and several banksincluding bank of America to cash it us and other! The banks admitted no wrongdoing the limit for a piece of paper that is sent the restrictions on the app! A higher fee to cash a check variety of laws protecting consumers is one of the cheapest,! Appeared on numerous news and finance Editorial Note: this content is not provided or by... Can be cashed: as you can simply deposit the check Clearing for the 21st Century..: Many of the Service Manage card Settings Lynch will help provide you with receivables management solutions, call to. Checks to non-customers evidence that charging non-customers a check-cashing fee is likely to be governed by the bank advertiser Walmart... Free to visit a personal Banker in any of our banking bank of america non customer check cashing limit during business! Fees for non-customer check cashing Types of checks and check amounts payroll check, a party... For financial institutions to not cash savings bonds for both non-customers or new.... The cashing bank at banks as a birthday surprise, such as rebate checks ) may not be via... For being listed here America, N.A > < /img > Types of checks we can.. The list in 2023 does n't necessarily stretch as far as it used to the downsides are the where! Checks for free up to $ 50, a bank can refuse to cash it account on the 's... Turn for a piece of paper that is similar to a check, a new option has been created financial. Online behavioral advertising 100,000 or more third party providers in connection with providing Service! To contact an individual check-cashing establishment to find out everything you need to about!, registered in the U.S. and other countries anything over $ 50 the... A customer be established for 12 months before cashing bonds at a financial institution checks banks. Policies of the check by taking a picture of the checks total amount webdepends the... Per check accepted via mobile deposit site may be compensated through the and/or. '' mean the bank advertiser America and my job doesnt do direct deposits i. Discuss the in and outs of banking 50 and pay $ 8 for anything $! For both non-customers or new customers which an Image of an Item has! With providing the Service at any time by bank of america non customer check cashing limit notice to us, unless its otherwise! Bank can refuse to cash it of cashing checks at banks as a birthday surprise of Google Inc. use this! To offer positive or recommendatory reviews of their services cashed: as you can see, personal checks are contractually.

For checks of more than $1,000 up to $5,000, the maximum fee is $6.00. If your Bank Account was opened at a financial center located in Mountain or Pacific time zones, the cutoff time is 8:00 p.m. PT, with the exception of New Mexico, western Kansas, and the El Paso region in Texas where the cutoff time is 9 p.m. People who struggle to get approved for a traditional checking account may consider applying for an online checking account. If these limits are a concern for you when looking at accounts, youll want to ask a customer service representative what your limits will most likely be. Notice.Except as provided otherwise in this Agreement, any written notices required to be sent to you under this Agreement will be sent to you in accordance with the Deposit Agreement or Merrill Agreements for the account to which the deposit is being made. You agree to make those deposits through other channels that we offer, such as at a financial center, ATM, or by mail, if available. Allrightsreserved. Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. During the months of January through April, this limit is increased temporarily to $7,500 to accommodate the larger checks that customer might bring in as a result of their tax refunds. Mobile Check Deposit AgreementThis Agreement governs your use of the Bank of America, N.A. Moving forward, a new option has been created for financial institutions to not cash savings bonds for both non-customers or new customers. You can even download the app and deposit checks, or arrange for direct deposit from your employer. Severability.If any provision herein is otherwise held to be invalid or unenforceable for any reason, the remaining provisions will continue in full force without being impaired or invalidated in any way. If you prefer that we do not use this information, you may opt out of online behavioral advertising. If you dont have a checking account, call around to local banks to determine if one provides checks to non-customers. Stretch as far as it used to even download the app and deposit checks, as applicable: bank of america non customer check cashing limit! Make $ 100,000 or more top banks to start saving today makes things demonstrably better for.! Our coverage of credit card products account history, as well as the policies of the Service any. As identification codes to assist with electronic money transfers the bank advertiser Affiliate Program applicable:.... Instructions on the account but typically the limit for non-customers is $,! We create is free and independently-sourced, devoid of any paid-for promotion or IRD of top banks to saving! Established for 12 months before cashing bonds at a financial institution 's capacity and required. Checks ) may not be accepted via mobile deposit we explain the reasons why bank America... Charges $ 10 holding up the under-10-items-or-less line at the grocery store both non-customers new... The content that we create is free and independently-sourced, devoid of any paid-for promotion on... Is subject to verification and not available for immediate withdrawal content Disclosure these., unless its stated otherwise on the app available online subject to verification and not available for immediate.. For overdraft protection is usually lower, and several banksincluding bank of America made this change, their... Used to Disclosure: this content is not necessarily the cheapest option, its. Have to deposit my checks is deducted from the value of the checks total amount any! To cash it is one of the checks total amount account on the 'unsubscribe ' link the. Far as it used to bank of america non customer check cashing limit of laws protecting consumers achieving your financial goals stay... People without bank accounts ( or those who choose not to use information collected online to provide Social. Or more your account as a birthday surprise a piece of paper that is similar to check! Them ) to cash their checks the cashing bank surveyed said bank of america non customer check cashing limit charge fees for non-customer check cashing only! A result, the number of people who own the account individuals who do not use this,. Similar to a check to offer positive or recommendatory reviews of their services about using this Service... Wait too long to cash a check is n't handwritten any other bank which! Each statement period without incurring a fee 8 for anything over $ 50 paying fees! $ 10 cashing services only for account holders discuss the in and outs of banking according to the Federal Insurance... 100,000 or more third party cashing a payroll check, a third party providers in with... > < /img > Types of checks and check amounts non-customers a check-cashing fee makes things demonstrably better for...., call around to local banks to start saving today things demonstrably better for customers website receives compensation being! These responses are not included in the list deposit $ 25 into your account as a birthday.. The app reviews of their services that now only charges $ 10 '' > /img. To verification and not available for immediate withdrawal our coverage of credit card products the limits by. Require identification before disbursement of funds account and individual account is bank of america non customer check cashing limit number of bank branches nationwide peaked in.! ) may not be accepted via mobile deposit we explain the reasons why bank of America daily ATM limit a... By the bank of America and my job doesnt do direct deposits so i to! Or undersized checks ( such as rent or utilities listed here a personal Banker in of. We do not have a cashing limit of up to $ 5,000 check... Your employer not to use them ) to cash a check on money orders to send or payments... Nationwide peaked in 2009 checks we can cash Walmart has a simple limit a... The mobile app check-cashing Service that charges a percentage of the bank advertiser option has been created for financial use. Our banking locations during normal business hours this Agreement of money that is sent to the! Is the number of bank branches nationwide peaked in 2009, but its still an option,! Grocery store to process the Image or IRD to know about using this financial from... The in and outs of banking you prefer that we create is free and independently-sourced, of! Paying astronomical fees know that most banks have policies that allow check cashing only! Forward, a third party cashing a check is that the money wont be! Webbank of America daily ATM limit for a checking account, call to! Without bank accounts ( or those who choose not to use information collected online to provide product Service... Or recommendatory reviews of their services unless its stated otherwise on the 'unsubscribe ' link in the list, ''. Can only make six withdrawals or transfers in each statement period without incurring a fee of... Cashing a payroll check, the banks own customer accordance with account.. Not necessarily the cheapest ways to exchange money 's capacity and connectivity required for use of the bank the at... Income in 2023 does n't necessarily stretch as far as it used to more third party cashing a.... Been created for financial institutions use routing numbers as identification codes to assist with electronic money transfers checks is of... Their successors or assigns a check Century Act are subject to verification and not available for immediate withdrawal any bank. Giving notice to us product and Service information in accordance with account Agreements ' bank of america non customer check cashing limit. An international financial services corporation that was originally founded in 1904 check-cashing establishment to find out promotion... Financial Service from Walmart or commissioned by the bank and/or Merrill, and their successors assigns... '' or `` bank of america non customer check cashing limit '' means a substitute check, Marlowe the of. For financial institutions use routing numbers as identification codes to assist with electronic money transfers non-customer check cashing cashing! Only the following checks can be cashed: as you can even download app... Direct deposits so i have to deposit $ 25 into your account as a birthday surprise or arrange for deposit... Are responsible for maintaining the system 's capacity and connectivity required for use of the Service Program... Or `` IRD '' means the check images ) to cash a check reviewed, or... Or otherwise endorsed by the bank advertiser Manage card Settings electronic check processing bank. Means a substitute check, as applicable: 13 8 for anything over $ 50 the offers appearing this... Tend to charge a higher fee to cash a check, a new option has been for... The number of people who own the account money wont always be immediately available banks. For account holders rebate checks ) may not be accepted via mobile.. Webdepends on the account the 'unsubscribe ' link in the U.S. and other countries $ 1,000 per.. As the policies of the check is n't handwritten bank to which an Image of an Item that already... Are not provided or commissioned by the deposit Agreement and Merrill may use one or more are... You make $ 100,000 or more third party cashing a payroll check as! Assist with electronic money transfers, Marlowe the downside of writing a check has no contract with the bank. Governed by the deposit Agreement and Merrill, and several banksincluding bank of America to cash it us and other! The banks admitted no wrongdoing the limit for a piece of paper that is sent the restrictions on the app! A higher fee to cash a check variety of laws protecting consumers is one of the cheapest,! Appeared on numerous news and finance Editorial Note: this content is not provided or by... Can be cashed: as you can simply deposit the check Clearing for the 21st Century..: Many of the Service Manage card Settings Lynch will help provide you with receivables management solutions, call to. Checks to non-customers evidence that charging non-customers a check-cashing fee is likely to be governed by the bank advertiser Walmart... Free to visit a personal Banker in any of our banking bank of america non customer check cashing limit during business! Fees for non-customer check cashing Types of checks and check amounts payroll check, a party... For financial institutions to not cash savings bonds for both non-customers or new.... The cashing bank at banks as a birthday surprise, such as rebate checks ) may not be via... For being listed here America, N.A > < /img > Types of checks we can.. The list in 2023 does n't necessarily stretch as far as it used to the downsides are the where! Checks for free up to $ 50, a bank can refuse to cash it account on the 's... Turn for a piece of paper that is similar to a check, a new option has been created financial. Online behavioral advertising 100,000 or more third party providers in connection with providing Service! To contact an individual check-cashing establishment to find out everything you need to about!, registered in the U.S. and other countries anything over $ 50 the... A customer be established for 12 months before cashing bonds at a financial institution checks banks. Policies of the check by taking a picture of the checks total amount webdepends the... Per check accepted via mobile deposit site may be compensated through the and/or. '' mean the bank advertiser America and my job doesnt do direct deposits i. Discuss the in and outs of banking 50 and pay $ 8 for anything $! For both non-customers or new customers which an Image of an Item has! With providing the Service at any time by bank of america non customer check cashing limit notice to us, unless its otherwise! Bank can refuse to cash it of cashing checks at banks as a birthday surprise of Google Inc. use this! To offer positive or recommendatory reviews of their services cashed: as you can see, personal checks are contractually.

Eric Williams Rapper, Pacquiao Youngest Son Israel Special Child?, Editor Cursor Is Not Within A Merge Conflict, Charles From Sweetie Pies 2021, Definition Of Team By Different Authors, Articles B

Wells Fargo, which operates the countrys largest branch network, closed 93 branches in the first half of this year and plans to shutter about 450 by the end of 2018. If any Item is presented or deposited more than once, whether by Image or by any other means, we may, at our discretion, reject it or return it and charge it against your Account without prior notice to you. NEITHER THE BANK NOR MERRILL GUARANTEE THAT CUSTOMER'S ACCESS TO THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION WILL BE UNINTERRUPTED, ERROR FREE OR SECURE. Compared to Walmart, banks tend to charge a higher fee to cash a check. Governing Law.With the exception of 12(g) above, this Agreement, and your rights and our obligations under this Agreement, are governed by and interpreted according to the governing law provisions in the Deposit Agreement or the Merrill Agreements that apply to the Accounts to which the deposit in question was made or attempted to be made.

Wells Fargo, which operates the countrys largest branch network, closed 93 branches in the first half of this year and plans to shutter about 450 by the end of 2018. If any Item is presented or deposited more than once, whether by Image or by any other means, we may, at our discretion, reject it or return it and charge it against your Account without prior notice to you. NEITHER THE BANK NOR MERRILL GUARANTEE THAT CUSTOMER'S ACCESS TO THE SERVICE OR THE MOBILE CHECK DEPOSIT APPLICATION WILL BE UNINTERRUPTED, ERROR FREE OR SECURE. Compared to Walmart, banks tend to charge a higher fee to cash a check. Governing Law.With the exception of 12(g) above, this Agreement, and your rights and our obligations under this Agreement, are governed by and interpreted according to the governing law provisions in the Deposit Agreement or the Merrill Agreements that apply to the Accounts to which the deposit in question was made or attempted to be made.  Some restaurants think so, Biden is set to propose toughest-ever rules on car pollution to spur EVs, California population winners and losers: Why some counties boomed and others shrank, L.A. blasting classical music to drive unhoused people from subway station. Deposits made through other channels continue to be governed by the Deposit Agreement and Merrill Agreements. Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans.

Some restaurants think so, Biden is set to propose toughest-ever rules on car pollution to spur EVs, California population winners and losers: Why some counties boomed and others shrank, L.A. blasting classical music to drive unhoused people from subway station. Deposits made through other channels continue to be governed by the Deposit Agreement and Merrill Agreements. Figure Out How Much Auto Coverage You Need, Collision vs. Comprehensive Coverage Options, Ways to Lock in Lower Homeowners Insurance Premiums, How to Choose the Right Life Insurance Policy, Compare the Different Types of Health Insurance Plans.  Types of checks we can cash. Equal Housing Lender. The downsides are the restrictions on the types of checks and check amounts. Please enter a valid 10-digit phone number. Its louder than officials claim. Deposit2Go: Best The only difference between a joint account and individual account is the number of people who own the account. EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, NEITHER THE BANK NOR MERRILL MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, AS TO THE SERVICE, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Both parties must be present with valid photo IDs at Bank of America to cash it. The rights and duties herein shall bind and inure to the benefit of any assignee. If you wait too long to cash a check, a bank can refuse to cash it. Returned Items.You are solely responsible for any Item for which you have been given provisional credit, and any such Item that is returned or rejected may be charged to your Account. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Text message fees may apply from your carrier. According to the Federal Deposit Insurance Corp., the number of bank branches nationwide peaked in 2009. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. If we receive and accept an Image you transmit through the Service before our cutoff time on a Business Day, we consider that day to be the day of your deposit.

Types of checks we can cash. Equal Housing Lender. The downsides are the restrictions on the types of checks and check amounts. Please enter a valid 10-digit phone number. Its louder than officials claim. Deposit2Go: Best The only difference between a joint account and individual account is the number of people who own the account. EXCEPT AS EXPRESSLY SET FORTH IN THIS AGREEMENT, NEITHER THE BANK NOR MERRILL MAKES ANY REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, AS TO THE SERVICE, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. Both parties must be present with valid photo IDs at Bank of America to cash it. The rights and duties herein shall bind and inure to the benefit of any assignee. If you wait too long to cash a check, a bank can refuse to cash it. Returned Items.You are solely responsible for any Item for which you have been given provisional credit, and any such Item that is returned or rejected may be charged to your Account. Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. Text message fees may apply from your carrier. According to the Federal Deposit Insurance Corp., the number of bank branches nationwide peaked in 2009. You, if acting on behalf of a small business entity, are fully authorized to execute this Agreement. If we receive and accept an Image you transmit through the Service before our cutoff time on a Business Day, we consider that day to be the day of your deposit.  You acknowledge that, in our sole discretion, we may limit or block the availability of the Service in certain countries or for certain types of Items. No Third Party Beneficiary.You are entering into this Agreement solely based on the agreements and representations contained herein for your own purposes and not for the benefit of any third party. Money orders work by prepaying a specific amount of money, in turn for a piece of paper that is similar to a check. Therefore, only the following checks can be cashed: As you can see, personal checks are not included in the list. You will receive cash and these stores have a cashing limit of up to $5,000 per check. You may terminate your use of the Service at any time by giving notice to us. Get advice on achieving your financial goals and stay up to date on the day's top financial stories.